Taiwan’s Yageo expects to clear Japan’s national security review for 740 million Shibaura buyout – CNA

Published on: 2025-08-27

Intelligence Report: Taiwan’s Yageo expects to clear Japan’s national security review for 740 million Shibaura buyout – CNA

1. BLUF (Bottom Line Up Front)

The most supported hypothesis is that Yageo will successfully obtain Japan’s national security clearance for the Shibaura buyout, with a moderate confidence level. This conclusion is based on Yageo’s proactive engagement with Japanese authorities and its willingness to meet the conditions set forth by Japan’s industry ministry. It is recommended to monitor the situation closely for any shifts in Japan’s regulatory stance or changes in Yageo’s strategic approach.

2. Competing Hypotheses

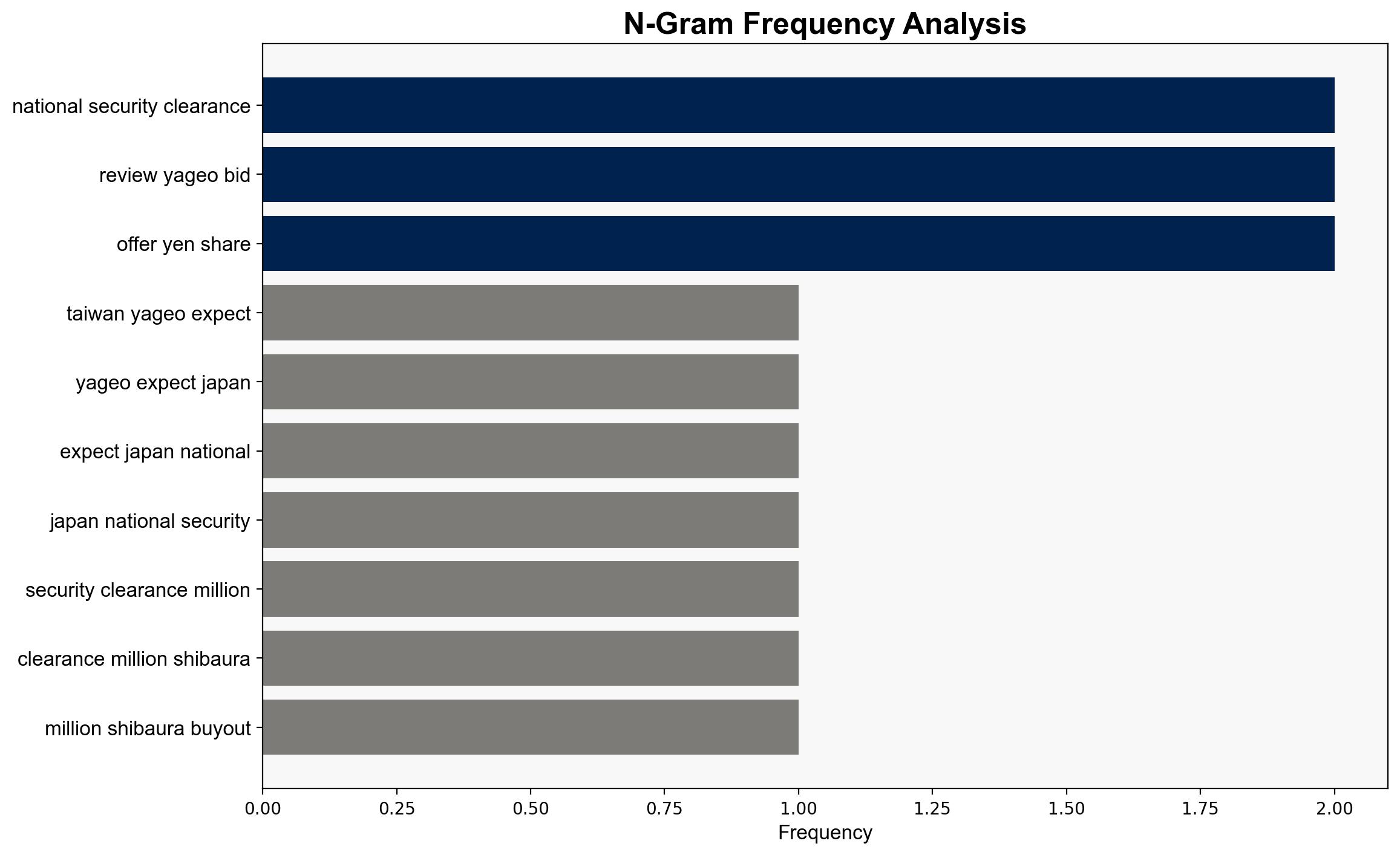

Hypothesis 1: Yageo will secure national security clearance from Japan, allowing the buyout of Shibaura to proceed. This is supported by Yageo’s strategic submission of documents reflecting discussions with Japan’s industry ministry and their readiness to comply with conditions.

Hypothesis 2: Japan will ultimately reject Yageo’s bid due to national security concerns, particularly given Shibaura’s reclassification under Japan’s core national security category and the historical precedent of Japan rejecting similar foreign acquisitions.

3. Key Assumptions and Red Flags

– Assumption for Hypothesis 1: Japan’s regulatory environment is becoming more open to foreign acquisitions, and Yageo’s compliance with conditions will be sufficient.

– Assumption for Hypothesis 2: Japan’s national security concerns outweigh economic incentives, leading to a rejection of the bid.

– Red Flags: The extended review period and the lack of transparency regarding the conditions set by Japan’s ministry could indicate potential hurdles.

– Missing Data: Specific conditions required by Japan for clearance are not disclosed, creating uncertainty about the feasibility of Yageo’s compliance.

4. Implications and Strategic Risks

– Economic: Successful clearance could set a precedent for future foreign acquisitions in Japan, potentially altering the investment landscape.

– Geopolitical: A rejection could strain Taiwan-Japan relations and impact regional economic dynamics.

– Cybersecurity: The acquisition involves a company with military and aerospace applications, raising potential cybersecurity risks if not managed properly.

– Psychological: Investor sentiment may be affected by the outcome, influencing market stability and future foreign interest in Japanese firms.

5. Recommendations and Outlook

- Monitor communications from Japan’s industry ministry for any updates on the conditions or decision timeline.

- Encourage Yageo to maintain transparency and open dialogue with Japanese authorities to mitigate potential national security concerns.

- Scenario Projections:

- Best Case: Yageo secures clearance, enhancing Taiwan-Japan economic ties and setting a positive precedent for future deals.

- Worst Case: Rejection of the bid leads to diplomatic tensions and a cooling of foreign investment interest in Japan.

- Most Likely: Conditional approval is granted, requiring ongoing compliance and monitoring of strategic sectors.

6. Key Individuals and Entities

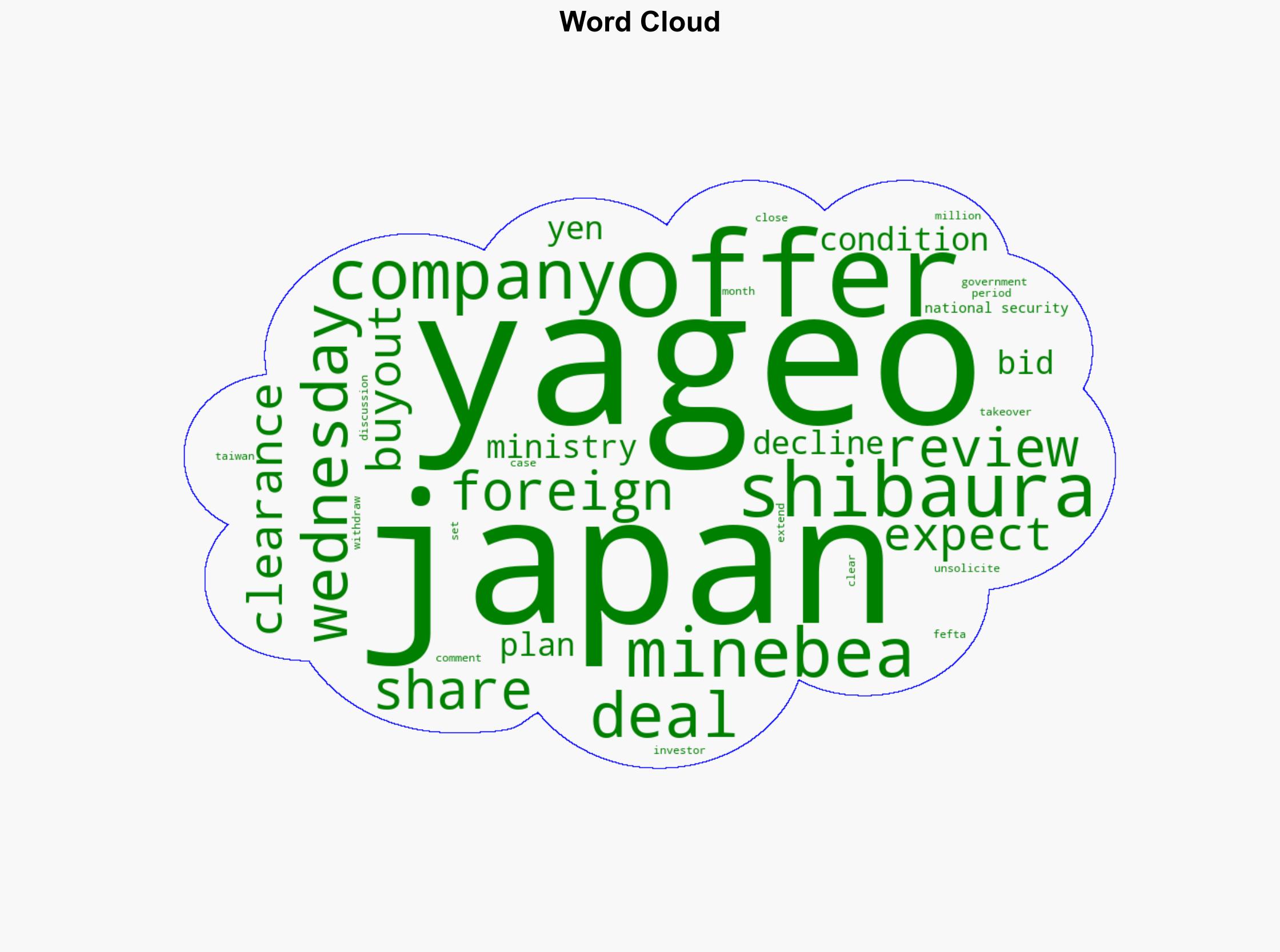

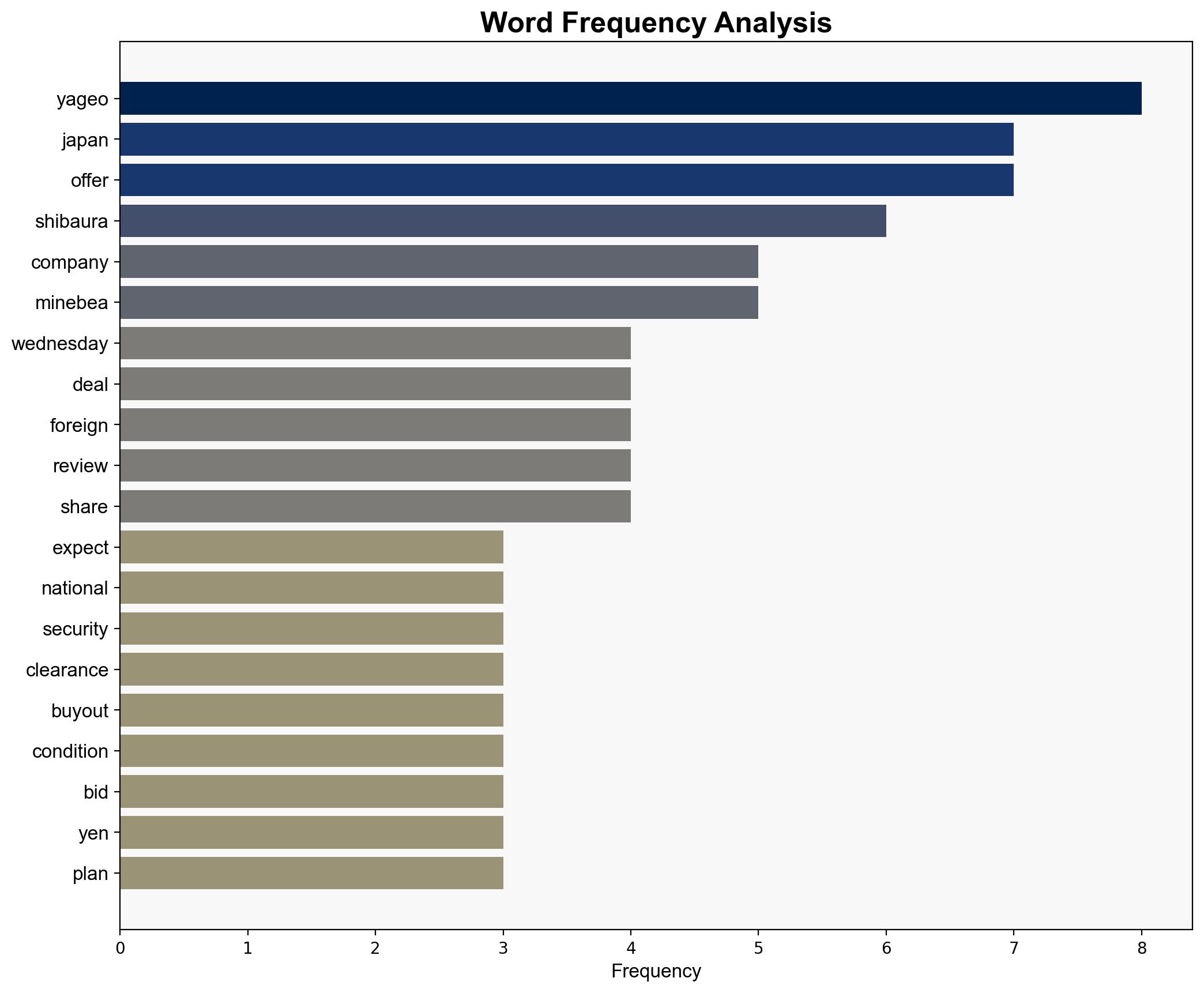

– Yageo Corporation

– Shibaura Electronics

– Minebea Mitsumi

– Japan’s industry ministry

7. Thematic Tags

national security threats, foreign investment, regulatory compliance, Taiwan-Japan relations