Sanctions’ failure drives de-dollarization and Russia’s advanced evasion network – Oanda.com

Published on: 2025-11-18

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report:

1. BLUF (Bottom Line Up Front)

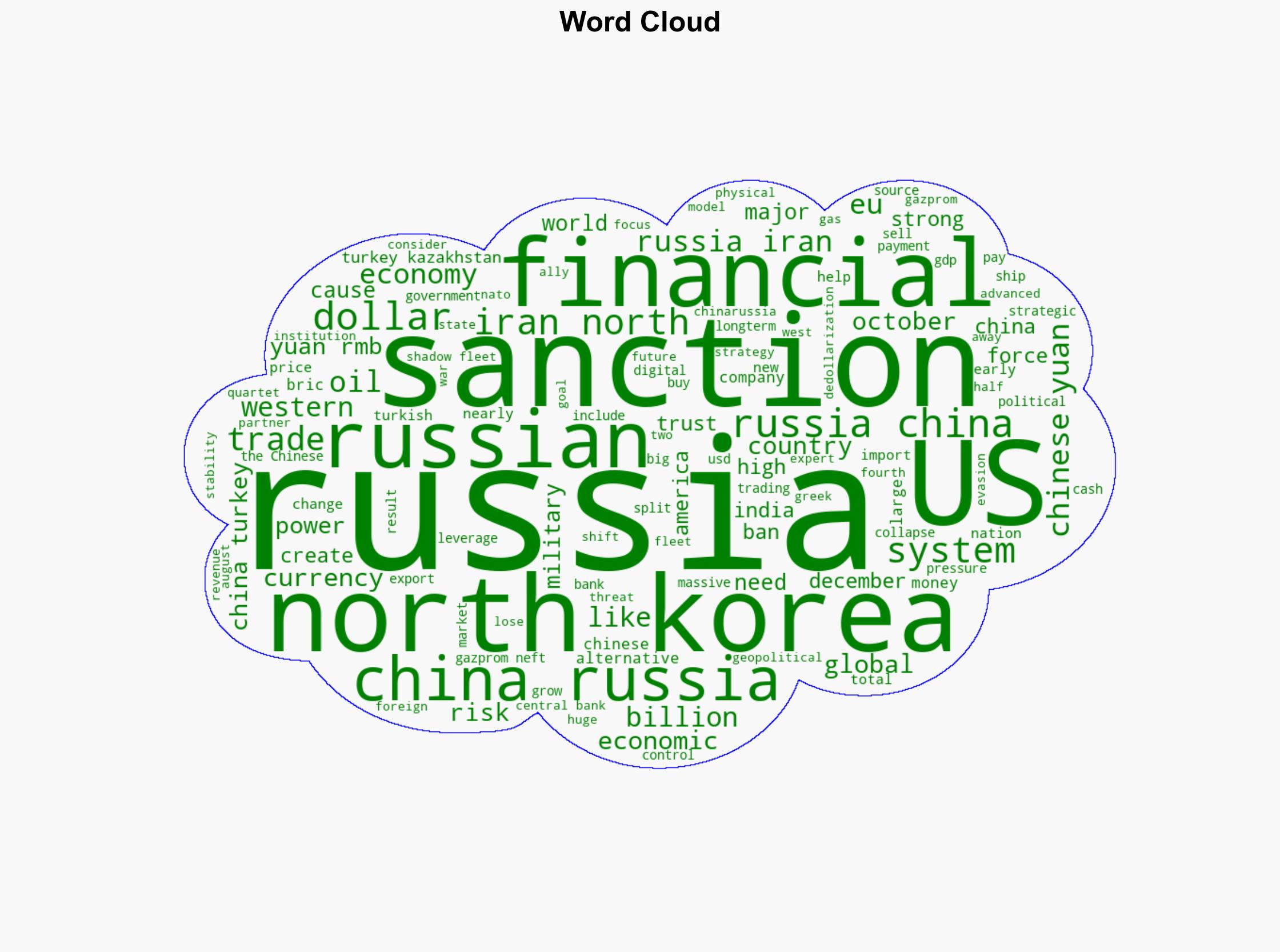

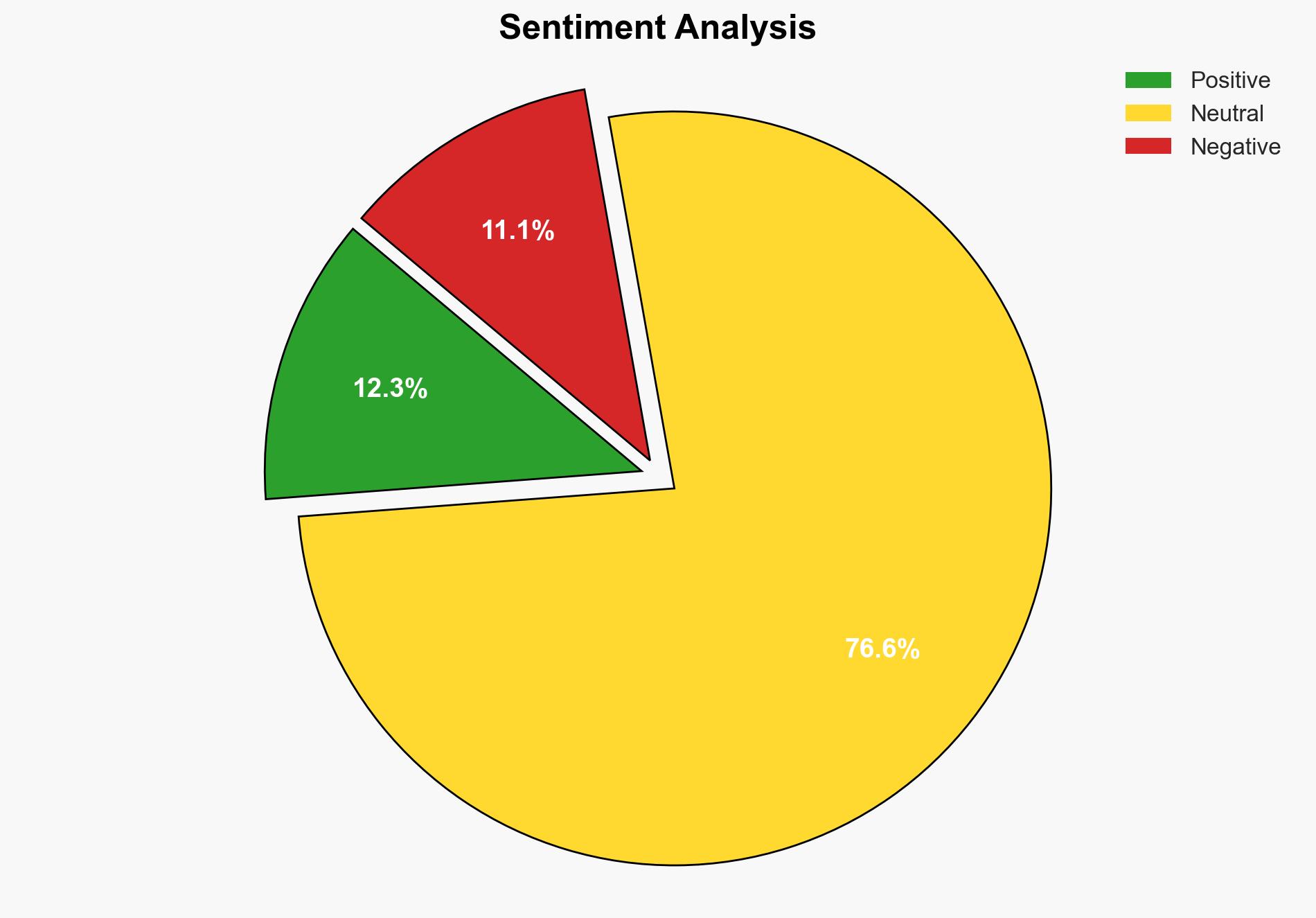

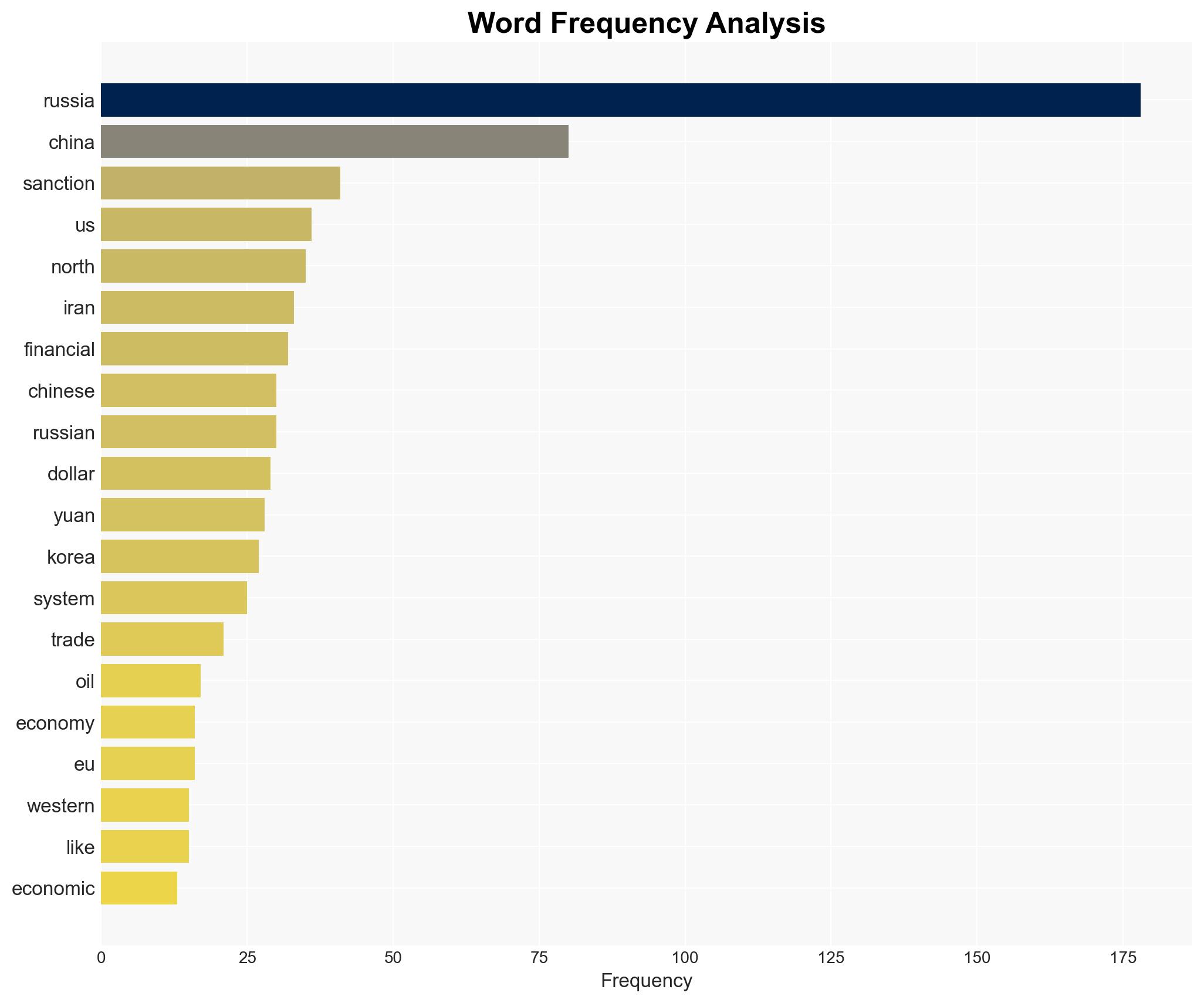

The strategic judgment is that the sanctions against Russia have not achieved their intended economic collapse but have instead accelerated a shift towards de-dollarization and strengthened Russia’s economic ties with China. The most supported hypothesis is that Russia’s advanced evasion tactics and the geopolitical realignment towards non-dollar economies are undermining the long-term efficacy of Western sanctions. Confidence Level: Moderate. Recommended action includes reassessing the sanctions strategy and exploring diplomatic channels to mitigate the geopolitical and economic shifts.

2. Competing Hypotheses

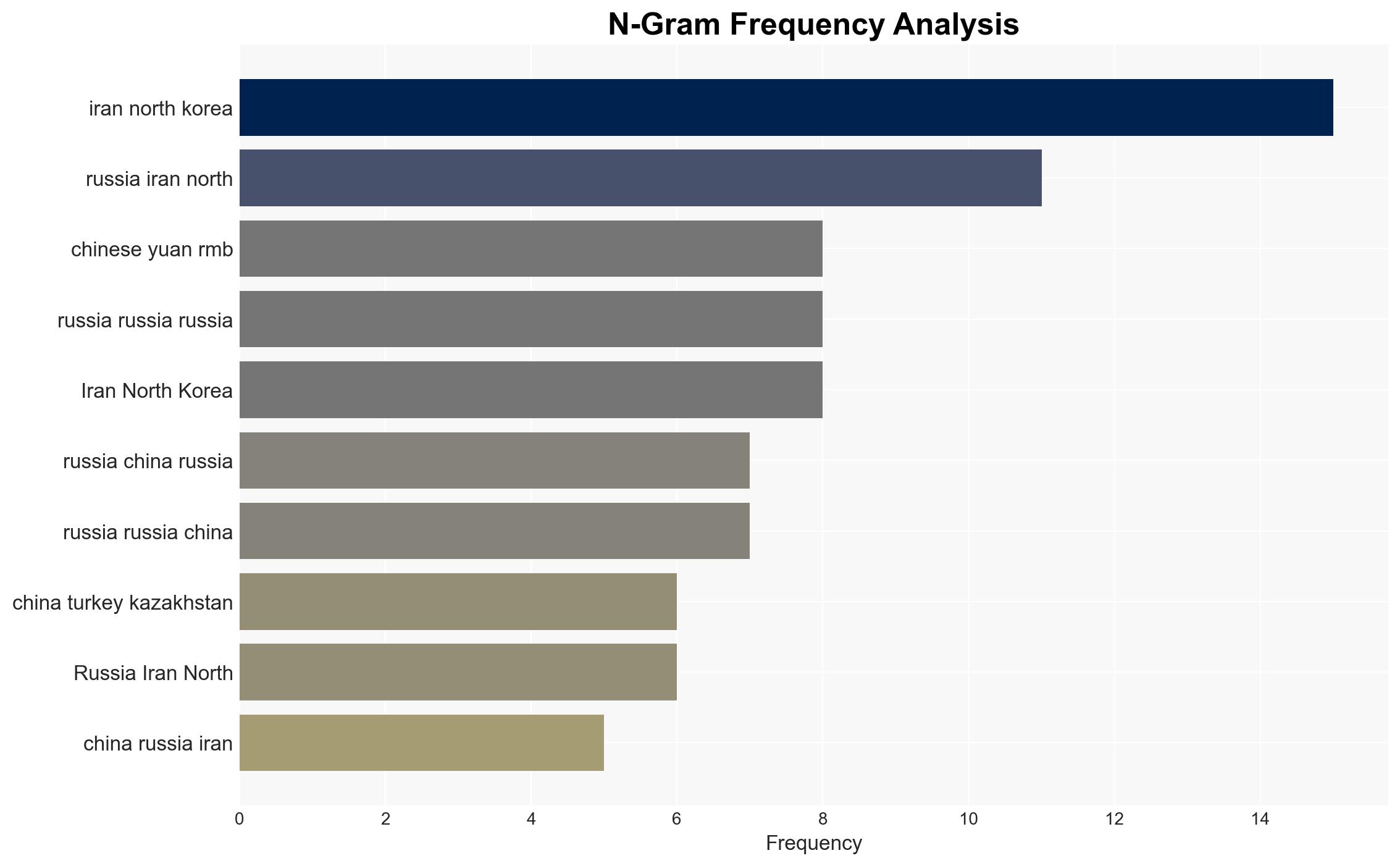

Hypothesis 1: Sanctions have failed to collapse Russia’s economy but have instead expedited a global shift towards de-dollarization, with Russia leveraging advanced evasion networks and fostering stronger economic ties with China.

Hypothesis 2: Sanctions are gradually weakening Russia’s economic capabilities, but the perceived failure is due to the time lag in observing the full impact, and the current resilience is temporary.

Hypothesis 1 is more likely due to the observable shift in trade practices and currency usage between Russia and China, as well as the historical precedent of similar evasion tactics by Iran and North Korea.

3. Key Assumptions and Red Flags

Assumptions: The assumption that sanctions would lead to immediate economic collapse may have underestimated Russia’s adaptability and alternative economic partnerships.

Red Flags: The rapid shift towards the Chinese yuan and the establishment of alternative financial networks suggest potential underestimation of Russia’s strategic planning and resilience.

Deception Indicators: Russia’s public portrayal of economic stability may mask underlying vulnerabilities not immediately visible to external analysts.

4. Implications and Strategic Risks

The primary implication is the potential erosion of the US dollar’s dominance in global trade, which could weaken US financial leverage. Strategic risks include the solidification of a bifurcated global financial system, increased cyber and economic warfare, and the strengthening of the China-Russia axis, which may challenge Western geopolitical interests.

5. Recommendations and Outlook

- Reevaluate the sanctions framework to address loopholes and consider multilateral diplomatic efforts to engage with emerging economies aligning with Russia.

- Enhance intelligence gathering on Russia’s evasion tactics and financial networks to better anticipate and counteract their strategies.

- Best-case scenario: Diplomatic engagement leads to a recalibration of sanctions, fostering a more cooperative international economic environment.

- Worst-case scenario: Continued de-dollarization and economic realignment result in a significant loss of US financial influence and increased geopolitical tensions.

- Most-likely scenario: A gradual shift towards a multipolar financial system with persistent geopolitical friction between Western and non-Western blocs.

6. Key Individuals and Entities

Vladimir Putin (Russia), Xi Jinping (China), Rosneft, Lukoil, Gazprom Neft, BRICS nations.

7. Thematic Tags

Regional Focus, Regional Focus: Russia, China, Global Financial System

Structured Analytic Techniques Applied

- Causal Layered Analysis (CLA): Analyze events across surface happenings, systems, worldviews, and myths.

- Cross-Impact Simulation: Model ripple effects across neighboring states, conflicts, or economic dependencies.

- Scenario Generation: Explore divergent futures under varying assumptions to identify plausible paths.

- Network Influence Mapping: Map influence relationships to assess actor impact.

Explore more:

Regional Focus Briefs ·

Daily Summary ·

Support us