Some Scam Victims May Be Able To Deduct Related Losses On Their Tax Returns – Forbes

Published on: 2025-04-25

Intelligence Report: Some Scam Victims May Be Able To Deduct Related Losses On Their Tax Returns – Forbes

1. BLUF (Bottom Line Up Front)

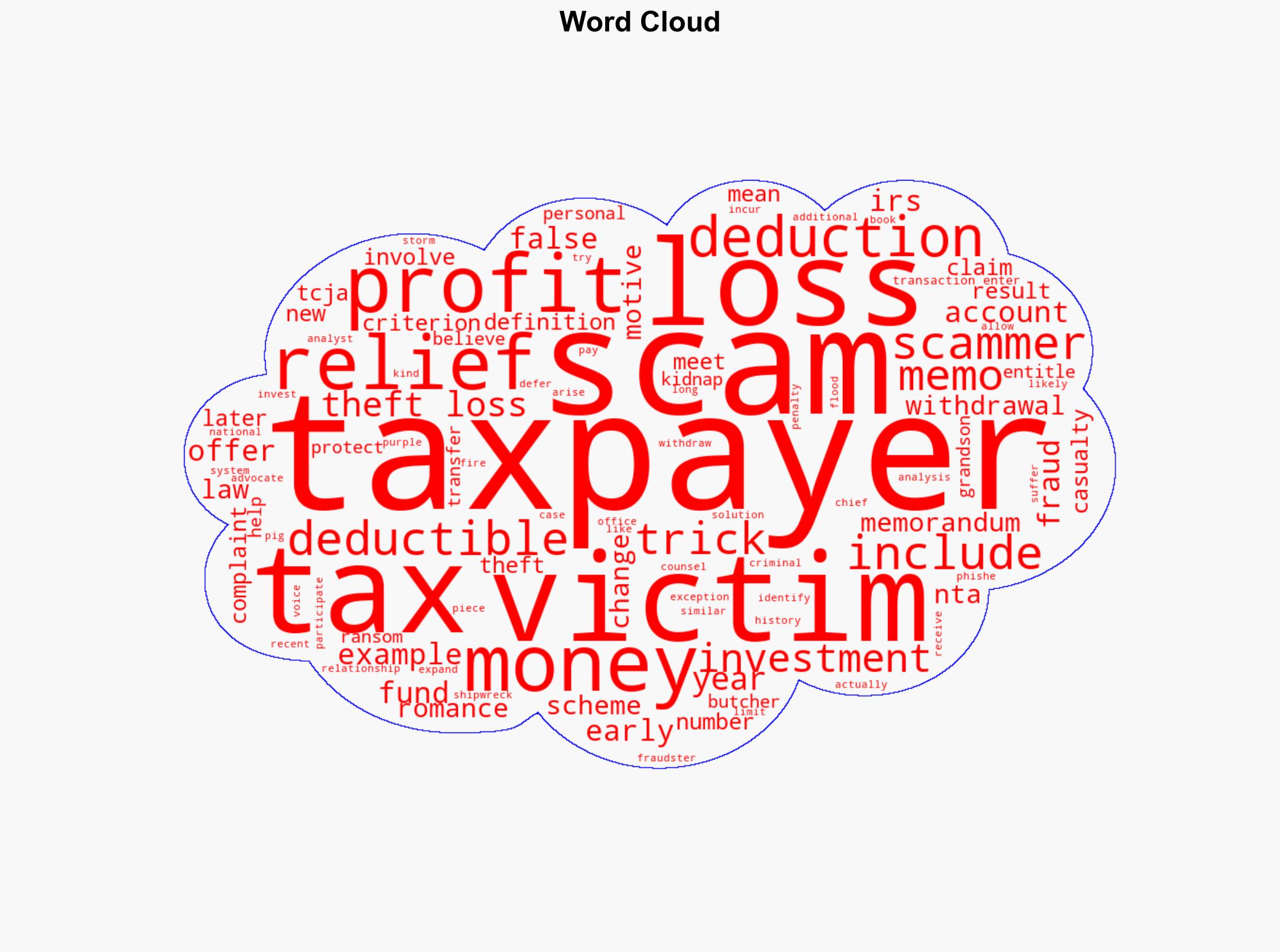

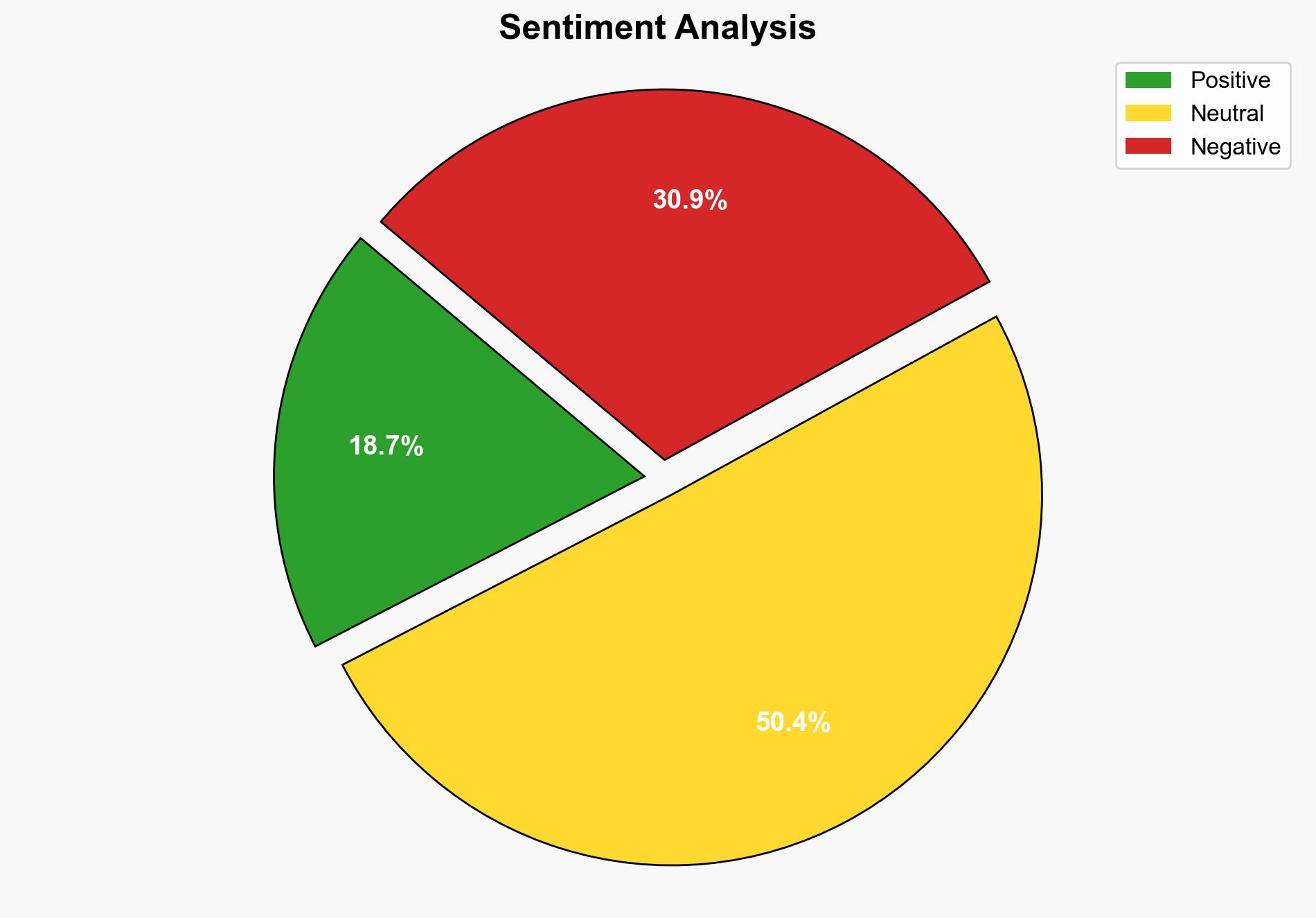

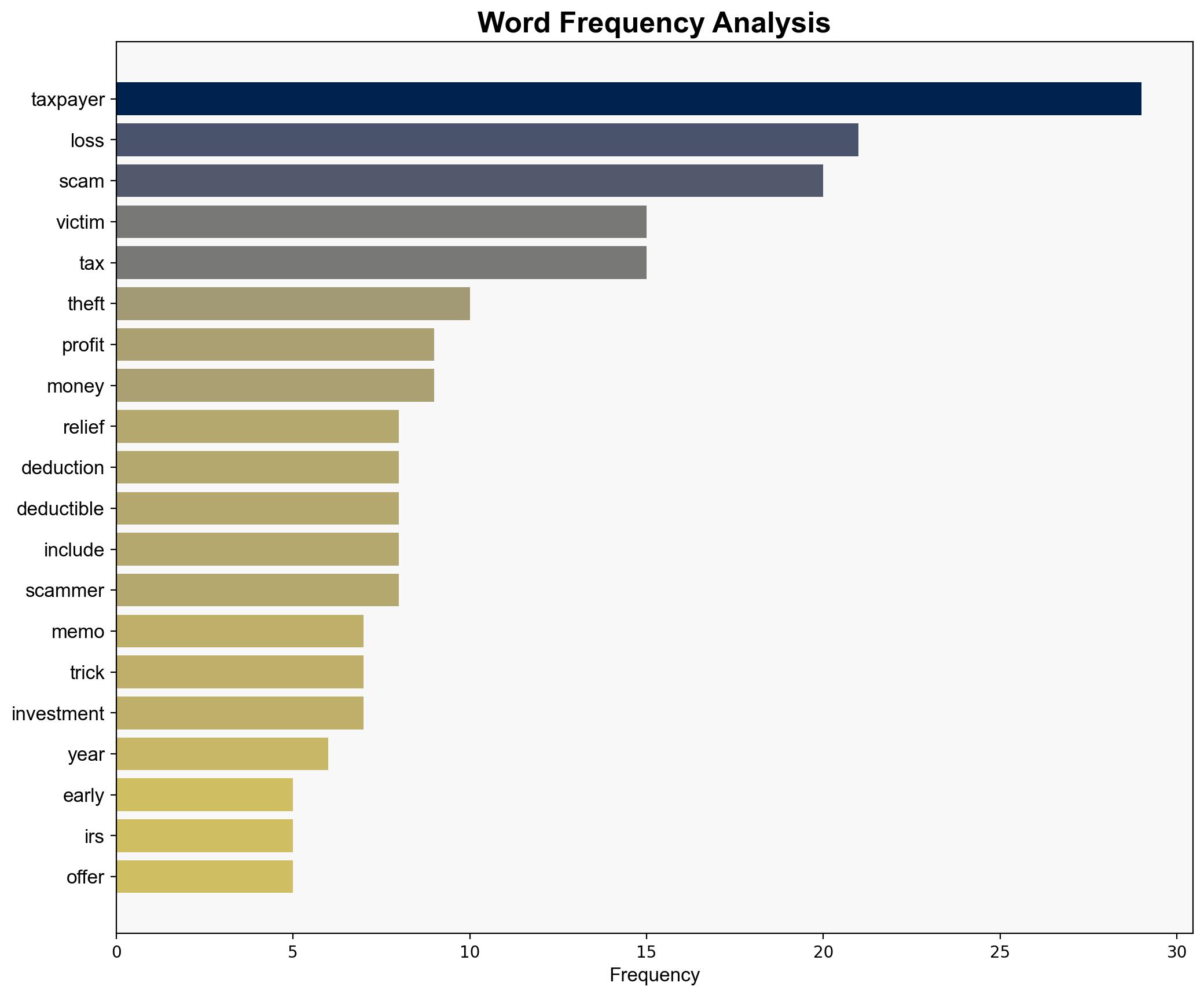

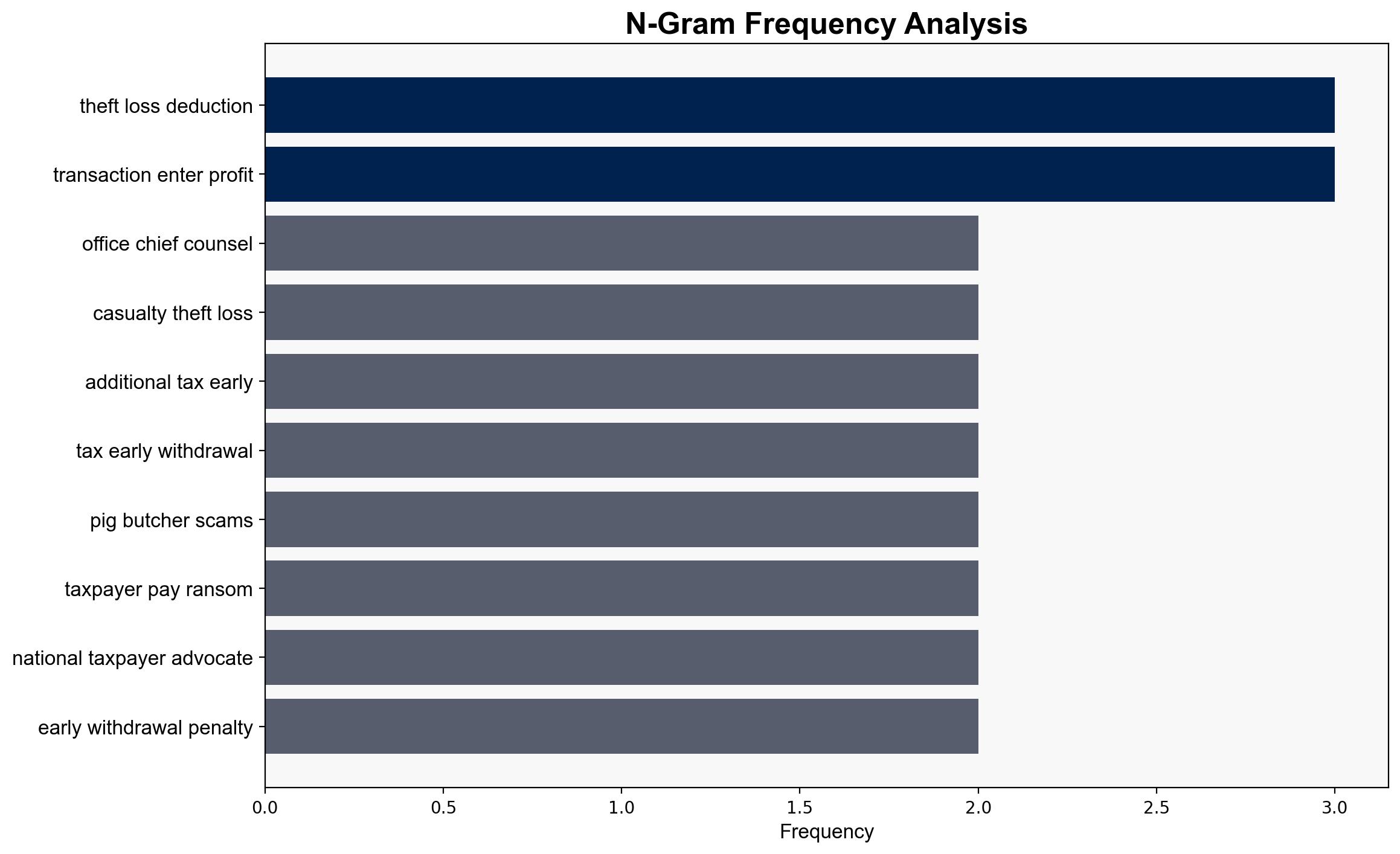

The IRS memorandum clarifies the conditions under which scam victims can deduct theft losses on their tax returns. This deduction is limited to cases where the loss arises from a transaction entered into for profit. The memorandum highlights the challenges victims face in claiming deductions, especially for scams like romance or phishing, due to the narrow criteria. This report suggests that increased awareness and strategic tax planning are essential for potential victims to mitigate financial impacts.

2. Detailed Analysis

The following structured analytic techniques have been applied to ensure methodological consistency:

Analysis of Competing Hypotheses (ACH)

The IRS memorandum was analyzed to determine the most plausible scenarios under which victims could claim deductions. The evidence suggests that only scams with a clear profit motive, such as investment fraud, qualify for deductions.

SWOT Analysis

Strengths: The IRS provides clear guidelines, aiding taxpayers in understanding their eligibility for deductions.

Weaknesses: The narrow criteria limit the applicability of deductions, leaving many victims without relief.

Opportunities: Taxpayers can leverage this information for strategic financial planning.

Threats: Increasing sophistication of scams may lead to more victims unable to claim deductions.

Indicators Development

Monitor for increased phishing campaigns and other scams that could lead to financial losses. Look for changes in IRS guidelines or tax code amendments that might affect deduction eligibility.

3. Implications and Strategic Risks

The memorandum underscores the financial vulnerability of scam victims and the limited relief available through tax deductions. As scams become more sophisticated, the economic impact on individuals and the broader economy could increase. There is a risk of reduced public trust in financial systems and regulatory bodies if relief measures are perceived as inadequate.

4. Recommendations and Outlook

- Enhance public awareness campaigns to educate taxpayers on the criteria for theft loss deductions.

- Advocate for broader tax code reforms to provide relief for a wider range of scam victims.

- Best case: Expanded deductions lead to increased financial recovery for victims. Worst case: Continued limitations result in minimal relief for most victims. Most likely: Incremental changes improve relief options over time.

5. Key Individuals and Entities

The report does not specify individuals by name but focuses on the IRS and its role in defining tax deduction eligibility.

6. Thematic Tags

(‘tax policy’, ‘financial scams’, ‘IRS guidelines’, ‘economic impact’)