Spark Capital launches wealth management operations in Dubais DIFC – Privatebankerinternational.com

Published on: 2025-06-03

Intelligence Report: Spark Capital launches wealth management operations in Dubai’s DIFC – Privatebankerinternational.com

1. BLUF (Bottom Line Up Front)

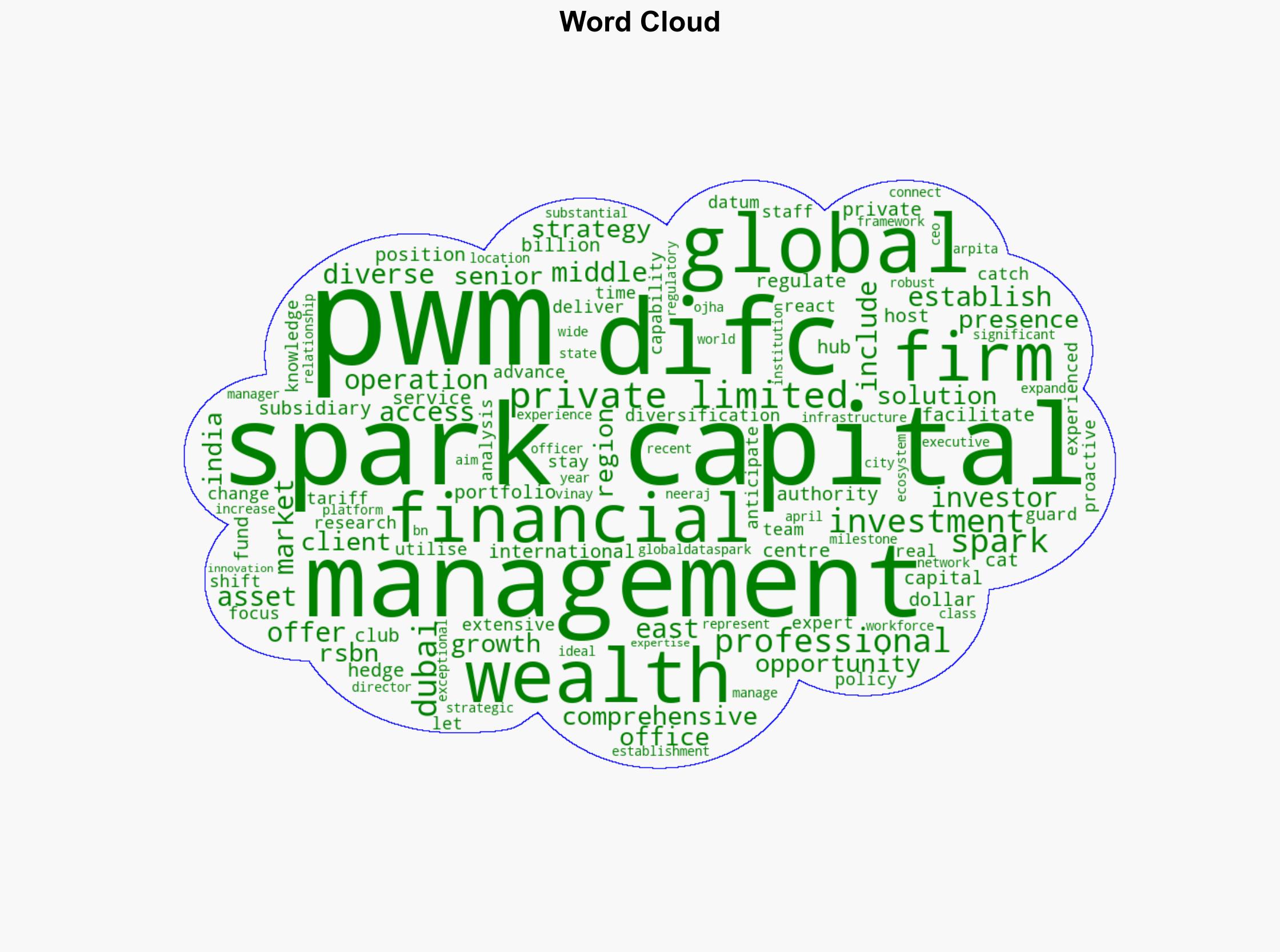

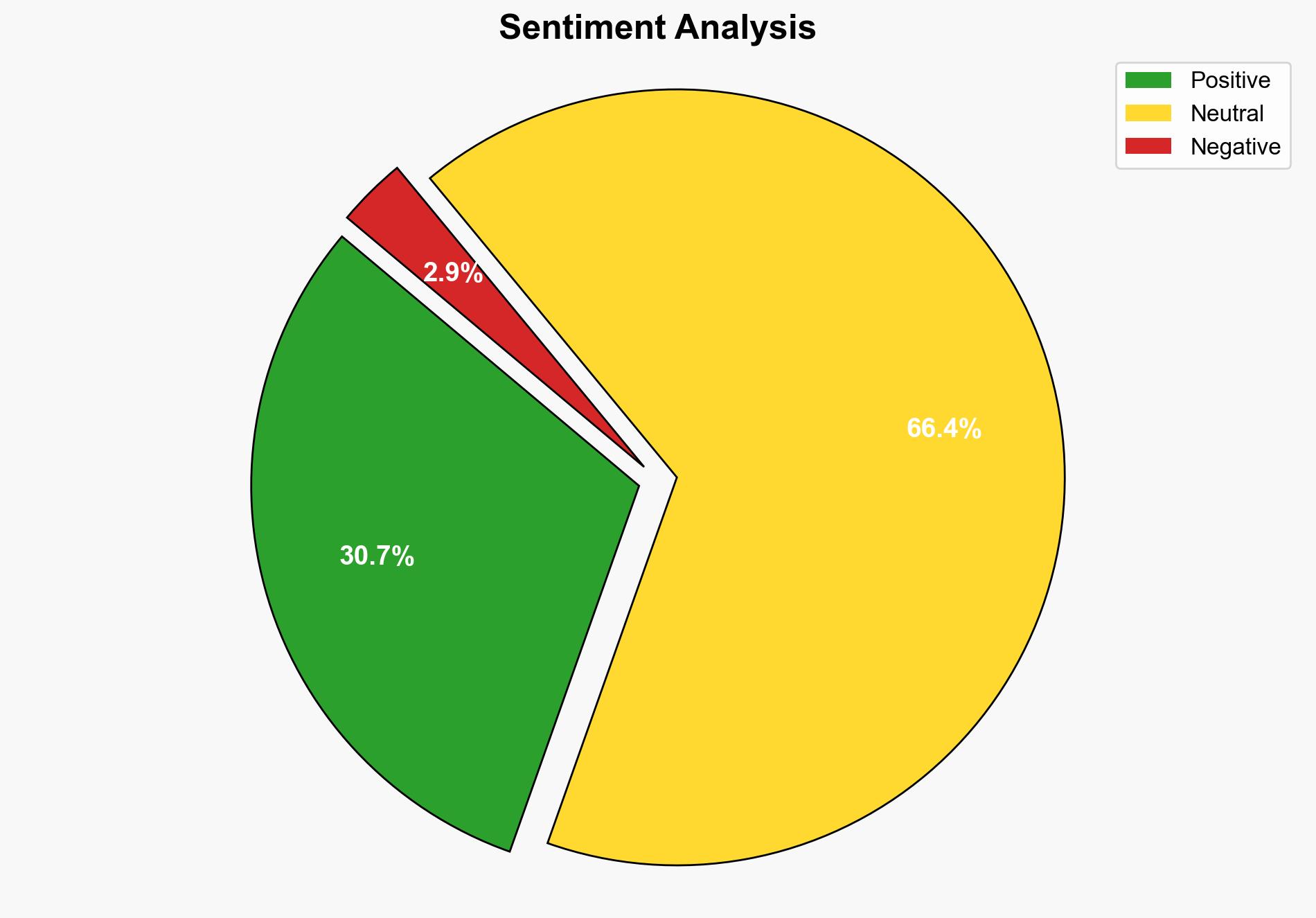

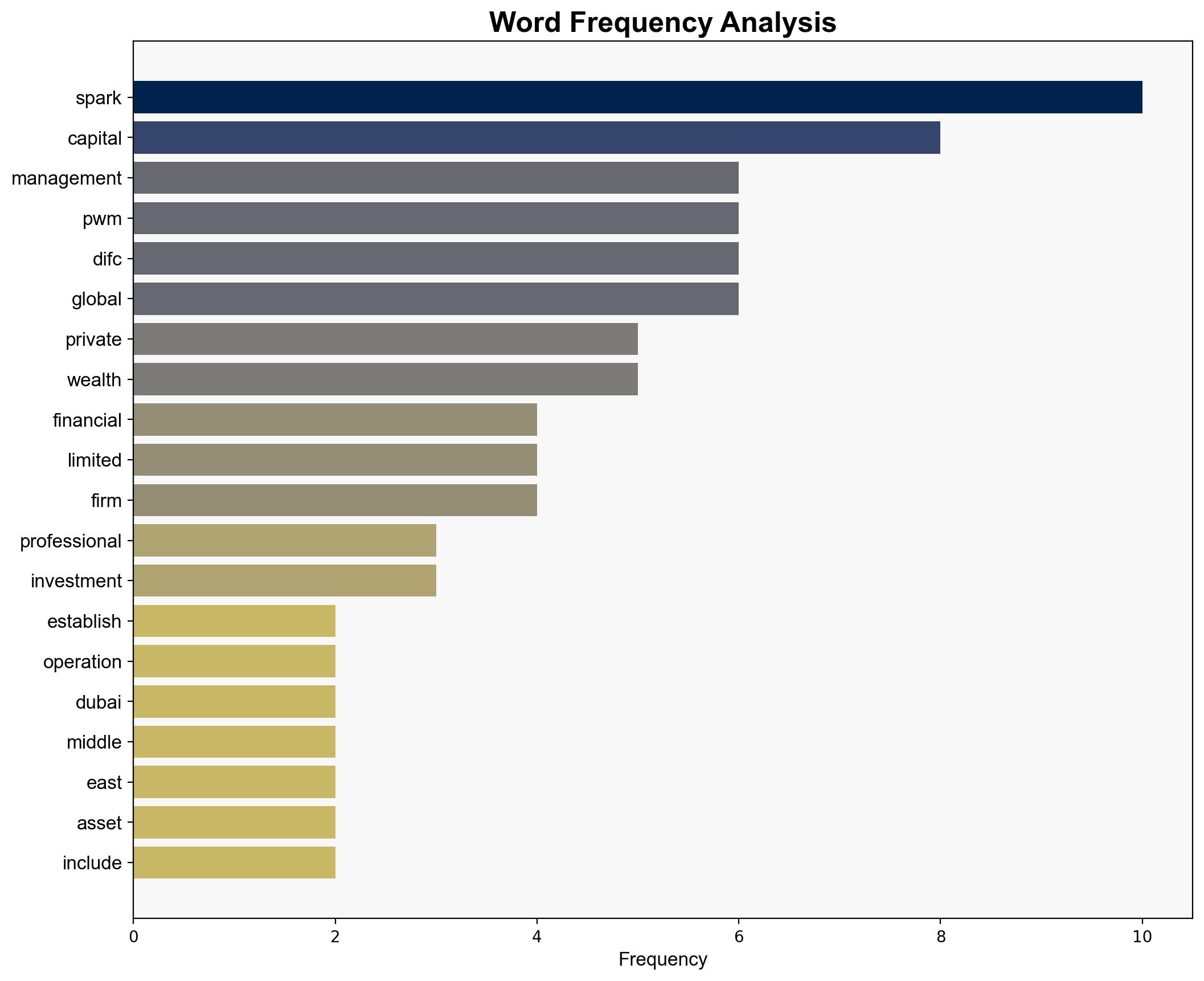

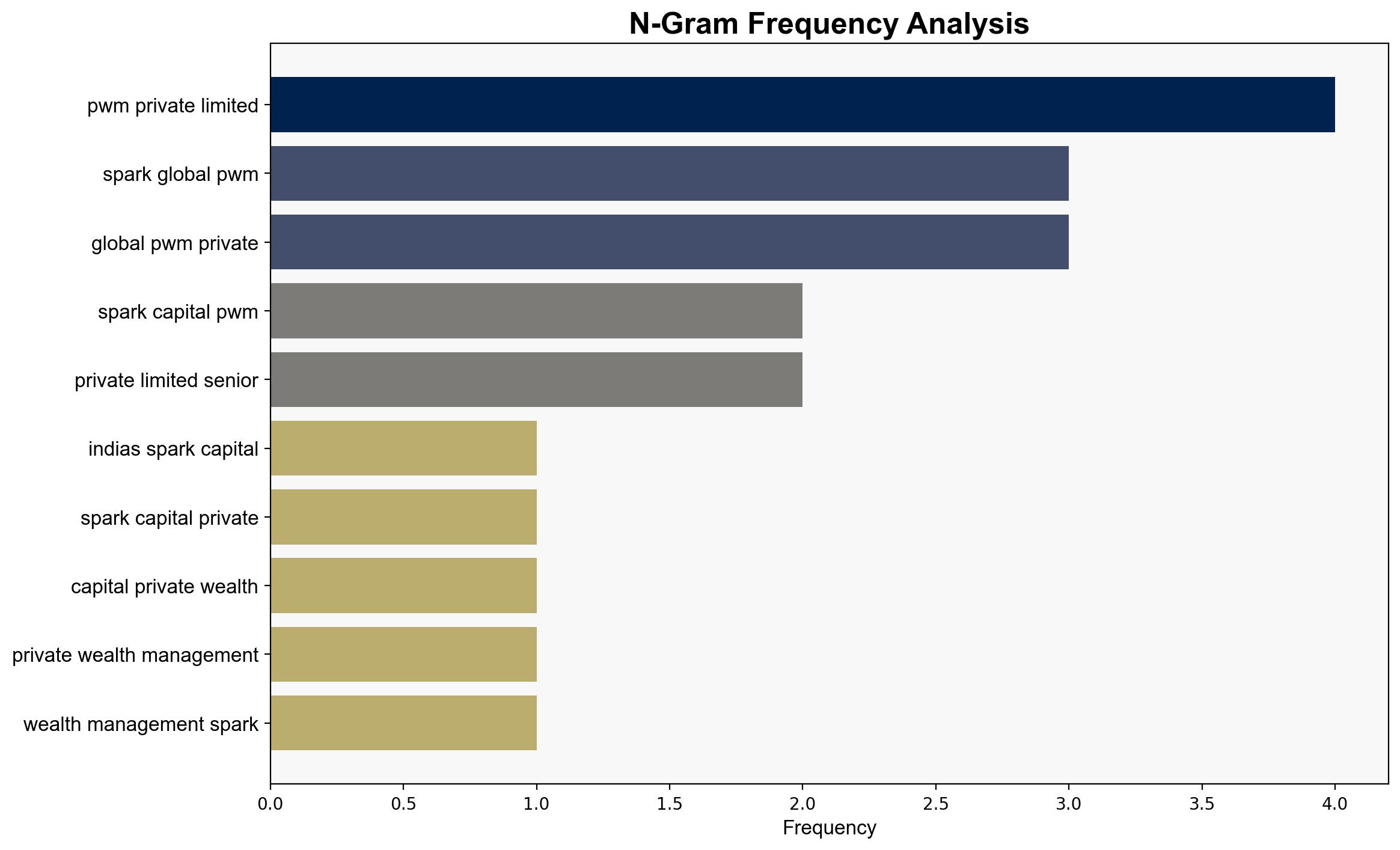

Spark Capital has strategically expanded its wealth management operations to the Dubai International Financial Centre (DIFC), positioning itself to leverage Dubai’s robust financial infrastructure and strategic location. This move is part of Spark Capital’s broader global growth strategy, aiming to connect investors with diverse investment opportunities in the Middle East. The establishment of Spark Global PWM Private Limited in DIFC is expected to enhance the firm’s market access and portfolio diversification capabilities.

2. Detailed Analysis

The following structured analytic techniques have been applied to ensure methodological consistency:

Causal Layered Analysis (CLA)

– **Surface Events**: Spark Capital’s entry into DIFC marks a significant expansion into a key financial hub.

– **Systemic Structures**: DIFC’s regulatory framework and financial ecosystem support wealth management operations.

– **Worldviews**: The move reflects a strategic vision to capitalize on Middle Eastern market opportunities.

– **Myths**: Dubai as a gateway to global financial markets.

Cross-Impact Simulation

– Potential ripple effects include increased competition among wealth management firms in DIFC and enhanced investment flows into the region.

Scenario Generation

– **Best Case**: Successful integration and growth in the Middle East market, leading to increased assets under management.

– **Worst Case**: Regulatory challenges or geopolitical tensions impacting operations.

– **Most Likely**: Steady growth with gradual market penetration.

Network Influence Mapping

– Mapping relationships with local financial institutions and regulatory bodies to assess Spark Capital’s influence and integration within DIFC.

3. Implications and Strategic Risks

– **Economic Dimension**: Entry into DIFC could lead to increased competition, potentially impacting local firms.

– **Political Dimension**: Geopolitical stability in the Middle East is crucial for sustained operations.

– **Systemic Vulnerabilities**: Regulatory changes or economic downturns could pose risks.

4. Recommendations and Outlook

- Enhance engagement with local regulatory bodies to ensure compliance and mitigate potential legal risks.

- Develop contingency plans for geopolitical disruptions to maintain operational continuity.

- Scenario-based projections suggest focusing on building strong local partnerships to enhance market presence.

5. Key Individuals and Entities

– Arpita Vinay

– Neeraj Ojha

6. Thematic Tags

financial expansion, Middle East market, wealth management, DIFC, strategic growth