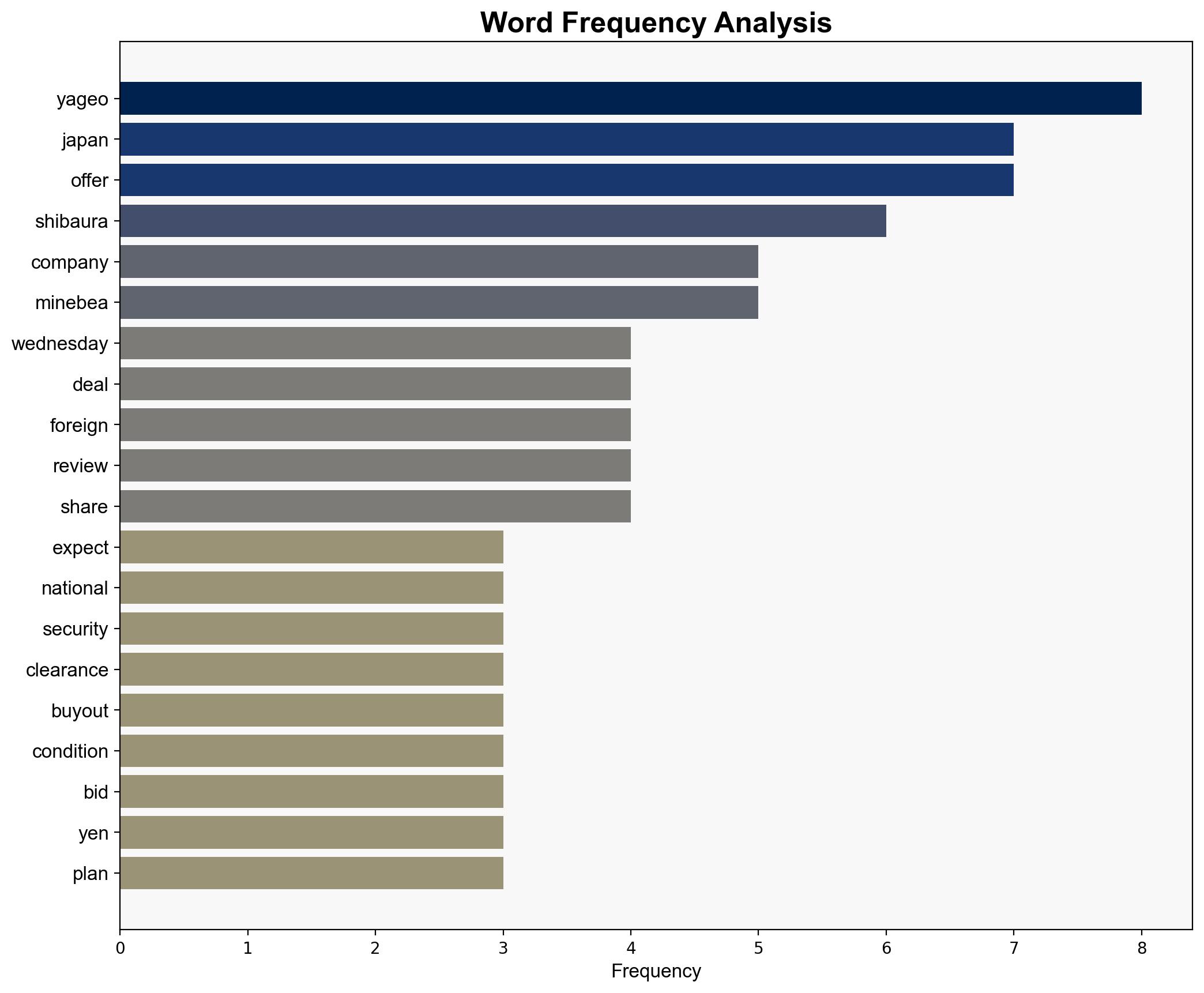

Taiwan’s Yageo expects Japan national security clearance for 740 million Shibaura buyout – CNA

Published on: 2025-08-27

Intelligence Report: Taiwan’s Yageo expects Japan national security clearance for 740 million Shibaura buyout – CNA

1. BLUF (Bottom Line Up Front)

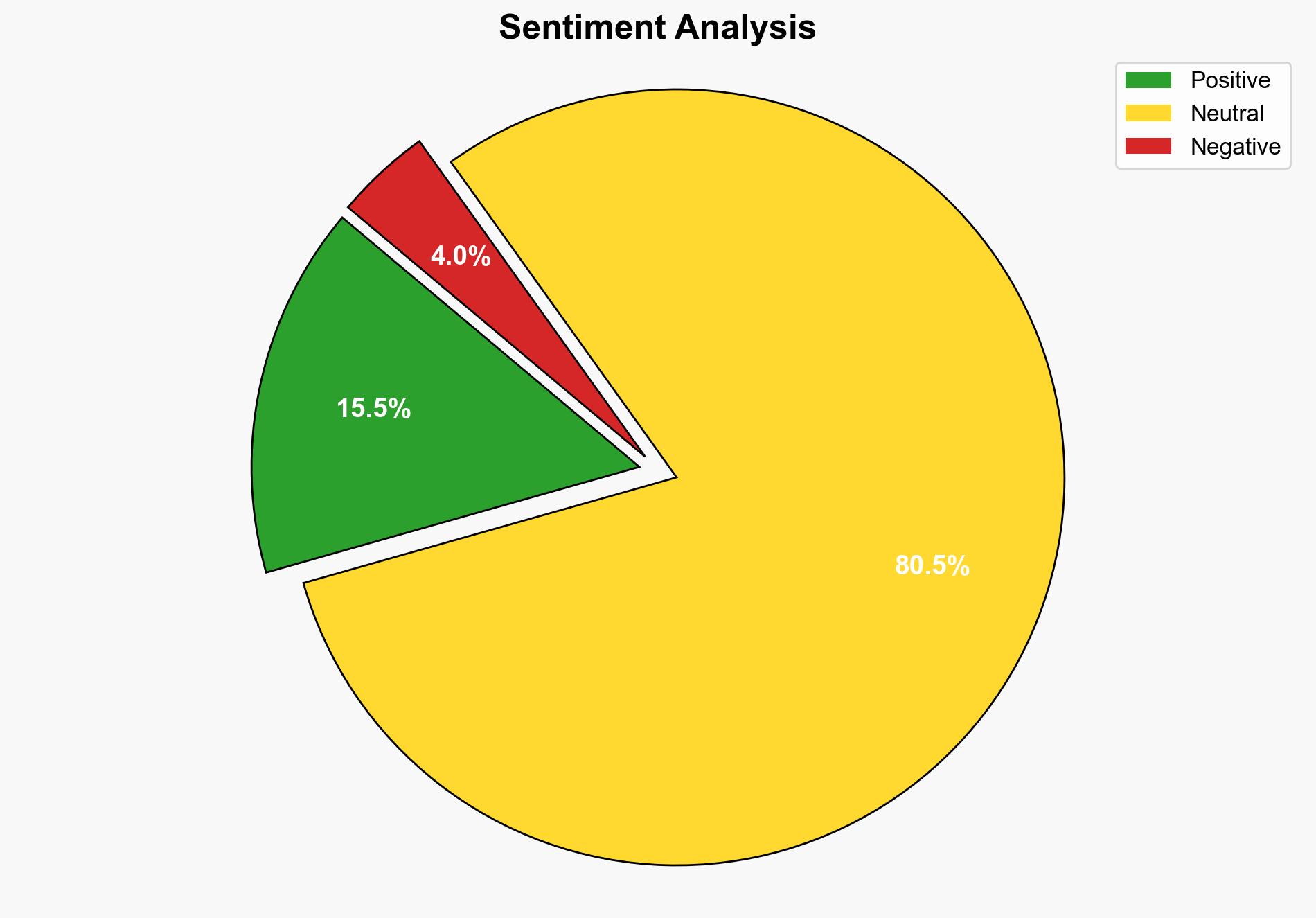

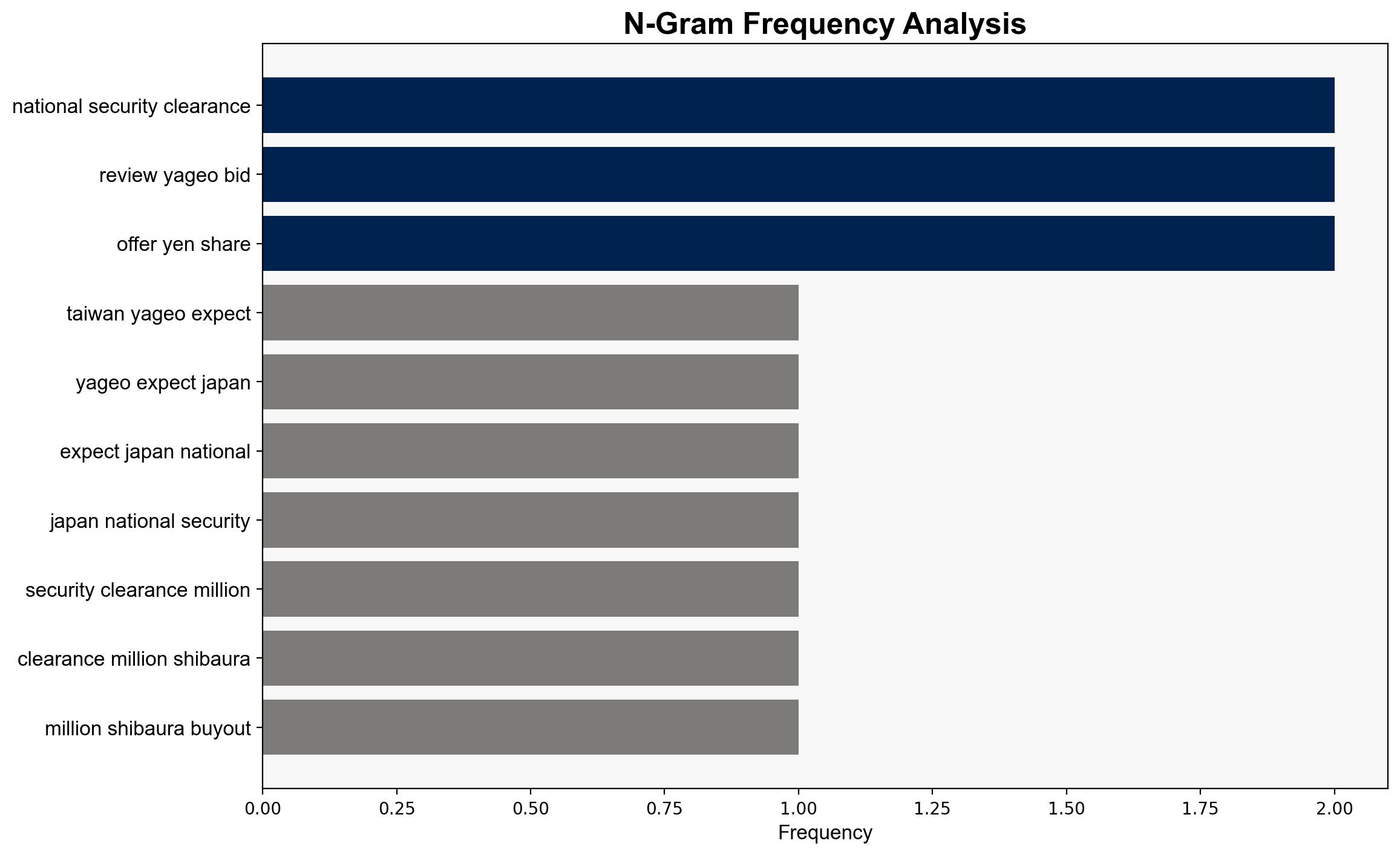

Yageo’s acquisition of Shibaura Electronics is likely to receive Japanese national security clearance, but with conditions that may affect the deal’s terms. Confidence level: Moderate. Recommended action: Monitor Japan’s regulatory stance on foreign acquisitions, particularly in sectors deemed sensitive to national security.

2. Competing Hypotheses

Hypothesis 1: Japan will grant national security clearance to Yageo’s acquisition of Shibaura, with conditions that align with national security interests. This is supported by Yageo’s proactive engagement with Japanese authorities and willingness to meet conditions set by Japan’s industry ministry.

Hypothesis 2: Japan will reject the acquisition due to national security concerns, particularly given Shibaura’s reclassification into a core national security category. The protracted review process and historical precedents of rejection under similar circumstances support this hypothesis.

Using ACH 2.0, Hypothesis 1 is better supported due to Yageo’s strategic adjustments and the Japanese government’s recent guidelines easing the stigma around unsolicited foreign buyouts.

3. Key Assumptions and Red Flags

Assumptions include the belief that Japan’s regulatory environment is becoming more open to foreign acquisitions and that Yageo’s bid sufficiently addresses national security concerns. A red flag is the lack of detailed conditions set by Japan’s industry ministry, which could introduce unexpected hurdles. Additionally, the historical reluctance of Japan to approve foreign takeovers in sensitive sectors remains a potential blind spot.

4. Implications and Strategic Risks

The approval of this acquisition could signal a shift in Japan’s policy towards foreign investments, potentially encouraging more unsolicited buyouts. However, failure to secure clearance could deter future foreign investments in Japan’s sensitive sectors. This situation could escalate into broader economic tensions between Taiwan and Japan if perceived as protectionist.

5. Recommendations and Outlook

- Yageo should prepare for potential modifications to the deal to meet Japanese conditions, including possible divestitures or operational restrictions.

- Monitor Japan’s regulatory decisions in similar cases to anticipate future trends in foreign investment policy.

- Scenario-based projections:

- Best Case: Approval with minimal conditions, setting a precedent for future foreign investments.

- Worst Case: Rejection leading to strained Taiwan-Japan economic relations.

- Most Likely: Approval with significant conditions, reflecting a cautious but open stance by Japan.

6. Key Individuals and Entities

– Yageo Corporation

– Shibaura Electronics

– Minebea Mitsumi

– Makiko Yamazaki (reporting)

7. Thematic Tags

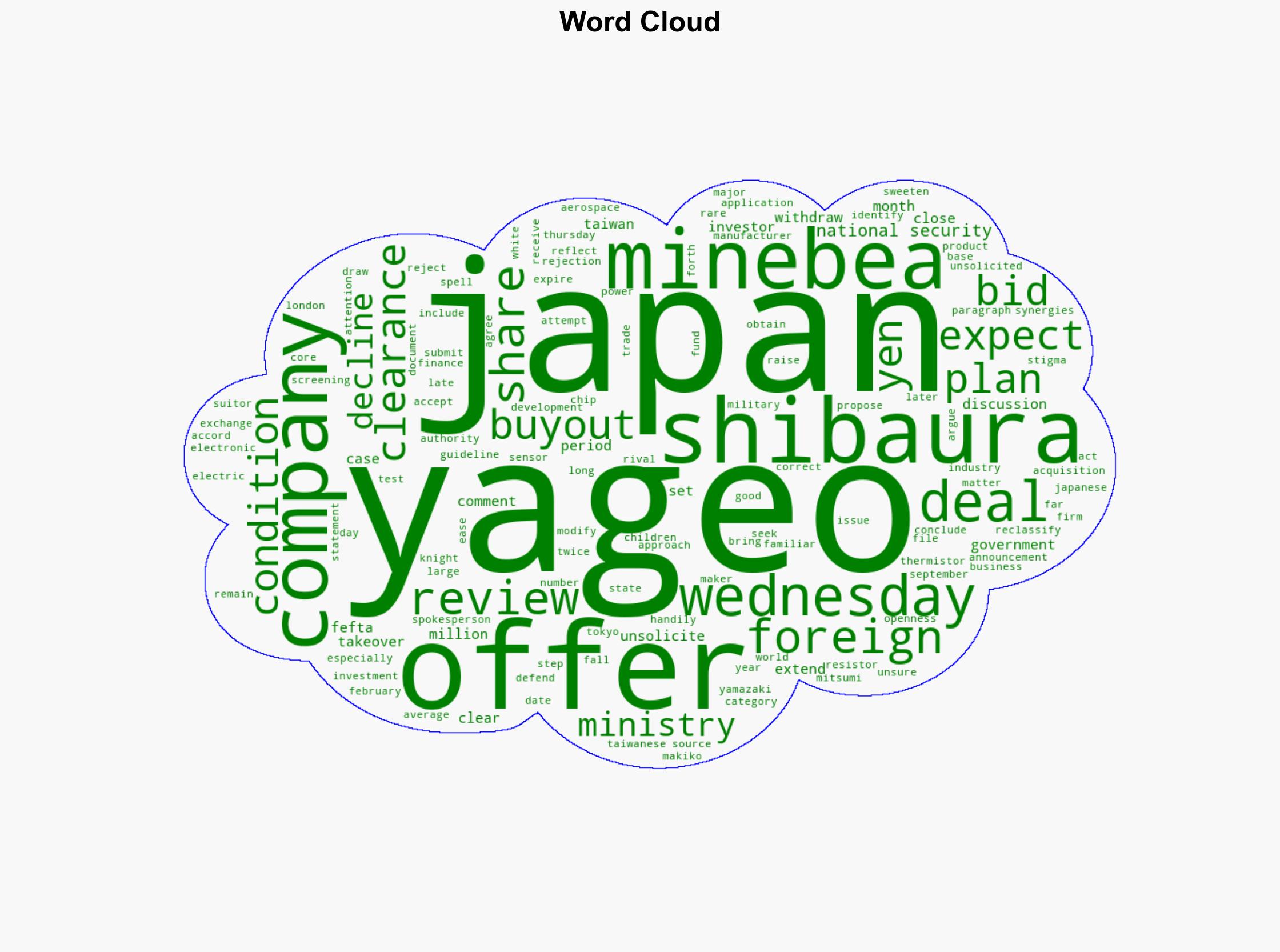

national security threats, foreign investment, economic policy, Taiwan-Japan relations