Solana price bounces off 129 lows but is SOL out of the woods – Coinjournal.net

Published on: 2025-11-18

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: Solana Price Dynamics and Market Outlook

1. BLUF (Bottom Line Up Front)

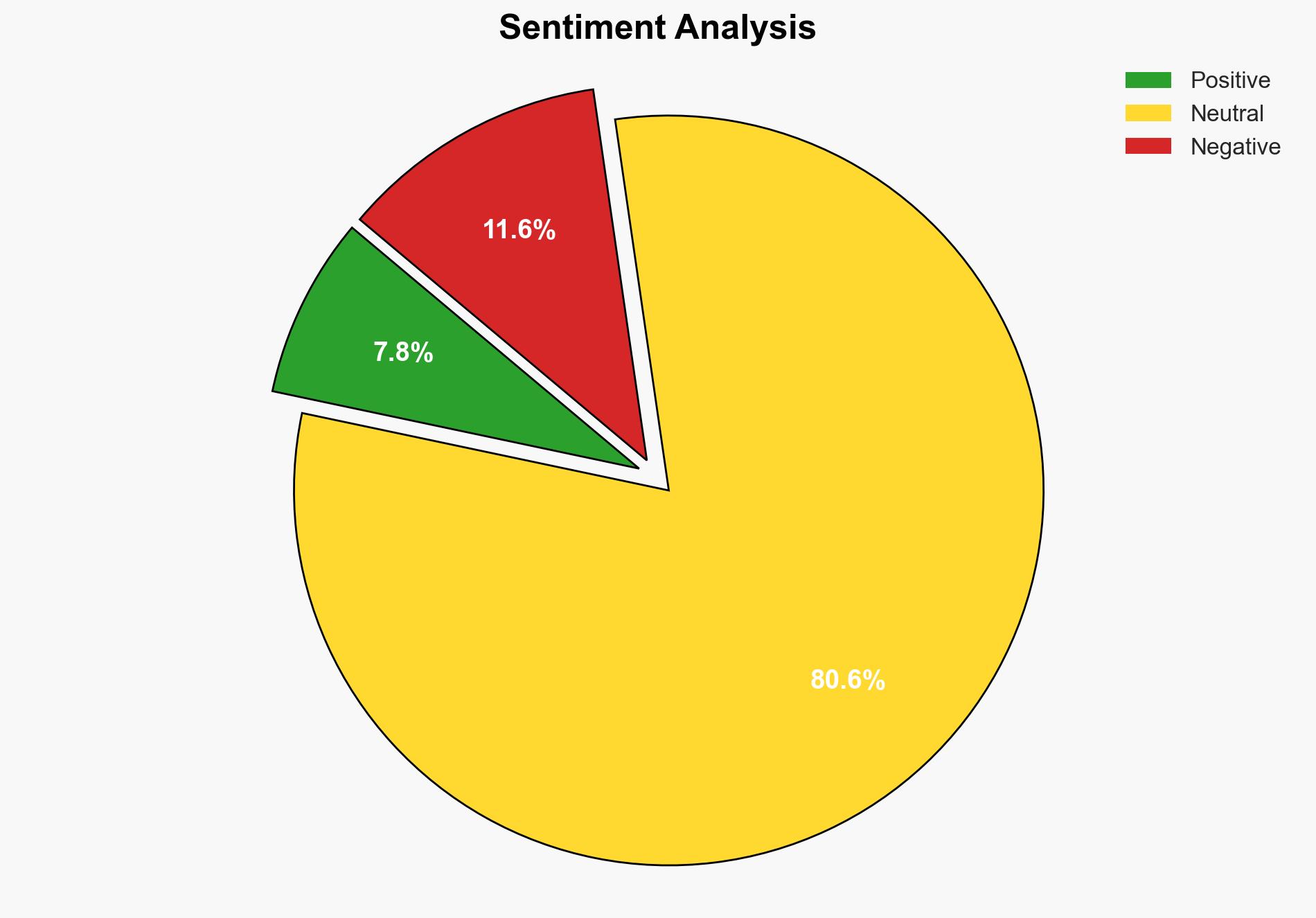

Confidence Level: Moderate. The most supported hypothesis is that Solana’s recent price bounce is a temporary recovery in a broader bearish trend. Strategic action should focus on monitoring key support levels and market sentiment indicators to anticipate further volatility.

2. Competing Hypotheses

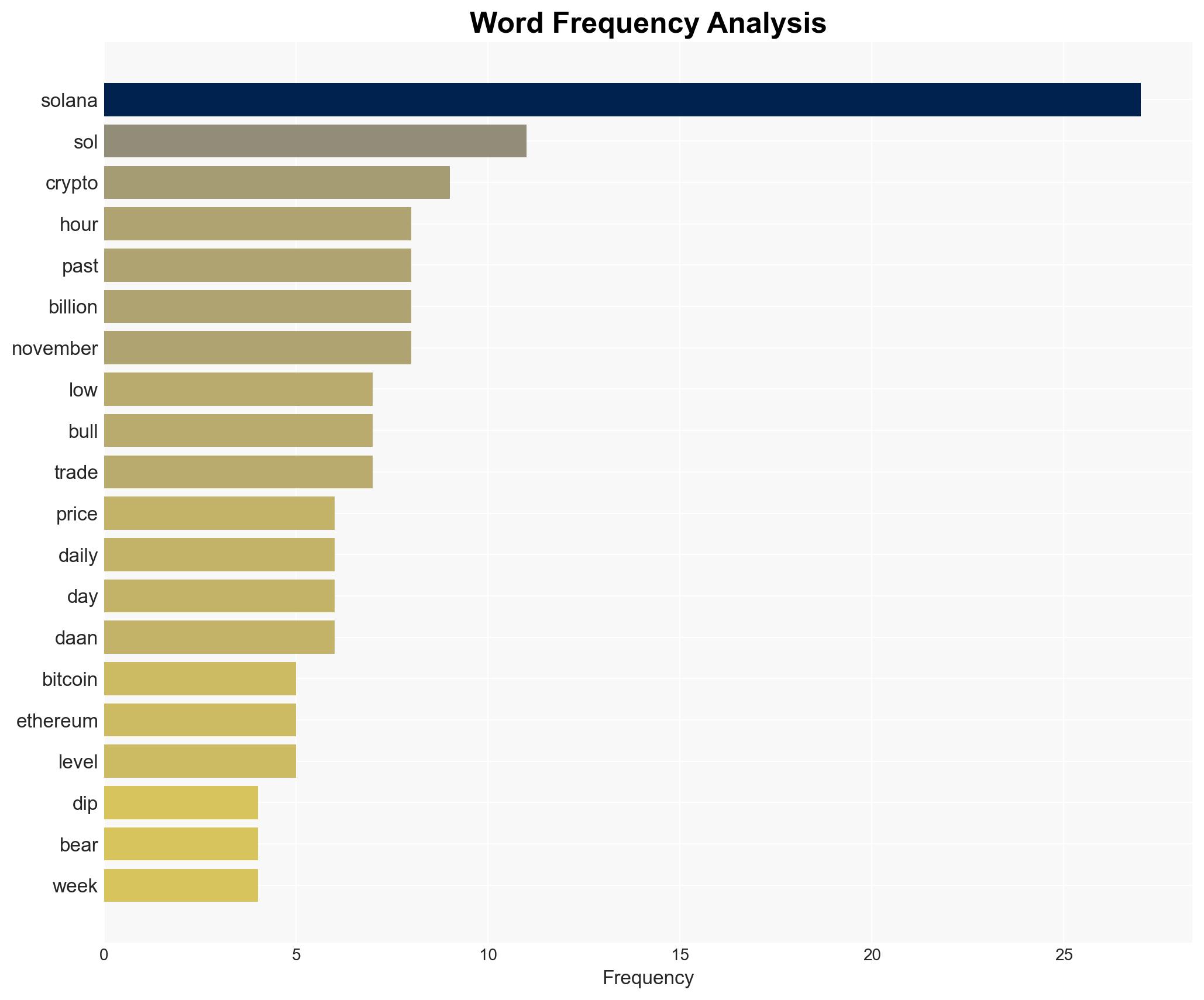

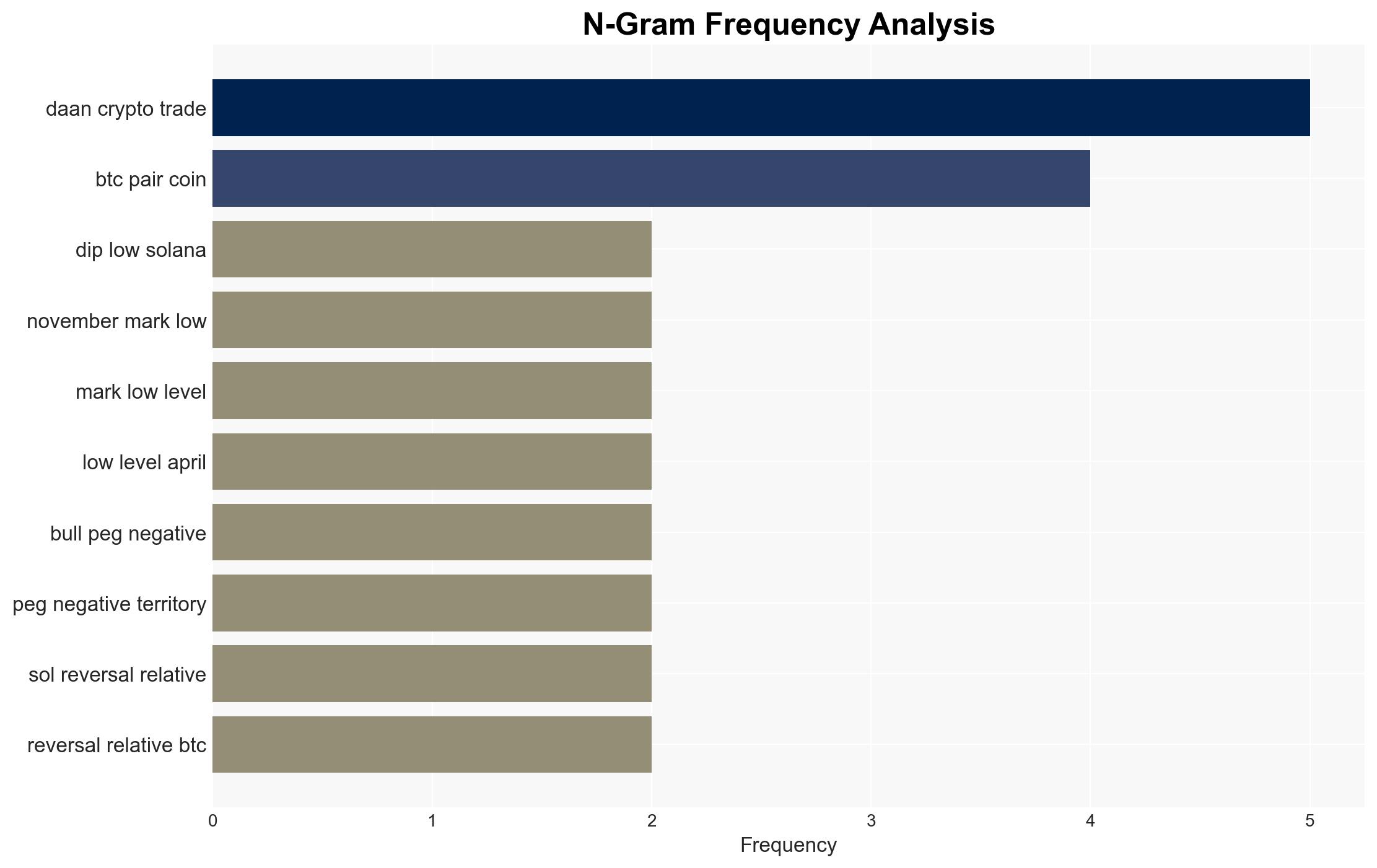

Hypothesis 1: Solana’s price recovery is a temporary bounce within a sustained bearish trend. This is supported by the presence of bearish technical indicators, such as the potential death cross pattern and the RSI/MACD signals indicating continued downward pressure.

Hypothesis 2: Solana is beginning a longer-term recovery, driven by increased trading volume and potential bullish divergence. This hypothesis suggests that the recent price bounce could lead to a reversal if key resistance levels are breached.

Hypothesis 1 is more likely due to the prevailing bearish market structure and technical indicators, despite the temporary increase in trading volume.

3. Key Assumptions and Red Flags

Assumptions: The analysis assumes that current technical indicators and trading volumes are reliable predictors of future price movements. It also assumes that broader market conditions, such as Bitcoin and Ethereum trends, will continue to influence Solana’s price.

Red Flags: The possibility of market manipulation or deceptive trading practices could skew technical indicators. Additionally, sudden regulatory changes or network issues could disrupt the current analysis.

4. Implications and Strategic Risks

The primary risk is a continued decline in Solana’s price, which could lead to broader market instability and investor losses. A significant drop could trigger a cascade of liquidations, exacerbating volatility. Conversely, a sustained recovery could restore investor confidence and stabilize the market.

5. Recommendations and Outlook

- Actionable Steps: Monitor key support and resistance levels closely. Implement risk management strategies to mitigate potential losses. Stay informed on regulatory developments and network upgrades that could impact Solana’s price.

- Best Case Scenario: Solana breaks through resistance levels, initiating a sustained recovery and attracting new investment.

- Worst Case Scenario: Solana fails to hold support levels, leading to a significant price drop and increased market volatility.

- Most-likely Scenario: Solana experiences continued volatility with short-term recoveries within a broader bearish trend.

6. Key Individuals and Entities

No specific individuals are mentioned in the source text. Entities include major exchanges like Binance and Coinbase, which influence market liquidity and trading dynamics.

7. Thematic Tags

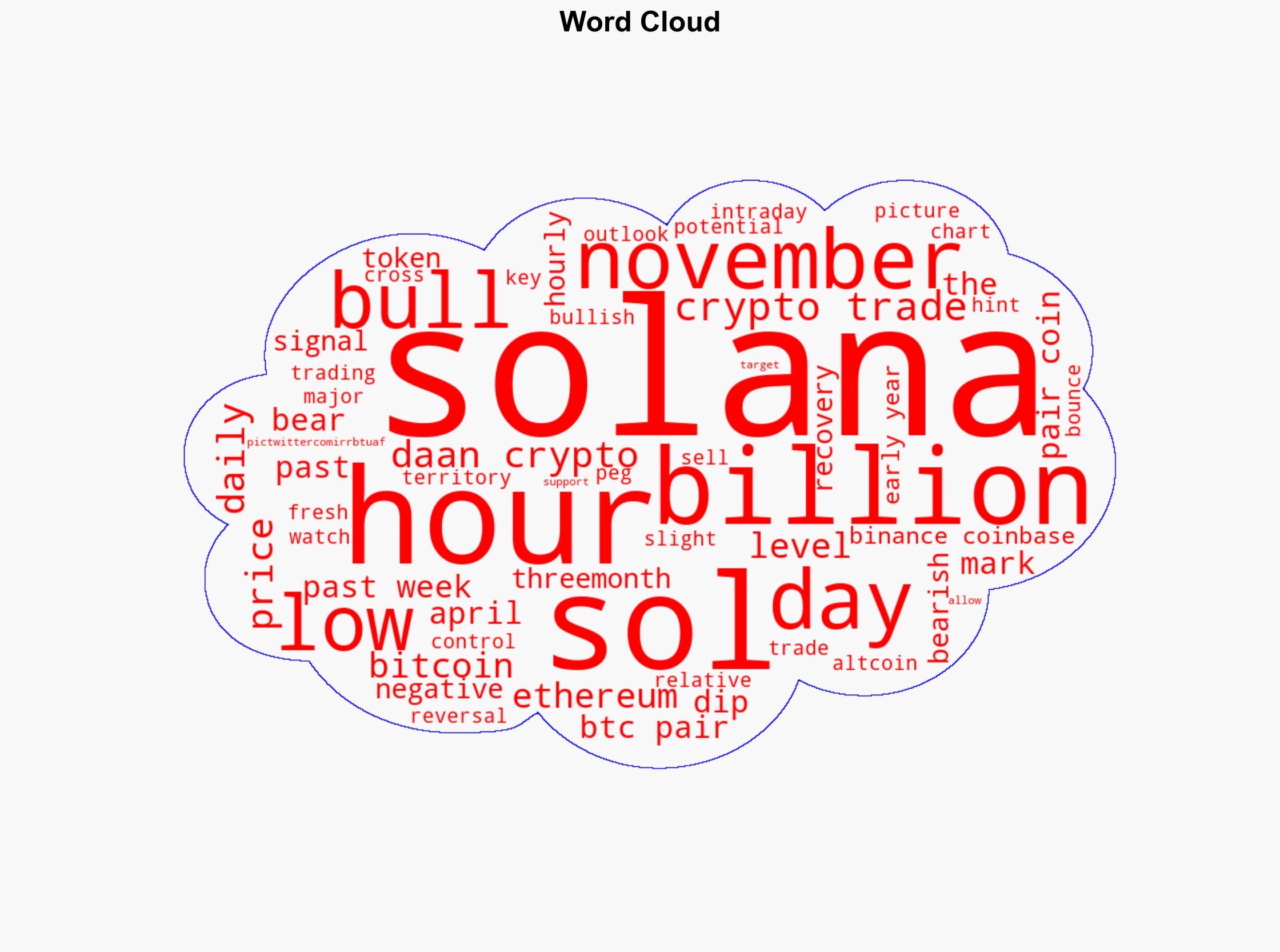

Cybersecurity, Cryptocurrency, Market Analysis, Technical Indicators, Trading Strategy

Structured Analytic Techniques Applied

- Adversarial Threat Simulation: Model and simulate actions of cyber adversaries to anticipate vulnerabilities and improve resilience.

- Indicators Development: Detect and monitor behavioral or technical anomalies across systems for early threat detection.

- Bayesian Scenario Modeling: Quantify uncertainty and predict cyberattack pathways using probabilistic inference.

- Network Influence Mapping: Map influence relationships to assess actor impact.

Explore more:

Cybersecurity Briefs ·

Daily Summary ·

Support us