Russian State Giant Rostec Plans Ruble-Pegged Stablecoin Payment Platform on Tron TASS – CoinDesk

Published on: 2025-07-04

Intelligence Report: Russian State Giant Rostec Plans Ruble-Pegged Stablecoin Payment Platform on Tron TASS – CoinDesk

1. BLUF (Bottom Line Up Front)

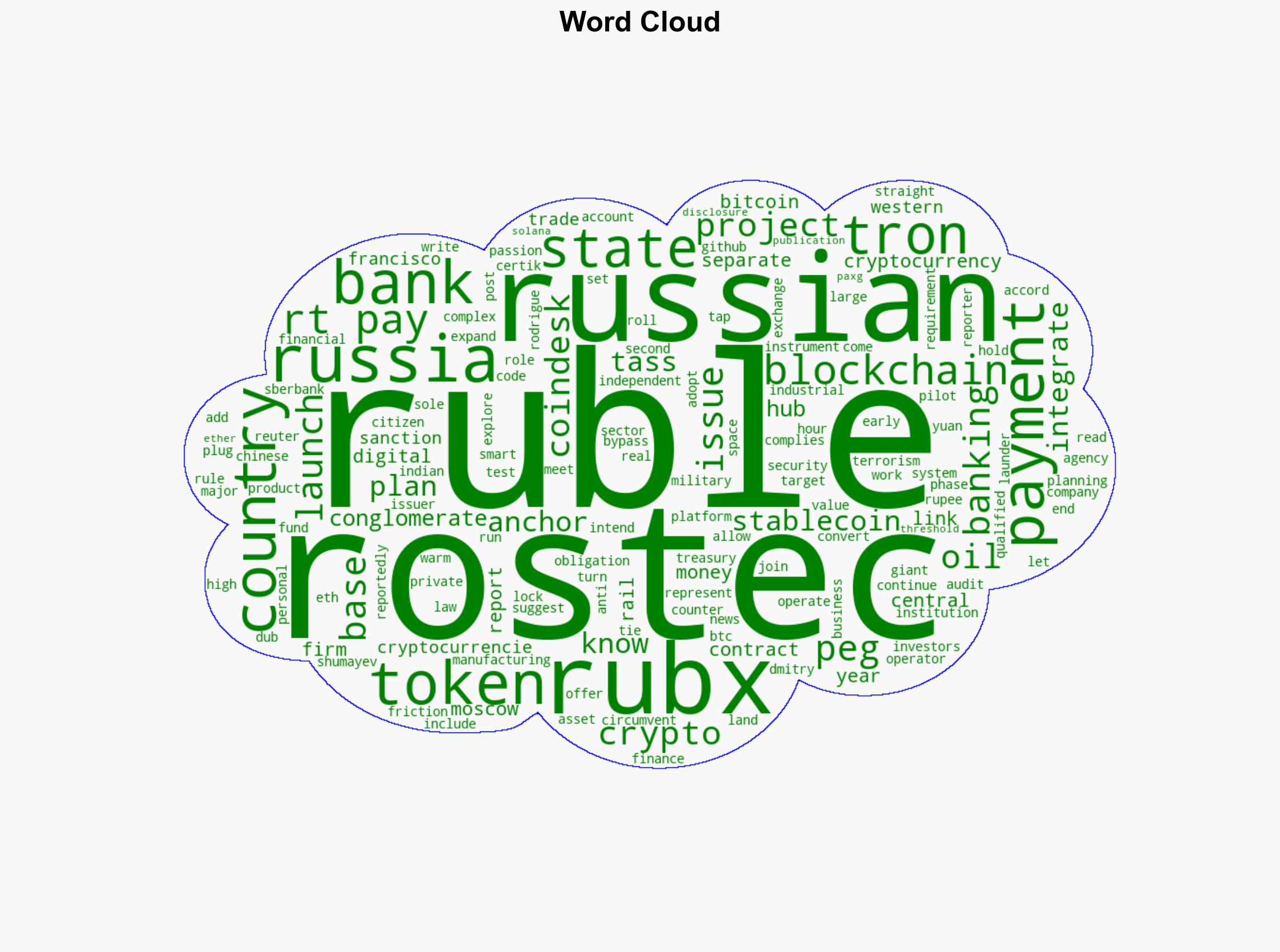

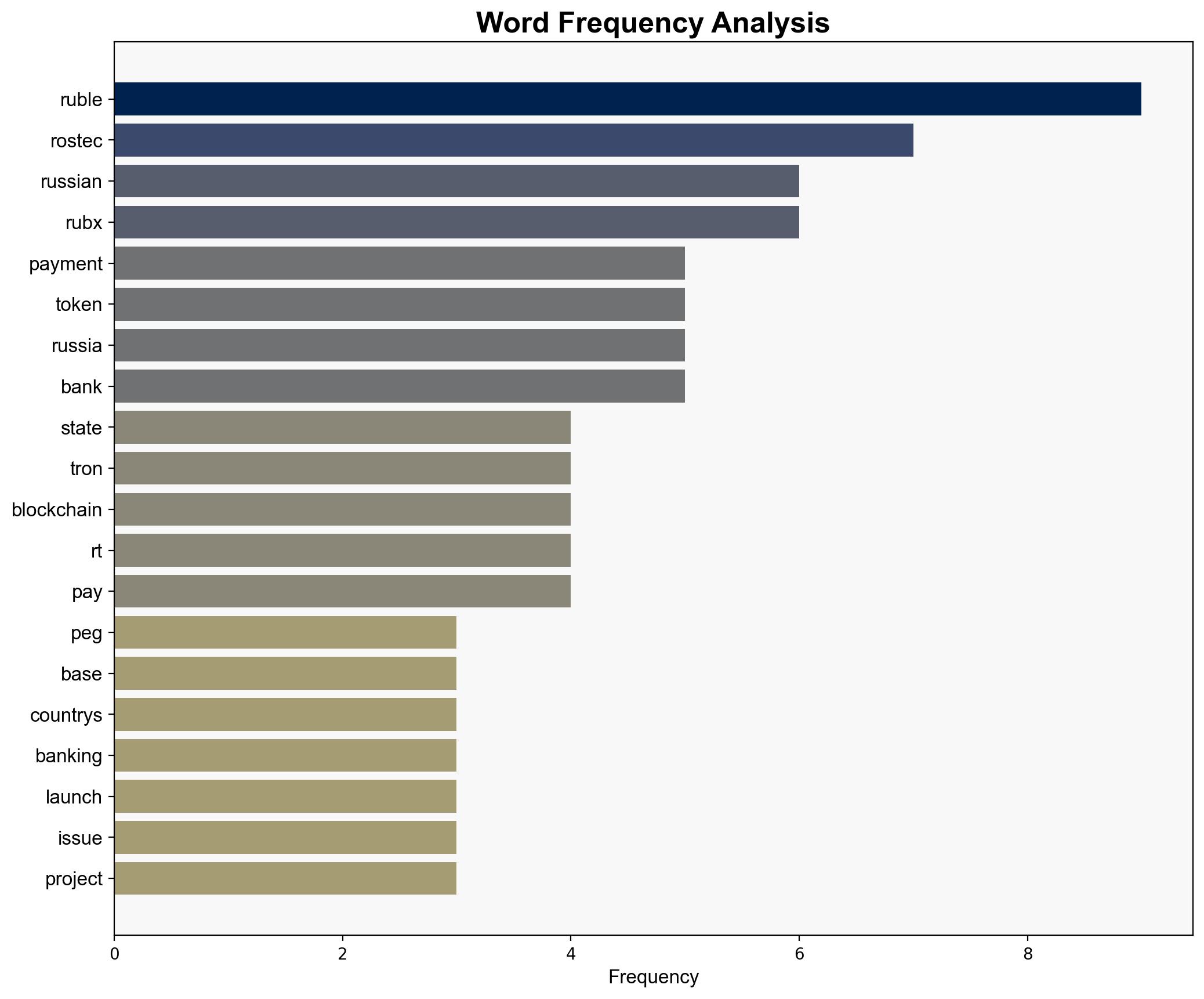

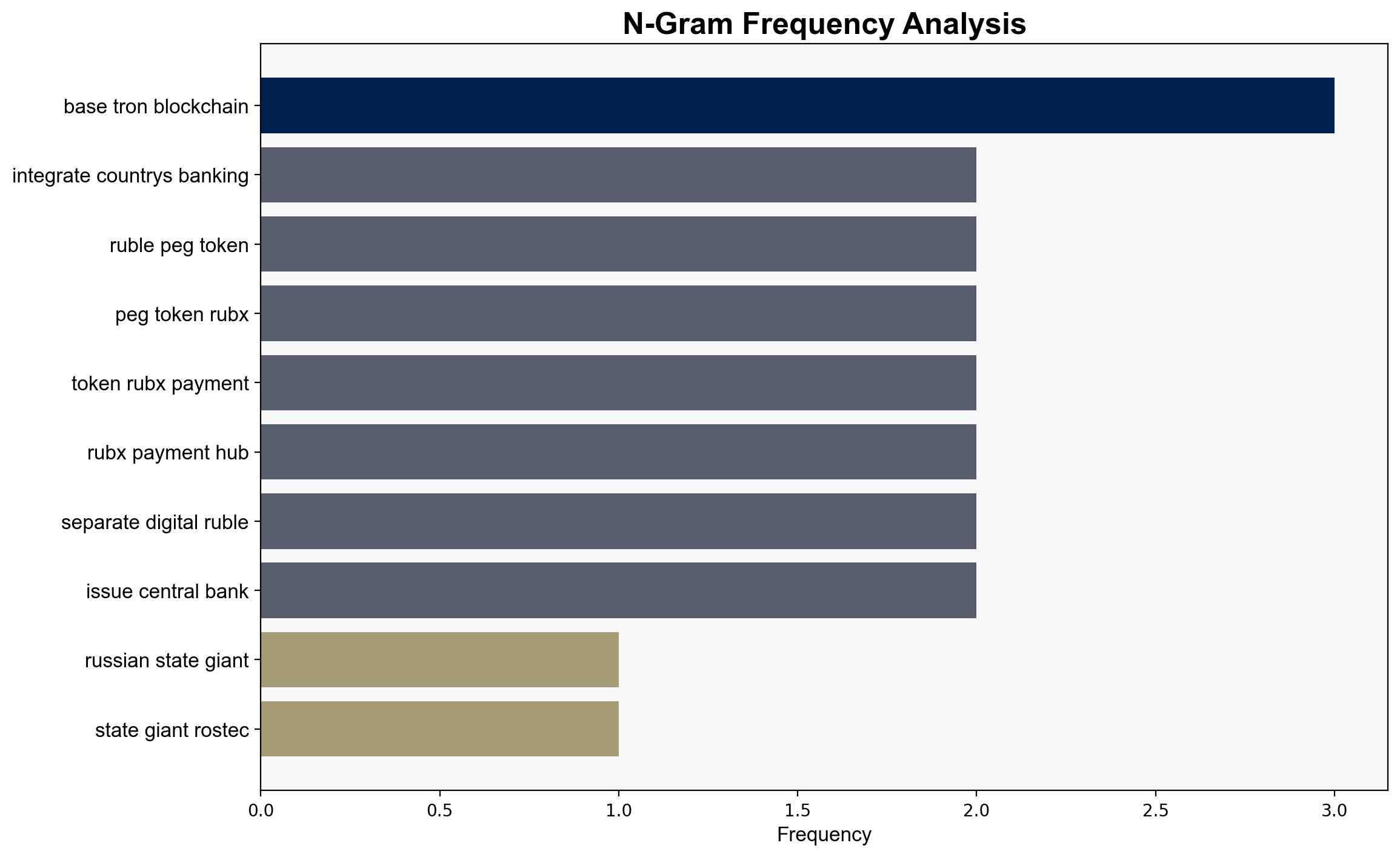

Rostec, a major Russian state conglomerate, is planning to launch a ruble-pegged stablecoin, RUBX, on the Tron blockchain. This initiative, named RT Pay, aims to integrate with Russia’s banking system, potentially enhancing the country’s digital currency infrastructure. The move aligns with Russia’s broader exploration of cryptocurrency adoption, including a digital ruble pilot by the central bank. This development could impact Russia’s economic strategies, especially in circumventing Western sanctions.

2. Detailed Analysis

The following structured analytic techniques have been applied to ensure methodological consistency:

Cognitive Bias Stress Test

Potential biases in assessing Rostec’s intentions and capabilities have been challenged through red teaming exercises, ensuring a balanced view of the strategic implications.

Bayesian Scenario Modeling

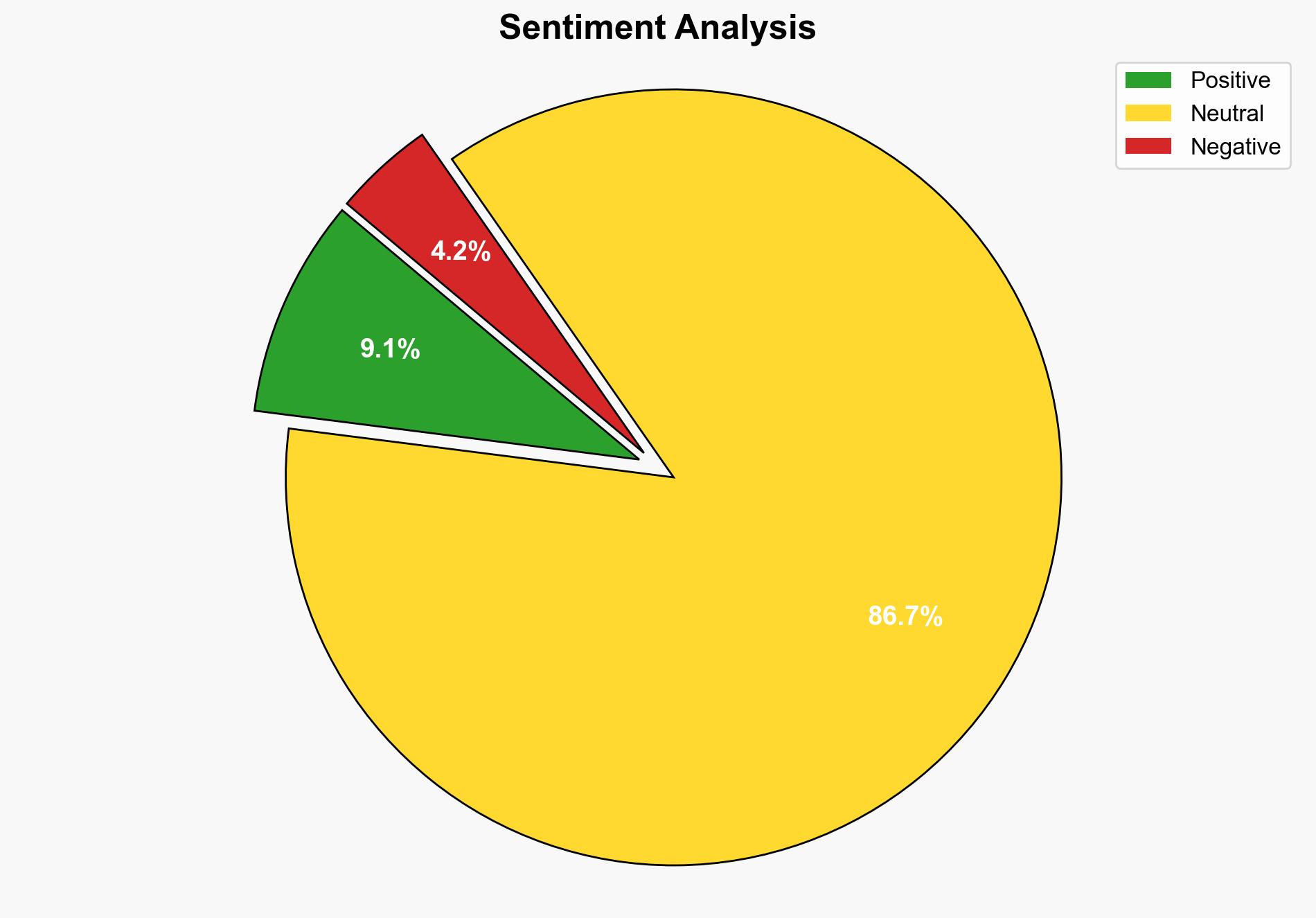

Probabilistic forecasting suggests a moderate likelihood of increased cryptocurrency adoption in Russia, with potential economic and geopolitical ramifications.

Network Influence Mapping

Rostec’s influence within Russia’s military-industrial complex and its connections to state financial systems have been mapped to assess potential impacts on domestic and international financial networks.

3. Implications and Strategic Risks

The introduction of a ruble-pegged stablecoin could facilitate Russia’s efforts to bypass Western financial sanctions, particularly in the oil trade. This move may also accelerate the adoption of digital currencies within Russia, posing cybersecurity risks and potential regulatory challenges. Additionally, the integration of RT Pay with the national banking system could create vulnerabilities to cyber threats and financial instability.

4. Recommendations and Outlook

- Monitor Rostec’s developments and the rollout of RT Pay for potential impacts on international financial systems.

- Enhance cybersecurity measures to protect against potential threats arising from increased digital currency use.

- Scenario-based projections:

- Best Case: Controlled adoption of digital currencies strengthens Russia’s economy without significant geopolitical tensions.

- Worst Case: Escalation of financial sanctions and cyber threats destabilizes Russia’s economy and international relations.

- Most Likely: Gradual integration of digital currencies with manageable geopolitical impacts.

5. Key Individuals and Entities

Dmitry Shumayev

6. Thematic Tags

national security threats, cybersecurity, counter-terrorism, regional focus