Stocks Plunge After Trump Declares Web Rumor on Tariffs Fake News – Gizmodo.com

Published on: 2025-04-07

Intelligence Report: Stocks Plunge After Trump Declares Web Rumor on Tariffs Fake News – Gizmodo.com

1. BLUF (Bottom Line Up Front)

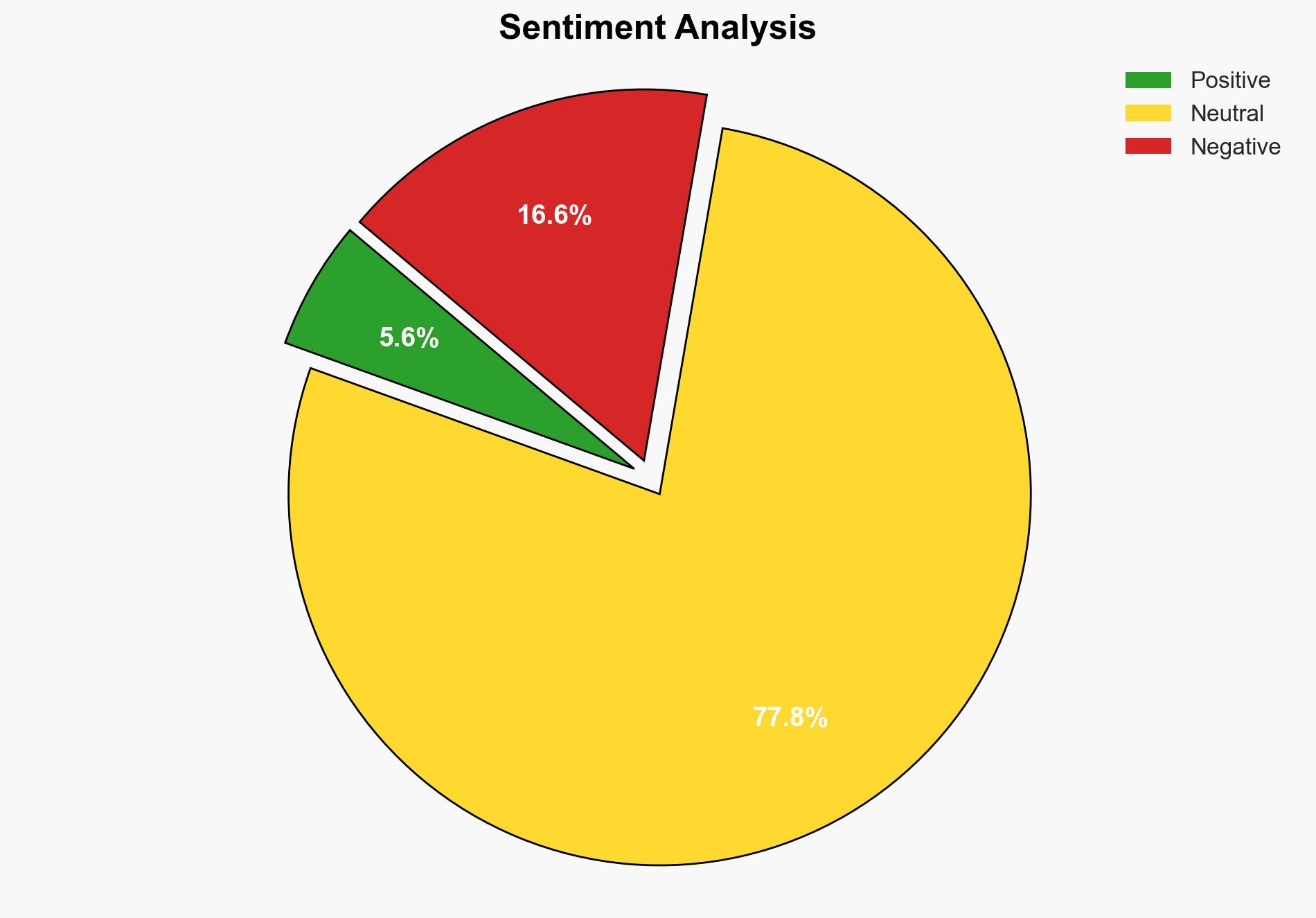

Recent online rumors regarding a potential pause in tariff policies by Donald Trump led to significant volatility in the stock market. The rumors, deemed “fake news” by Trump, caused a brief surge followed by a sharp decline in stock prices. This incident highlights the sensitivity of financial markets to misinformation and the rapid dissemination of unverified news through social media channels.

2. Detailed Analysis

The following structured analytic techniques have been applied for this analysis:

General Analysis

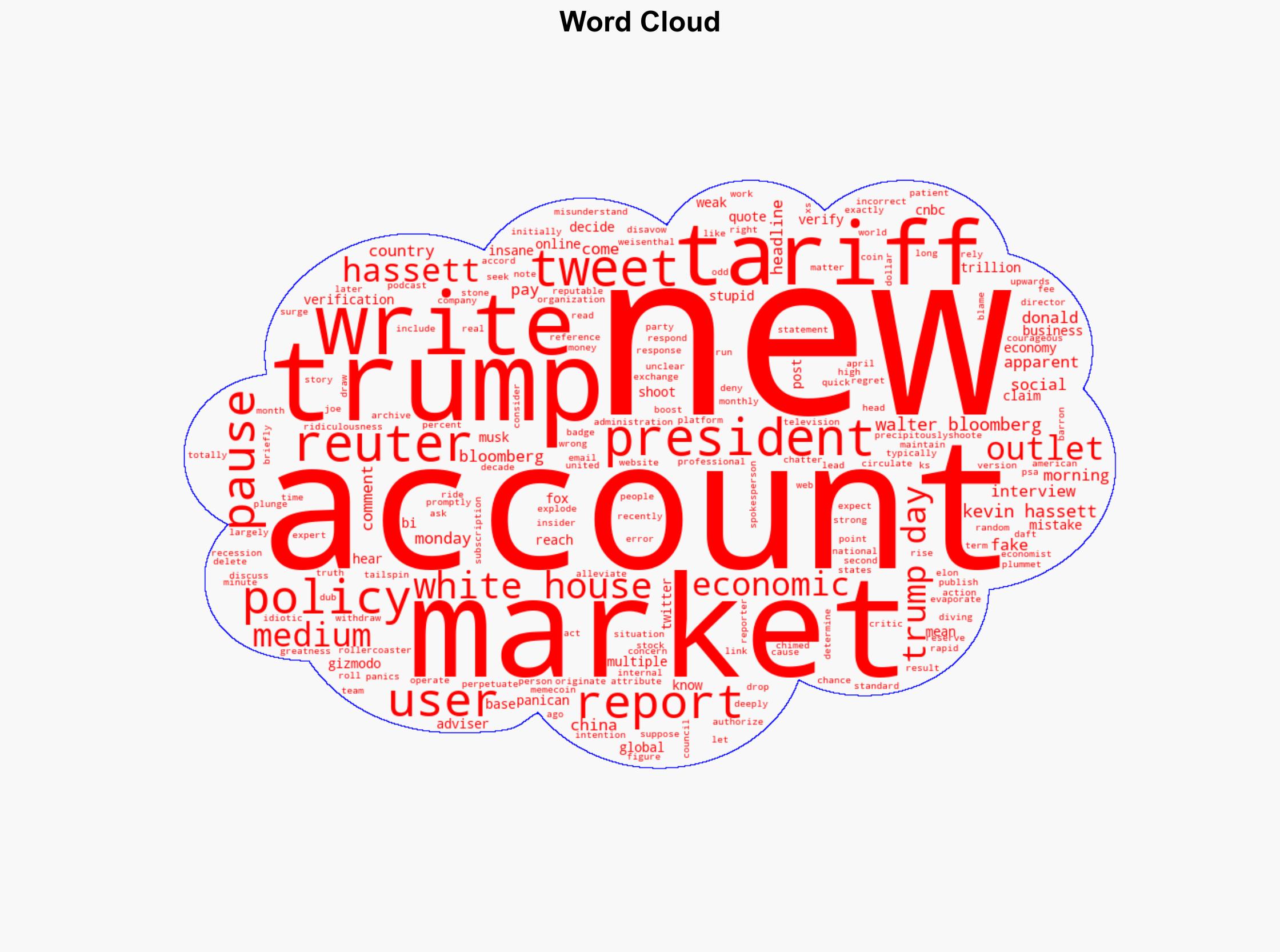

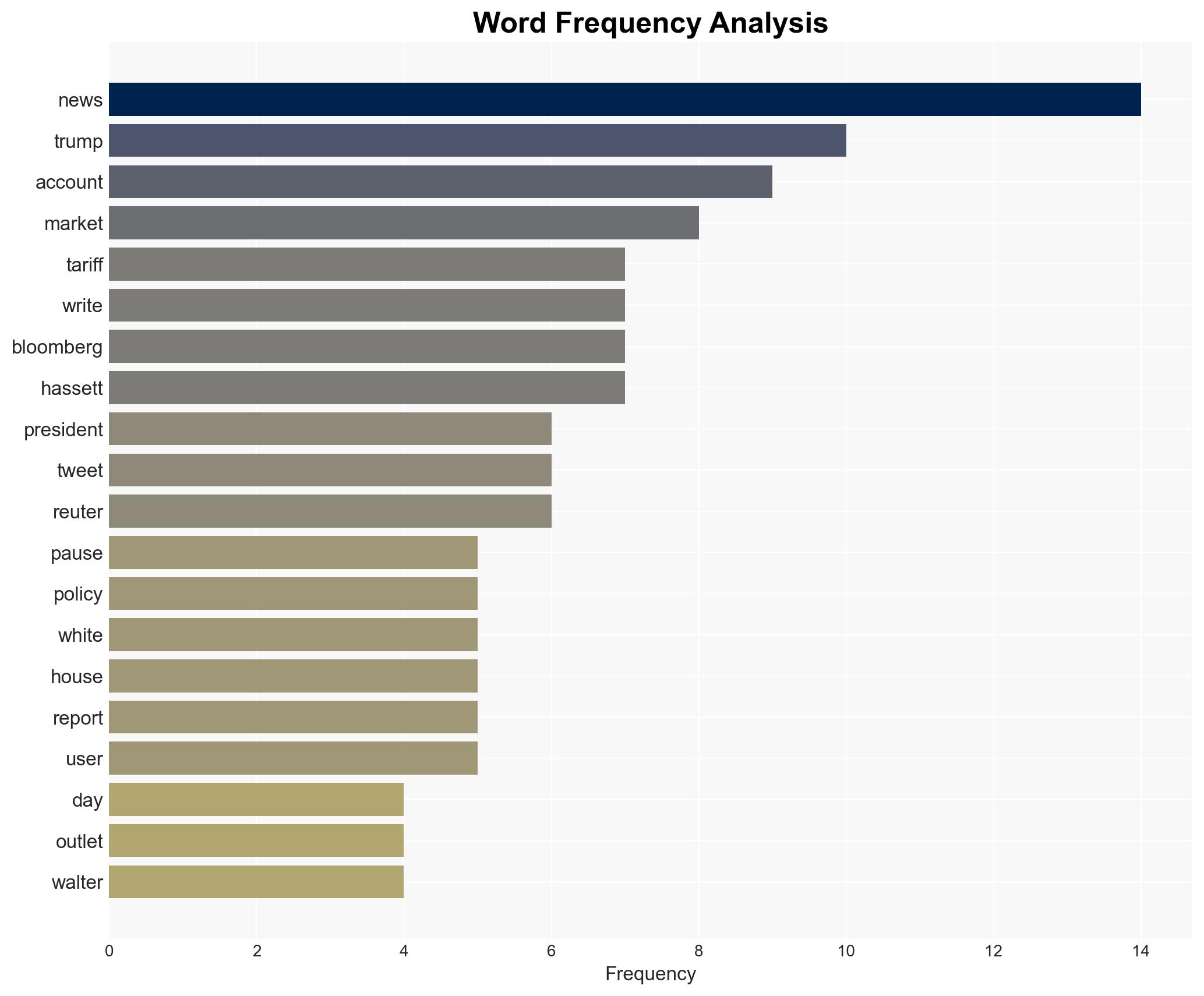

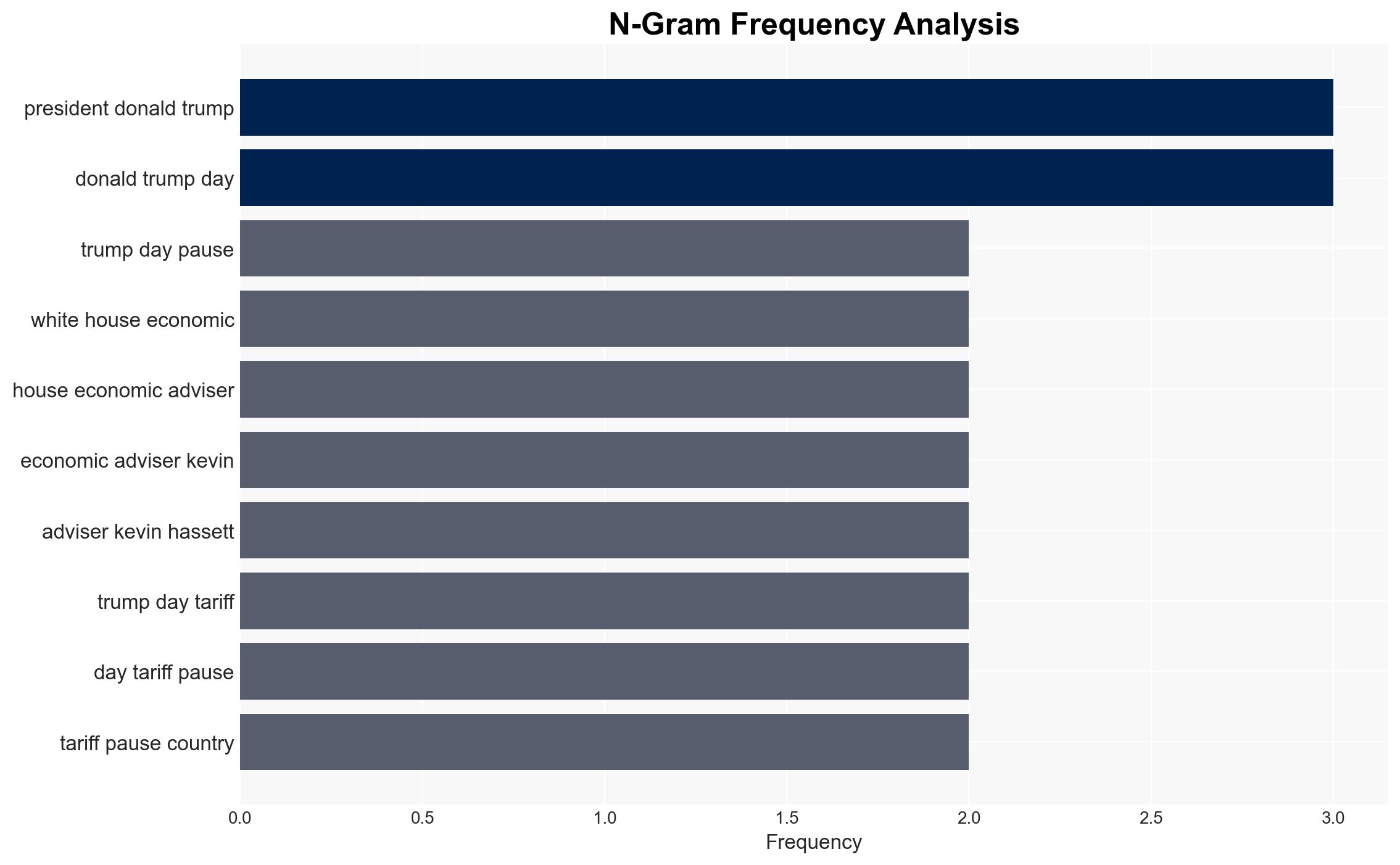

The incident began with a tweet from an account known for posting headline news, which claimed that Trump intended to pause tariffs on China. This information was quickly picked up by multiple reputable news outlets, including Reuters and CNBC, leading to a temporary surge in the stock market. However, the White House swiftly denied the report, labeling it as “fake news,” which resulted in a rapid market decline. The misinformation appears to have originated from a misunderstanding of comments made by Kevin Hassett during a television interview.

3. Implications and Strategic Risks

The rapid spread of misinformation poses significant risks to financial stability and investor confidence. The incident underscores the vulnerability of markets to unverified information, which can lead to drastic economic consequences. Additionally, the reliance on social media for news dissemination increases the potential for similar occurrences, potentially impacting national economic interests and contributing to broader regional instability.

4. Recommendations and Outlook

Recommendations:

- Enhance verification processes for news dissemination to prevent the spread of misinformation.

- Implement regulatory measures to ensure accountability for social media platforms in managing false information.

- Encourage financial institutions to develop strategies to mitigate the impact of sudden market fluctuations due to misinformation.

Outlook:

In the best-case scenario, improved verification and regulatory measures will reduce the frequency and impact of misinformation on financial markets. In the worst-case scenario, continued reliance on unverified sources may lead to increased market volatility and economic instability. The most likely outcome involves gradual improvements in information verification processes, with occasional disruptions due to persistent challenges in managing misinformation.

5. Key Individuals and Entities

The report mentions significant individuals and organizations, including Donald Trump, Walter Bloomberg, Kevin Hassett, and the White House. These entities played pivotal roles in the dissemination and response to the misinformation incident.