Shares cautious in Asia as US government faces shutdown risk – CNA

Published on: 2025-09-29

Intelligence Report: Shares cautious in Asia as US government faces shutdown risk – CNA

1. BLUF (Bottom Line Up Front)

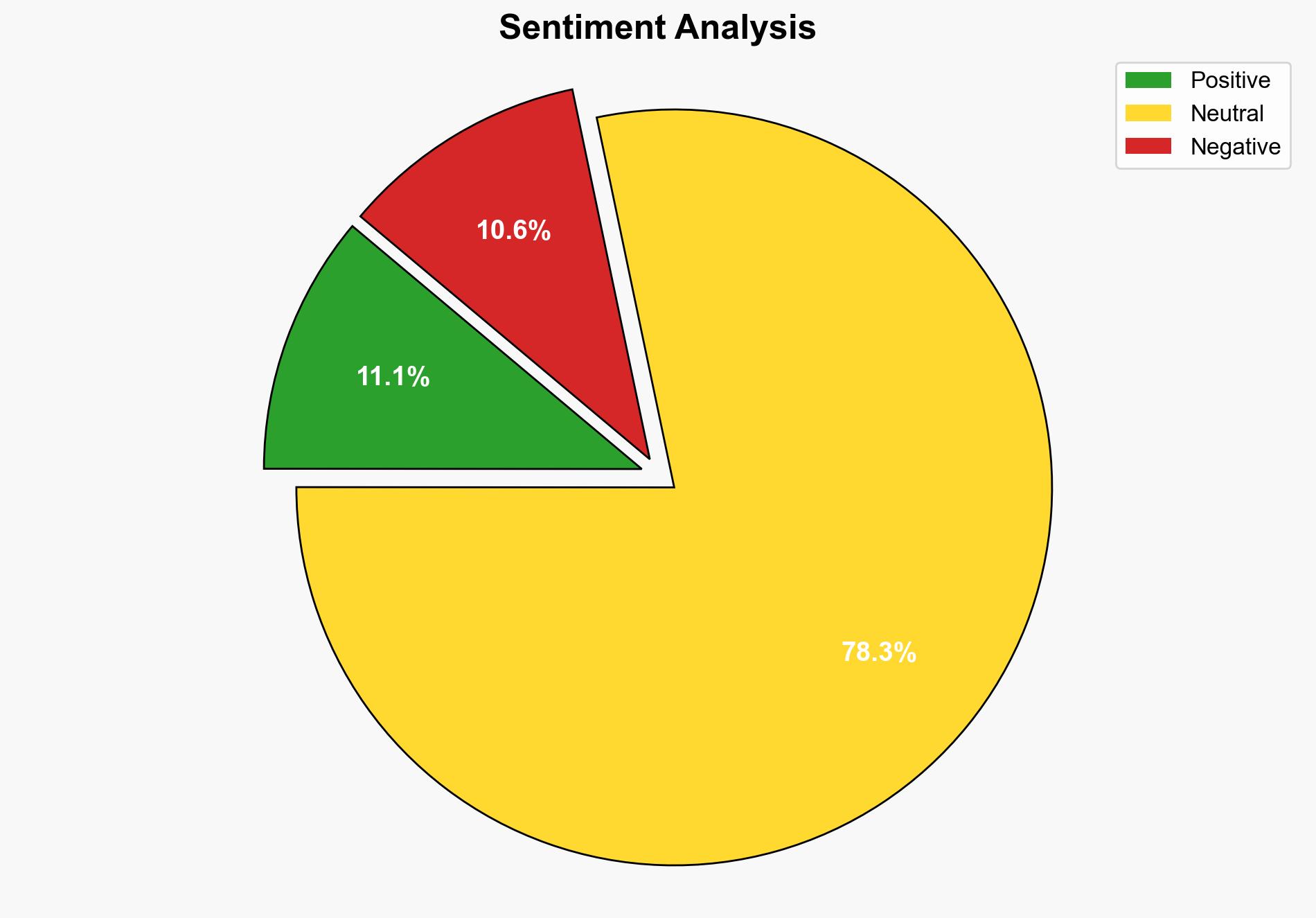

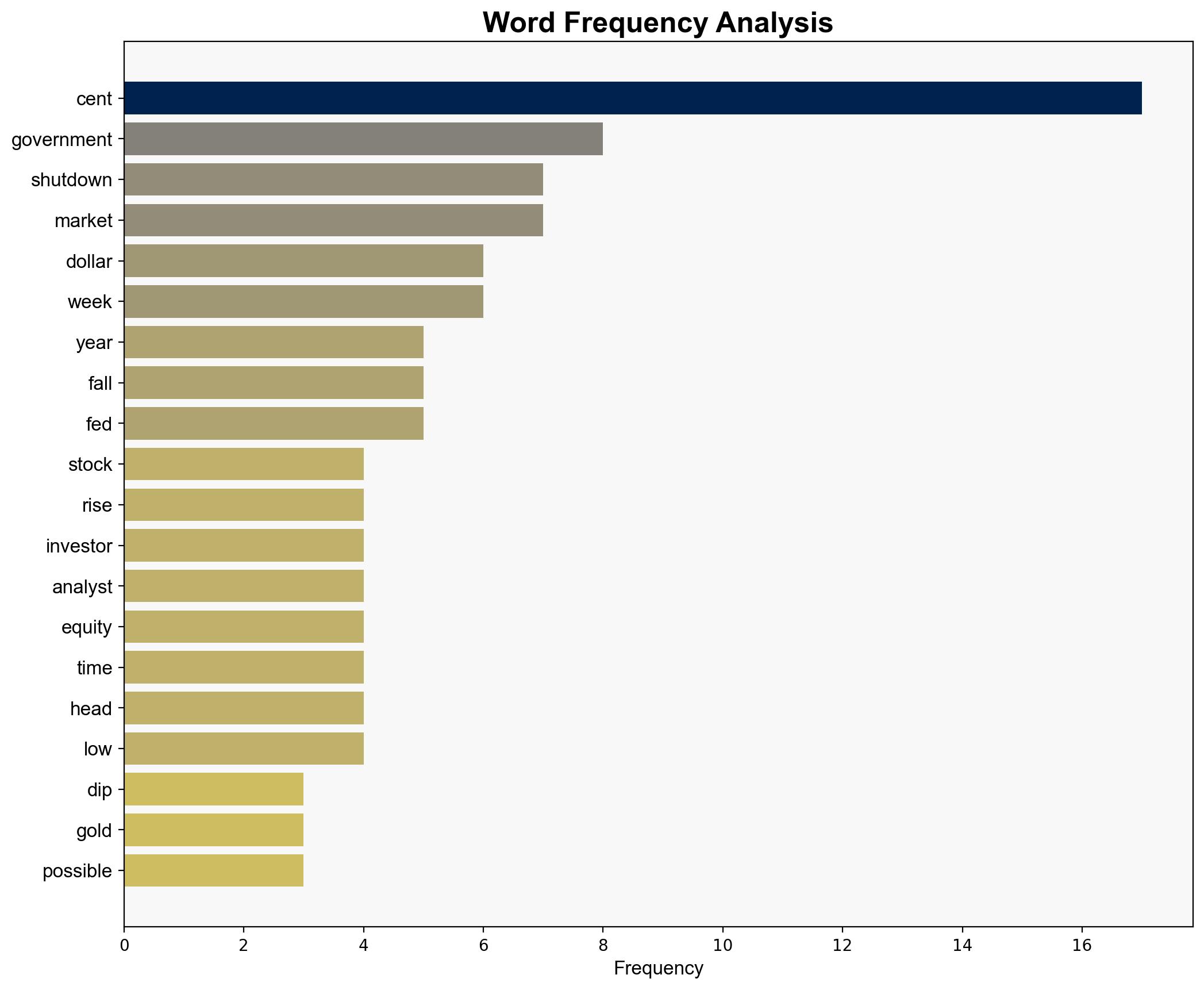

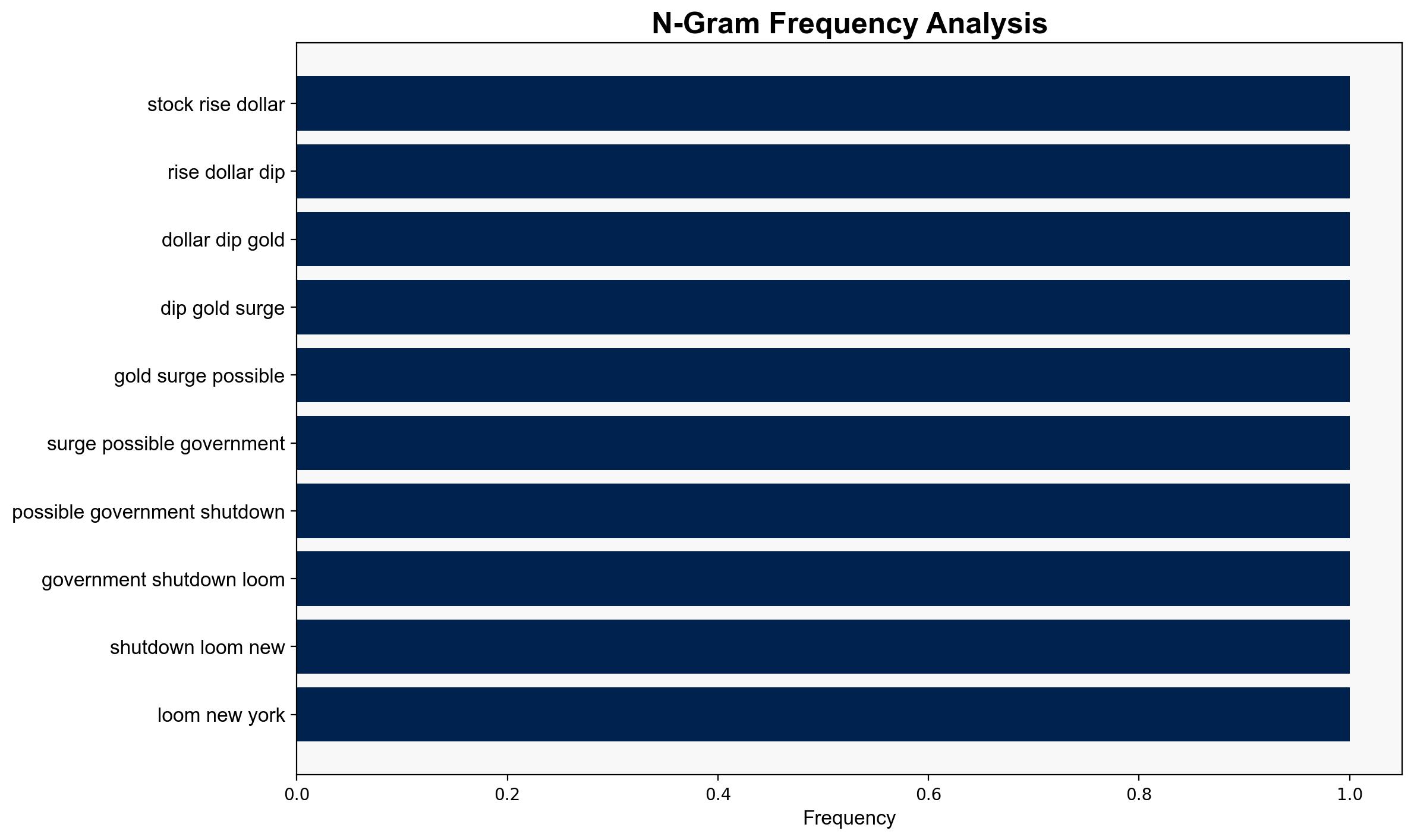

The most supported hypothesis is that the potential US government shutdown will have a limited short-term impact on global markets, but could lead to significant long-term economic and strategic implications if prolonged. Confidence Level: Moderate. It is recommended to monitor the situation closely, particularly the negotiations in Congress, and prepare for potential volatility in financial markets.

2. Competing Hypotheses

Hypothesis 1: The potential US government shutdown will have a minimal impact on global financial markets in the short term, as investors have historically shown resilience to such events.

Hypothesis 2: A prolonged US government shutdown could lead to significant economic disruptions, affecting global market stability and investor confidence, particularly if it impacts key economic data releases and Federal Reserve policy decisions.

3. Key Assumptions and Red Flags

Assumptions:

– Investors are relying on historical patterns where past shutdowns had limited market impact.

– The Federal Reserve can effectively operate using private data sources if government data is unavailable.

Red Flags:

– Potential underestimation of the impact on consumer confidence and economic growth.

– Lack of clarity on how long the shutdown might last and its broader economic implications.

– Over-reliance on historical data without considering current geopolitical and economic contexts.

4. Implications and Strategic Risks

A prolonged shutdown could lead to cascading economic effects, including reduced consumer spending and delayed policy decisions by the Federal Reserve. This scenario could exacerbate existing geopolitical tensions and lead to increased volatility in global markets. Additionally, the shutdown could impact US credibility and influence in international economic forums.

5. Recommendations and Outlook

- Monitor Congressional negotiations closely to anticipate potential resolutions or extensions.

- Prepare for market volatility by diversifying investments and considering hedging strategies.

- Scenario Projections:

- Best Case: Quick resolution to the shutdown with minimal market impact.

- Worst Case: Protracted shutdown leading to significant economic slowdown and market instability.

- Most Likely: Short-term market fluctuations with a resolution before significant economic damage occurs.

6. Key Individuals and Entities

– Donald Trump

– Nicole Inui

– Alastair Pind

– Pete Hegseth

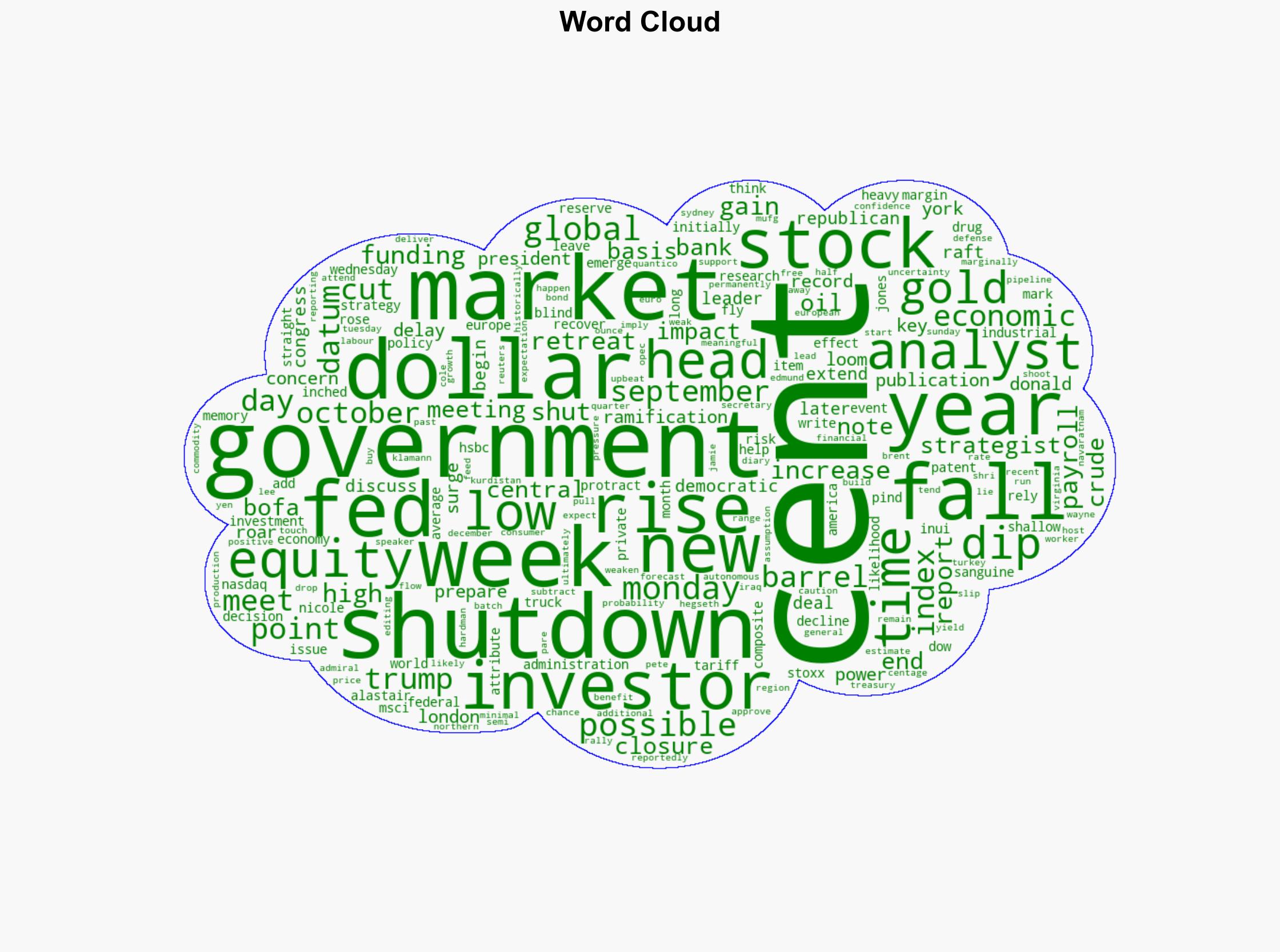

7. Thematic Tags

national security threats, economic stability, financial markets, US government shutdown