Raast The Digital Revolution Transforming How Pakistan Handles Money Muhammad Qasim – Finextra

Published on: 2025-10-07

Intelligence Report: Raast The Digital Revolution Transforming How Pakistan Handles Money Muhammad Qasim – Finextra

1. BLUF (Bottom Line Up Front)

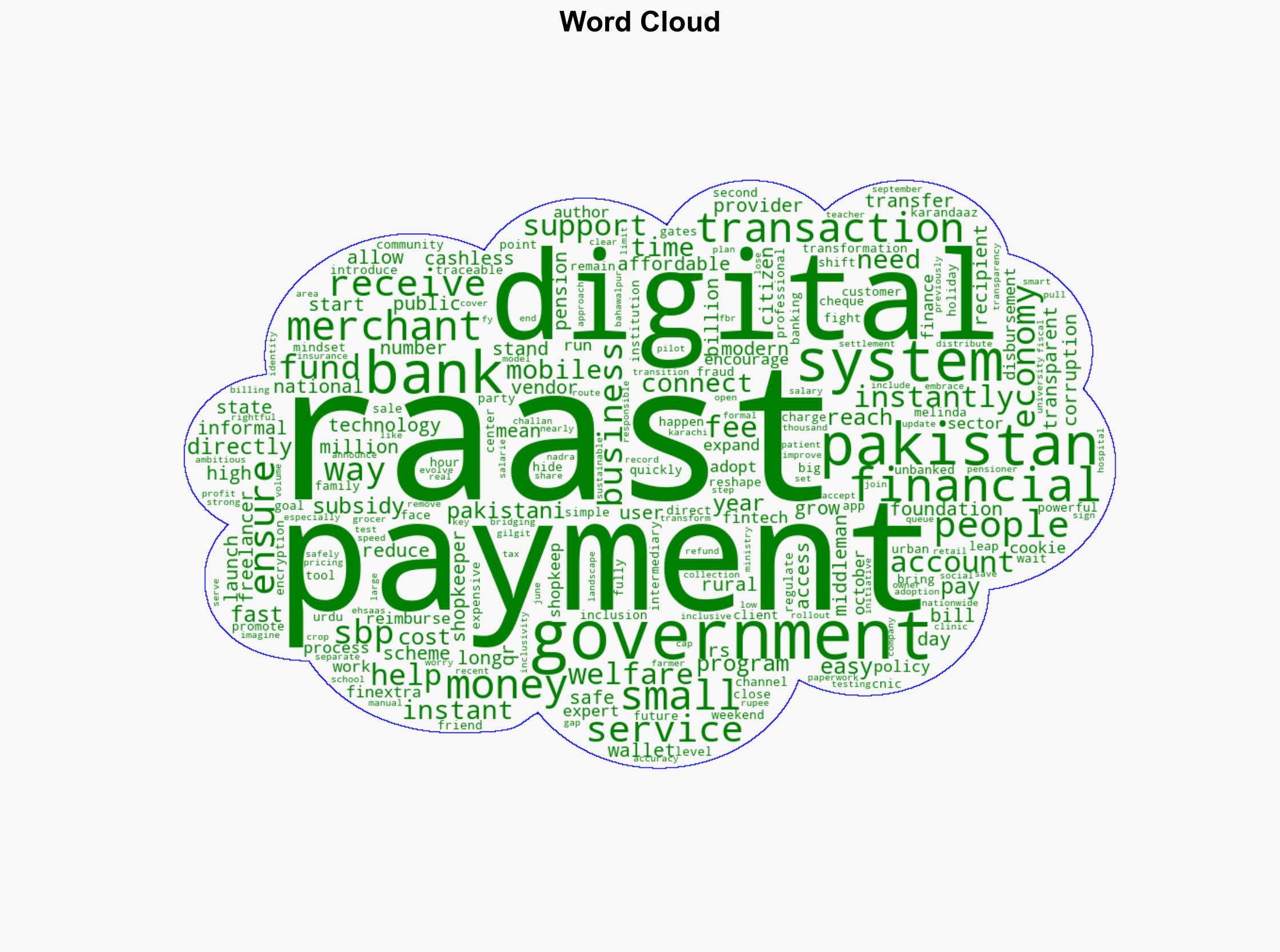

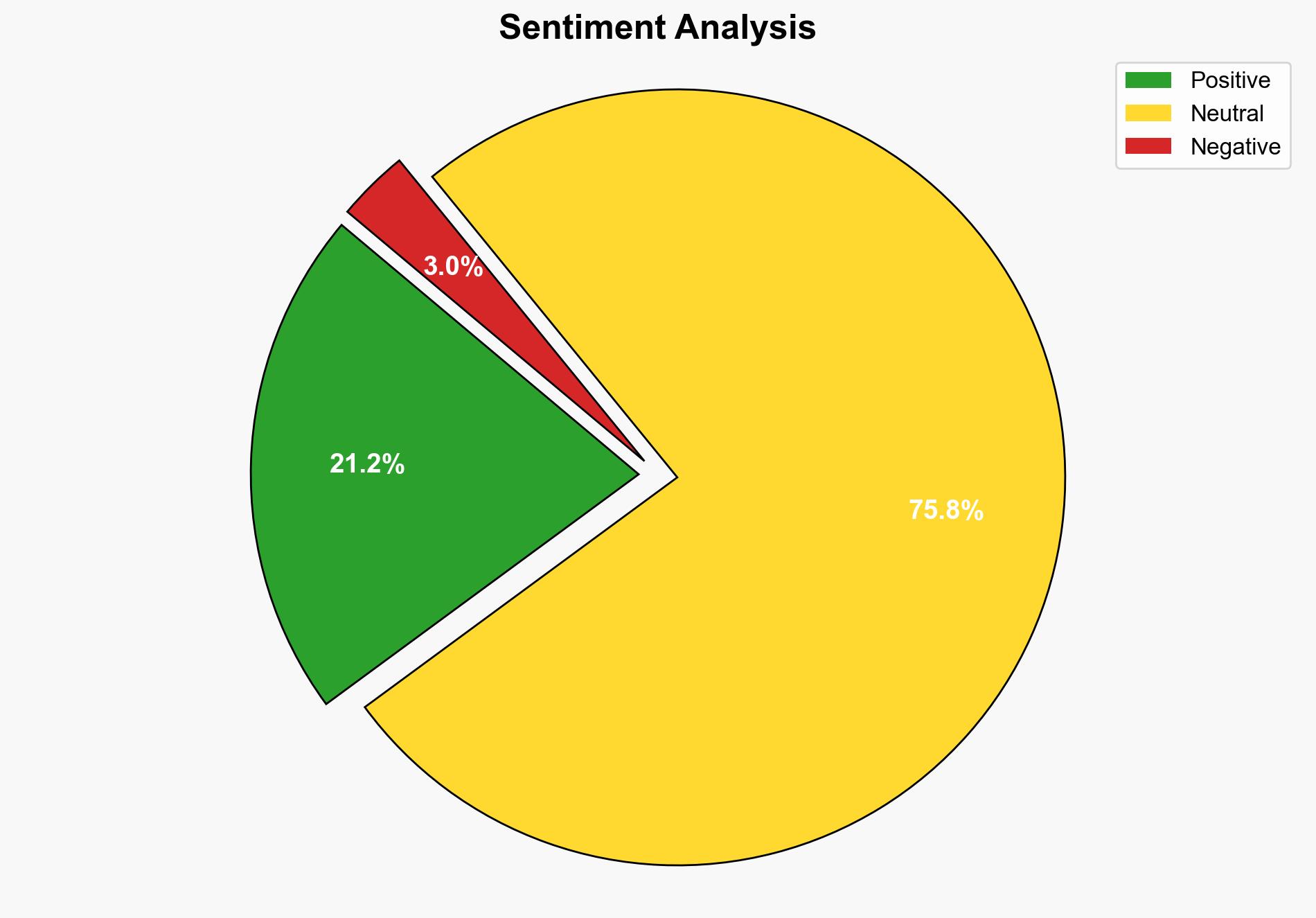

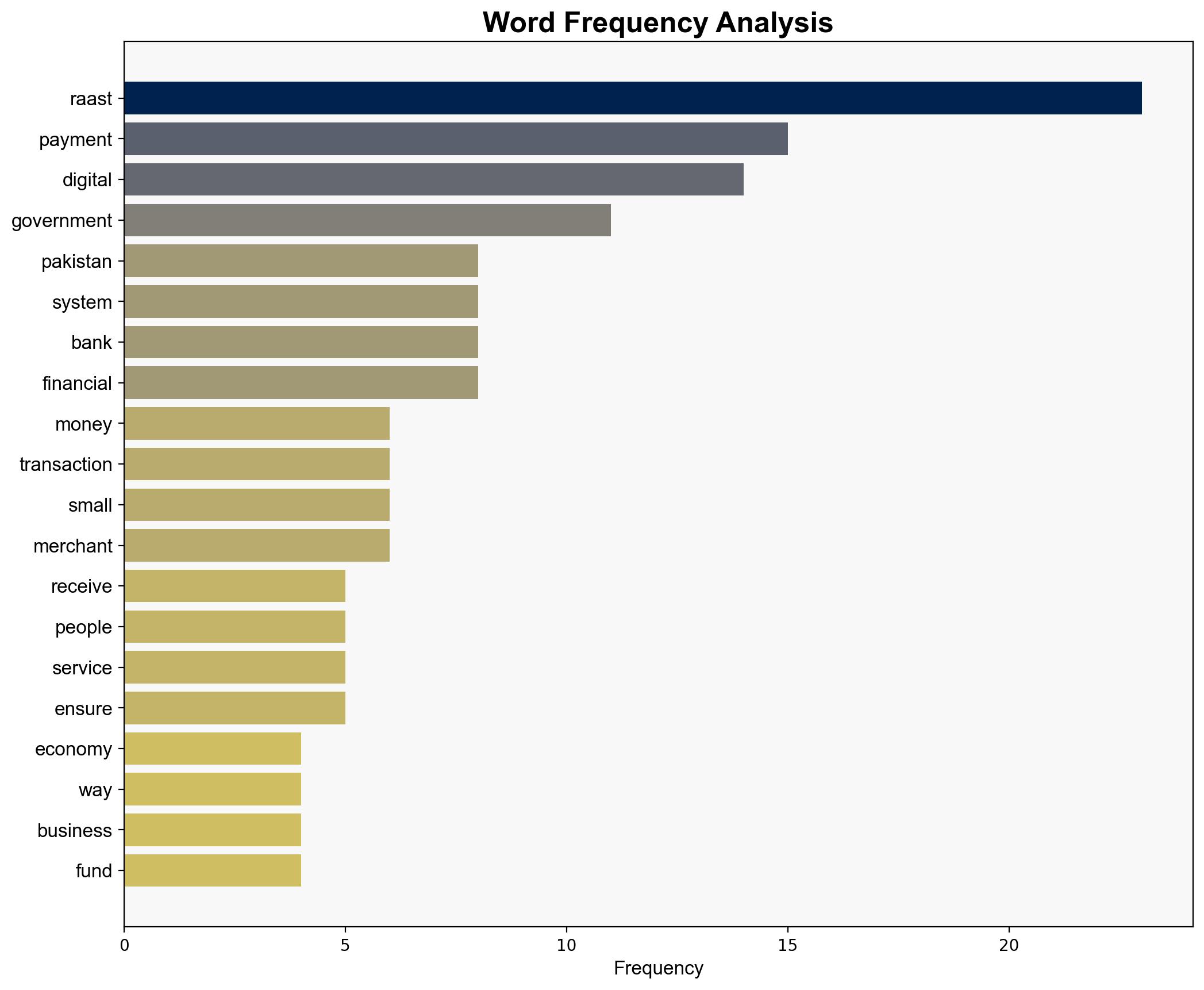

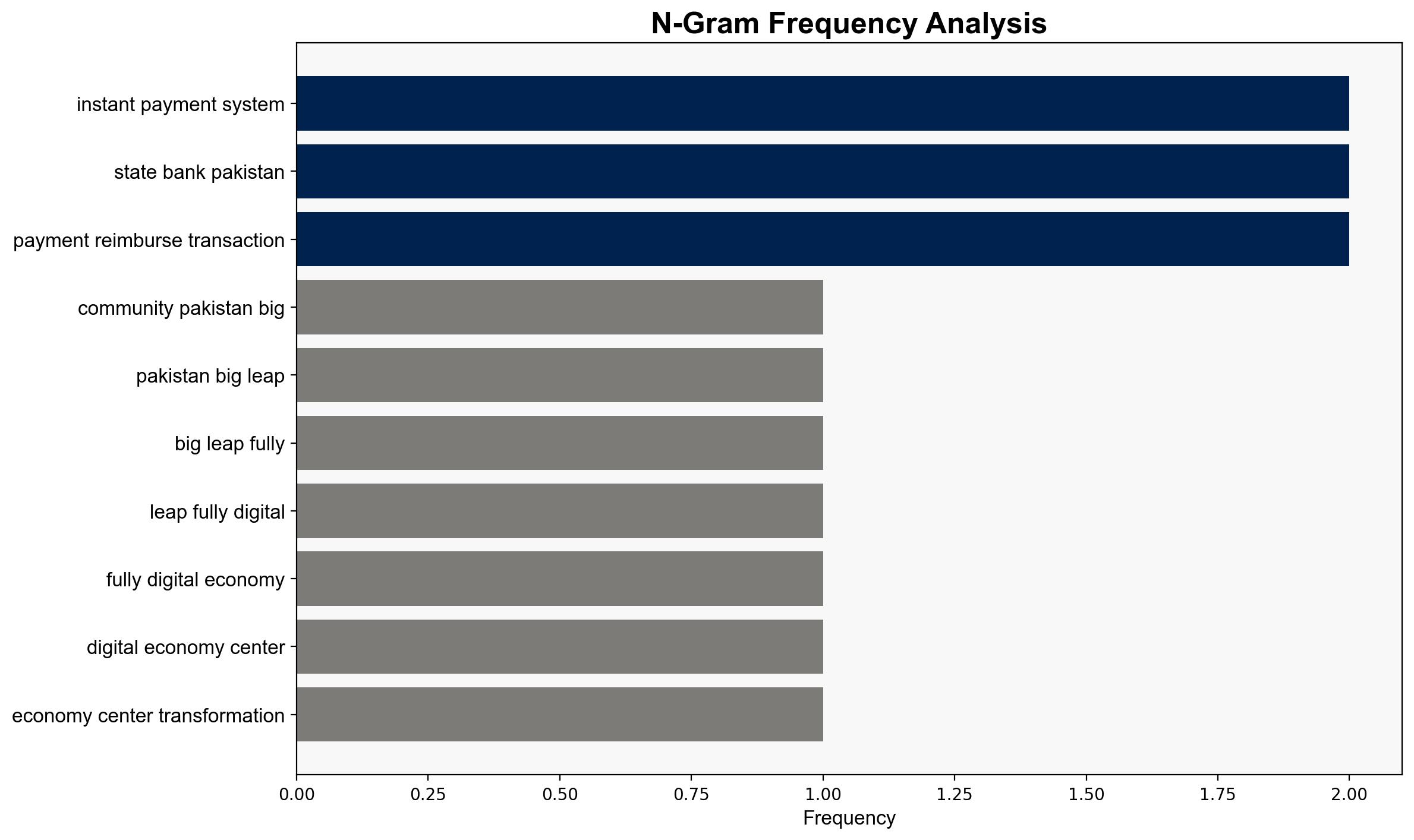

The introduction of Raast, Pakistan’s instant payment system, is a significant step towards a digital economy, with potential to enhance financial inclusion and transparency. However, the success of this initiative depends on overcoming infrastructural and adoption challenges. Confidence Level: Moderate. Recommended Action: Strengthen digital infrastructure and conduct awareness campaigns to ensure widespread adoption.

2. Competing Hypotheses

Hypothesis 1: Raast will successfully transform Pakistan into a cashless society, significantly reducing corruption and increasing financial inclusion.

Hypothesis 2: Raast will face significant implementation challenges, including resistance from unbanked populations and infrastructural limitations, limiting its impact on financial inclusion and transparency.

Using ACH 2.0, Hypothesis 2 is better supported due to existing infrastructural challenges and potential resistance from rural and unbanked populations. Historical data shows slow adoption of digital financial systems in similar contexts.

3. Key Assumptions and Red Flags

Assumptions:

– The government and financial institutions will provide adequate support for Raast’s implementation.

– There will be sufficient digital literacy among the population to adopt Raast.

Red Flags:

– Potential over-reliance on government subsidies and incentives for adoption.

– Lack of detailed data on rural infrastructure readiness.

4. Implications and Strategic Risks

– **Economic:** Successful implementation could boost economic growth by formalizing the informal economy. However, failure could exacerbate existing economic disparities.

– **Cyber:** Increased digital transactions may heighten cybersecurity risks, necessitating robust security measures.

– **Geopolitical:** A successful digital transition could enhance Pakistan’s regional influence by showcasing technological advancement.

– **Psychological:** Resistance from traditional sectors and populations could slow adoption, requiring targeted educational initiatives.

5. Recommendations and Outlook

- Enhance digital infrastructure, particularly in rural areas, to support Raast’s implementation.

- Launch educational campaigns to improve digital literacy and promote the benefits of Raast.

- Scenario Projections:

- Best Case: Rapid adoption leads to a significant reduction in cash-based transactions, boosting economic transparency.

- Worst Case: Infrastructural and adoption challenges lead to minimal impact, maintaining current economic inefficiencies.

- Most Likely: Gradual adoption with moderate improvements in financial inclusion and transparency.

6. Key Individuals and Entities

– Muhammad Qasim (Author)

– State Bank of Pakistan

– Bill & Melinda Gates Foundation

– Karandaaz

7. Thematic Tags

national security threats, cybersecurity, financial inclusion, digital economy, regional focus