SingleKey Study Renting No Longer a Stepping Stone to Homeownership in Canada Many Require Dual Incomes to Afford Rental Housing – Financial Post

Published on: 2025-11-20

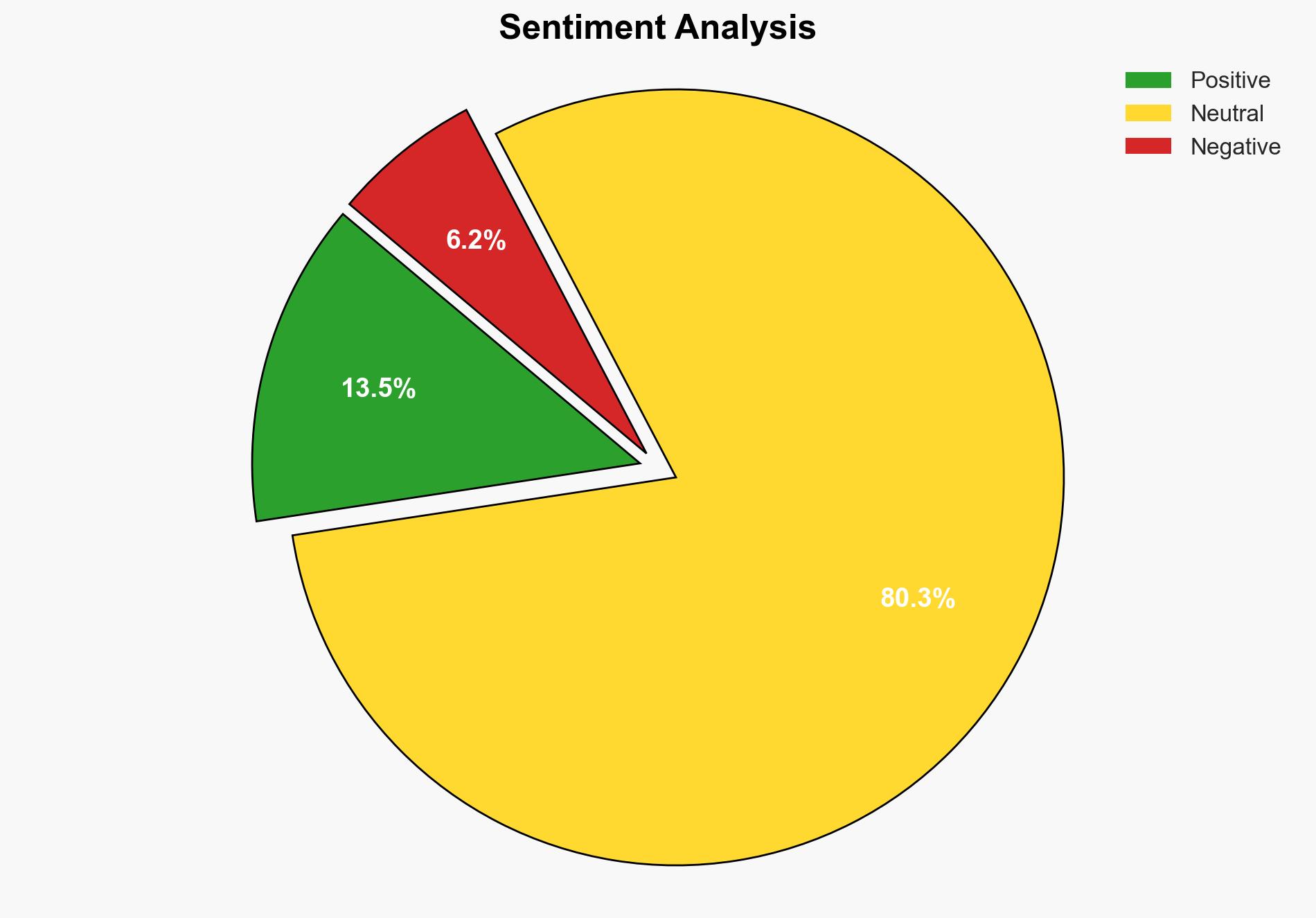

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report:

1. BLUF (Bottom Line Up Front)

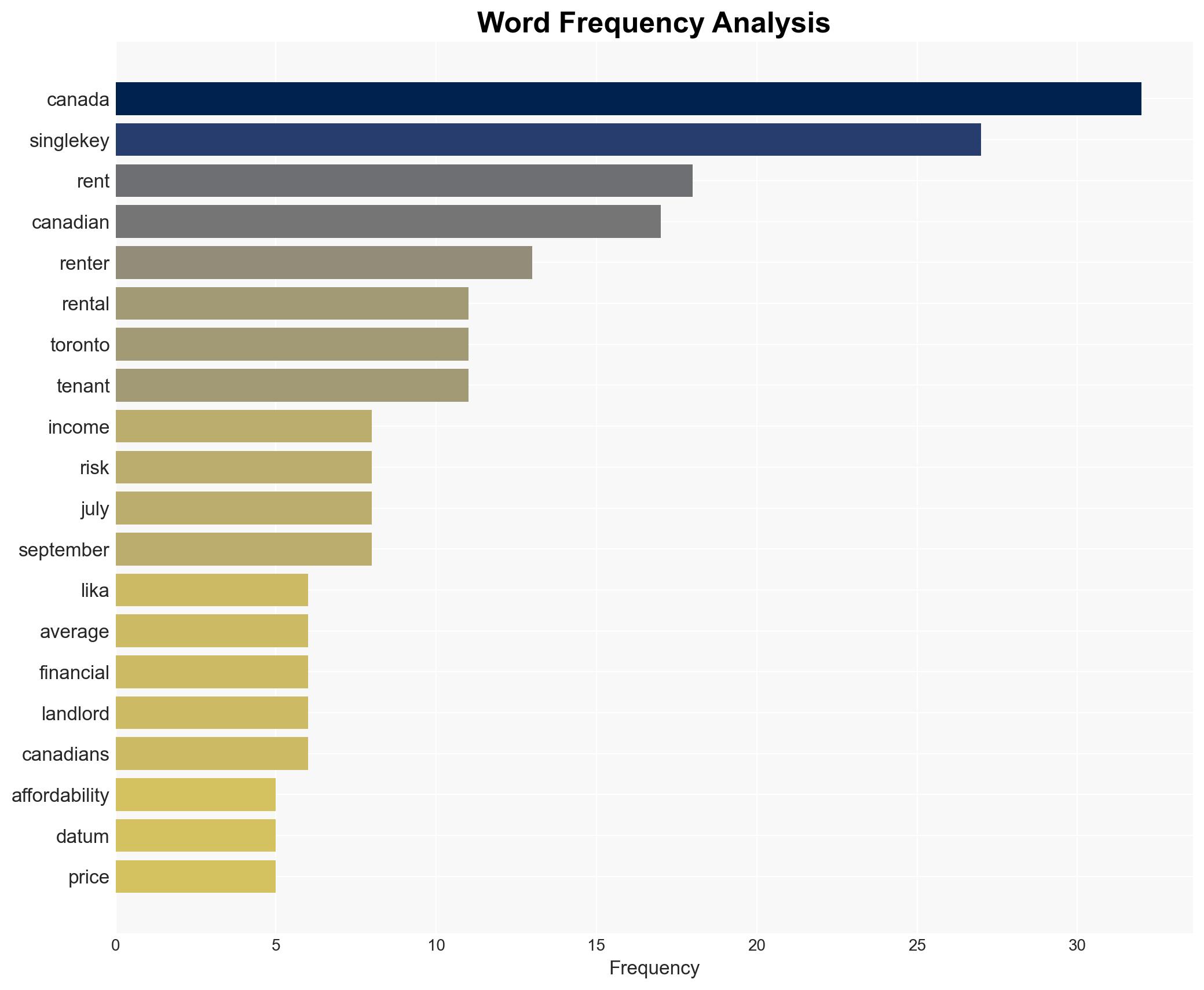

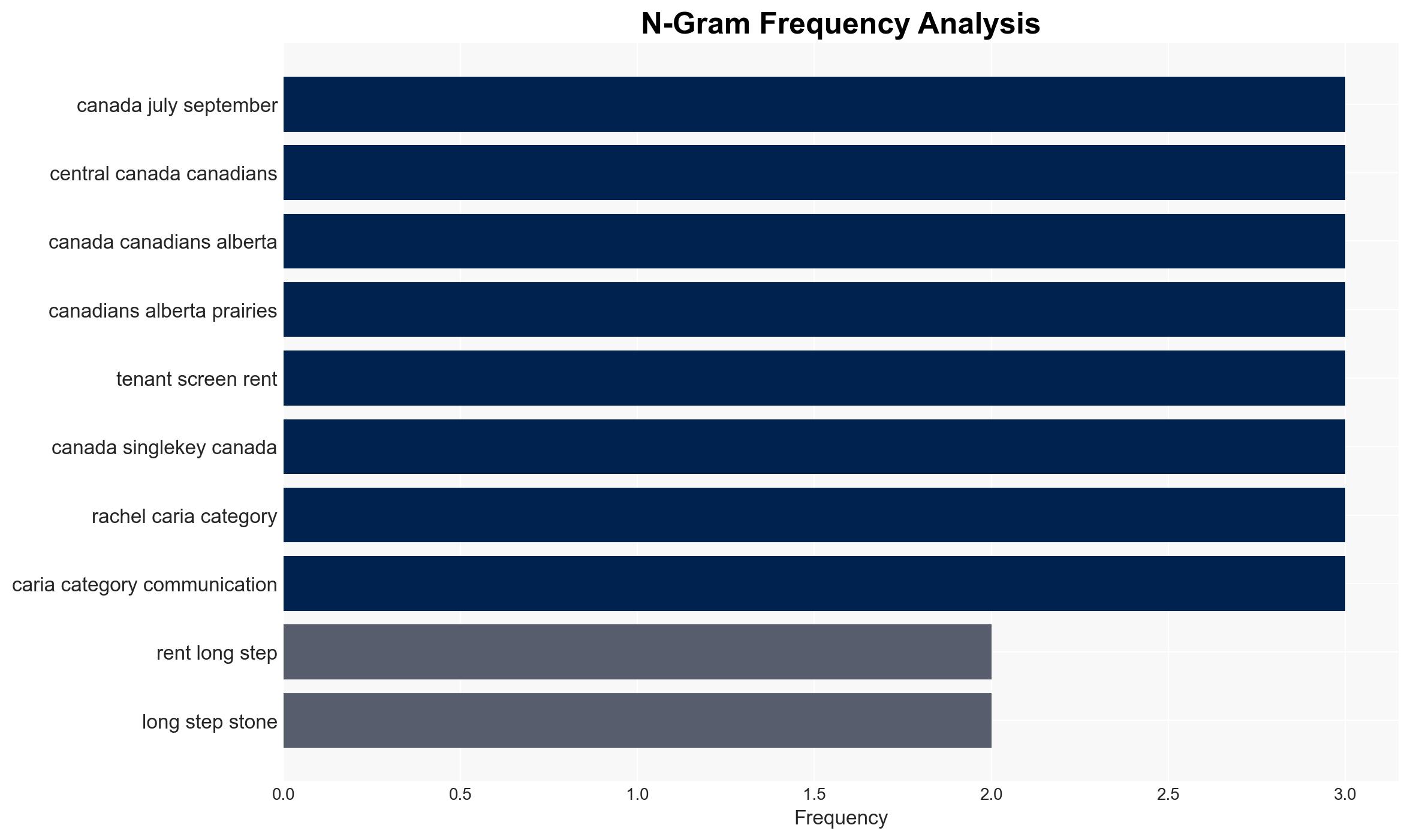

The Canadian rental market is increasingly becoming a permanent housing solution rather than a transitional phase towards homeownership. This shift is driven by rising rental costs and the necessity for dual incomes to afford housing. The most supported hypothesis is that this trend will continue, leading to increased financial vulnerability among renters and potential instability in the rental market. Confidence Level: Moderate. Recommended action includes policy interventions to stabilize rental costs and support for affordable housing development.

2. Competing Hypotheses

Hypothesis 1: The trend of renting as a permanent housing solution will continue, driven by high housing costs and the need for dual incomes. This will lead to increased financial strain on renters and potential market instability.

Hypothesis 2: The current rental affordability crisis is a temporary phase, and market adjustments or policy interventions will restore renting as a stepping stone to homeownership.

Hypothesis 1 is more likely due to persistent high housing costs, stagnant wage growth, and the increasing necessity for dual incomes, which are not easily reversible trends.

3. Key Assumptions and Red Flags

Assumptions include the continued rise in housing costs and the necessity for dual incomes. A red flag is the potential bias in data interpretation by SingleKey, given their vested interest in promoting their rental risk intelligence platform. Deception indicators could include overemphasizing financial risks to promote their services.

4. Implications and Strategic Risks

The shift towards renting as a permanent solution could lead to increased economic inequality and social stratification. Political risks include potential unrest due to housing affordability issues. Economically, this trend could deter investment in rental properties, leading to a supply shortage. Informational risks involve potential misinformation about market conditions affecting investor and consumer behavior.

5. Recommendations and Outlook

- Implement policy measures to stabilize rental costs and encourage affordable housing development.

- Encourage financial literacy programs to help renters manage debt and improve credit scores.

- Best Case: Effective policy interventions lead to stabilized rental markets and renewed pathways to homeownership.

- Worst Case: Continued rental cost increases lead to widespread financial instability and reduced investment in rental properties.

- Most Likely: A gradual increase in rental costs with ongoing financial strain on renters, necessitating policy action.

6. Key Individuals and Entities

Viler Lika, Founder and CEO of SingleKey.

7. Thematic Tags

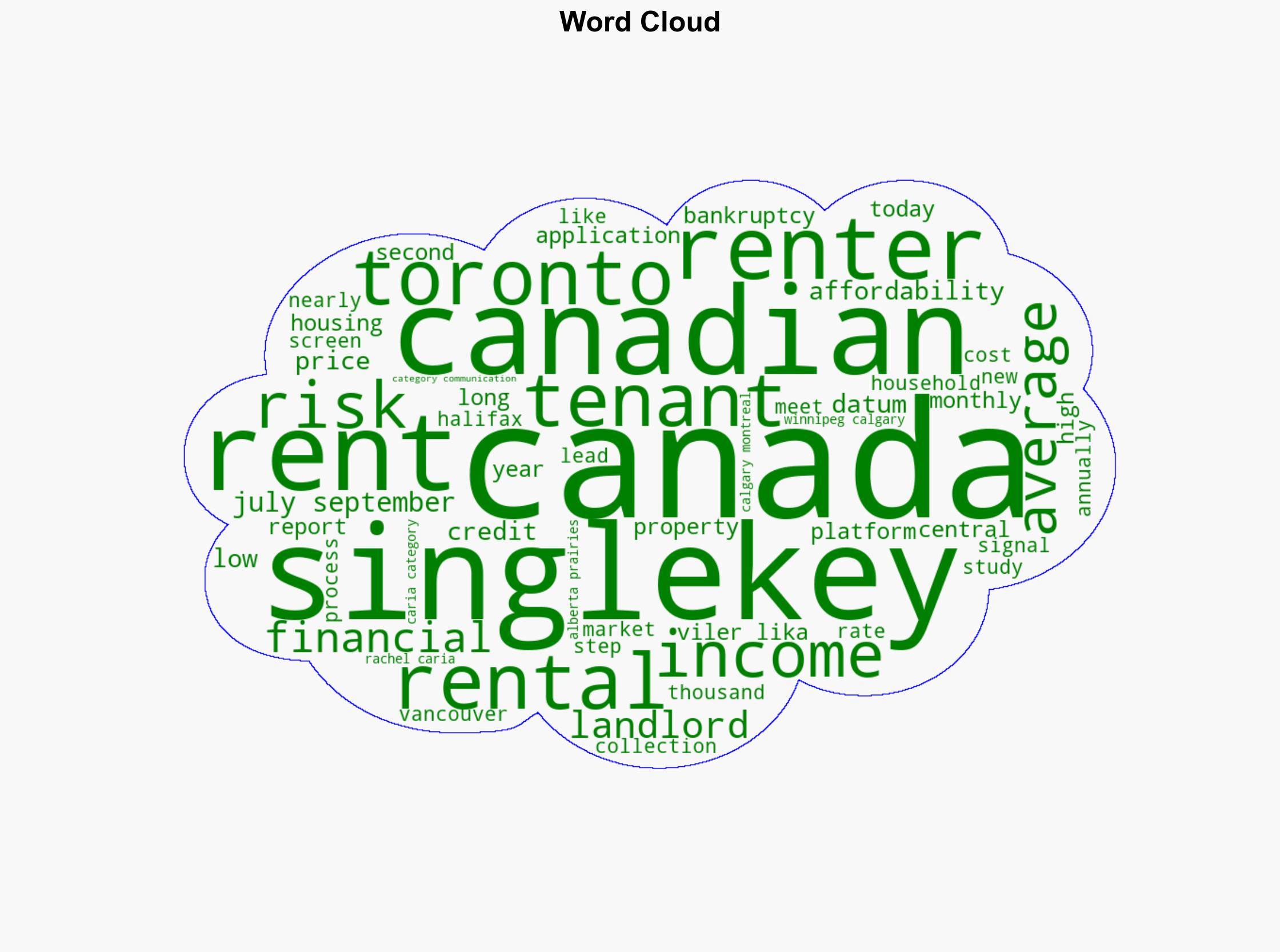

Cybersecurity, Economic Stability, Housing Policy, Financial Vulnerability, Rental Market Dynamics

Structured Analytic Techniques Applied

- Adversarial Threat Simulation: Model and simulate actions of cyber adversaries to anticipate vulnerabilities and improve resilience.

- Indicators Development: Detect and monitor behavioral or technical anomalies across systems for early threat detection.

- Bayesian Scenario Modeling: Quantify uncertainty and predict cyberattack pathways using probabilistic inference.

Explore more:

Cybersecurity Briefs ·

Daily Summary ·

Support us