Republican Tax Cut Effort Needs A Strong Push From President Trump – Forbes

Published on: 2025-04-26

Intelligence Report: Republican Tax Cut Effort Needs A Strong Push From President Trump – Forbes

1. BLUF (Bottom Line Up Front)

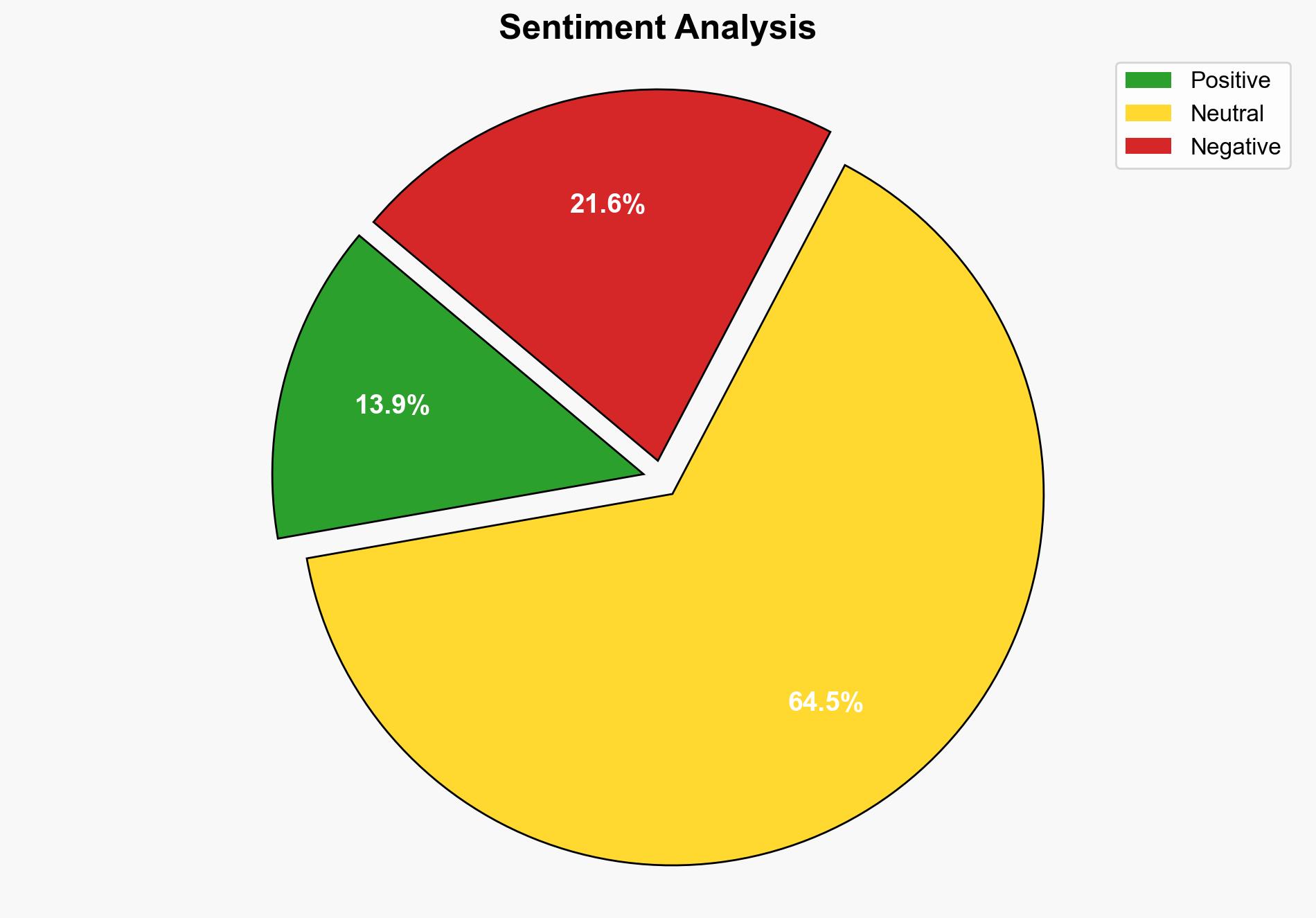

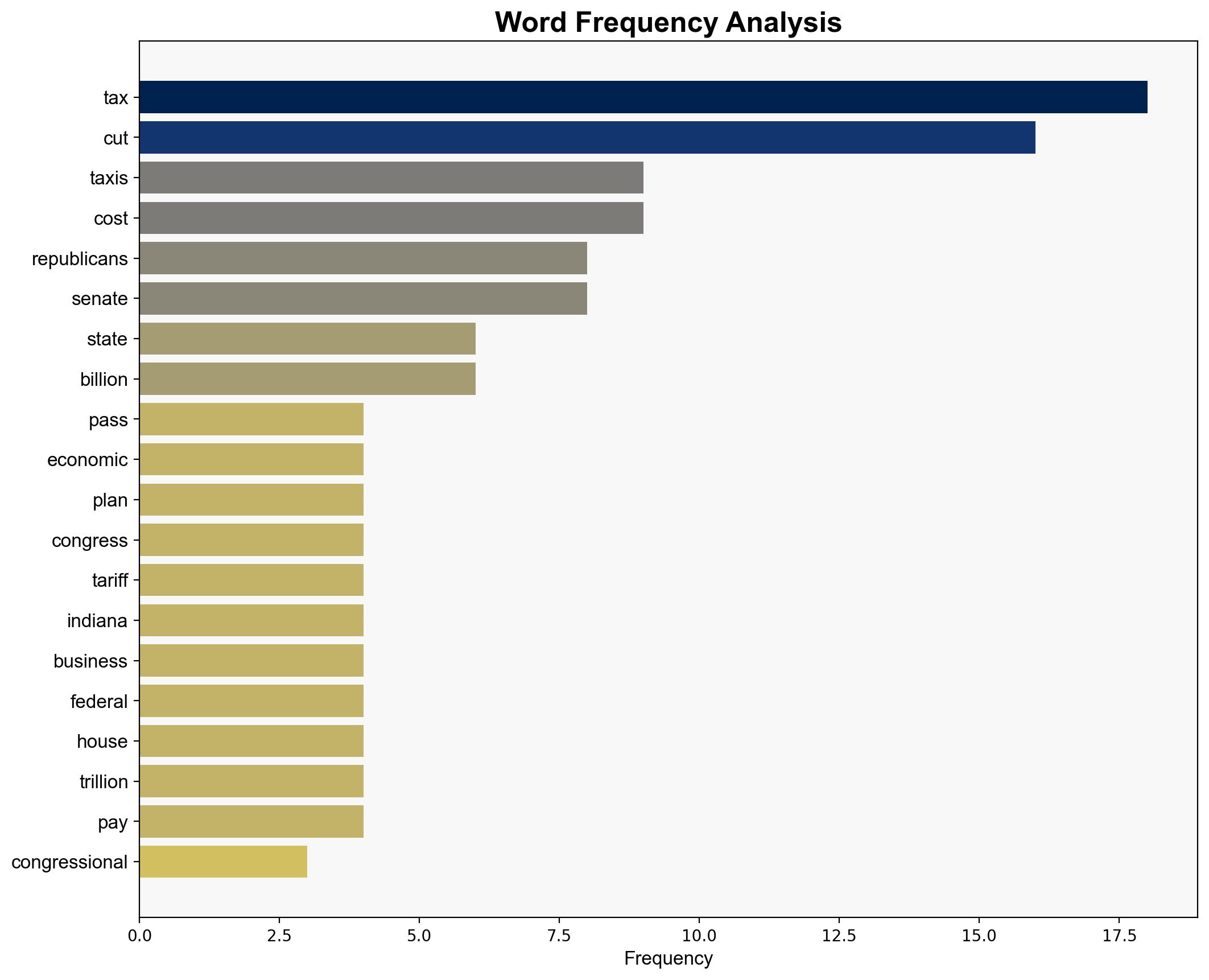

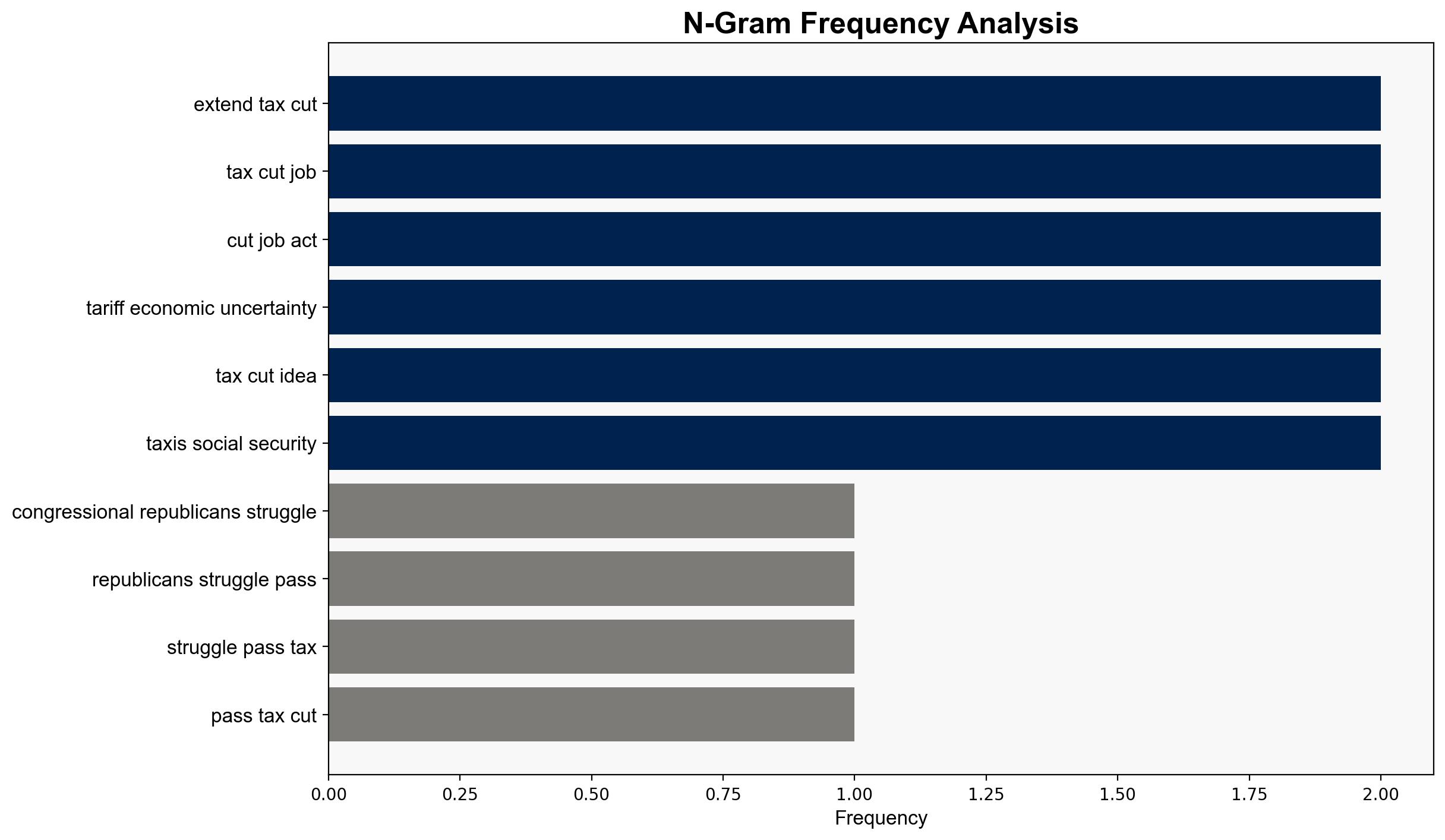

The Republican effort to pass a significant tax cut is encountering substantial challenges due to economic uncertainties and internal party divisions. President Trump’s active involvement is deemed crucial to overcoming legislative hurdles. Immediate strategic action is recommended to unify party efforts and address economic concerns exacerbated by tariffs and recession fears.

2. Detailed Analysis

The following structured analytic techniques have been applied to ensure methodological consistency:

Scenario Analysis

Three potential scenarios have been identified:

1) Successful passage of the tax cut with strong presidential backing, leading to short-term economic stimulation but potential long-term debt concerns.

2) Continued legislative stalemate, resulting in economic stagnation and increased political risk for the Republican party.

3) Partial tax reforms with limited impact, maintaining economic uncertainty and dissatisfaction among stakeholders.

Key Assumptions Check

The assumption that tax cuts will automatically lead to economic growth is under scrutiny. The impact of tariffs and global economic conditions may counteract anticipated benefits. Additionally, the assumption of party unity is challenged by internal disagreements on fiscal strategies.

Indicators Development

Key indicators to monitor include legislative voting patterns, public statements by influential party members, economic performance metrics, and shifts in public opinion. These will provide insights into the likelihood of passing the tax cut and its potential impact.

3. Implications and Strategic Risks

The failure to pass a tax cut could exacerbate economic uncertainty and weaken the party’s position ahead of upcoming elections. Conversely, successful passage without addressing underlying economic issues may lead to increased national debt and fiscal instability. The interplay between domestic policy and international economic trends poses a significant risk.

4. Recommendations and Outlook

- Encourage President Trump to take a more active role in negotiations to unify party efforts and expedite the legislative process.

- Consider alternative fiscal strategies to mitigate the impact of tariffs and economic uncertainty.

- Develop contingency plans for scenarios where tax reforms are delayed or partially implemented.

- Best case: Successful tax reform boosts economic confidence. Worst case: Legislative failure exacerbates economic downturn. Most likely: Partial reforms with limited impact.

5. Key Individuals and Entities

Donald Trump, Elizabeth MacDonough

6. Thematic Tags

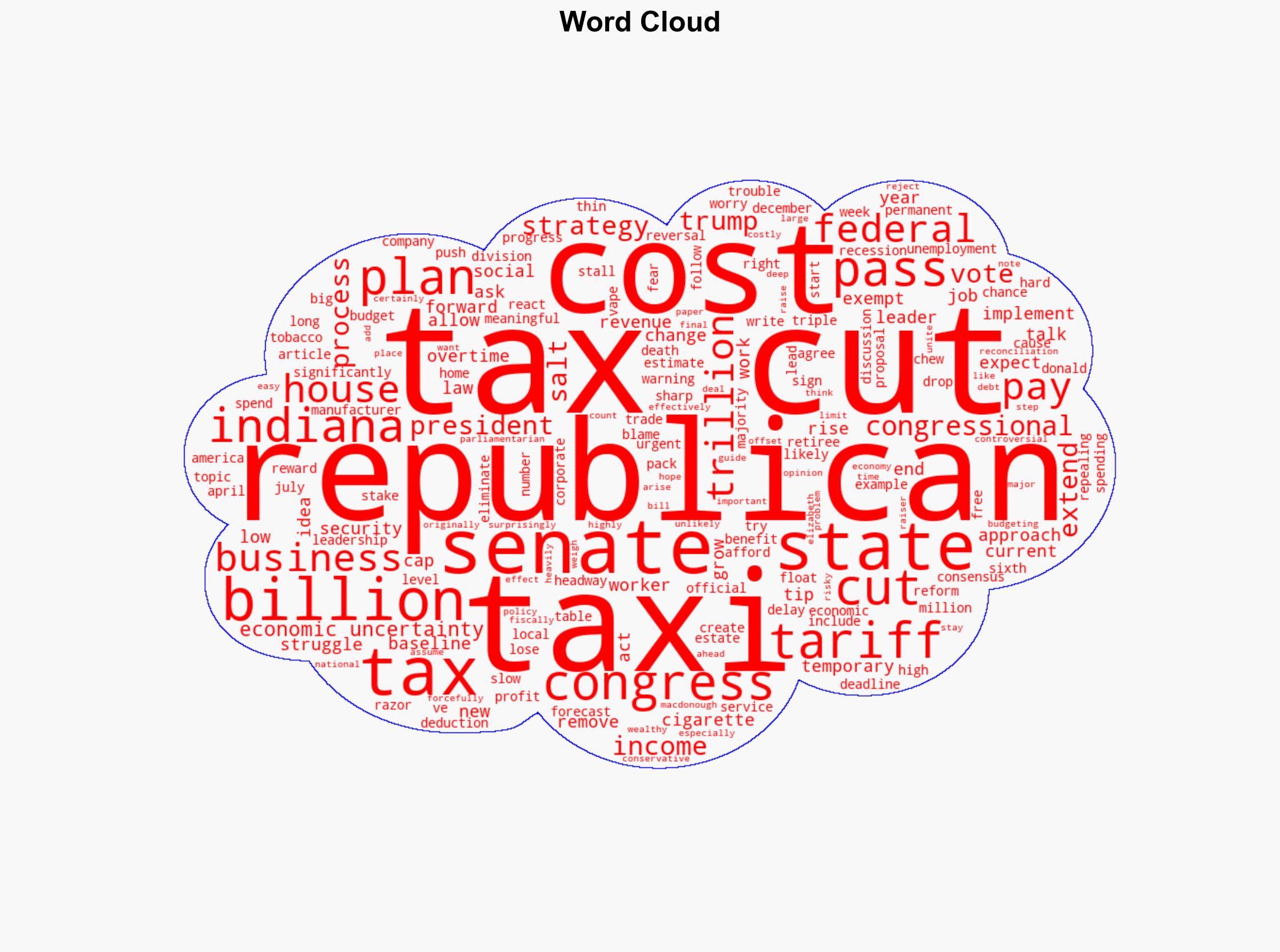

(‘economic policy, legislative strategy, fiscal reform, political risk’)