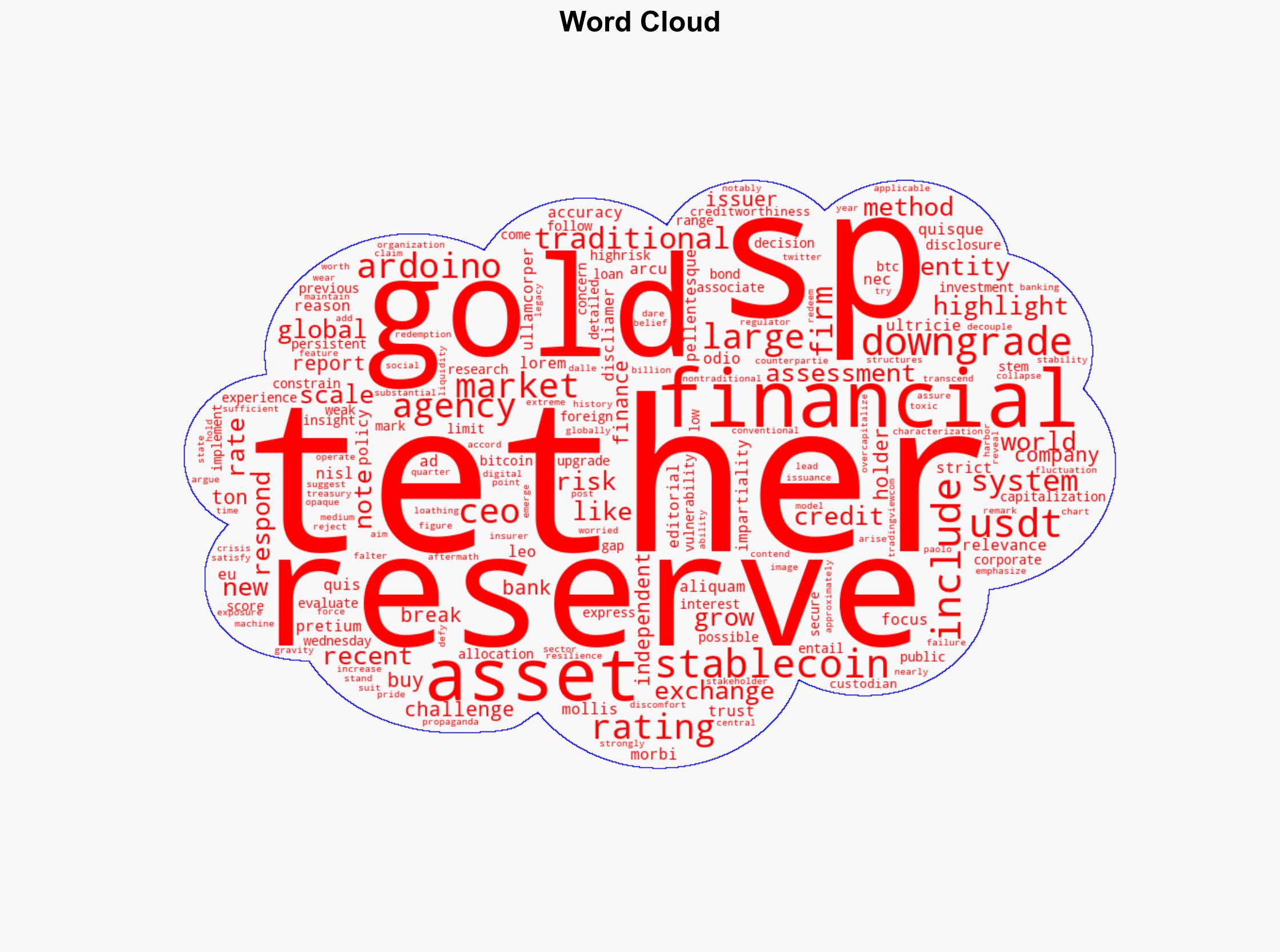

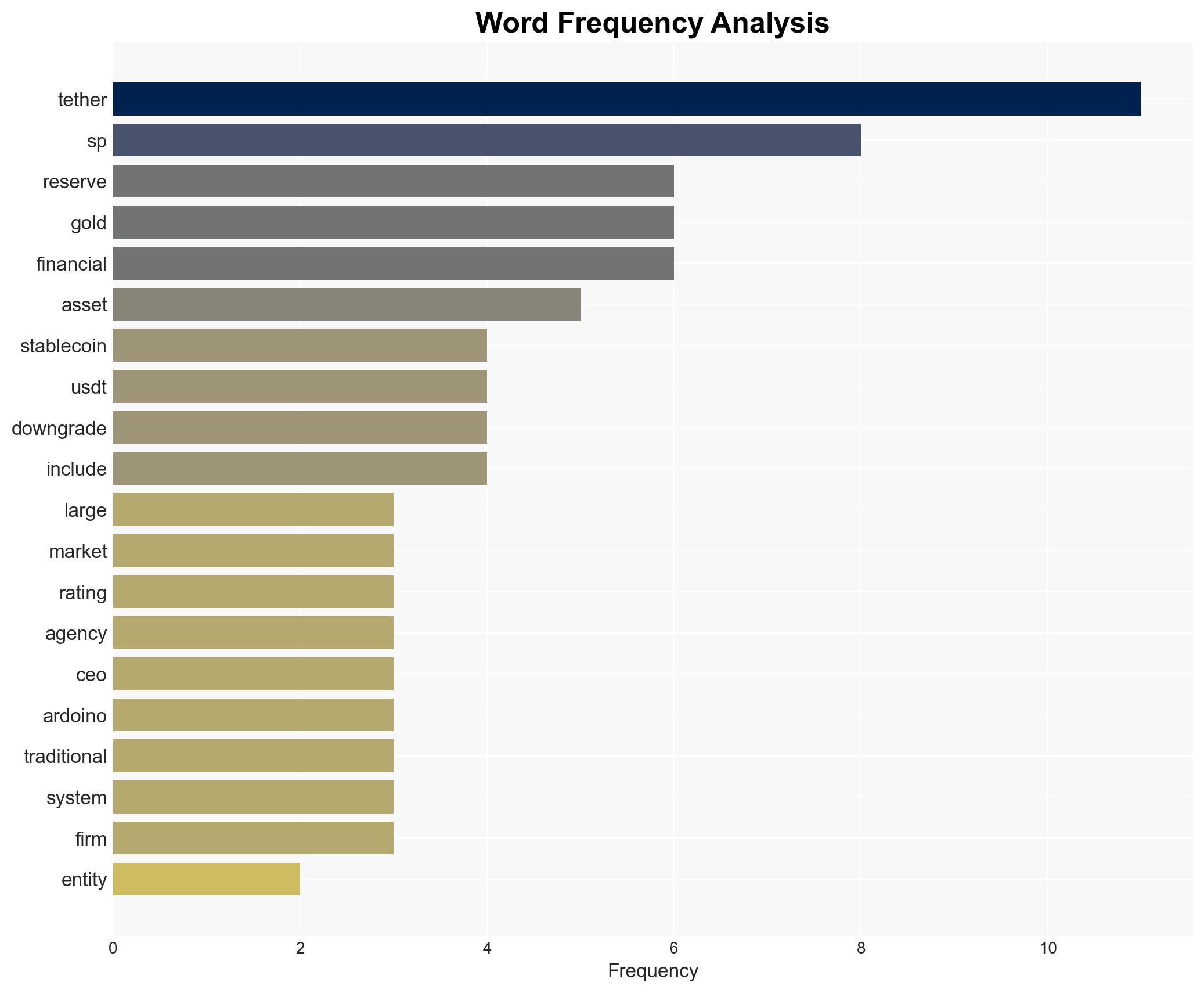

SP Global Downgrades Tether Amid Ongoing Concerns About Asset Transparency and Risk Management

Published on: 2025-11-27

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: Tether Faces Downgrade By SP Global Amid Concerns Over Disclosure And Assets Holdings

1. BLUF (Bottom Line Up Front)

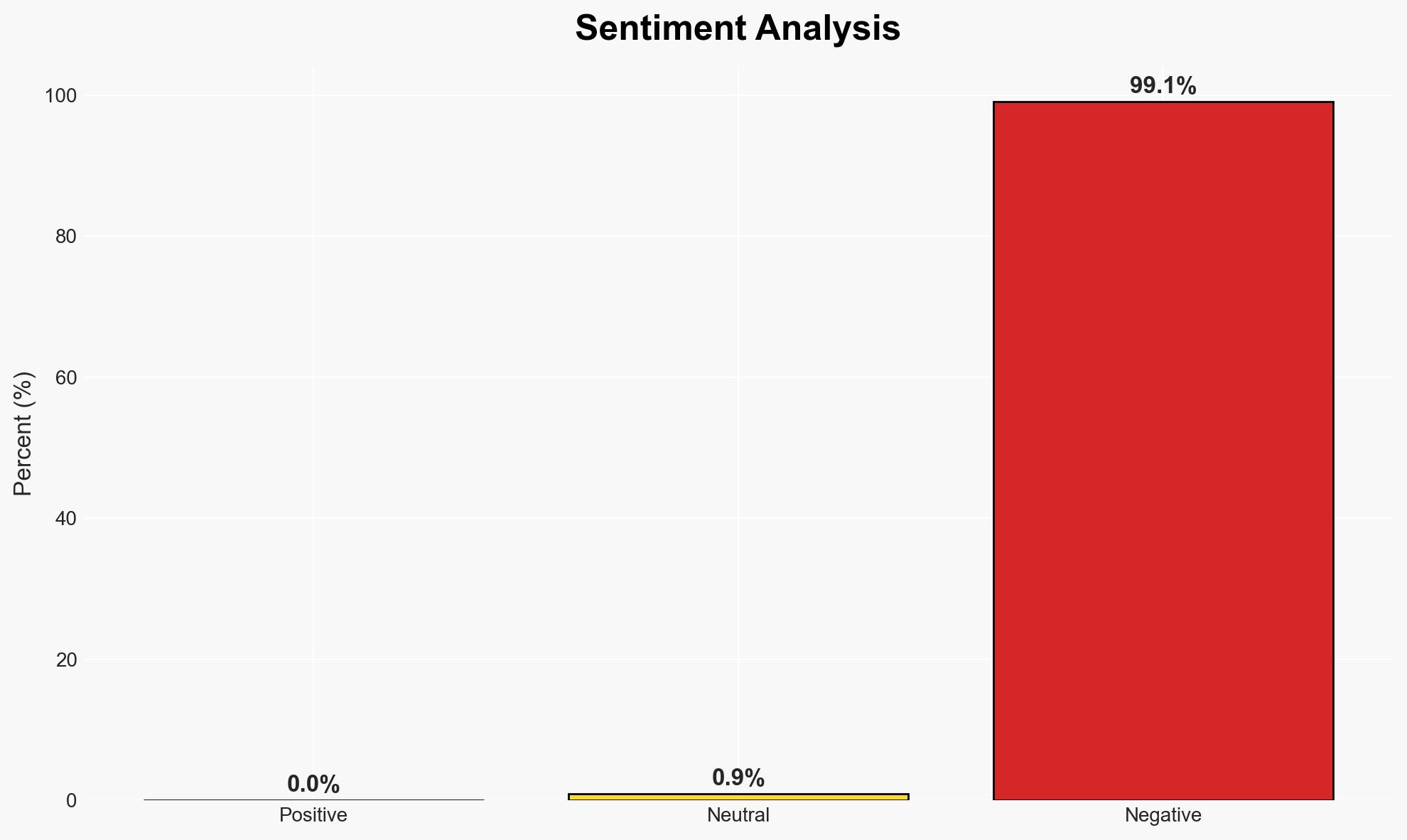

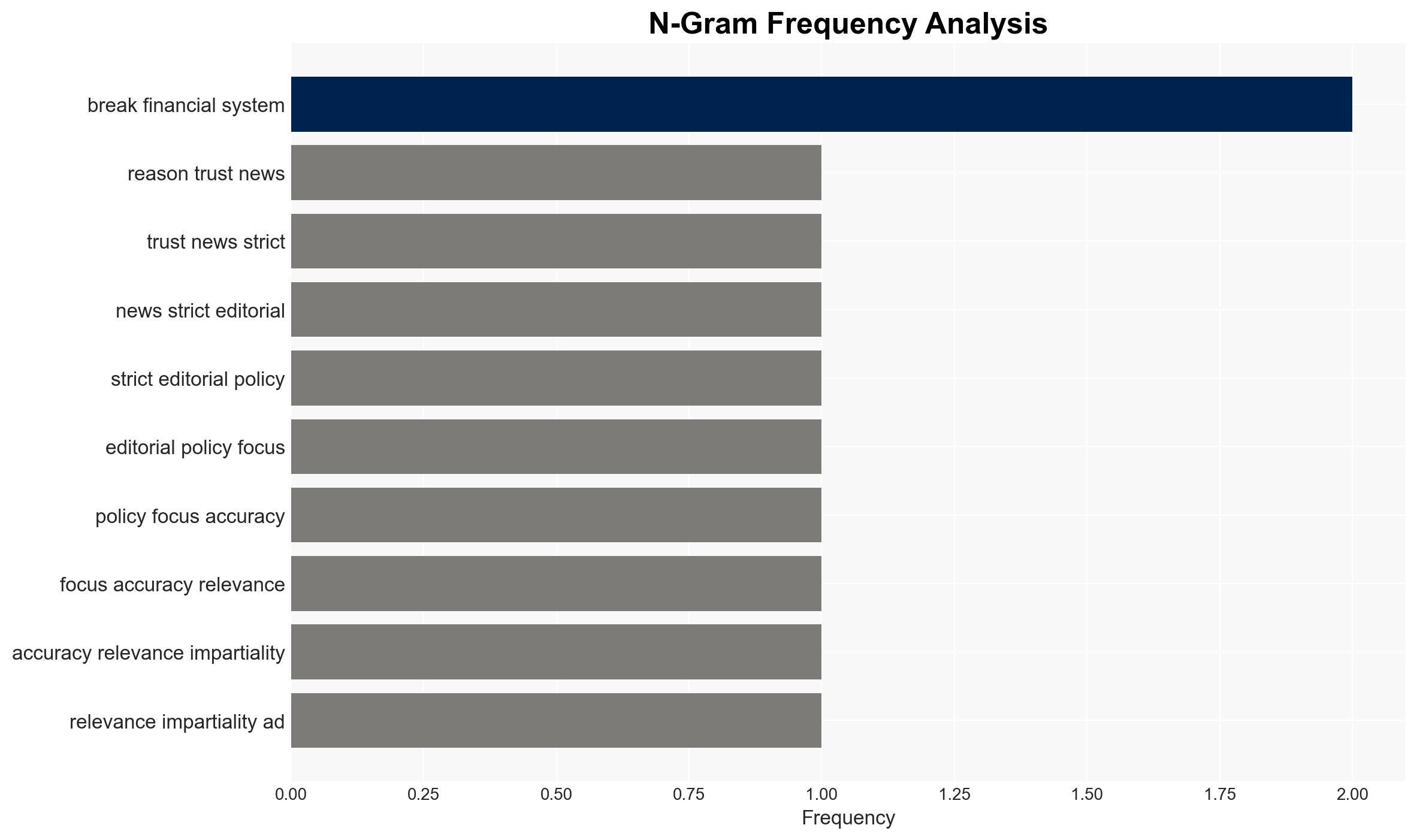

Tether, a major stablecoin issuer, is facing a downgrade by SP Global due to concerns over its asset disclosure and holdings. This development could impact the cryptocurrency market and stakeholders relying on Tether’s stability. The most likely hypothesis is that the downgrade reflects genuine concerns about Tether’s financial practices. Overall confidence in this assessment is moderate, given the limited transparency and potential biases involved.

2. Competing Hypotheses

- Hypothesis A: The SP Global downgrade is based on legitimate concerns about Tether’s asset disclosure and risk management practices. Supporting evidence includes SP Global’s detailed assessment and Tether’s significant exposure to high-risk assets. Contradicting evidence includes Tether’s claims of sufficient reserves and resilience during financial crises.

- Hypothesis B: The downgrade is influenced by traditional financial institutions’ discomfort with Tether’s business model, potentially as a strategic move to undermine its market position. Supporting evidence includes Tether CEO’s statements about traditional finance’s resistance to change. Contradicting evidence includes the structured assessment process by SP Global.

- Assessment: Hypothesis A is currently better supported due to the structured nature of SP Global’s assessment and the specific concerns about Tether’s asset management. Indicators that could shift this judgment include further transparency from Tether or evidence of bias in SP Global’s methodology.

3. Key Assumptions and Red Flags

- Assumptions: Tether’s financial disclosures are incomplete; SP Global’s assessment is impartial; Tether’s asset management practices pose genuine risks.

- Information Gaps: Detailed breakdown of Tether’s asset holdings and risk management strategies; SP Global’s full assessment criteria and methodology.

- Bias & Deception Risks: Potential bias from SP Global due to traditional finance interests; Tether’s public statements may be strategically framed to downplay risks.

4. Implications and Strategic Risks

This downgrade could lead to increased scrutiny of Tether and similar stablecoin issuers, potentially affecting market stability and regulatory approaches.

- Political / Geopolitical: Increased regulatory pressure on stablecoins could lead to international policy coordination challenges.

- Security / Counter-Terrorism: No direct implications identified, but financial instability could indirectly affect security environments.

- Cyber / Information Space: Potential for misinformation campaigns targeting Tether’s credibility and stability.

- Economic / Social: Market volatility could affect investor confidence and broader economic stability, particularly in emerging markets relying on stablecoins.

5. Recommendations and Outlook

- Immediate Actions (0–30 days): Monitor Tether’s financial disclosures and market reactions; engage with regulatory bodies to assess potential policy responses.

- Medium-Term Posture (1–12 months): Develop resilience measures for financial systems potentially impacted by stablecoin volatility; foster partnerships with international regulatory bodies.

- Scenario Outlook:

- Best: Tether improves transparency, stabilizing market confidence.

- Worst: Continued opacity leads to regulatory crackdowns and market instability.

- Most-Likely: Gradual improvements in disclosure with ongoing regulatory scrutiny.

6. Key Individuals and Entities

- Tether CEO Paolo Ardoino

- SP Global

- Not clearly identifiable from open sources in this snippet.

7. Thematic Tags

Structured Analytic Techniques Applied

- Cognitive Bias Stress Test: Expose and correct potential biases in assessments through red-teaming and structured challenge.

- Bayesian Scenario Modeling: Use probabilistic forecasting for conflict trajectories or escalation likelihood.

- Network Influence Mapping: Map relationships between state and non-state actors for impact estimation.

Explore more:

National Security Threats Briefs ·

Daily Summary ·

Support us