Stocks and dollar slide as Trump’s Fed attacks jangle nerves – Yahoo Entertainment

Published on: 2025-04-21

Intelligence Report: Stocks and Dollar Slide as Trump’s Fed Attacks Jangle Nerves – Yahoo Entertainment

1. BLUF (Bottom Line Up Front)

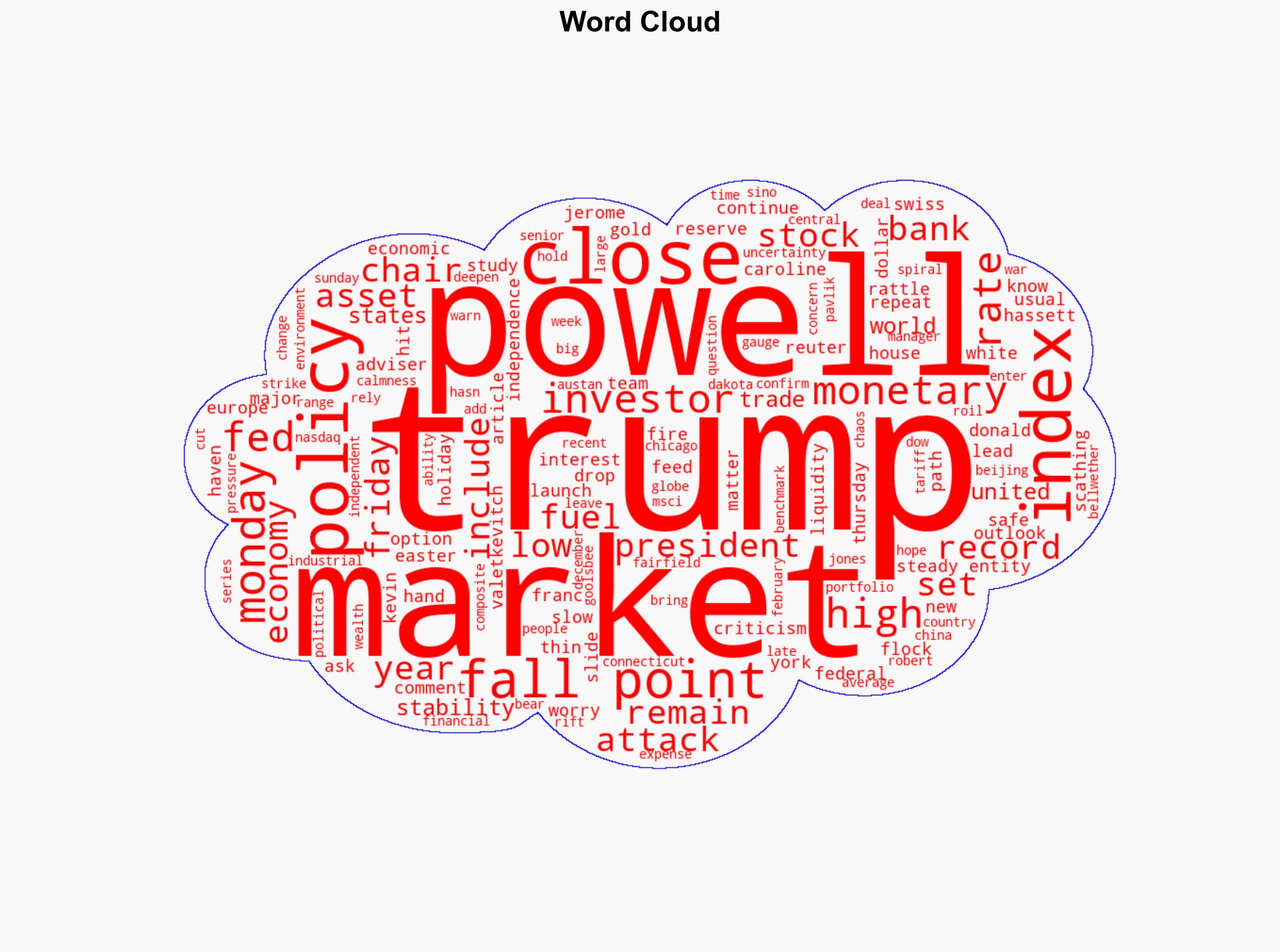

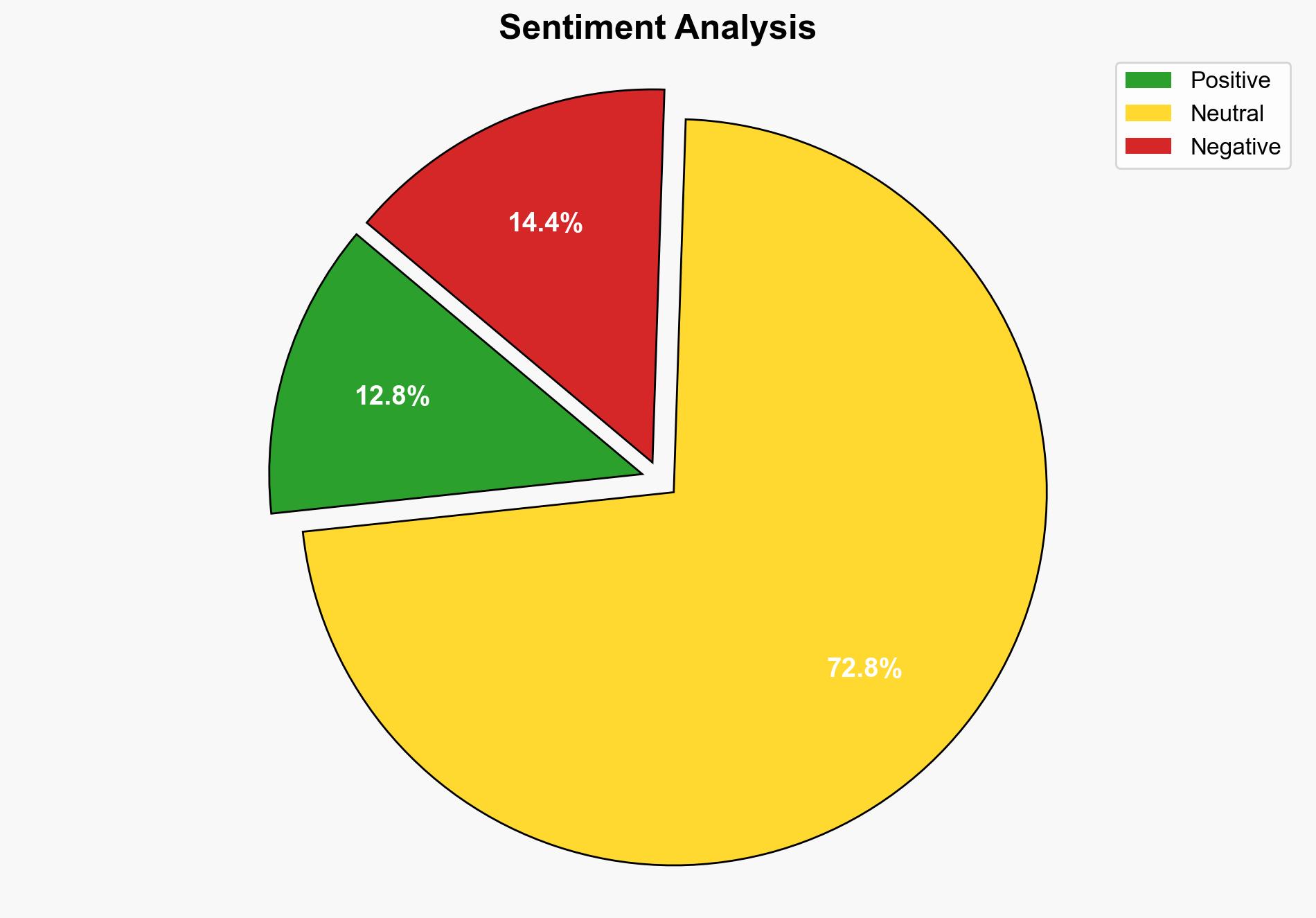

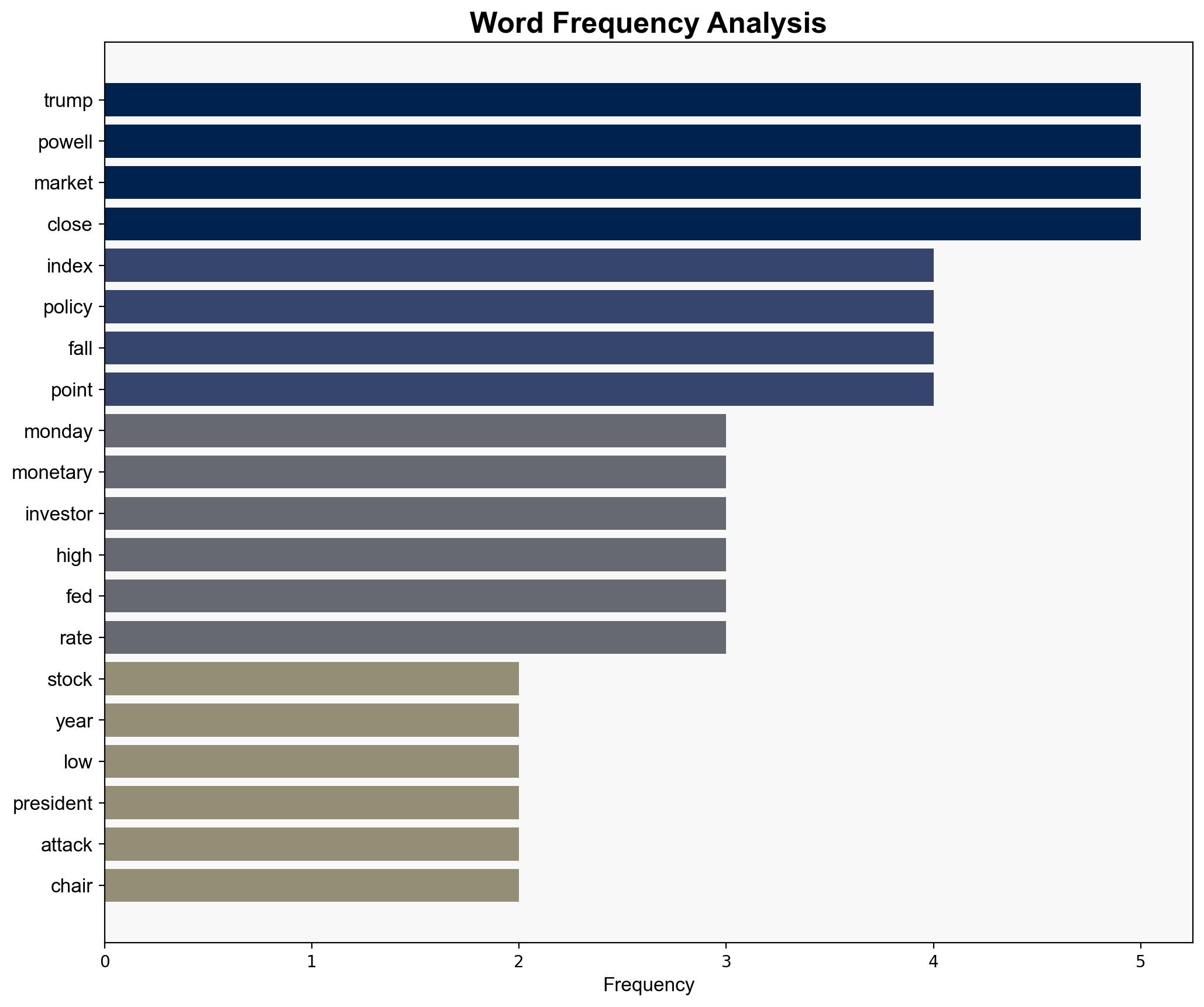

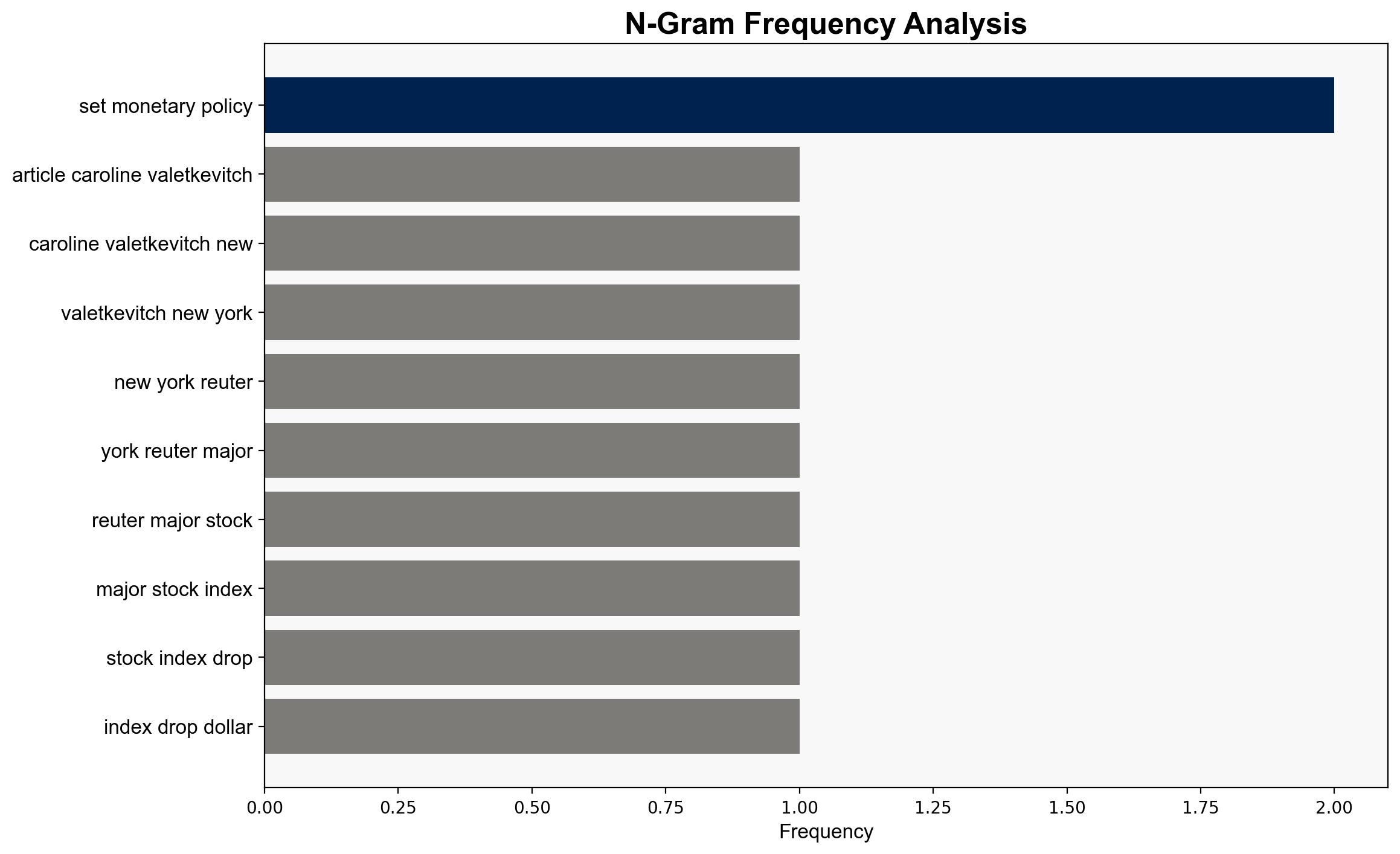

Recent criticisms by Donald Trump towards the Federal Reserve and its chair have led to significant market volatility, with major stock indices and the dollar experiencing notable declines. Investors are increasingly moving towards safe-haven assets, indicating heightened economic uncertainty. Strategic recommendations include monitoring further political developments and preparing for potential market instability.

2. Detailed Analysis

The following structured analytic techniques have been applied:

SWOT Analysis

Strengths: The U.S. economy’s foundational strength remains intact despite political pressures.

Weaknesses: Political interference in monetary policy undermines investor confidence.

Opportunities: Safe-haven assets like gold and the Swiss franc are gaining traction, offering alternative investment opportunities.

Threats: Continued political pressure on the Federal Reserve could lead to long-term market instability.

Cross-Impact Matrix

Political tensions in the U.S. are impacting global markets, with European markets experiencing reduced liquidity due to holiday closures. The trade tensions between the U.S. and China further exacerbate global economic uncertainties.

Scenario Generation

Scenario 1: Continued political pressure leads to a loss of Federal Reserve independence, resulting in prolonged market volatility.

Scenario 2: A resolution in U.S.-China trade tensions stabilizes markets, restoring investor confidence.

Scenario 3: Escalating trade wars and political interference trigger a global economic downturn.

3. Implications and Strategic Risks

The ongoing political and economic tensions pose significant risks to global market stability. The potential erosion of central bank independence could lead to unpredictable monetary policy shifts, affecting global economic growth. Additionally, the deepening U.S.-China trade rift remains a critical threat to international trade dynamics.

4. Recommendations and Outlook

- Monitor political developments closely to anticipate potential impacts on market stability.

- Encourage diversification into safe-haven assets to mitigate risks associated with market volatility.

- Promote diplomatic engagement to resolve U.S.-China trade tensions, reducing global economic uncertainty.

- Prepare for scenario-based outcomes by developing contingency plans for potential economic downturns.

5. Key Individuals and Entities

Donald Trump, Jerome Powell, Kevin Hassett, Robert Pavlik, Austan Goolsbee.