Russia’s crude deliveries plunge as US sanctions begin to bite – The Times of India

Published on: 2025-11-05

Intelligence Report: Russia’s crude deliveries plunge as US sanctions begin to bite – The Times of India

1. BLUF (Bottom Line Up Front)

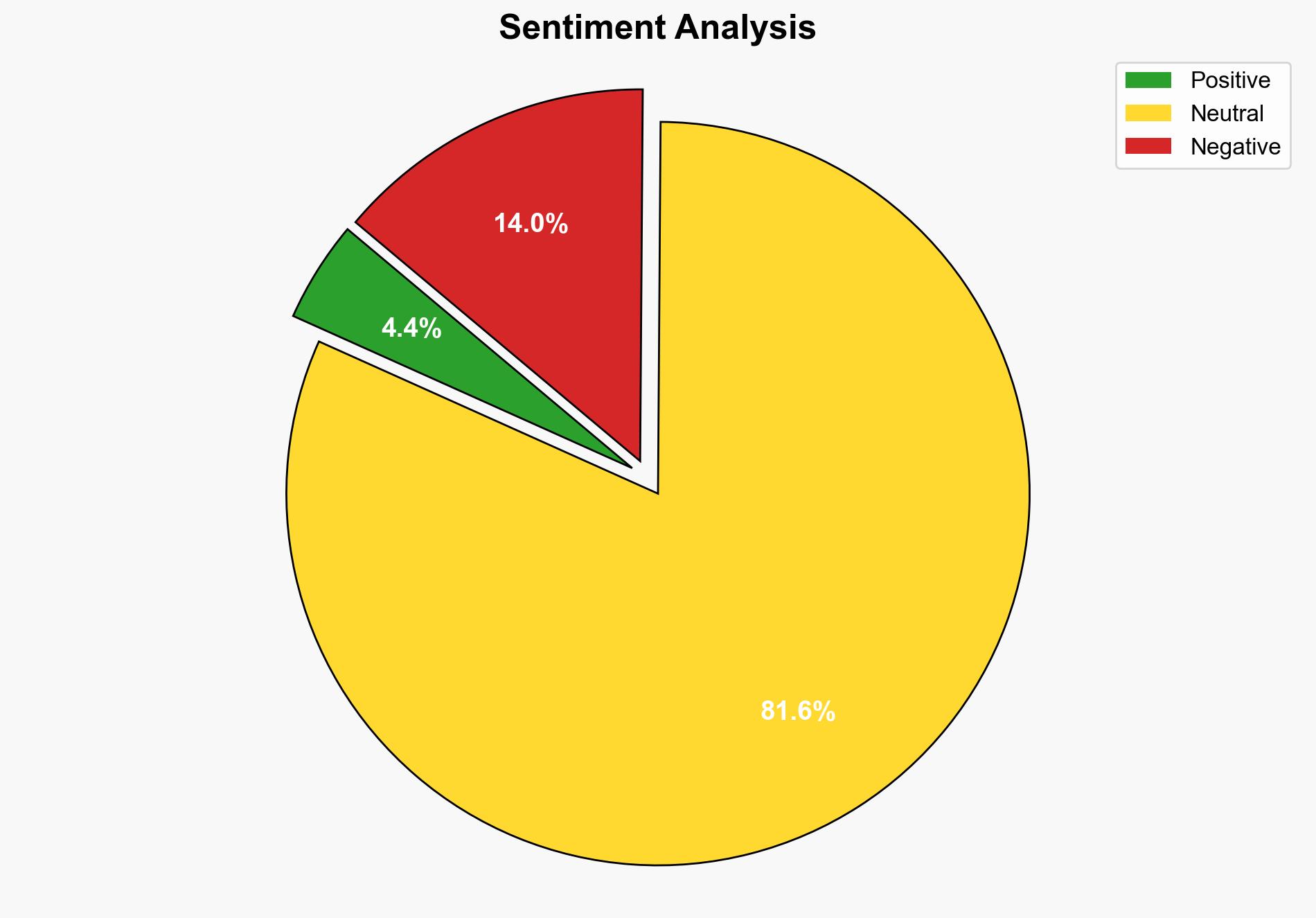

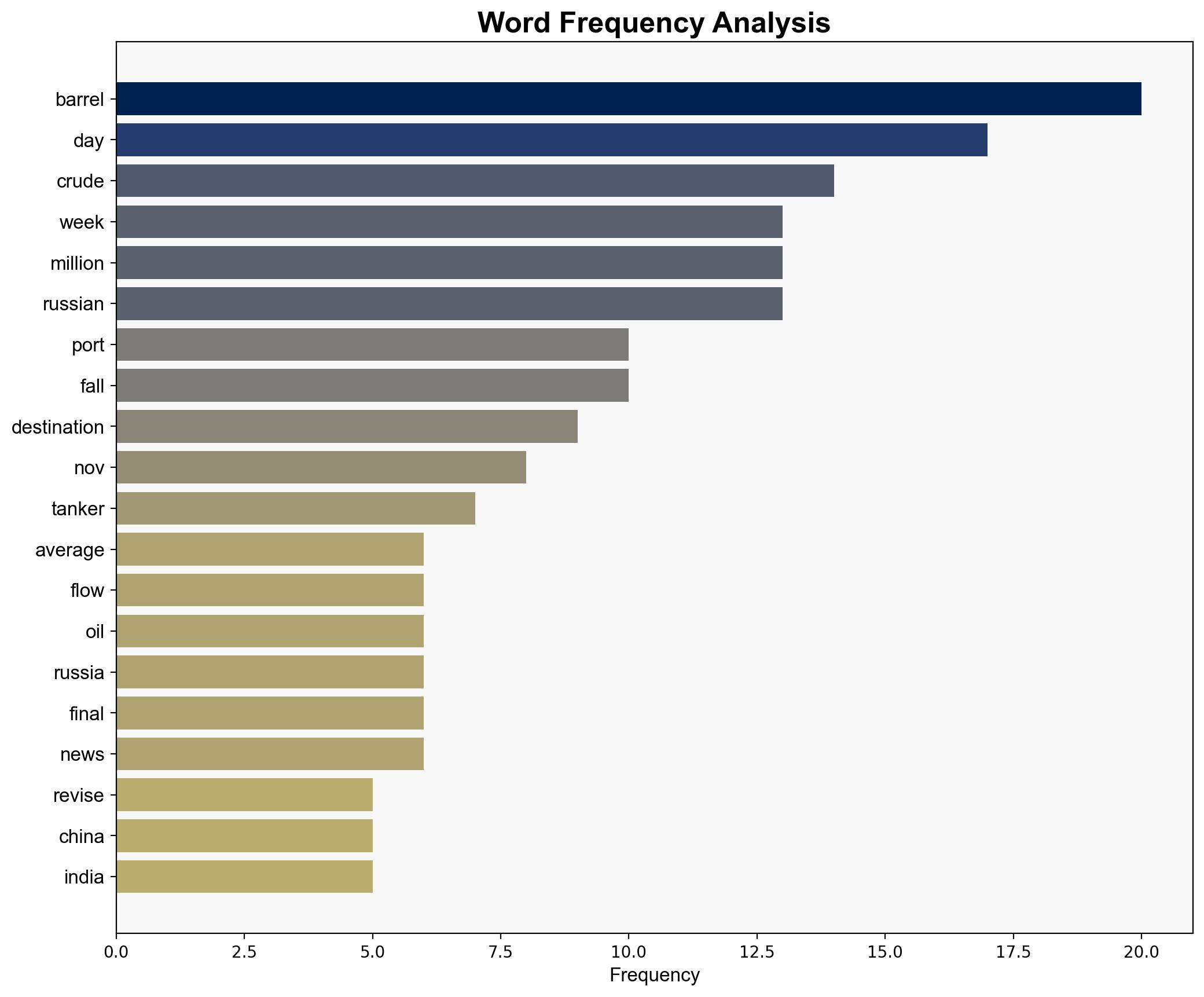

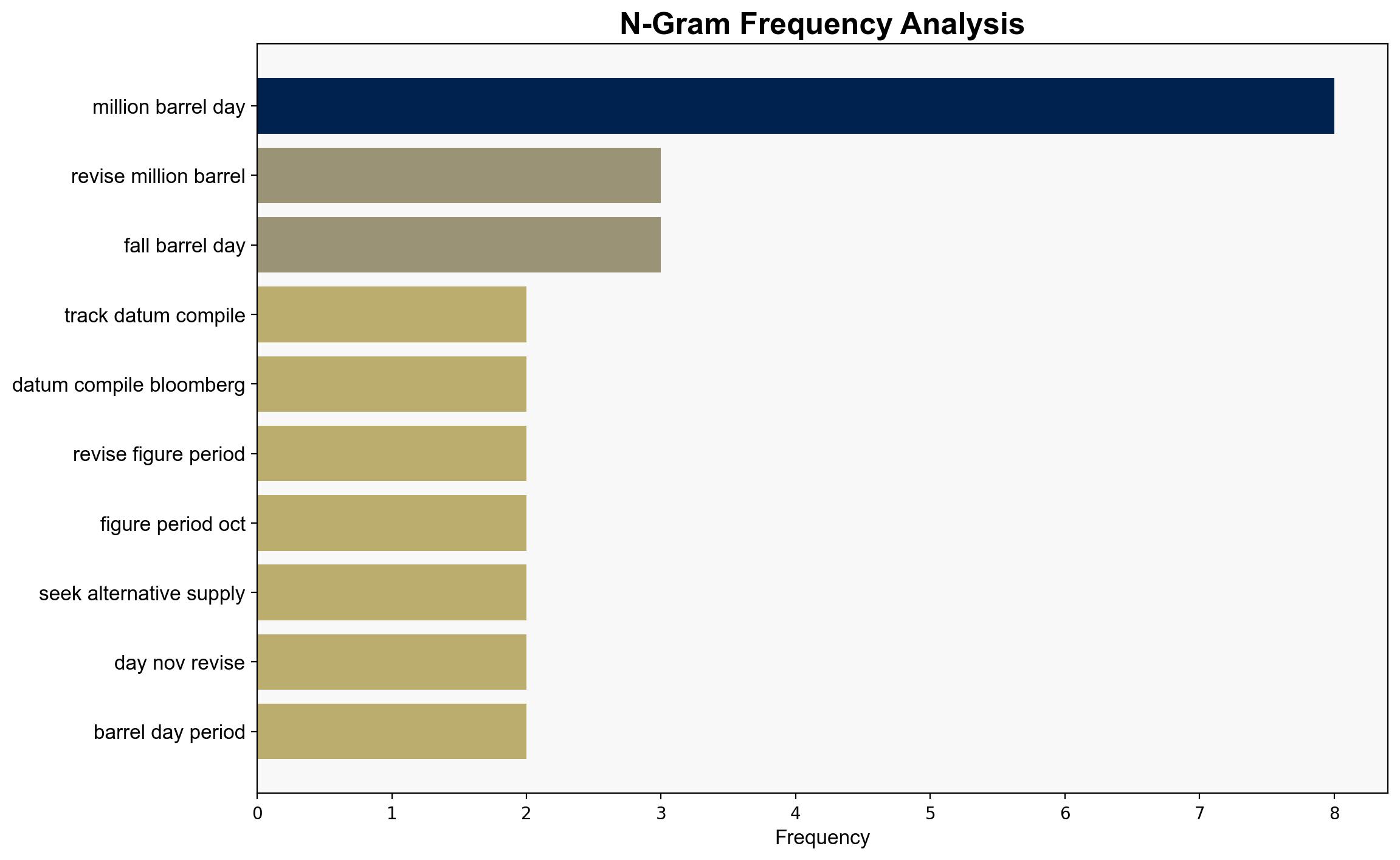

The most supported hypothesis is that US sanctions are significantly impacting Russia’s crude oil exports, leading to a strategic realignment in global oil supply chains. The confidence level in this assessment is moderate, given the complexity of global oil markets and potential mitigating actions by Russia and its partners. Recommended action includes monitoring alternative supply routes and assessing the impact on global oil prices and energy security.

2. Competing Hypotheses

1. **Hypothesis A**: US sanctions are effectively reducing Russia’s crude oil exports, causing a significant decline in revenue and forcing Russia to seek alternative markets and methods to circumvent sanctions.

2. **Hypothesis B**: The observed decline in Russian crude deliveries is temporary and primarily due to logistical disruptions and market adjustments, with Russia likely to adapt and maintain its export levels through alternative routes and partnerships.

Using the Analysis of Competing Hypotheses (ACH) 2.0, Hypothesis A is better supported by the data indicating a drop in deliveries and the actions of major buyers like China and India pausing purchases. Hypothesis B is less supported due to the scale of the decline and the immediate impact of sanctions.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that sanctions will continue to be enforced effectively and that alternative markets for Russian crude will not fully compensate for the loss of traditional buyers.

– **Red Flags**: Potential underreporting or manipulation of export data by Russia to obscure the true impact of sanctions. The possibility of covert agreements between Russia and other countries to bypass sanctions.

– **Blind Spots**: Lack of detailed information on Russia’s internal strategies to mitigate the impact of sanctions and potential new alliances.

4. Implications and Strategic Risks

– **Economic**: A sustained reduction in Russian oil exports could lead to increased global oil prices, affecting energy-dependent economies.

– **Geopolitical**: Russia may deepen ties with non-Western countries, potentially shifting global power dynamics.

– **Cyber**: Increased cyber activities targeting energy infrastructure as Russia seeks to disrupt adversaries’ energy security.

– **Psychological**: Market uncertainty could lead to speculative trading, exacerbating price volatility.

5. Recommendations and Outlook

- Monitor developments in alternative supply routes and partnerships involving Russia.

- Engage with allies to ensure coordinated enforcement of sanctions.

- Scenario-based projections:

- **Best Case**: Russia fails to find alternative markets, leading to a significant reduction in its geopolitical influence.

- **Worst Case**: Russia successfully circumvents sanctions, maintaining its revenue and destabilizing global markets.

- **Most Likely**: Partial adaptation by Russia, leading to moderate disruptions in global oil supply.

6. Key Individuals and Entities

– Rosneft PJSC

– Lukoil PJSC

– Sinopec

– PetroChina

– Gunvor Group CEO Torbjörn Törnqvist

7. Thematic Tags

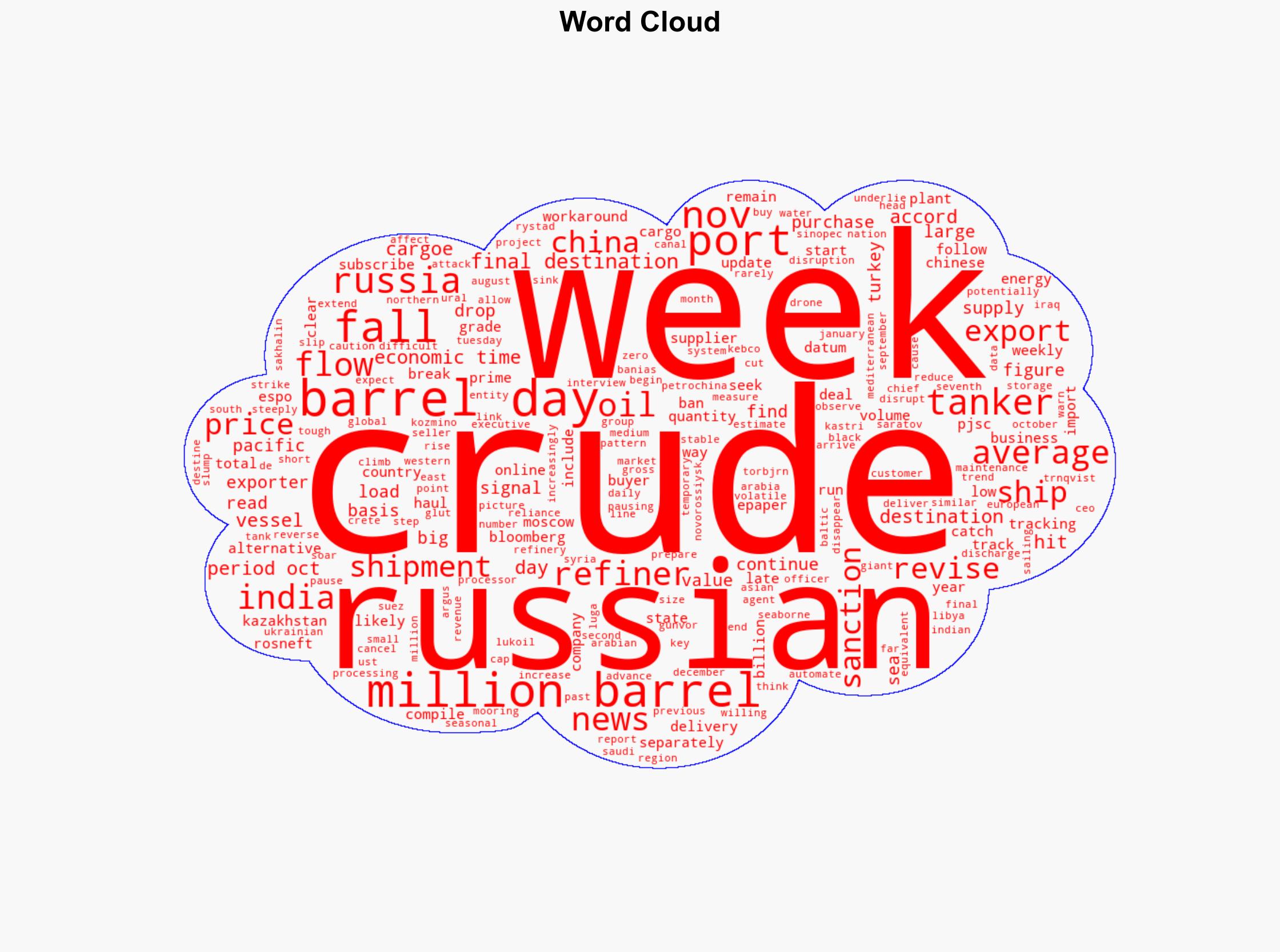

national security threats, energy security, geopolitical shifts, economic sanctions