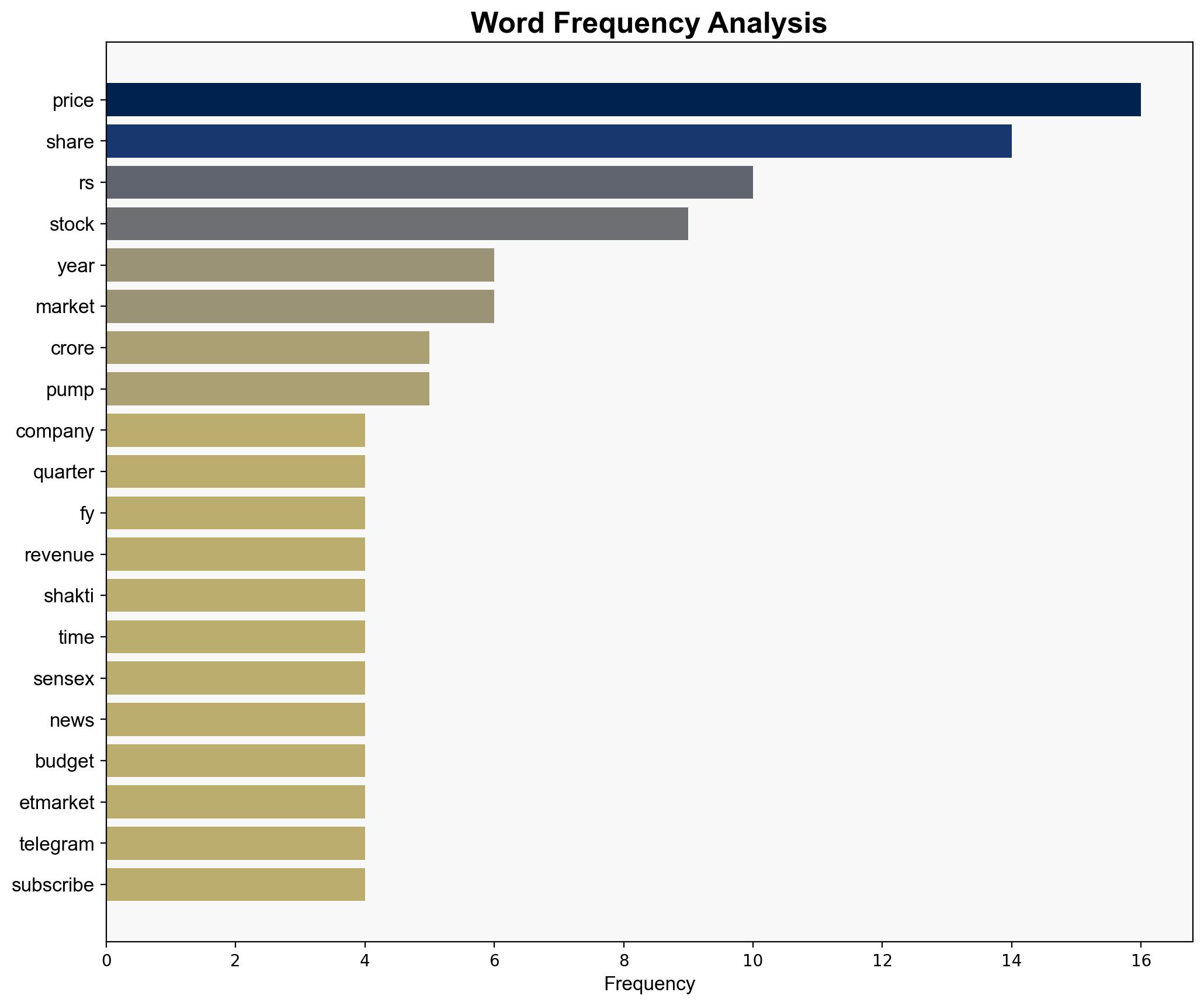

Shakti Pumps shares plunge 8 following weak September quarter profits – The Times of India

Published on: 2025-11-10

Intelligence Report: Shakti Pumps shares plunge 8 following weak September quarter profits – The Times of India

1. BLUF (Bottom Line Up Front)

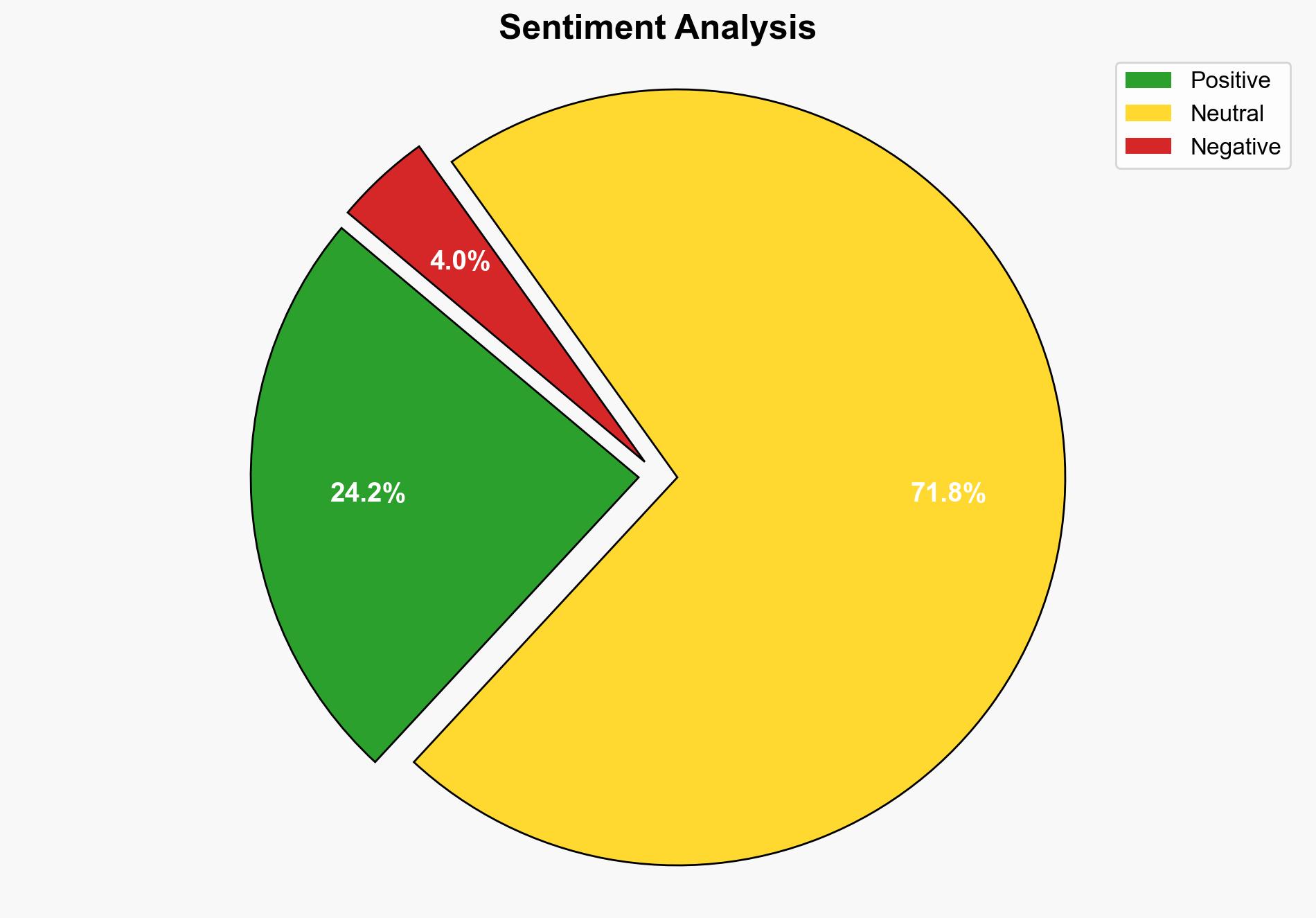

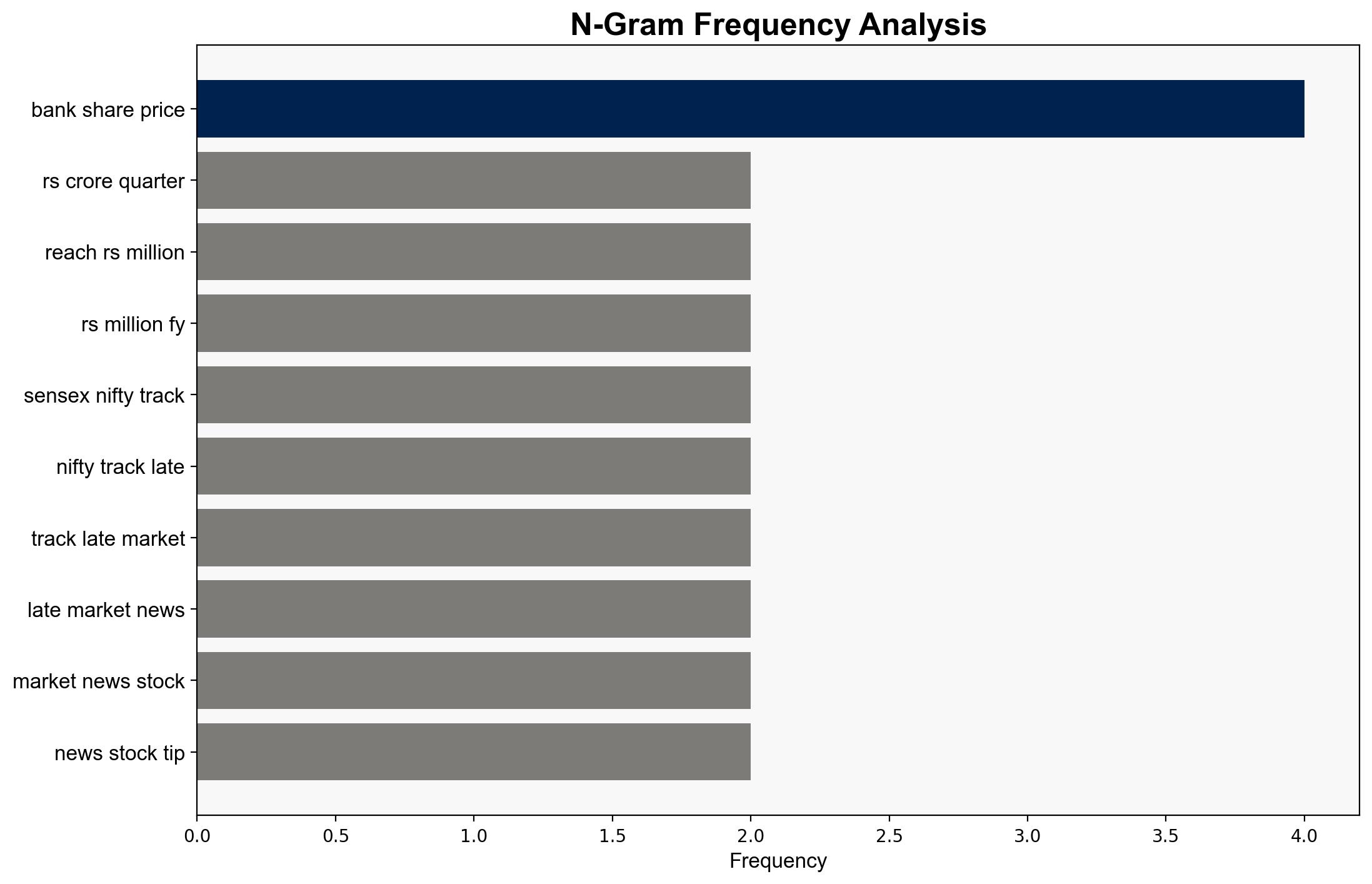

The most supported hypothesis is that Shakti Pumps’ share price decline is primarily due to weak quarterly profits and investor concerns over profitability despite revenue growth. Confidence level: Moderate. Recommended action: Monitor financial performance and investor sentiment closely, while exploring strategic partnerships to enhance profitability.

2. Competing Hypotheses

1. **Hypothesis A**: The decline in Shakti Pumps’ share price is primarily due to weak quarterly profits and concerns over declining profit margins, overshadowing revenue growth.

2. **Hypothesis B**: The share price decline is driven by broader market trends and investor sentiment, with Shakti Pumps’ financial performance being a secondary factor.

Using ACH 2.0, Hypothesis A is better supported by the evidence of declining net profits and profit margins, despite revenue growth. Hypothesis B lacks specific evidence linking broader market trends to Shakti Pumps’ performance.

3. Key Assumptions and Red Flags

– Assumption: Investors prioritize profitability over revenue growth in their valuation of Shakti Pumps.

– Red Flag: The report lacks detailed information on broader market conditions that could influence investor behavior.

– Potential cognitive bias: Overemphasis on recent financial results without considering long-term strategic initiatives.

4. Implications and Strategic Risks

– Economic: Continued pressure on profit margins could lead to reduced investor confidence and further share price declines.

– Strategic Risk: Failure to improve profitability may hinder Shakti Pumps’ ability to capitalize on growth opportunities in the solar pumping sector.

– Psychological: Negative investor sentiment could create a self-reinforcing cycle of declining share prices.

5. Recommendations and Outlook

- Enhance transparency in financial reporting to build investor confidence.

- Explore cost-reduction strategies to improve profit margins.

- Scenario-based projections:

- Best: Profitability improves, leading to share price recovery.

- Worst: Continued profit margin decline results in sustained share price weakness.

- Most Likely: Moderate improvement in profitability stabilizes share price.

6. Key Individuals and Entities

– Shakti Pumps

– Investors and stakeholders in the solar pumping sector

7. Thematic Tags

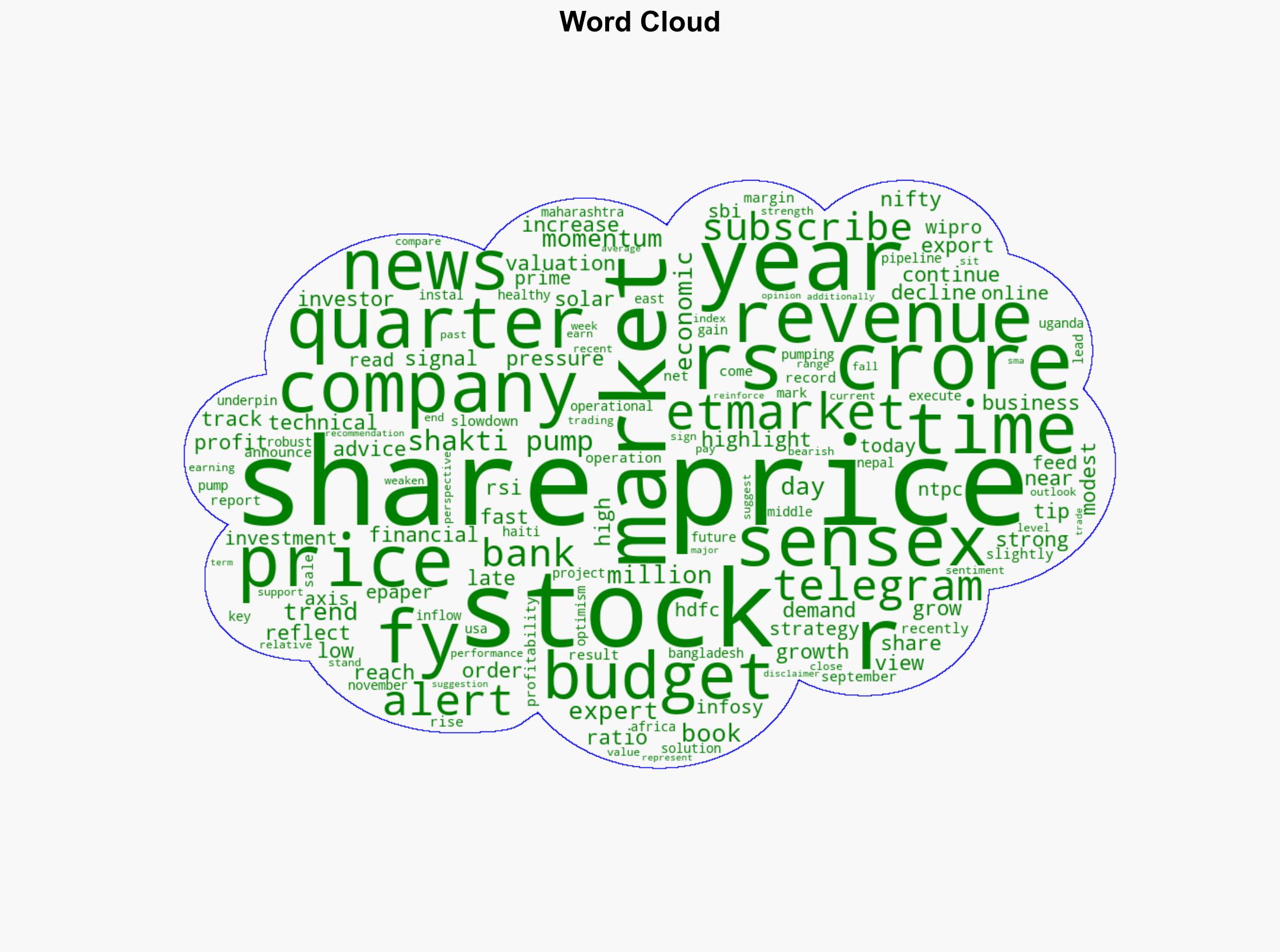

economic analysis, investor sentiment, financial performance, market trends