Stocks Mixed As Traders Assess AI Rally US Rates And Shutdown – International Business Times

Published on: 2025-10-09

Intelligence Report: Stocks Mixed As Traders Assess AI Rally US Rates And Shutdown – International Business Times

1. BLUF (Bottom Line Up Front)

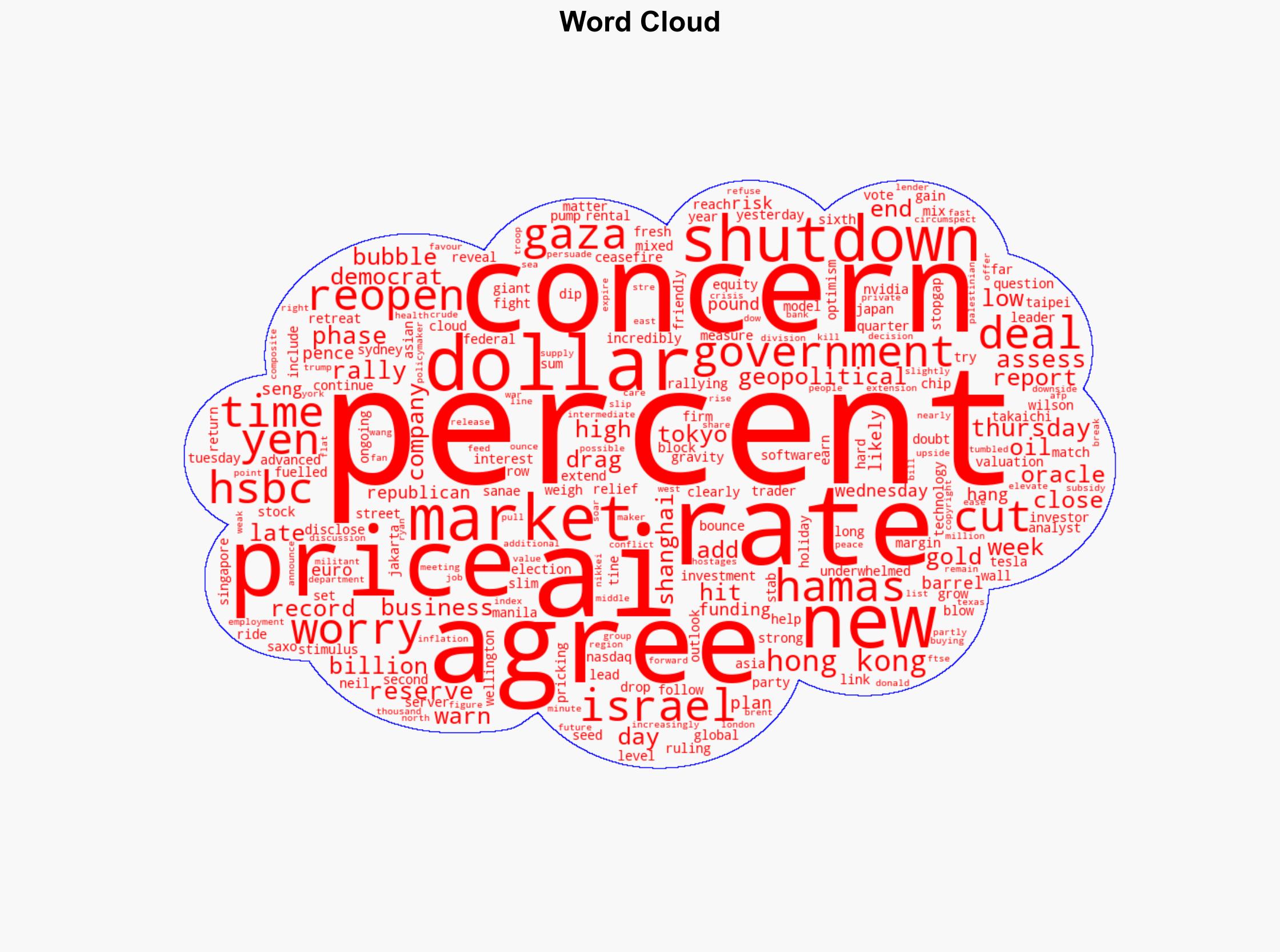

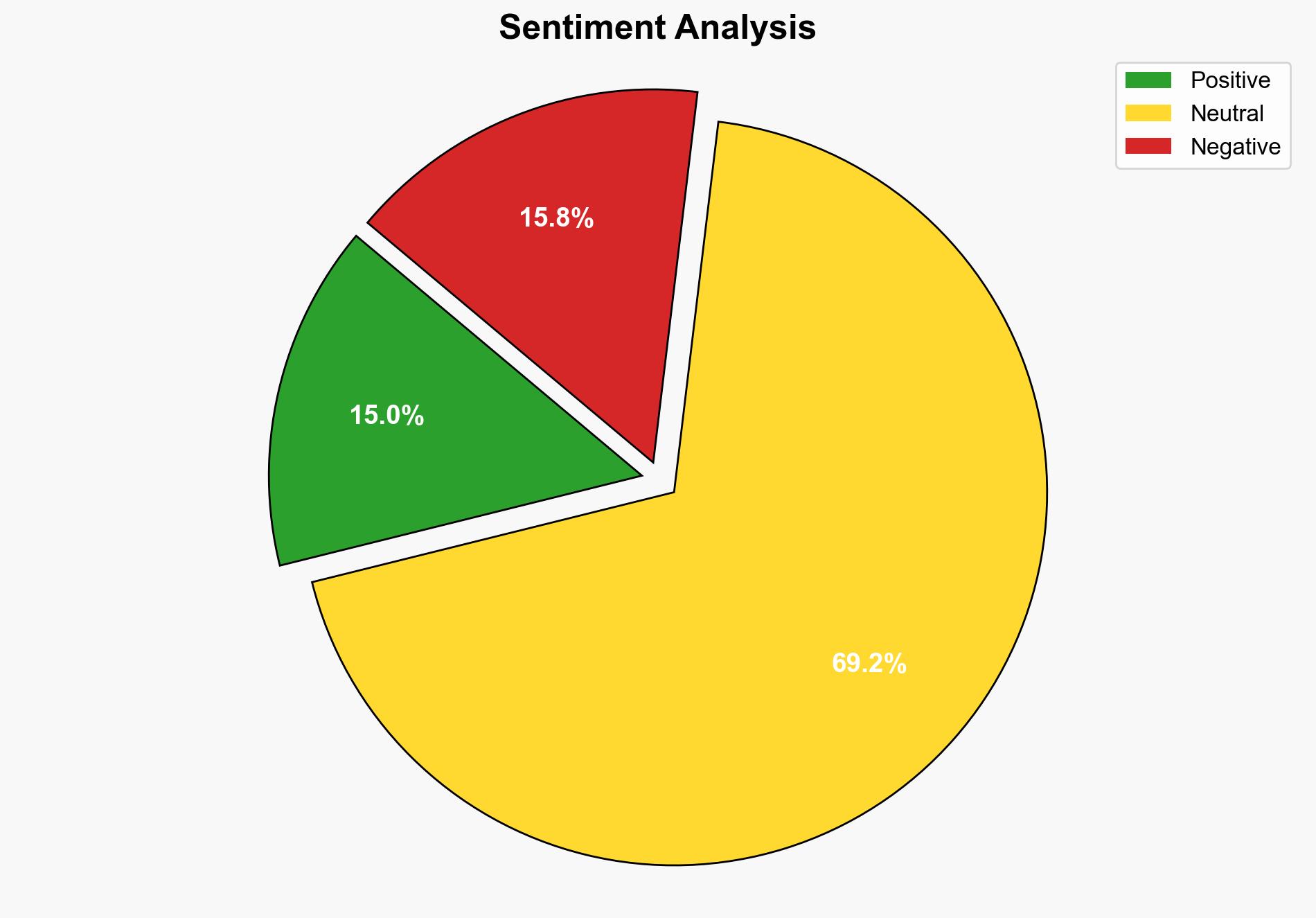

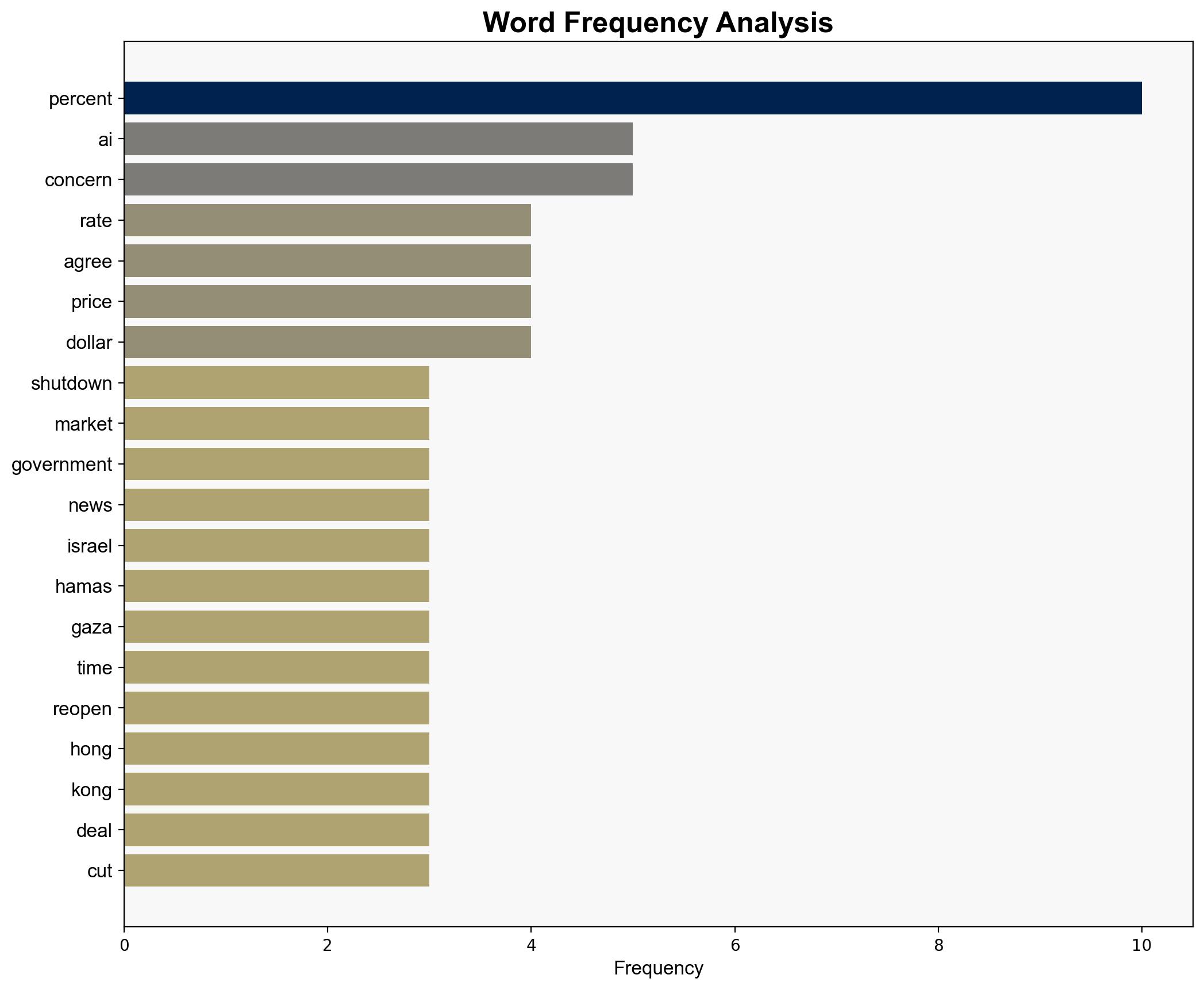

The analysis suggests a moderate confidence level in the hypothesis that the mixed stock market performance is primarily driven by uncertainty surrounding AI investments and geopolitical tensions, rather than solely by economic indicators such as interest rates or government shutdowns. It is recommended to closely monitor AI sector valuations and geopolitical developments, particularly in the Middle East, as these factors may significantly influence market stability.

2. Competing Hypotheses

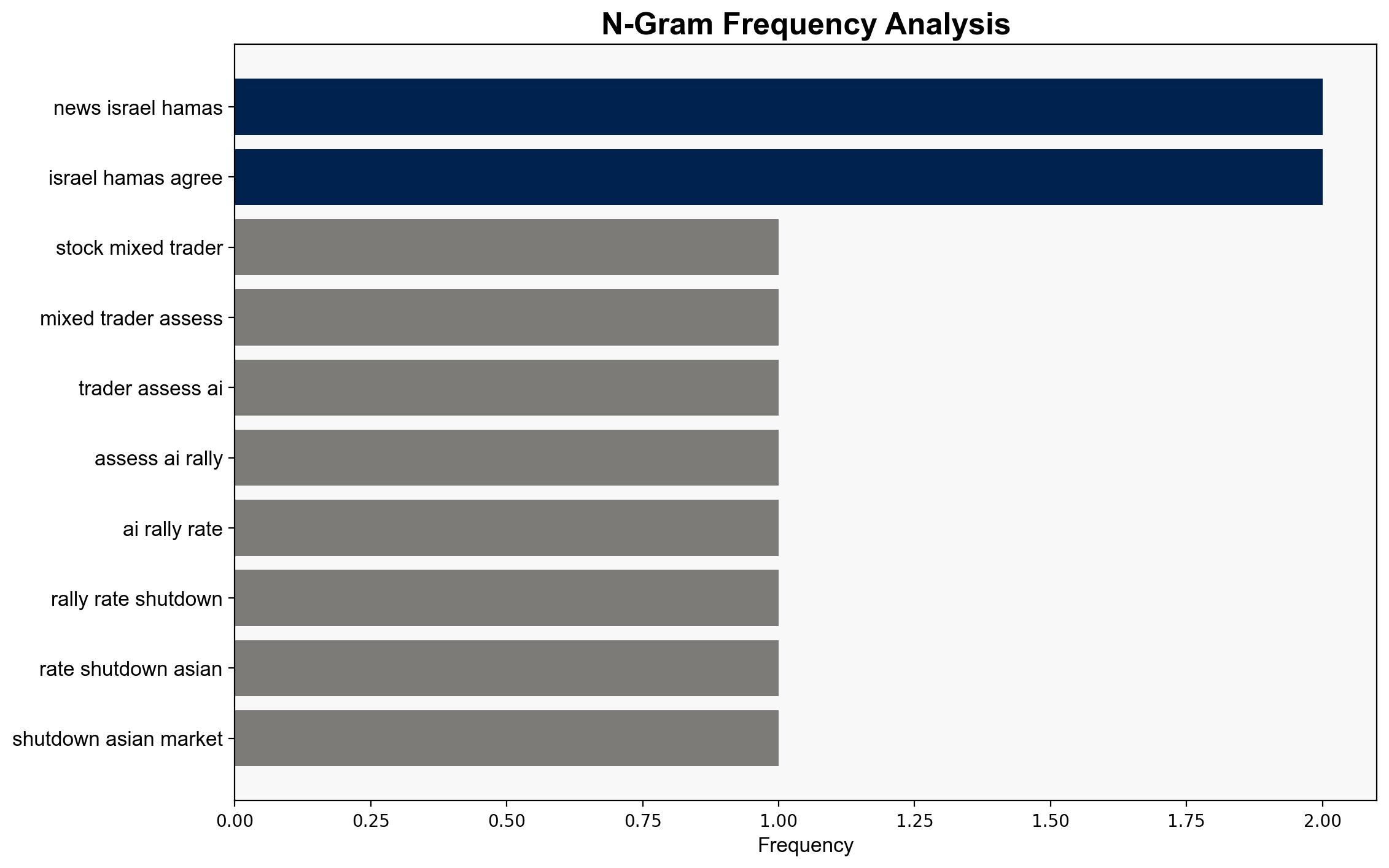

1. **Hypothesis A**: The mixed stock market performance is primarily due to overvaluation concerns in the AI sector and geopolitical tensions, particularly the Israel-Hamas ceasefire and potential Middle East conflicts.

2. **Hypothesis B**: The mixed performance is mainly influenced by economic factors such as Federal Reserve interest rate decisions and the ongoing U.S. government shutdown.

Using the Analysis of Competing Hypotheses (ACH) 2.0, Hypothesis A is better supported. The source indicates significant investor concern over AI valuations and geopolitical developments, which are likely to have a more immediate and direct impact on market sentiment compared to the more predictable economic factors.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that AI sector valuations are unsustainable and that geopolitical tensions have a direct impact on market volatility.

– **Red Flags**: There is a potential cognitive bias in overemphasizing the AI sector’s impact without considering broader economic indicators. Additionally, the geopolitical situation’s complexity may not be fully captured, leading to oversimplification.

– **Missing Data**: Detailed analysis of the Federal Reserve’s internal deliberations and comprehensive data on AI investments’ real economic impact are lacking.

4. Implications and Strategic Risks

– **Economic**: A potential AI bubble burst could lead to significant market corrections, affecting global economic stability.

– **Geopolitical**: Escalation of Middle East tensions could disrupt oil supplies, leading to increased energy prices and broader economic repercussions.

– **Psychological**: Investor sentiment may become increasingly volatile, driven by fear of geopolitical instability and economic uncertainty.

5. Recommendations and Outlook

- Monitor AI sector developments and valuations closely to anticipate potential market corrections.

- Engage in scenario planning for geopolitical developments, particularly in the Middle East, to mitigate risks associated with energy supply disruptions.

- Best Case: AI sector stabilizes with sustainable growth, geopolitical tensions ease, leading to market recovery.

- Worst Case: AI bubble bursts, coupled with escalating Middle East conflict, causing severe market downturn.

- Most Likely: Continued market volatility with periodic corrections as AI and geopolitical factors evolve.

6. Key Individuals and Entities

– Neil Wilson, Saxo Market analyst, warns of AI bubble risks.

– Oracle and Tesla, key companies in AI sector, influencing market sentiment.

– Donald Trump, associated with Middle East peace plan announcement.

7. Thematic Tags

national security threats, cybersecurity, counter-terrorism, regional focus