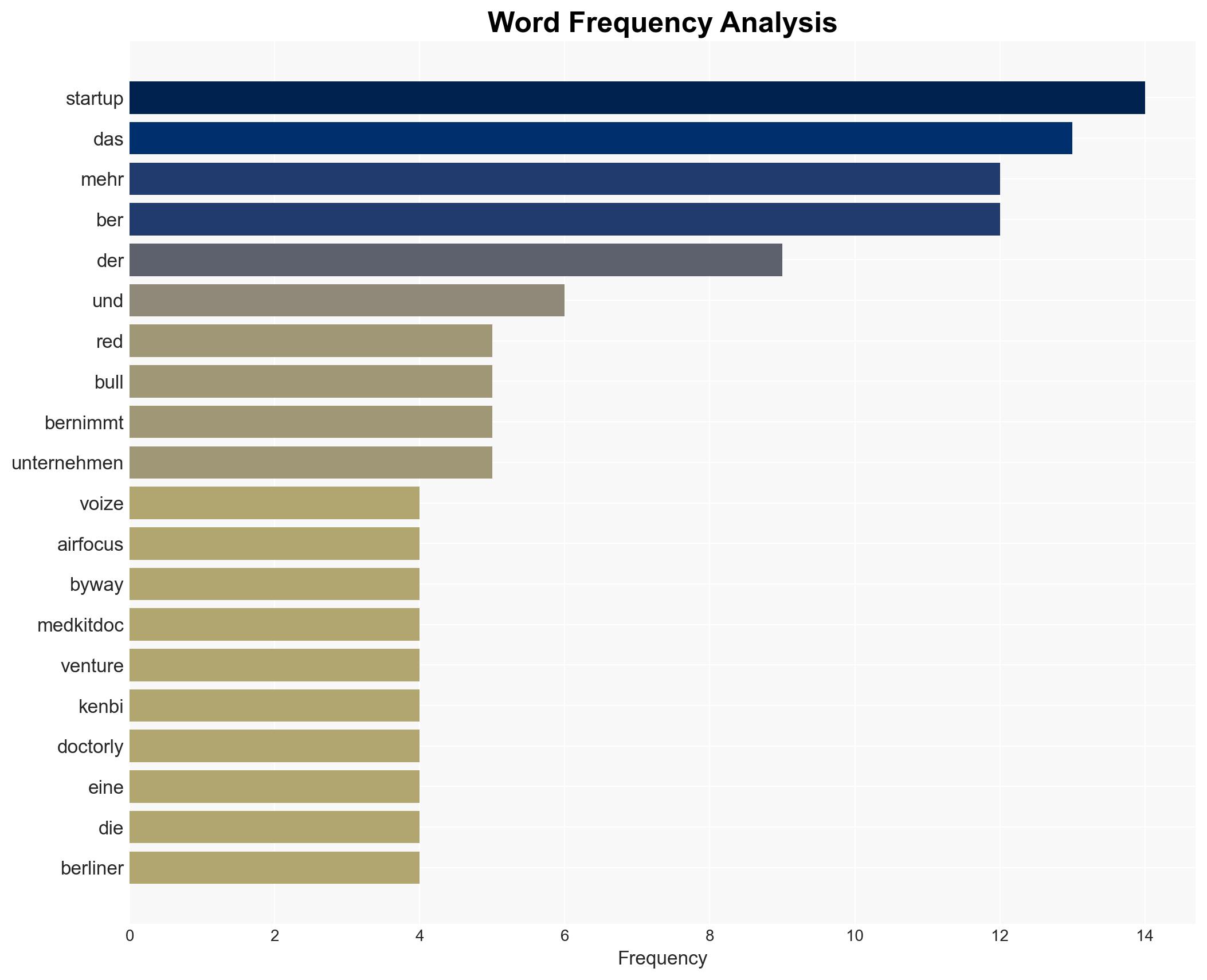

StartupTicker – voize airfocus byways MedKitDoc Red Bull Ventures Kenbi Doctorly – Deutsche-startups.de

Published on: 2025-04-05

Intelligence Report: StartupTicker – voize airfocus byways MedKitDoc Red Bull Ventures Kenbi Doctorly – Deutsche-startups.de

1. BLUF (Bottom Line Up Front)

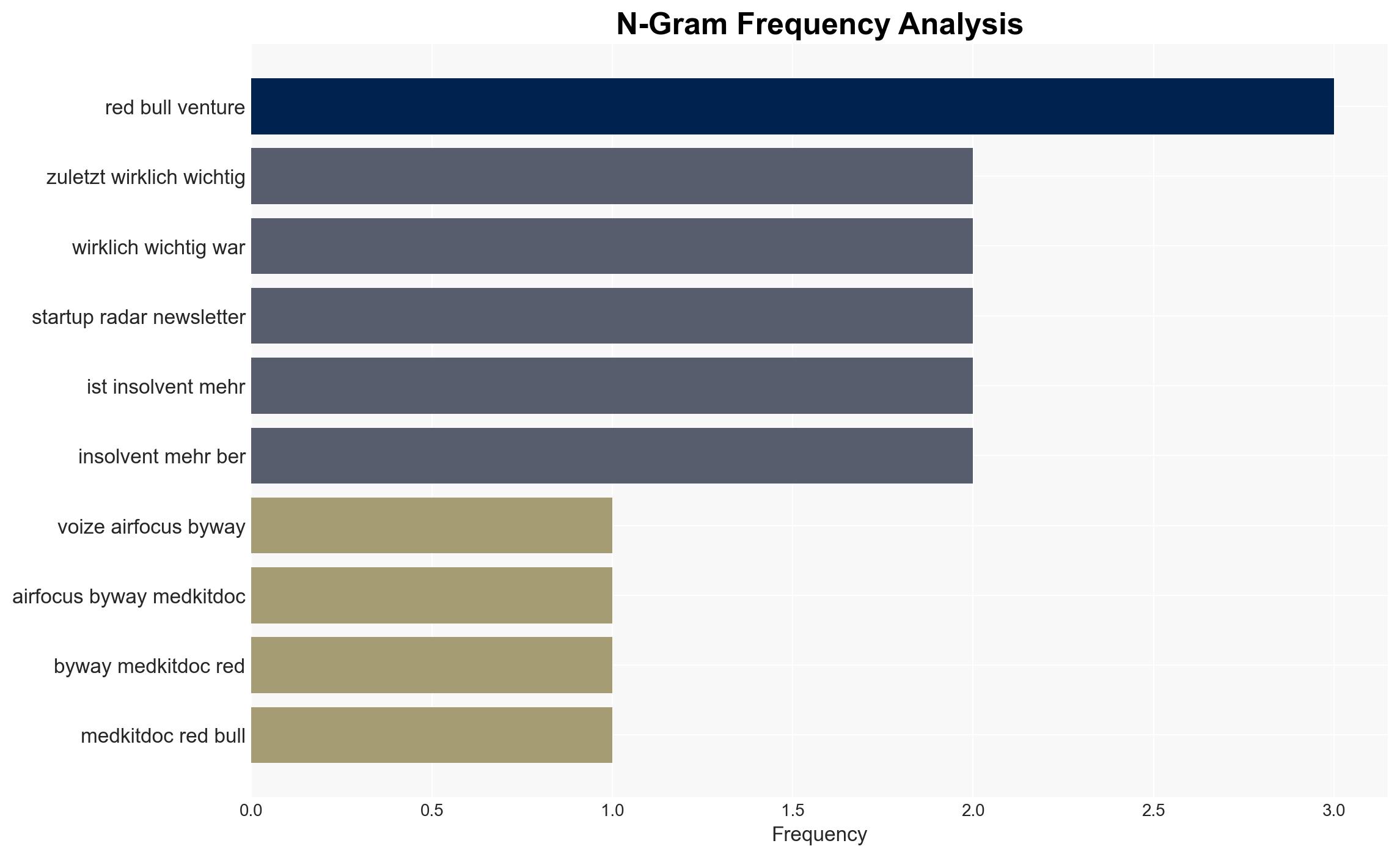

The German-speaking startup scene is experiencing significant activity, with notable mergers, acquisitions, and investments. Key developments include the acquisition of airfocus by Lucid, the insolvency of Kenbi and Doctorly, and the launch of Red Bull Ventures. These events signal a dynamic shift in the startup ecosystem, with potential implications for innovation and economic growth. Strategic recommendations focus on monitoring these trends for opportunities and risks.

2. Detailed Analysis

The following structured analytic techniques have been applied for this analysis:

General Analysis

Recent activities in the startup sector highlight a trend towards consolidation and strategic investments. Lucid’s acquisition of airfocus and EPG’s acquisition of byway indicate a move towards enhancing product offerings and expanding market reach. The insolvency of Kenbi and Doctorly reflects challenges in the healthcare startup sector, potentially due to market saturation or financial mismanagement. Red Bull Ventures’ official launch suggests increased interest in diversifying investment portfolios.

3. Implications and Strategic Risks

The current trends pose several strategic risks and implications:

- Economic Impact: The consolidation of startups could lead to reduced competition, impacting innovation and consumer choices.

- Regional Stability: The insolvency of healthcare startups like Kenbi and Doctorly may affect service delivery and healthcare innovation.

- Investment Trends: The launch of Red Bull Ventures may attract more investors to the startup ecosystem, potentially increasing competition for funding.

4. Recommendations and Outlook

Recommendations:

- Monitor the impact of startup consolidations on market competition and innovation.

- Encourage regulatory frameworks that support sustainable growth and financial stability in the startup sector.

- Promote investment in diverse sectors to mitigate risks associated with market saturation.

Outlook:

In the best-case scenario, strategic investments and consolidations will lead to enhanced innovation and economic growth. In the worst-case scenario, market saturation and financial instability could hinder startup success. The most likely outcome is a balanced environment where strategic investments drive growth while regulatory measures ensure stability.

5. Key Individuals and Entities

The report mentions significant individuals and organizations, including:

- Lucid

- airfocus

- EPG

- byway

- Kenbi

- Doctorly

- Red Bull Ventures