RBL BankEmirates NBD deal set to close in 58 months – The Times of India

Published on: 2025-10-20

Intelligence Report: RBL BankEmirates NBD deal set to close in 58 months – The Times of India

1. BLUF (Bottom Line Up Front)

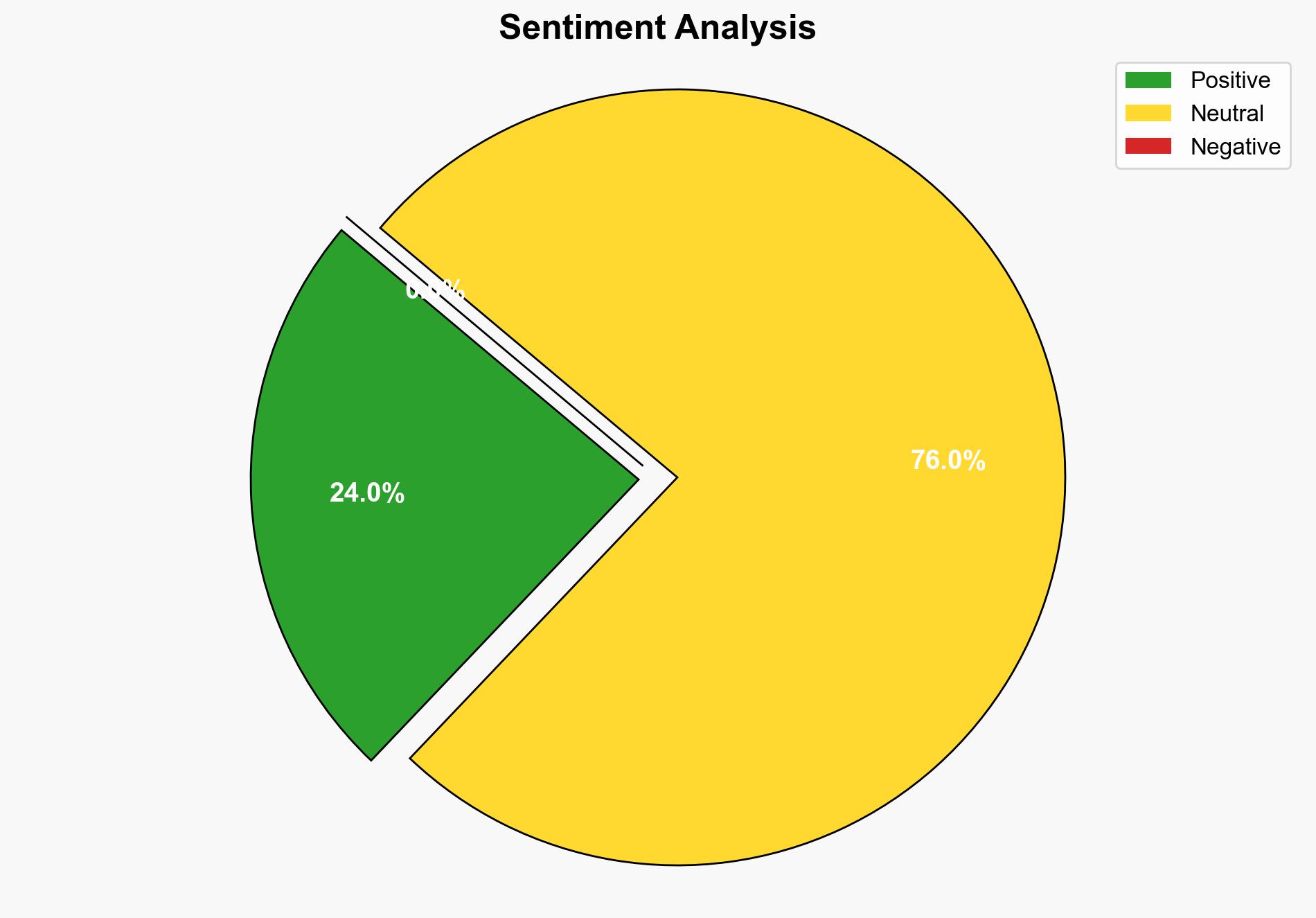

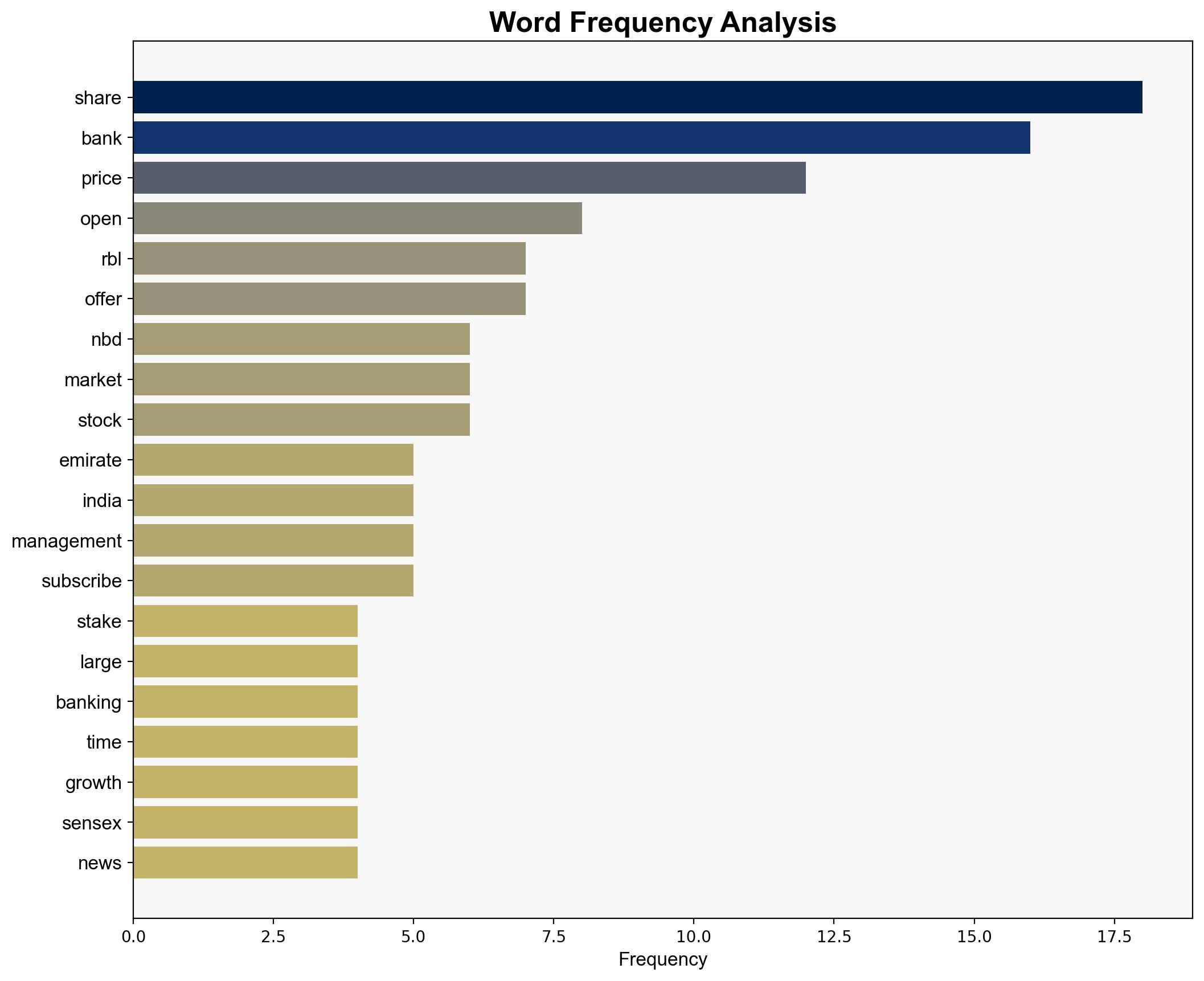

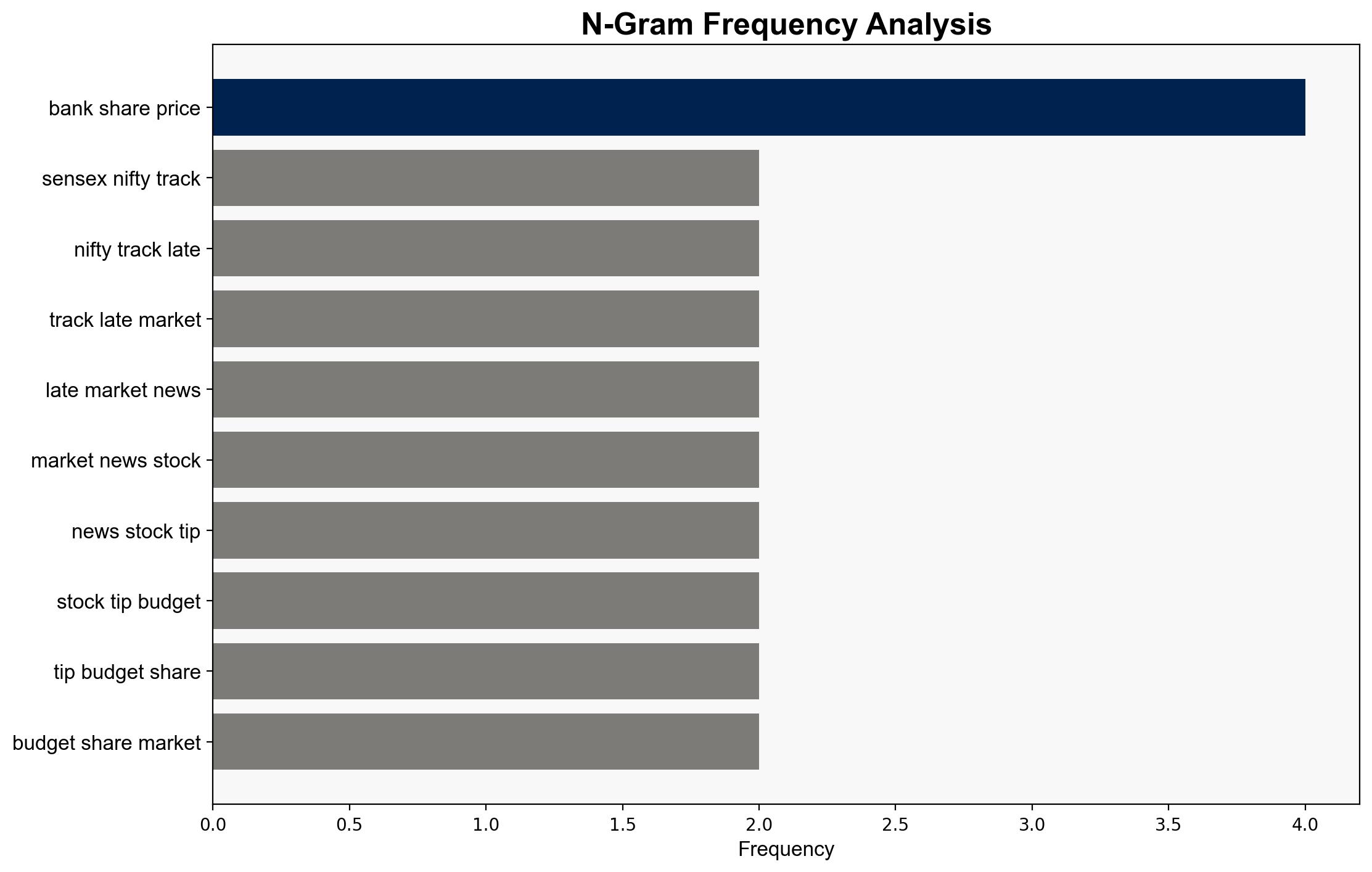

The proposed acquisition of a majority stake in RBL Bank by Emirates NBD is likely to proceed, with significant implications for the Indian banking sector and foreign direct investment (FDI) landscape. The most supported hypothesis suggests that the deal will enhance RBL Bank’s growth trajectory and strengthen its balance sheet. Confidence Level: Moderate. Recommended Action: Monitor regulatory developments and stakeholder responses to anticipate potential disruptions or opportunities.

2. Competing Hypotheses

Hypothesis 1: The acquisition will proceed smoothly, resulting in a strengthened RBL Bank with enhanced capabilities in corporate, retail, and microfinance sectors. This hypothesis is supported by the strategic alignment between RBL Bank and Emirates NBD, and the anticipated regulatory approvals.

Hypothesis 2: The acquisition faces significant regulatory and shareholder challenges, potentially delaying or altering the deal structure. This hypothesis considers potential resistance from stakeholders and regulatory hurdles that could impede the transaction.

3. Key Assumptions and Red Flags

– Assumption: Regulatory bodies will approve the acquisition without significant delay.

– Assumption: Shareholders will support the deal, recognizing its strategic benefits.

– Red Flag: Potential resistance from minority shareholders or regulatory bodies could disrupt the timeline.

– Red Flag: The assumption that the open offer will not materially reduce the primary issuance may be overly optimistic.

4. Implications and Strategic Risks

– Economic Impact: Successful acquisition could lead to increased FDI in India’s banking sector, enhancing economic growth.

– Geopolitical Dimension: Strengthened ties between India and the UAE through banking collaboration.

– Strategic Risk: Delays or alterations in the deal could affect investor confidence and market stability.

– Cybersecurity: Integration of technology platforms poses potential cybersecurity risks that need to be managed.

5. Recommendations and Outlook

- Monitor regulatory and shareholder feedback closely to anticipate potential challenges.

- Develop contingency plans for potential delays or restructuring of the deal.

- Scenario Projections:

- Best Case: Smooth acquisition process, leading to enhanced growth and market expansion.

- Worst Case: Regulatory or shareholder resistance leads to significant delays or deal restructuring.

- Most Likely: Acquisition proceeds with minor delays, resulting in moderate growth benefits.

6. Key Individuals and Entities

– Subramaniakumar

– Jaideep Iyer

– Emirates NBD

– RBL Bank

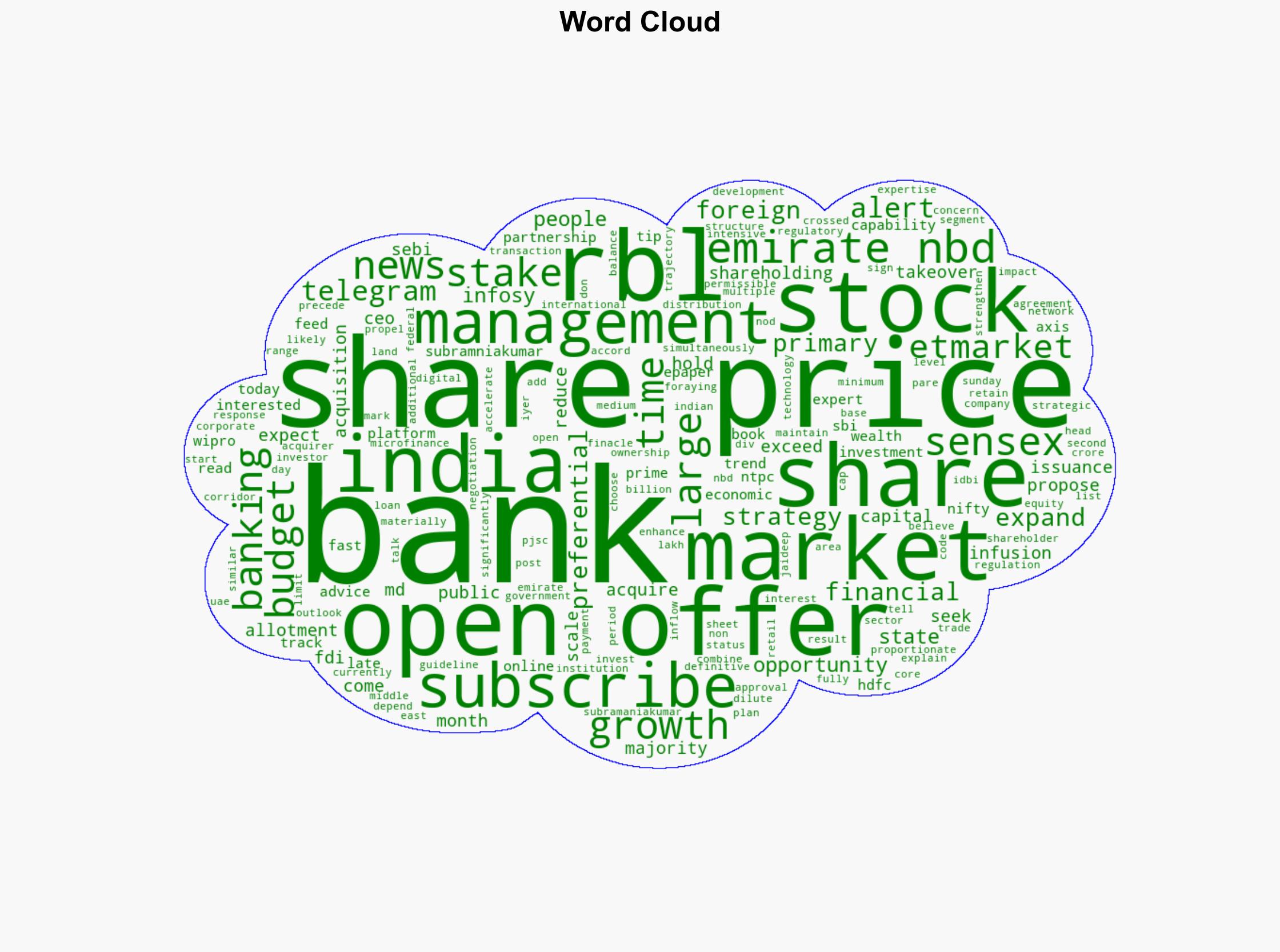

7. Thematic Tags

foreign direct investment, banking sector, regulatory challenges, strategic partnerships