Russia and Iran increasingly leverage stablecoins to circumvent sanctions, report reveals.

Published on: 2026-01-08

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

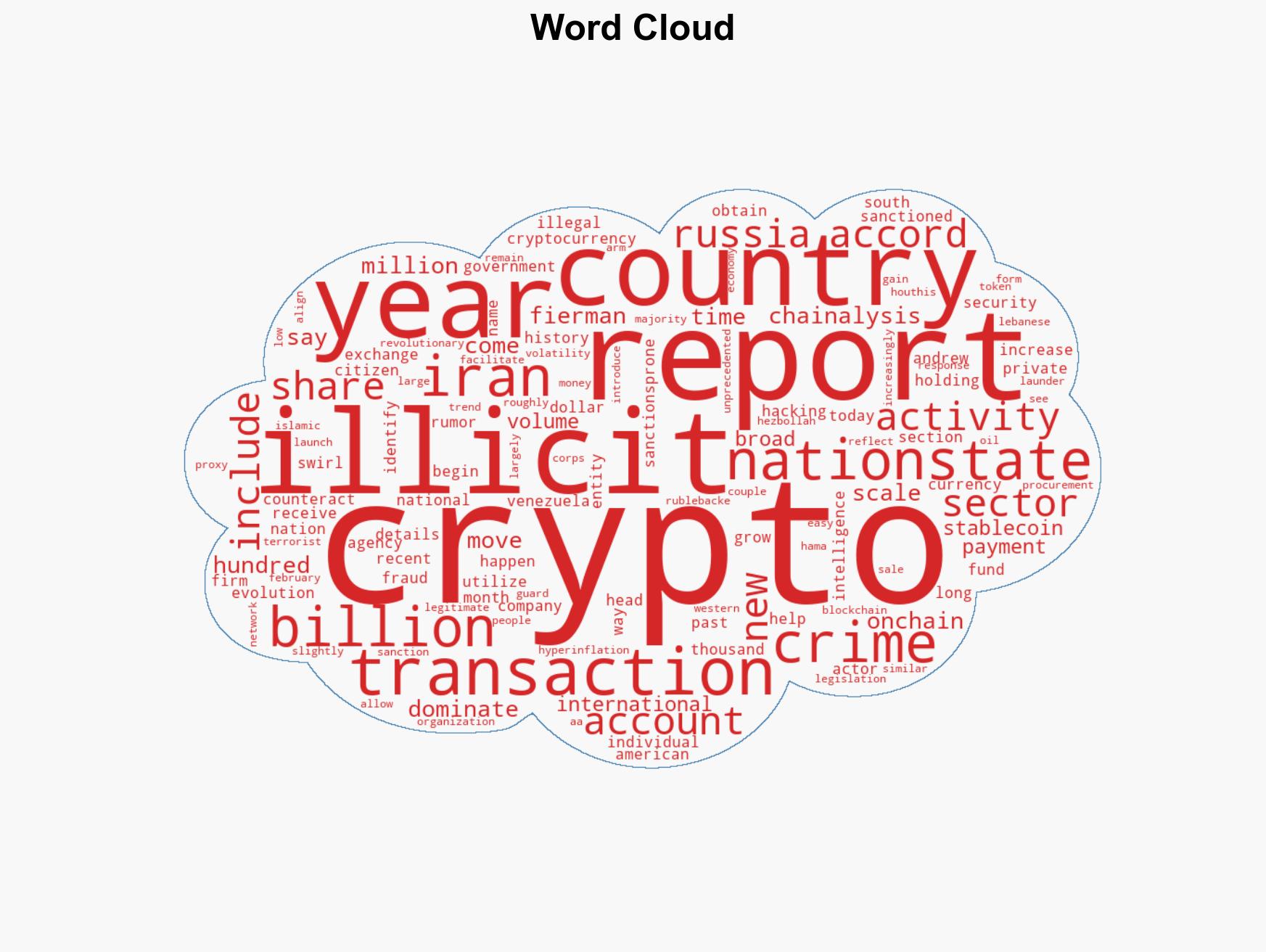

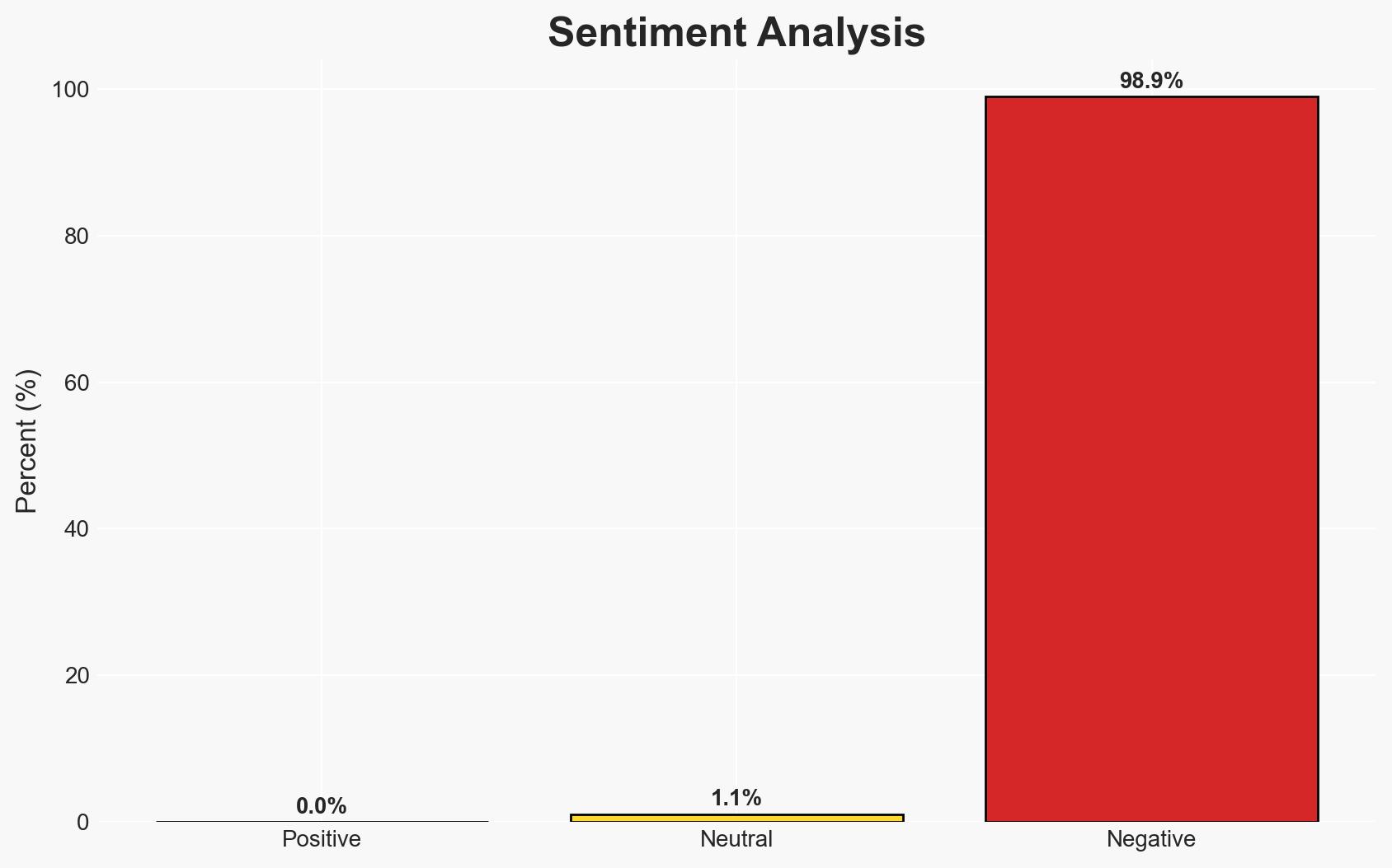

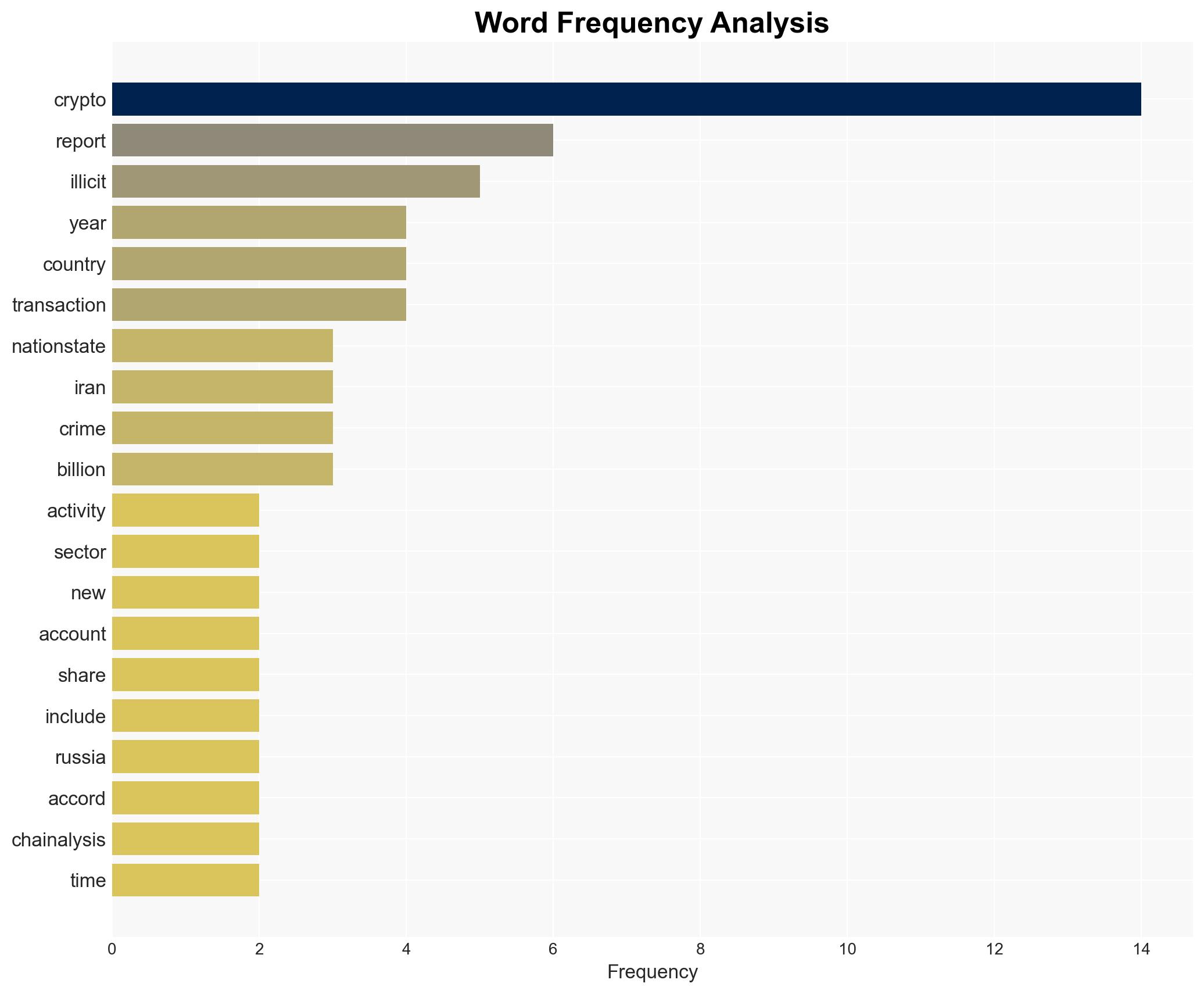

Intelligence Report: Russia and Iran are increasingly turning to cryptoespecially stablecoinsto avoid sanctions report finds

1. BLUF (Bottom Line Up Front)

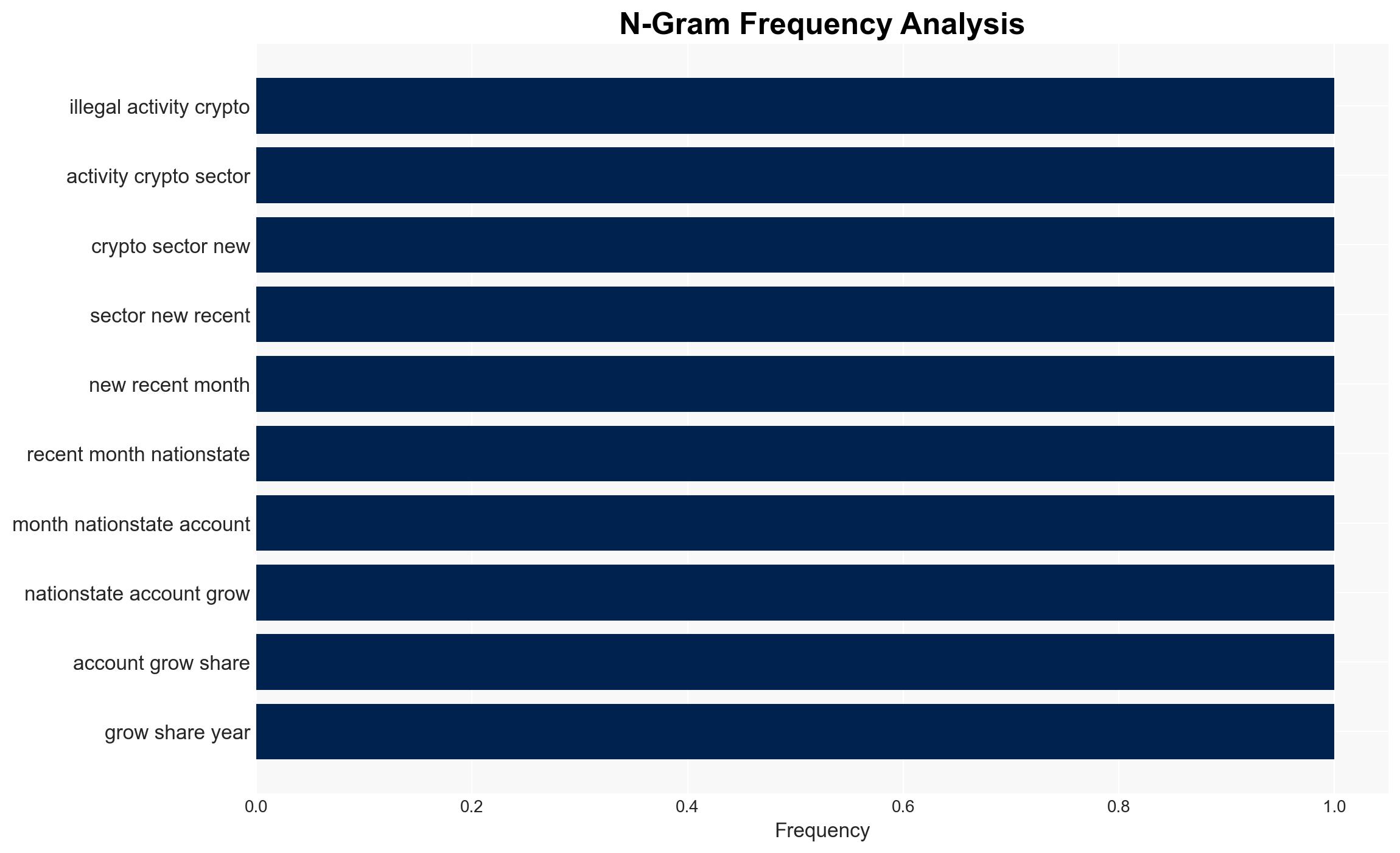

Russia and Iran are increasingly utilizing cryptocurrencies, particularly stablecoins, to circumvent international sanctions, with a significant rise in illicit crypto transactions linked to these nation-states. This development poses challenges to global financial oversight and sanctions enforcement, with moderate confidence in the assessment due to existing information gaps and potential bias in data sources.

2. Competing Hypotheses

- Hypothesis A: Russia and Iran are deliberately leveraging cryptocurrencies to evade sanctions, as evidenced by the substantial increase in crypto transactions involving sanctioned entities. This hypothesis is supported by the reported 694% increase in crypto received by these entities and the strategic use of stablecoins for their low volatility and ease of international transactions. Key uncertainties include the full extent of state involvement and the potential for other actors to be similarly engaged.

- Hypothesis B: The increase in crypto transactions involving sanctioned entities is coincidental and primarily driven by individual actors or non-state groups exploiting the anonymity of cryptocurrencies. This hypothesis is less supported due to the scale and coordination implied by the transactions, which align with state-level capabilities and strategic interests.

- Assessment: Hypothesis A is currently better supported due to the scale of transactions and the strategic interests of Russia and Iran in circumventing sanctions. Indicators such as further legislative moves to integrate crypto into national financial systems or increased crypto activity by known state proxies could reinforce this judgment.

3. Key Assumptions and Red Flags

- Assumptions:

- Cryptocurrencies provide a viable means for sanctioned states to bypass financial restrictions.

- Stablecoins are preferred due to their stability and ease of use in international transactions.

- State actors have the technical capability to conduct large-scale crypto operations.

- Information Gaps: Detailed data on the specific entities involved in these transactions and the role of intermediaries or third-party facilitators.

- Bias & Deception Risks: Potential bias in data interpretation from Chainalysis, as a private firm with vested interests in highlighting crypto crime; possible state-level misinformation or obfuscation efforts by Russia and Iran.

4. Implications and Strategic Risks

This development could lead to increased geopolitical tensions as Western nations may enhance sanctions enforcement and cyber monitoring. The use of cryptocurrencies by sanctioned states could undermine international financial systems and complicate counter-terrorism financing efforts.

- Political / Geopolitical: Potential for escalated sanctions or diplomatic confrontations as affected countries seek to counteract these evasion tactics.

- Security / Counter-Terrorism: Enhanced capability for terrorist organizations to finance operations, potentially increasing global security threats.

- Cyber / Information Space: Increased cyber operations targeting crypto exchanges and infrastructure to disrupt illicit activities.

- Economic / Social: Potential destabilization of national economies reliant on traditional financial systems and increased public distrust in financial oversight mechanisms.

5. Recommendations and Outlook

- Immediate Actions (0–30 days): Enhance monitoring of crypto transactions linked to sanctioned entities and increase collaboration with international partners to share intelligence and enforcement strategies.

- Medium-Term Posture (1–12 months): Develop resilience measures such as regulatory frameworks for crypto exchanges and strengthen partnerships with tech firms to improve tracking capabilities.

- Scenario Outlook:

- Best: Effective international cooperation leads to reduced illicit crypto activity.

- Worst: Increased use of crypto by additional states undermines global sanctions regimes.

- Most-Likely: Continued rise in crypto use by sanctioned states, prompting gradual policy adaptations by affected nations.

6. Key Individuals and Entities

- Islamic Revolutionary Guard Corps

- Hezbollah

- Hamas

- Houthis

- Not clearly identifiable from open sources in this snippet.

7. Thematic Tags

Counter-Terrorism, sanctions, cryptocurrency, stablecoins, national security, cybercrime, financial oversight

Structured Analytic Techniques Applied

- ACH 2.0: Reconstruct likely threat actor intentions via hypothesis testing and structured refutation.

- Indicators Development: Track radicalization signals and propaganda patterns to anticipate operational planning.

- Narrative Pattern Analysis: Analyze spread/adaptation of ideological narratives for recruitment/incitement signals.

- Network Influence Mapping: Map influence relationships to assess actor impact.

Explore more:

Counter-Terrorism Briefs ·

Daily Summary ·

Support us