Tax Season and the Making of the American Fiscal State – Time

Published on: 2025-04-16

Intelligence Report: Tax Season and the Making of the American Fiscal State – Time

1. BLUF (Bottom Line Up Front)

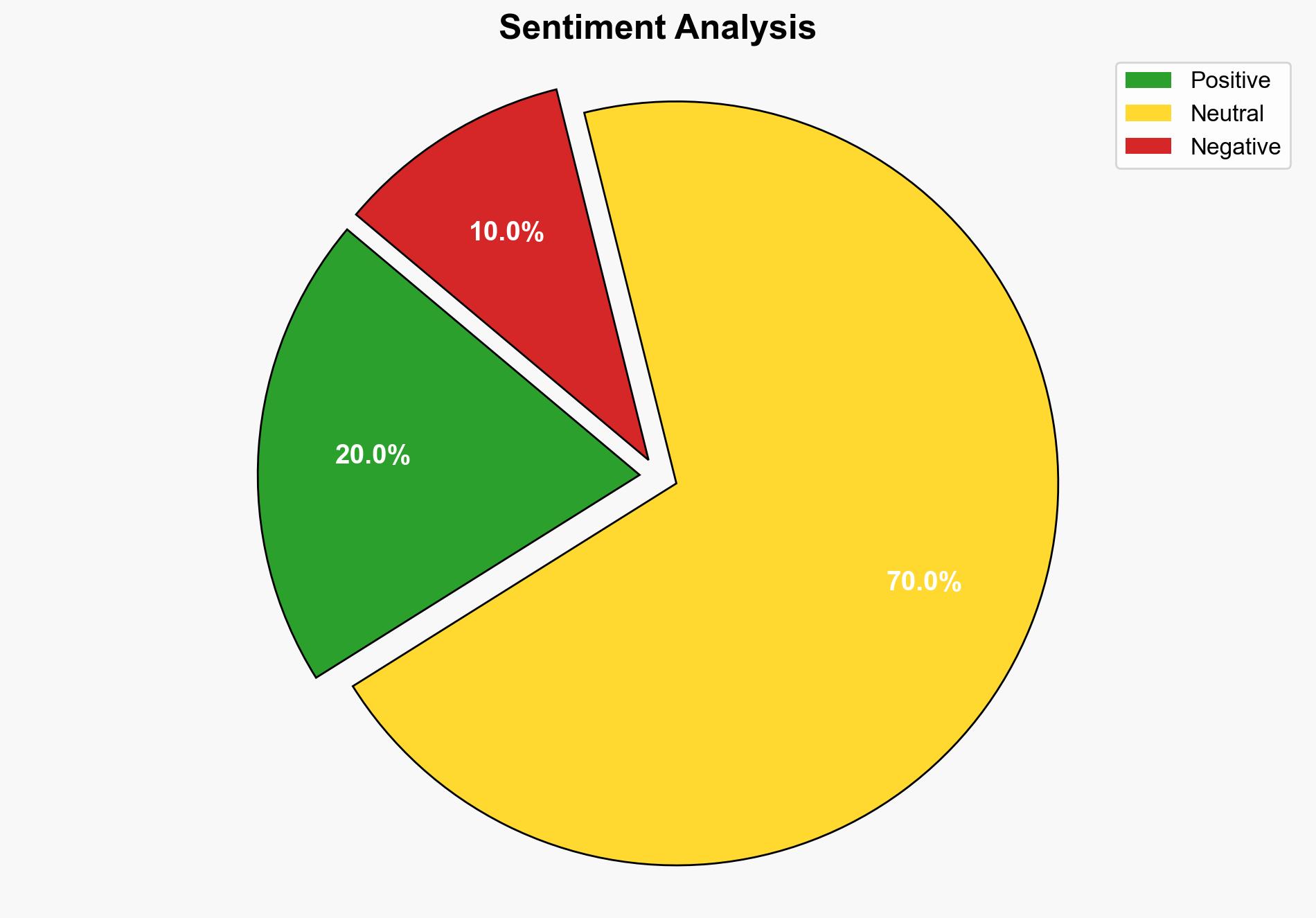

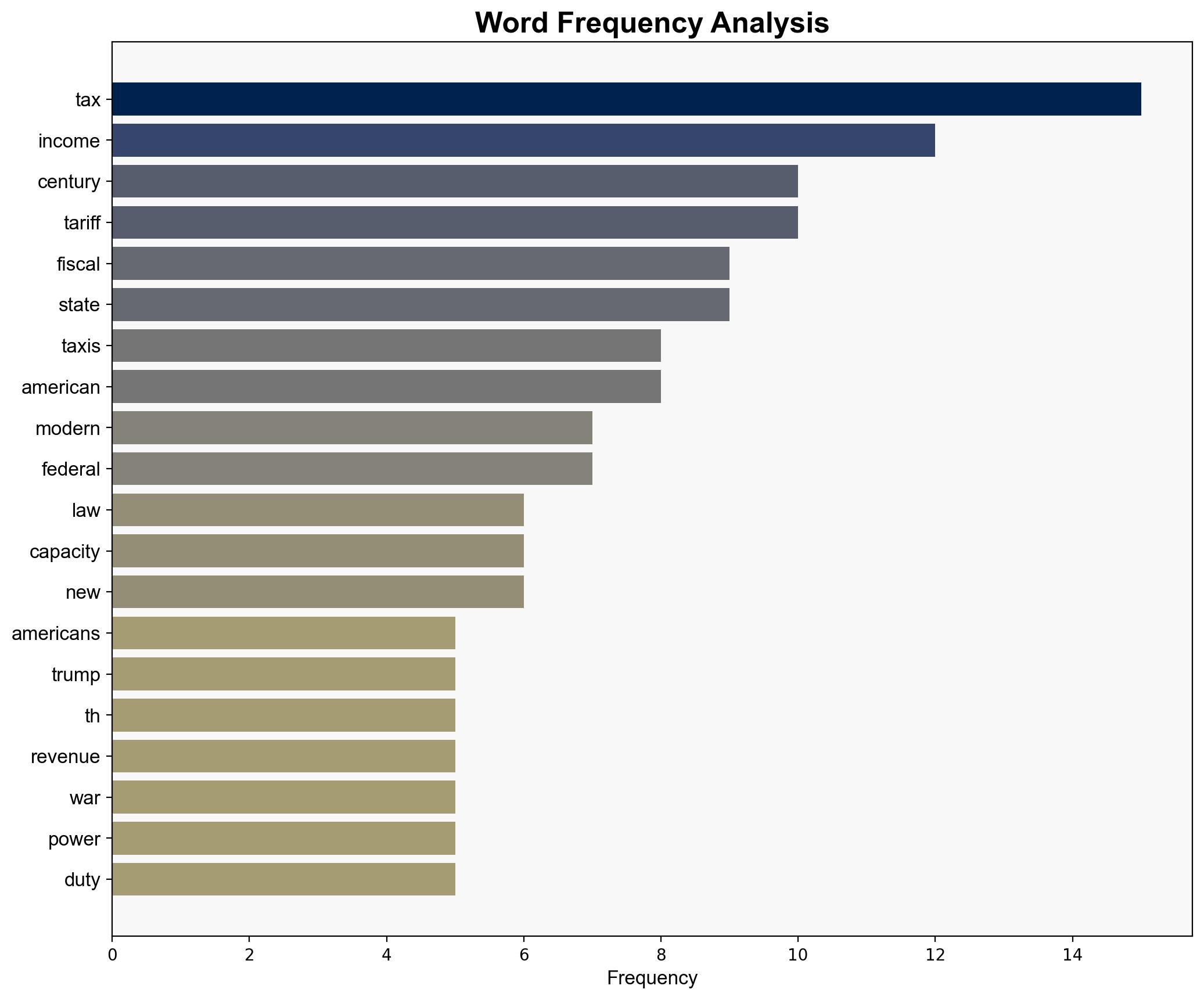

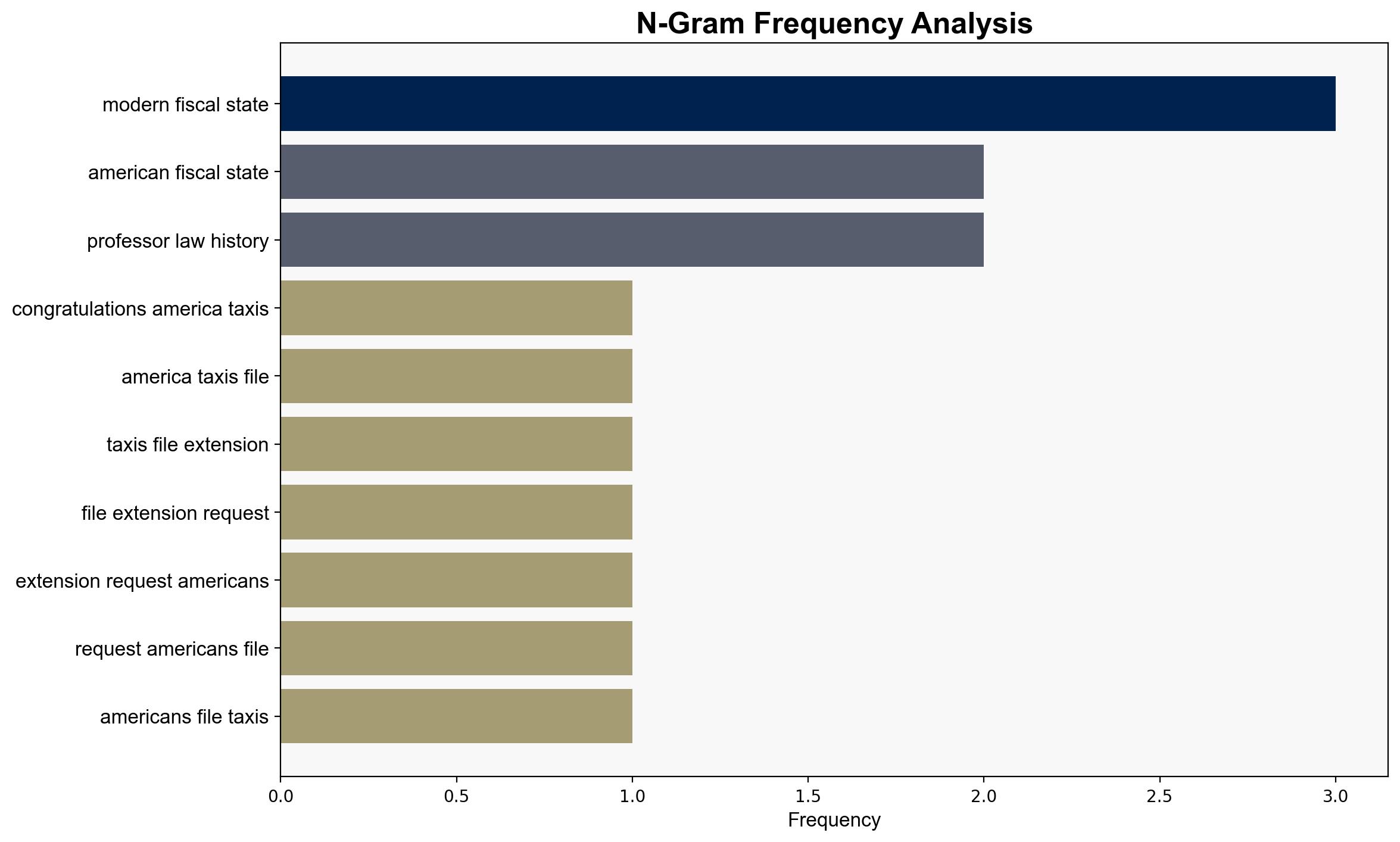

Recent developments in the U.S. fiscal policy landscape indicate a potential shift away from traditional income tax structures towards tariff-based revenue generation. This shift, driven by recent administrative actions, poses significant implications for the stability and functionality of the American fiscal state. Key recommendations include monitoring policy changes, assessing impacts on federal revenue, and preparing for potential economic disruptions.

2. Detailed Analysis

The following structured analytic techniques have been applied:

Scenario Analysis

The current fiscal policy changes could lead to several scenarios:

1) A successful transition to tariff-based revenue, potentially reducing reliance on income taxes but risking trade tensions.

2) A partial implementation causing fiscal instability due to inadequate revenue replacement.

3) Reversal of policy changes due to public or political pushback, maintaining the status quo.

Key Assumptions Check

Assumptions that tariffs can fully replace income tax revenue are challenged by historical data showing tariffs’ limited revenue capacity. Additionally, the assumption that reduced IRS staffing will not impact tax collection efficiency needs reevaluation.

Indicators Development

Indicators to monitor include legislative actions on tax policy, changes in trade relations, public and political response to fiscal changes, and IRS operational capacity. These indicators will help assess the trajectory of fiscal policy changes.

3. Implications and Strategic Risks

The shift towards tariffs could increase economic vulnerability due to potential trade disputes and reduced consumer purchasing power. Politically, these changes may lead to increased polarization and public dissent. Economically, the risk of fiscal shortfalls could impact government services and national security funding.

4. Recommendations and Outlook

- Conduct comprehensive impact assessments of proposed fiscal changes on federal revenue and economic stability.

- Engage in diplomatic efforts to mitigate potential trade tensions arising from increased tariffs.

- Develop contingency plans for potential fiscal shortfalls to ensure continuity of government services.

- Scenario-based projections suggest that maintaining a balance between income tax and tariffs could provide a more stable fiscal environment.

5. Key Individuals and Entities

Key figures include Donald Trump and entities such as the Department of Government Efficiency and the Justice Department’s Tax Division.