Stock market today Dow surges 600 points SP 500 has best week since 2023 to cap wild week of tariff-fueled chaos – Yahoo Entertainment

Published on: 2025-04-11

Intelligence Report: Stock Market Today – Dow Surges 600 Points, S&P 500 Has Best Week Since 2023 to Cap Wild Week of Tariff-Fueled Chaos

1. BLUF (Bottom Line Up Front)

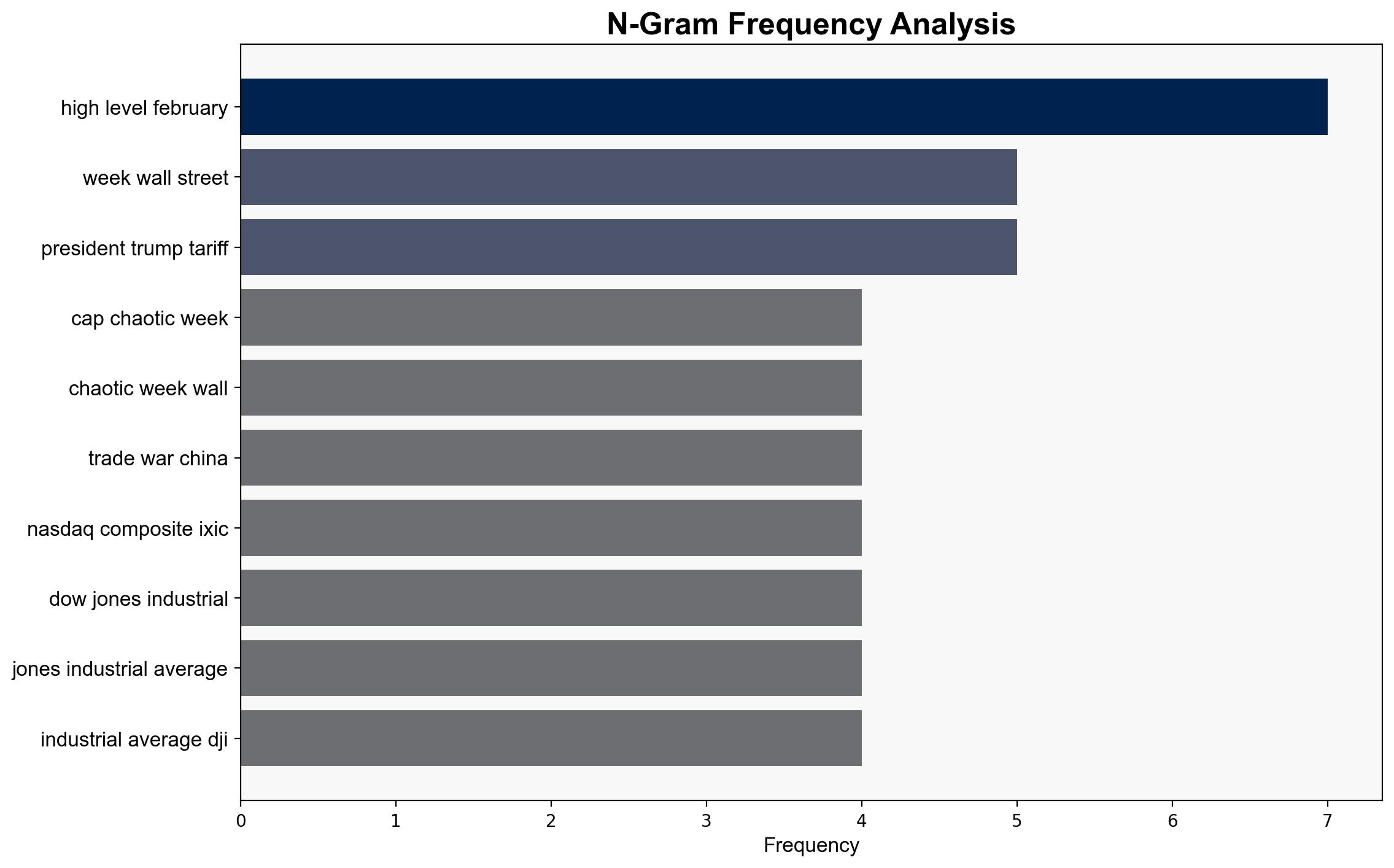

The US stock market experienced significant volatility due to tariff-related developments between the US and China. The Dow Jones Industrial Average surged by 600 points, and the S&P 500 recorded its best week since 2023. The Nasdaq Composite also saw substantial gains, marking its best week since 2022. These movements were driven by rapid changes in tariff policies and market reactions to geopolitical tensions. Key recommendations include monitoring ongoing trade negotiations and preparing for potential market adjustments.

2. Detailed Analysis

The following structured analytic techniques have been applied for this analysis:

General Analysis

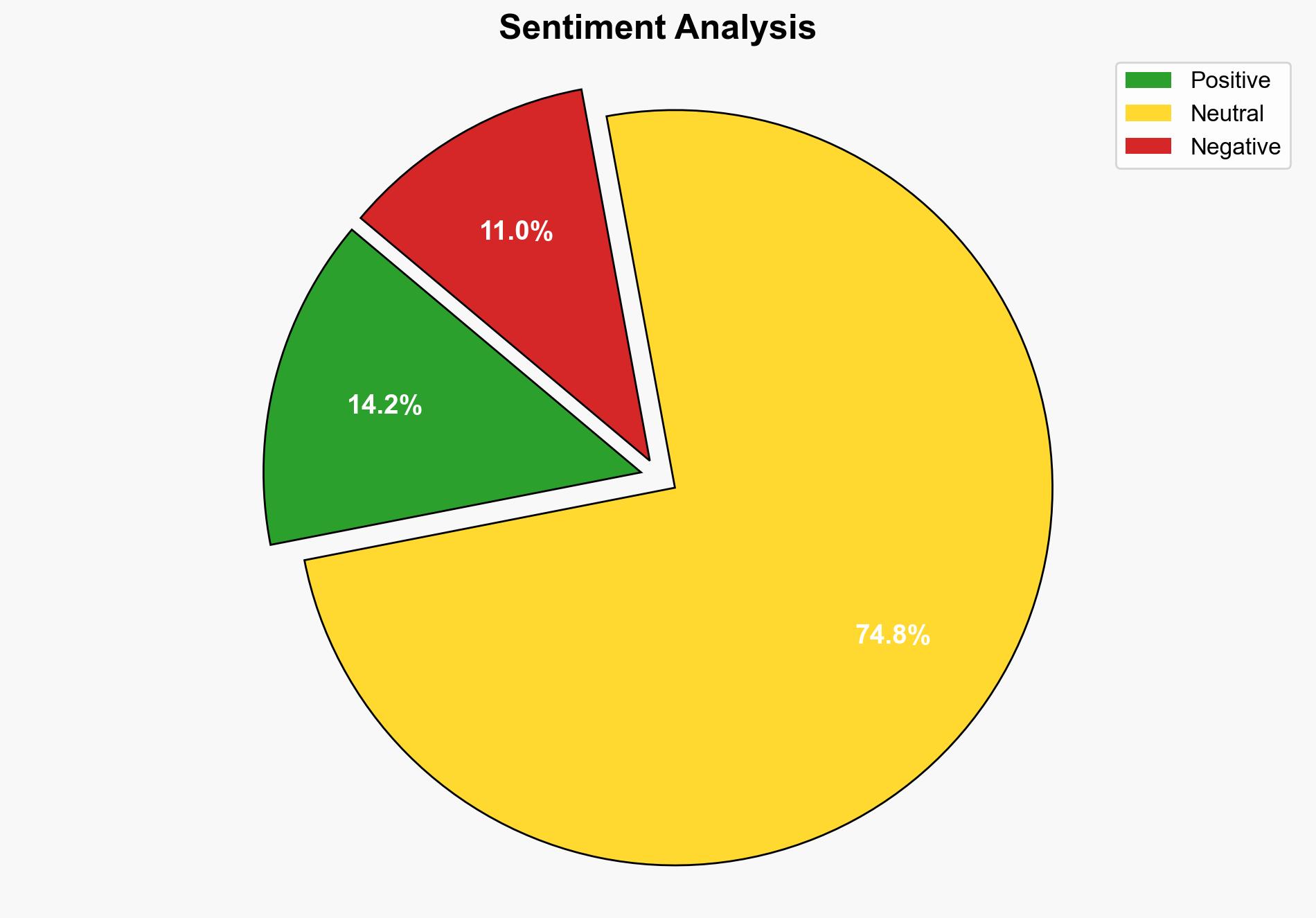

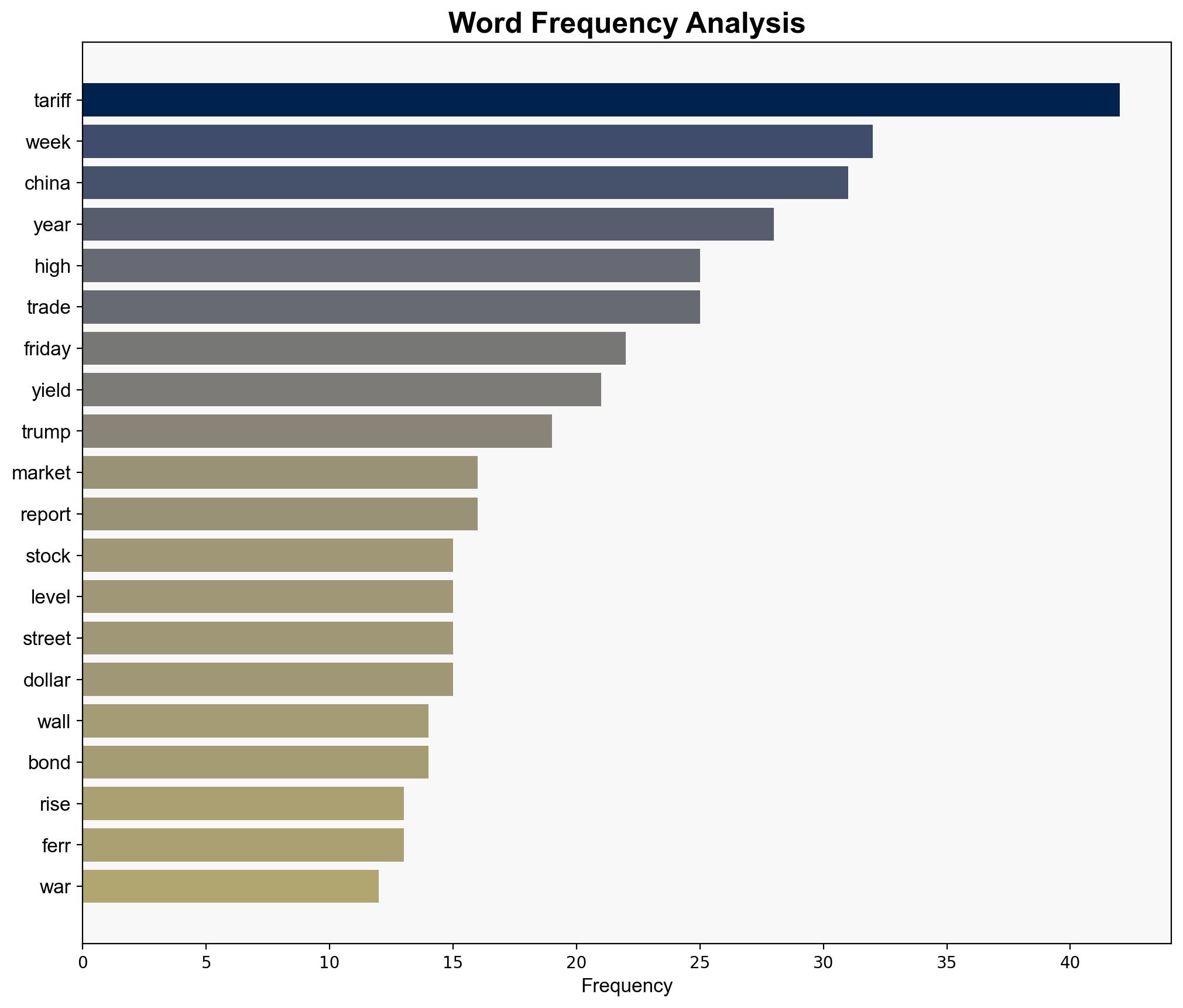

The stock market’s performance this week was heavily influenced by the US-China trade war, with tariffs playing a central role. The market saw historic gains mid-week, followed by sharp declines, culminating in a strong recovery by the week’s end. The S&P 500 rose by 1.8%, while the Nasdaq Composite increased by 2.1%, and the Dow Jones by 1.5%. The technology, industrial, and financial sectors were the biggest gainers, with Nvidia leading the “Magnificent Seven” group.

3. Implications and Strategic Risks

The ongoing trade tensions and tariff policies pose risks to economic stability and investor confidence. The increase in the 10-year Treasury yield to its highest level since February indicates potential inflationary pressures. The decline in consumer sentiment suggests a cautious outlook from consumers, which could impact economic growth. Additionally, China’s decision to raise duties on US imports may escalate trade tensions further, affecting global markets and economic relations.

4. Recommendations and Outlook

Recommendations:

- Monitor trade negotiations closely to anticipate market reactions and adjust investment strategies accordingly.

- Consider regulatory measures to stabilize markets and provide clear guidance to investors.

- Encourage technological advancements and diversification in key sectors to mitigate risks from geopolitical tensions.

Outlook:

Best-case scenario: Successful trade negotiations lead to reduced tariffs and stabilized markets, fostering economic growth.

Worst-case scenario: Escalation of trade tensions results in prolonged market volatility and economic downturn.

Most likely outcome: Continued fluctuations in the stock market as negotiations progress, with periodic gains and losses reflecting geopolitical developments.

5. Key Individuals and Entities

The report mentions significant individuals such as Trump and Jamie Dimon, as well as entities like JPMorgan, Wells Fargo, and BlackRock. These individuals and organizations play pivotal roles in the current economic landscape, influencing market dynamics and investor sentiment.