Stocks hesitate in Asia with a lot riding on the Fed – CNA

Published on: 2025-09-15

Intelligence Report: Stocks hesitate in Asia with a lot riding on the Fed – CNA

1. BLUF (Bottom Line Up Front)

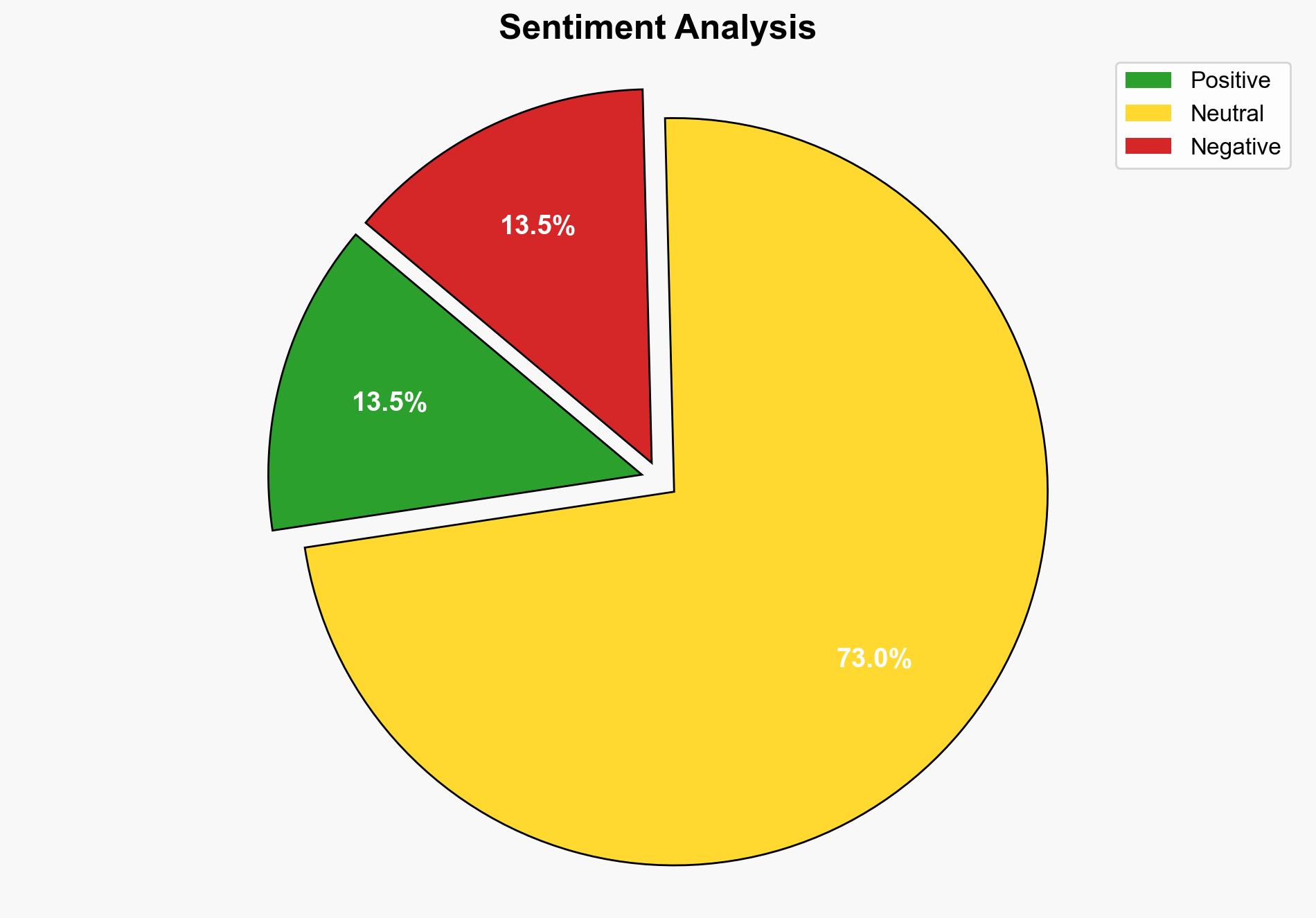

The most supported hypothesis is that Asian markets are reacting cautiously to anticipated Federal Reserve interest rate decisions, which could significantly impact global economic stability. Confidence level: Moderate. Recommended action: Monitor Federal Reserve announcements closely and prepare for potential market volatility.

2. Competing Hypotheses

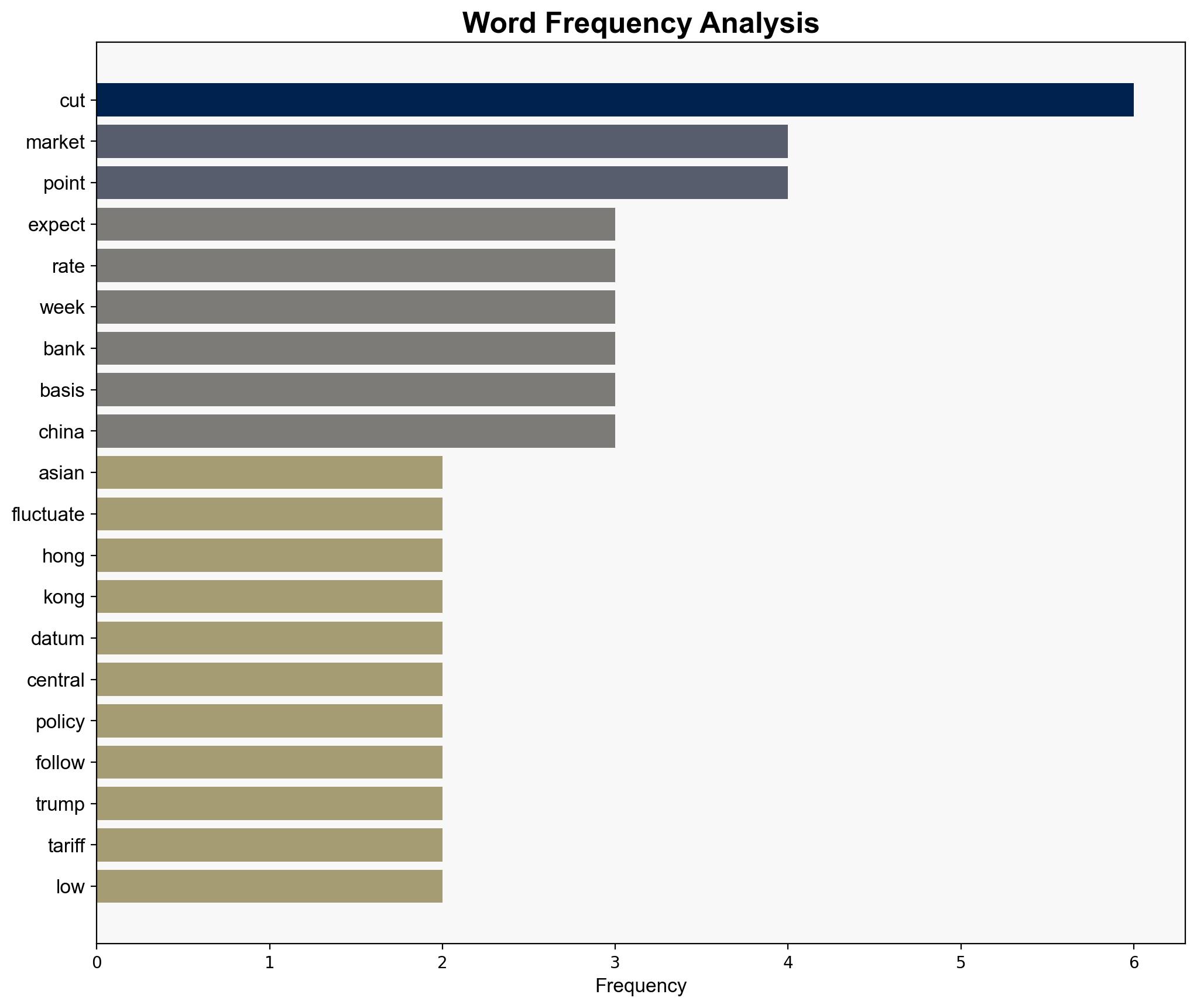

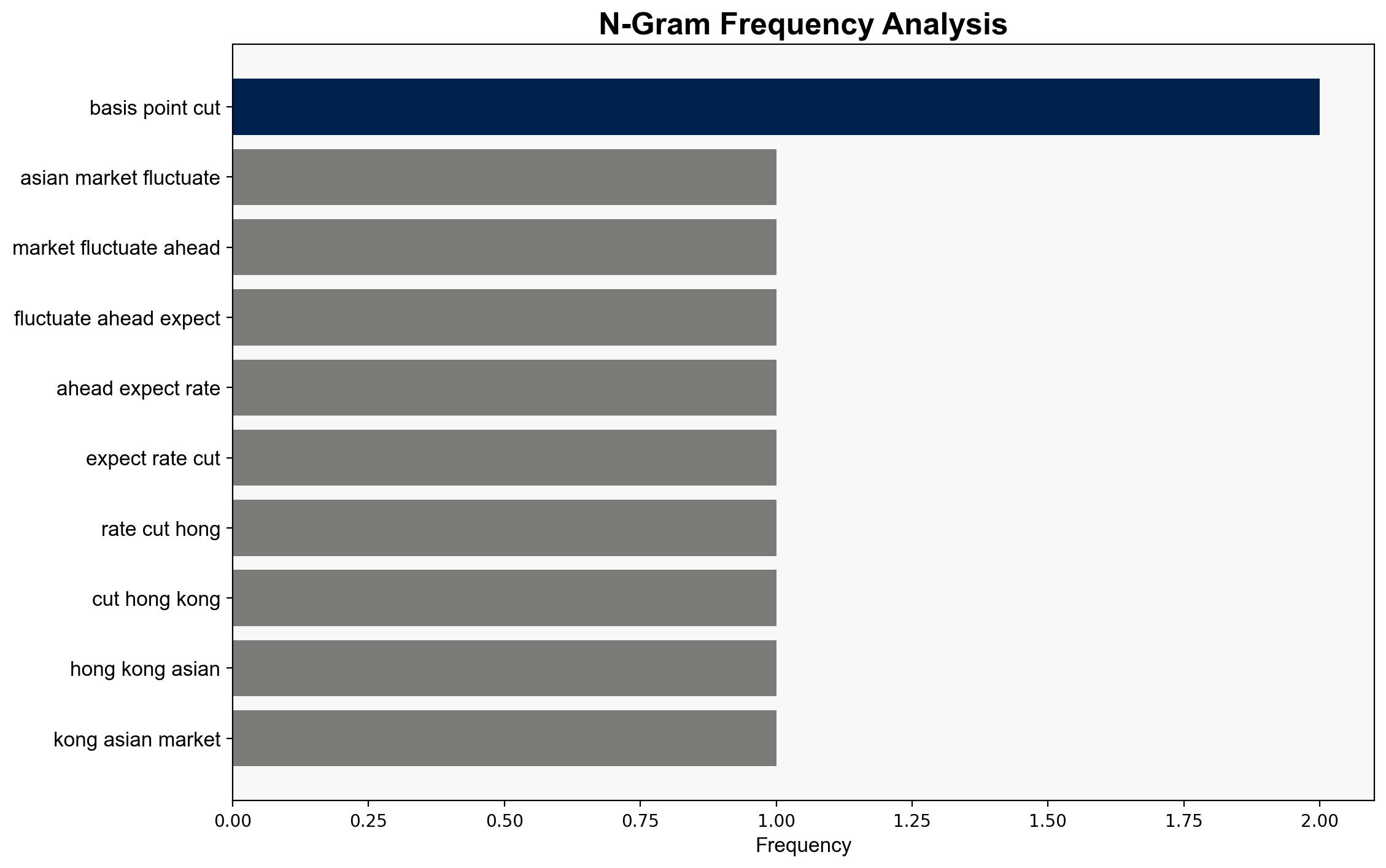

Hypothesis 1: Asian markets are fluctuating due to anticipation of a Federal Reserve interest rate cut, which is expected to provide economic stimulus and support market growth.

Hypothesis 2: The fluctuations in Asian markets are primarily driven by geopolitical tensions, such as the U.S.-China trade dispute and regional economic weaknesses, rather than the Federal Reserve’s potential rate cut.

Using ACH 2.0, Hypothesis 1 is better supported by the data, as the source emphasizes the expectation of a rate cut and its potential impact on borrowing costs and market sentiment. Hypothesis 2 is less supported due to the lack of direct evidence linking geopolitical tensions to the current market fluctuations in the source text.

3. Key Assumptions and Red Flags

Assumptions:

– The Federal Reserve’s decision will have a direct and significant impact on Asian markets.

– Market participants are primarily focused on monetary policy rather than geopolitical factors.

Red Flags:

– Over-reliance on Federal Reserve actions as the sole market driver.

– Potential underestimation of geopolitical factors, such as U.S.-China trade tensions and regional economic data.

4. Implications and Strategic Risks

The anticipation of a Federal Reserve rate cut could lead to increased market volatility if expectations are not met. A smaller-than-expected cut or unchanged rates could trigger a negative market reaction. Additionally, ongoing geopolitical tensions, such as the U.S.-China trade dispute, could exacerbate market instability and impact investor confidence.

5. Recommendations and Outlook

- Monitor Federal Reserve announcements and market reactions closely to adjust investment strategies accordingly.

- Consider hedging strategies to mitigate potential market volatility.

- Scenario-based projections:

- Best Case: A significant rate cut leads to market stabilization and growth.

- Worst Case: No rate cut or a minimal cut triggers market downturn and increased volatility.

- Most Likely: A moderate rate cut results in short-term market fluctuations followed by stabilization.

6. Key Individuals and Entities

– Donald Trump

– Chris Weston

– Scott Bessent

– Federal Reserve

– Central banks of Canada, Britain, Japan

7. Thematic Tags

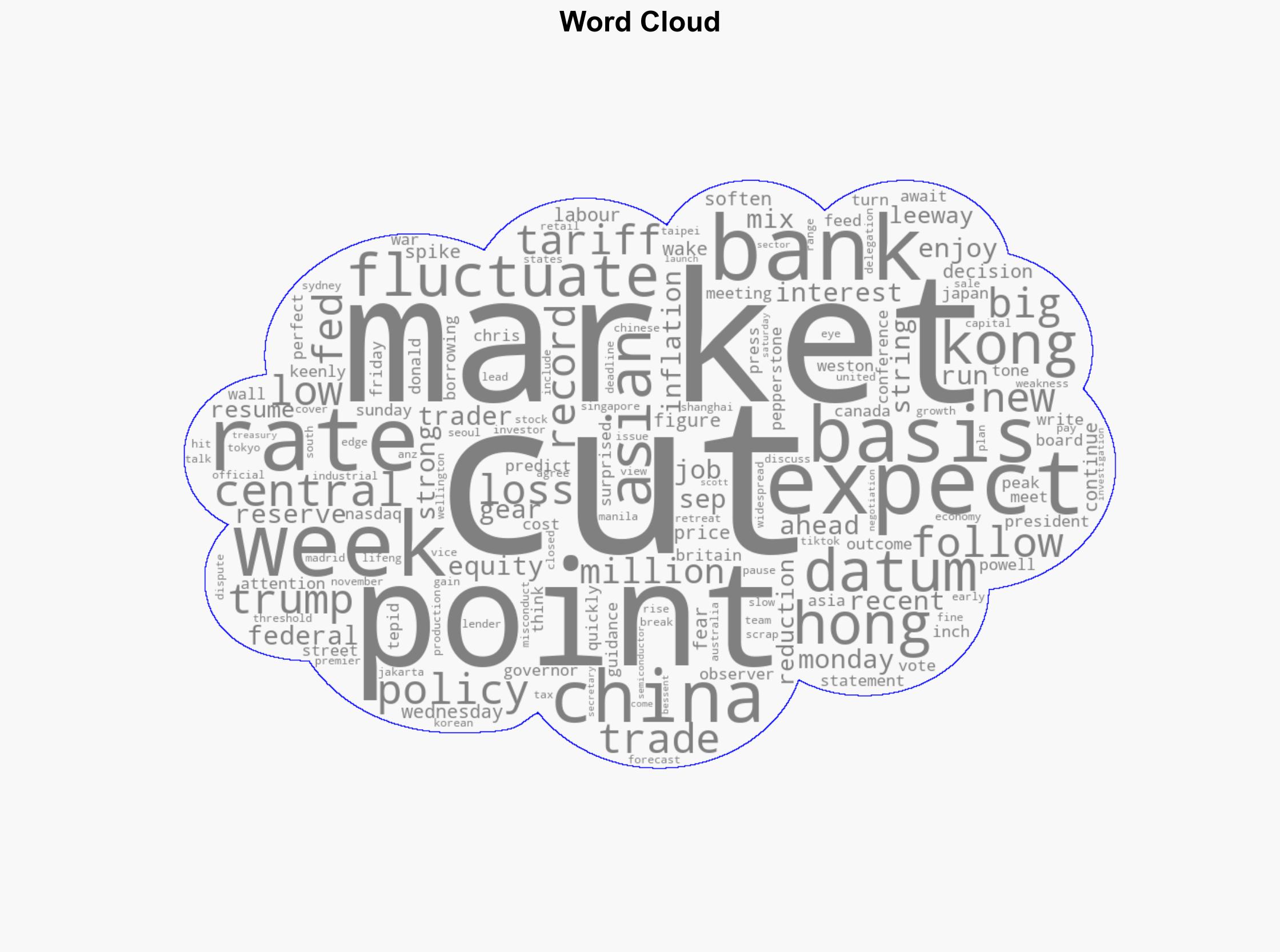

economic stability, monetary policy, market volatility, U.S.-China relations, regional economic trends