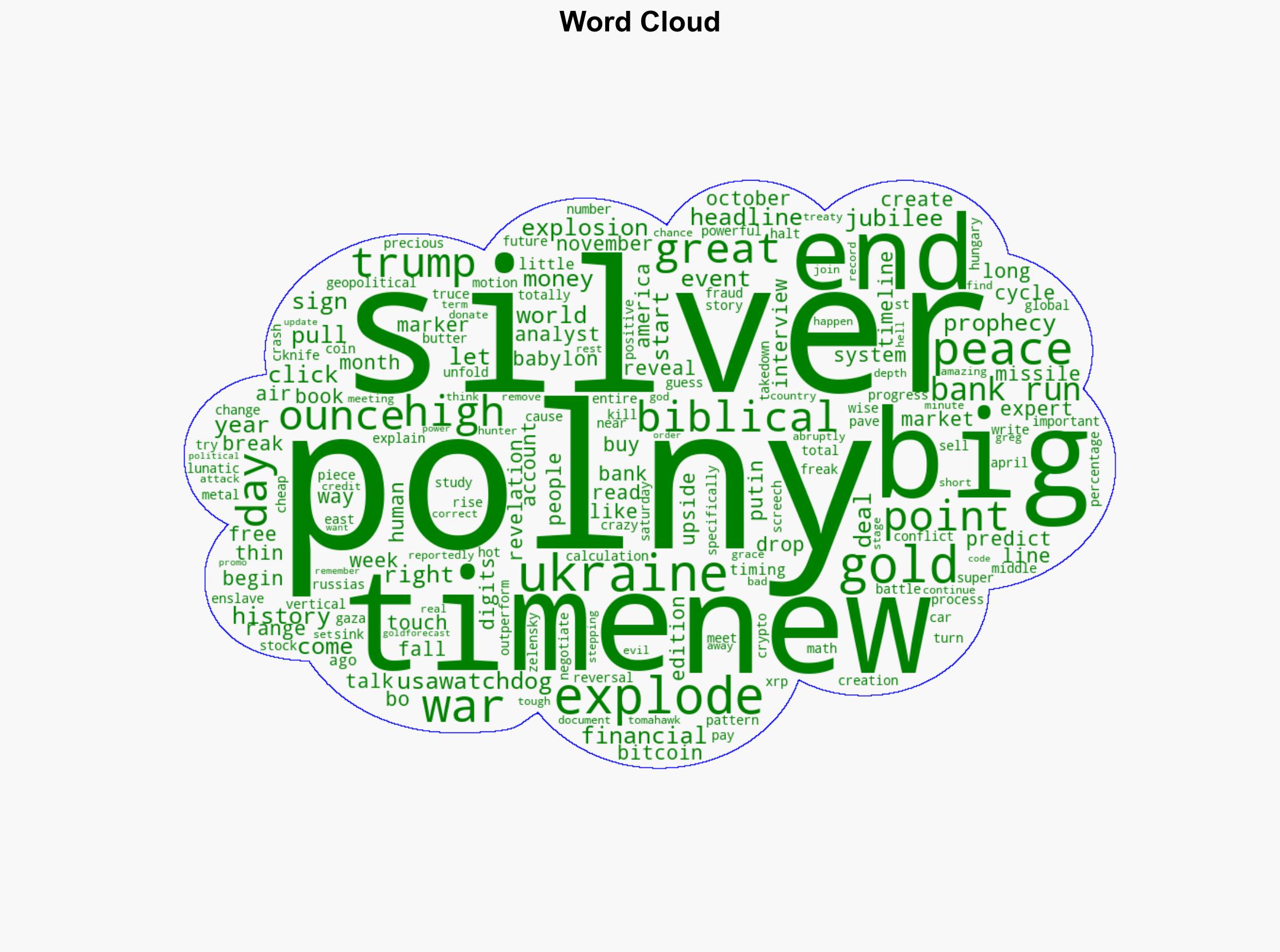

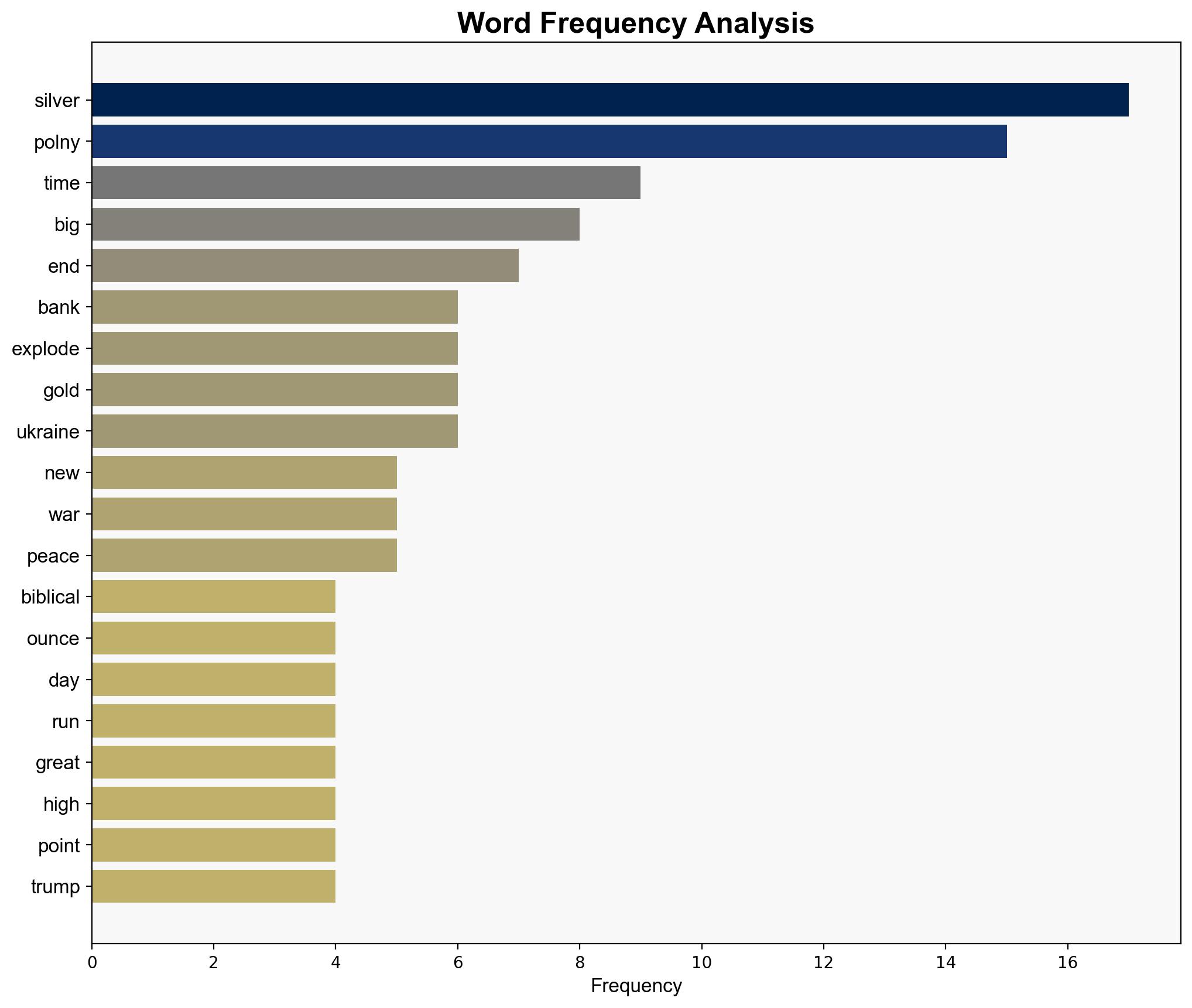

Silver Gold Record Highs Continue No War Bo Polny – Activistpost.com

Published on: 2025-10-24

Intelligence Report: Silver Gold Record Highs Continue No War Bo Polny – Activistpost.com

1. BLUF (Bottom Line Up Front)

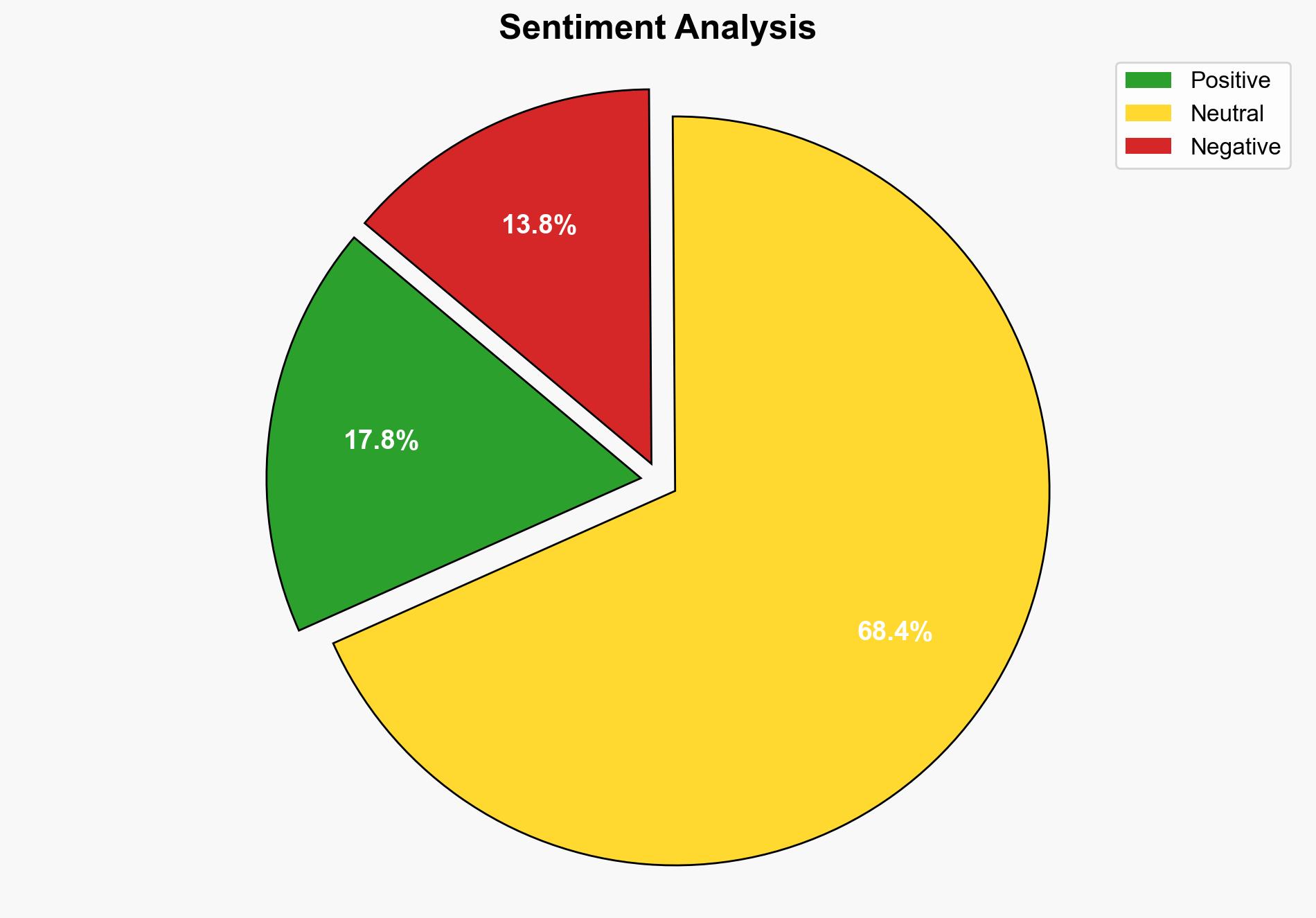

The analysis suggests a moderate confidence level that the financial predictions of Bo Polny, particularly regarding silver and gold, are speculative and influenced by non-traditional forecasting methods. The hypothesis that these predictions are primarily driven by market speculation and psychological factors is better supported. It is recommended to monitor market reactions and investor sentiment closely, as these could influence short-term market volatility.

2. Competing Hypotheses

1. **Hypothesis A**: Bo Polny’s predictions about silver and gold reaching record highs are based on accurate geopolitical and financial analysis, indicating a significant market shift.

2. **Hypothesis B**: The predictions are speculative, driven by psychological factors and non-traditional forecasting methods, lacking substantial empirical support.

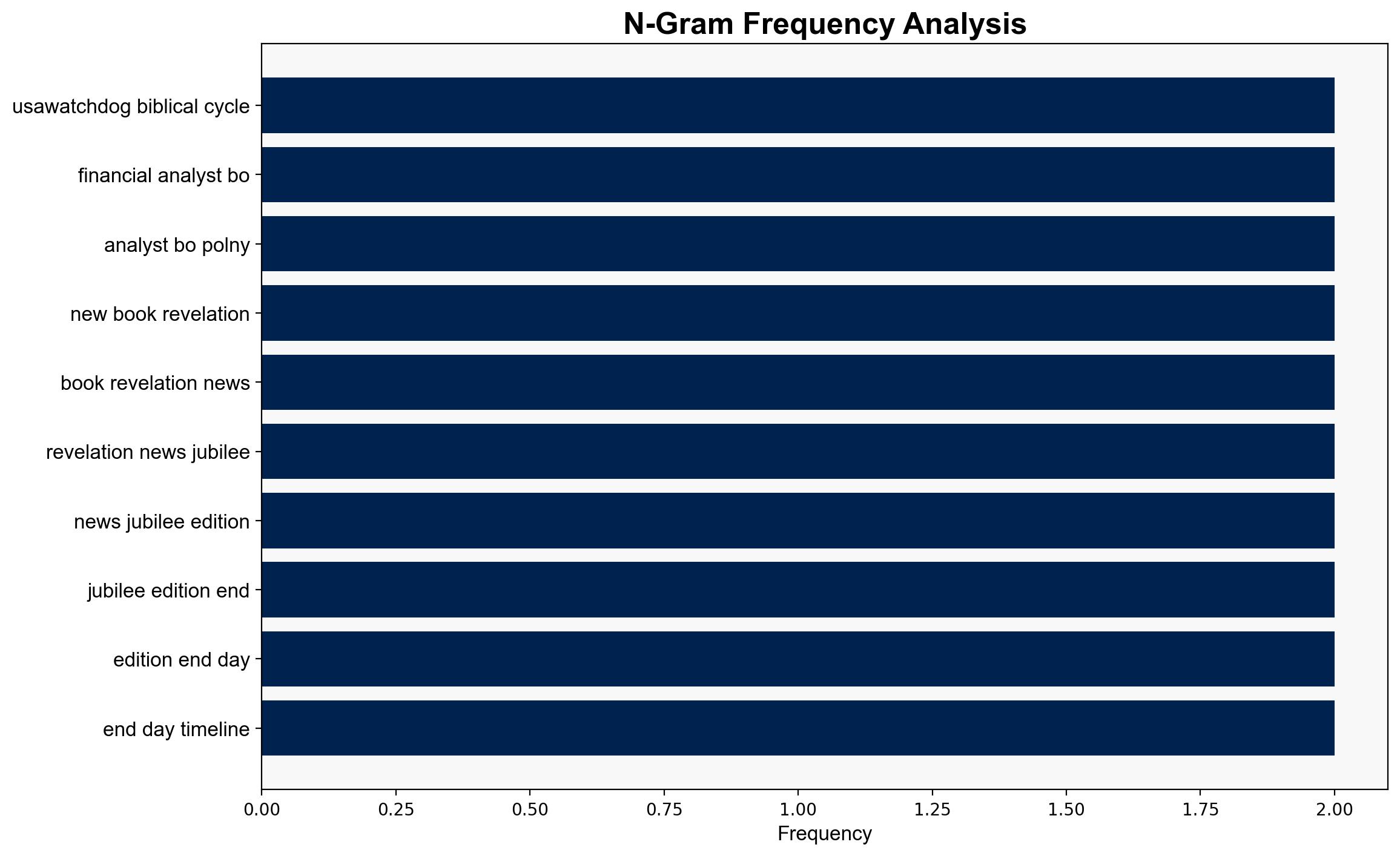

Using the Analysis of Competing Hypotheses (ACH) 2.0, Hypothesis B is better supported due to the reliance on non-traditional methods such as biblical cycle timing, which lacks empirical validation.

3. Key Assumptions and Red Flags

– **Assumptions**: Hypothesis A assumes that non-traditional methods can accurately predict financial markets. Hypothesis B assumes market movements are primarily driven by traditional economic indicators and investor sentiment.

– **Red Flags**: The use of biblical cycles as a forecasting tool is a significant red flag, indicating potential bias or deception.

– **Inconsistent Data**: Lack of empirical data supporting the correlation between geopolitical events and immediate market shifts as predicted.

4. Implications and Strategic Risks

– **Economic Risks**: If market participants act on these speculative predictions, it could lead to increased volatility in precious metals markets.

– **Geopolitical Risks**: Predictions of imminent global conflict could influence investor behavior and market stability.

– **Psychological Risks**: The narrative of a financial system collapse could trigger panic, leading to bank runs or irrational market behavior.

5. Recommendations and Outlook

- Monitor market sentiment and investor behavior for signs of increased volatility in precious metals.

- Engage with financial analysts to assess the impact of geopolitical developments on market trends.

- Scenario Projections:

- Best Case: Market stabilizes as predictions are not realized, leading to normalized trading behavior.

- Worst Case: Panic induced by predictions leads to market crashes and economic instability.

- Most Likely: Short-term volatility with eventual stabilization as traditional economic indicators prevail.

6. Key Individuals and Entities

– Bo Polny

– Greg Hunter

– Donald Trump

– Vladimir Putin

– Volodymyr Zelensky

7. Thematic Tags

national security threats, economic volatility, geopolitical analysis, market speculation