Singapores financial system remains resilient but MAS warns of rising global risks – CNA

Published on: 2025-11-05

Intelligence Report: Singapore’s Financial System Resilience Amid Rising Global Risks

1. BLUF (Bottom Line Up Front)

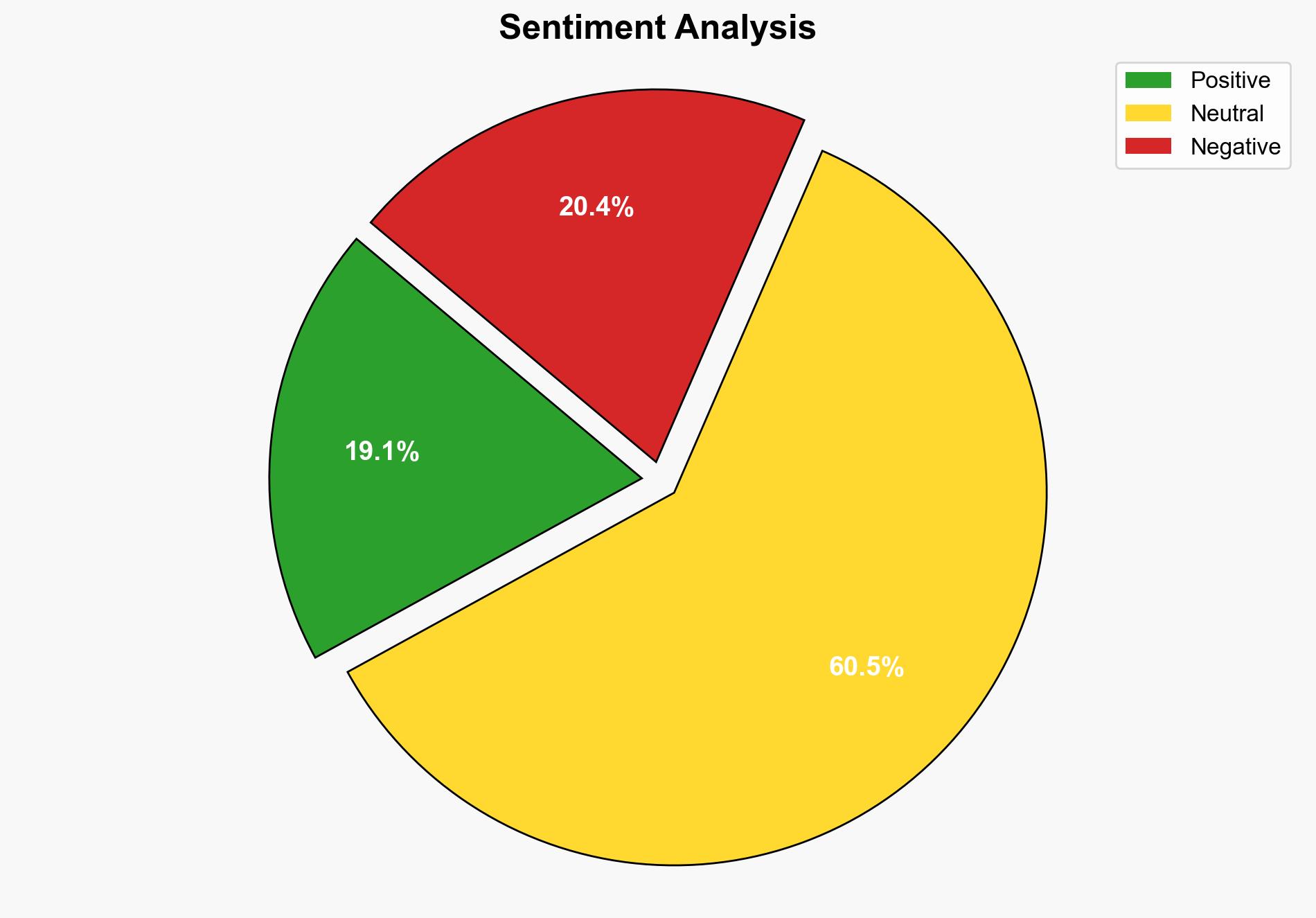

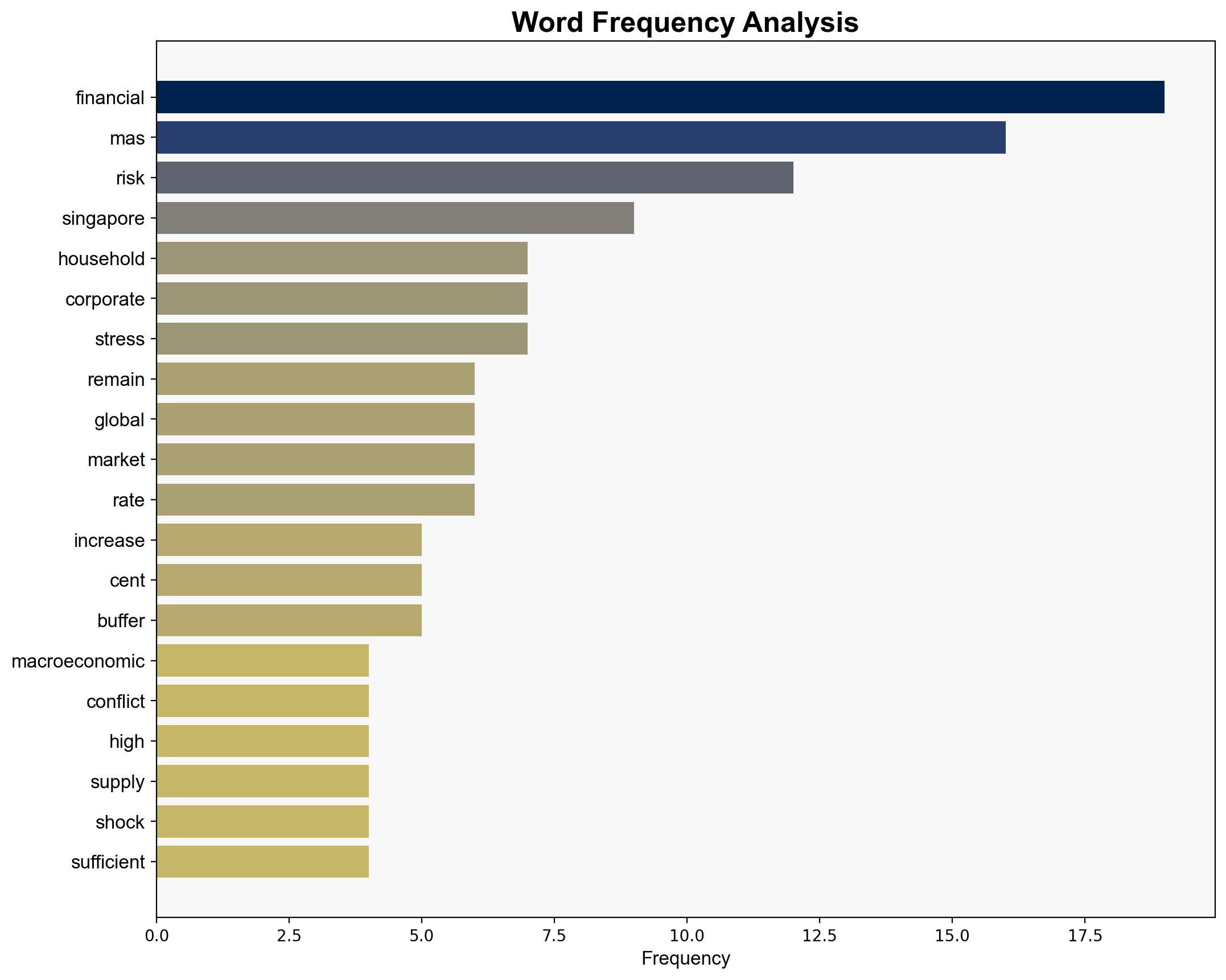

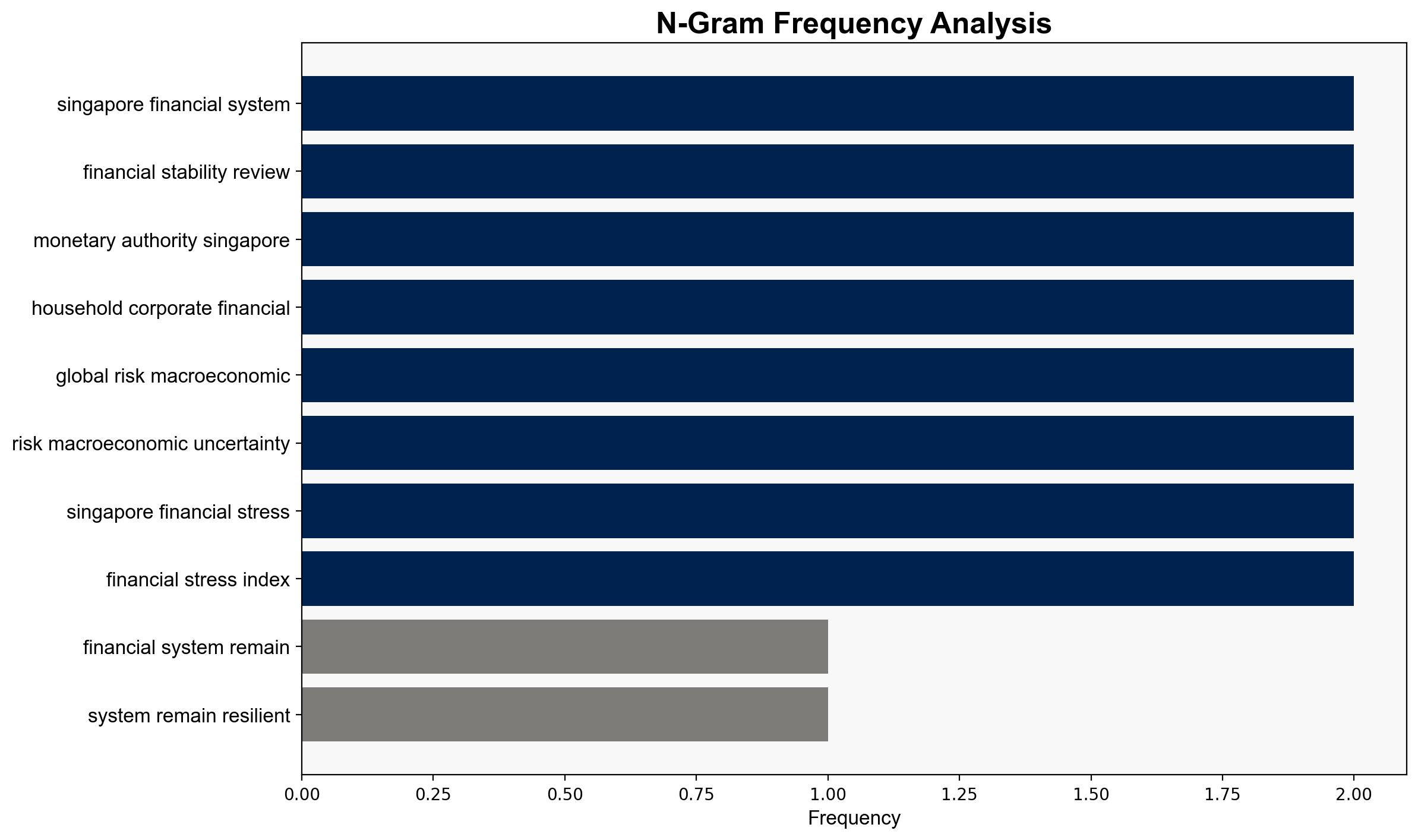

Singapore’s financial system remains robust, yet faces significant external risks. The most supported hypothesis is that while domestic resilience is strong, global macroeconomic and geopolitical uncertainties pose substantial threats. Confidence level: Moderate. Recommended action: Enhance risk mitigation strategies focusing on global exposure and maintain vigilance in monitoring international developments.

2. Competing Hypotheses

Hypothesis 1: Singapore’s financial system will continue to withstand global risks due to its inherent resilience and proactive measures by the Monetary Authority of Singapore (MAS). This is supported by the current low financial stress index and strong domestic financial conditions.

Hypothesis 2: Despite current resilience, Singapore’s financial system is vulnerable to external shocks, particularly from geopolitical tensions and macroeconomic uncertainties. The potential for a sharp correction in international markets and increased volatility could impact Singapore significantly.

Using ACH 2.0, Hypothesis 2 is better supported due to the ongoing global risks highlighted by MAS, such as geopolitical conflicts and high valuation corrections, which could undermine Singapore’s financial stability despite its current resilience.

3. Key Assumptions and Red Flags

Assumptions:

– Singapore’s financial system can absorb external shocks due to its current resilience.

– MAS’s warnings are based on comprehensive risk assessments.

Red Flags:

– Over-reliance on current indicators of resilience without accounting for rapid changes in global risk factors.

– Potential underestimation of geopolitical risks and their cascading effects on financial markets.

4. Implications and Strategic Risks

The primary risk is a sharp correction in global markets driven by geopolitical tensions, particularly involving Ukraine, the Middle East, and China. Such events could lead to supply chain disruptions and impact investor sentiment, affecting Singapore’s financial markets. Additionally, high exposure to sectors like artificial intelligence, which are currently overvalued, presents a risk of significant market corrections.

5. Recommendations and Outlook

- Enhance monitoring of global geopolitical developments and their potential impacts on financial markets.

- Strengthen liquidity buffers and diversify investment portfolios to mitigate risks from market corrections.

- Scenario-based projections:

- Best Case: Global risks stabilize, and Singapore’s financial system remains robust.

- Worst Case: Escalation of geopolitical tensions leads to significant market corrections, impacting Singapore’s financial stability.

- Most Likely: Continued vigilance and proactive measures by MAS mitigate some risks, but external factors still pose challenges.

6. Key Individuals and Entities

– Monetary Authority of Singapore (MAS)

7. Thematic Tags

national security threats, economic resilience, geopolitical risks, financial stability