The Great Decoupling of Labor and Capital – Mbi-deepdives.com

Published on: 2025-11-03

Intelligence Report: The Great Decoupling of Labor and Capital – Mbi-deepdives.com

1. BLUF (Bottom Line Up Front)

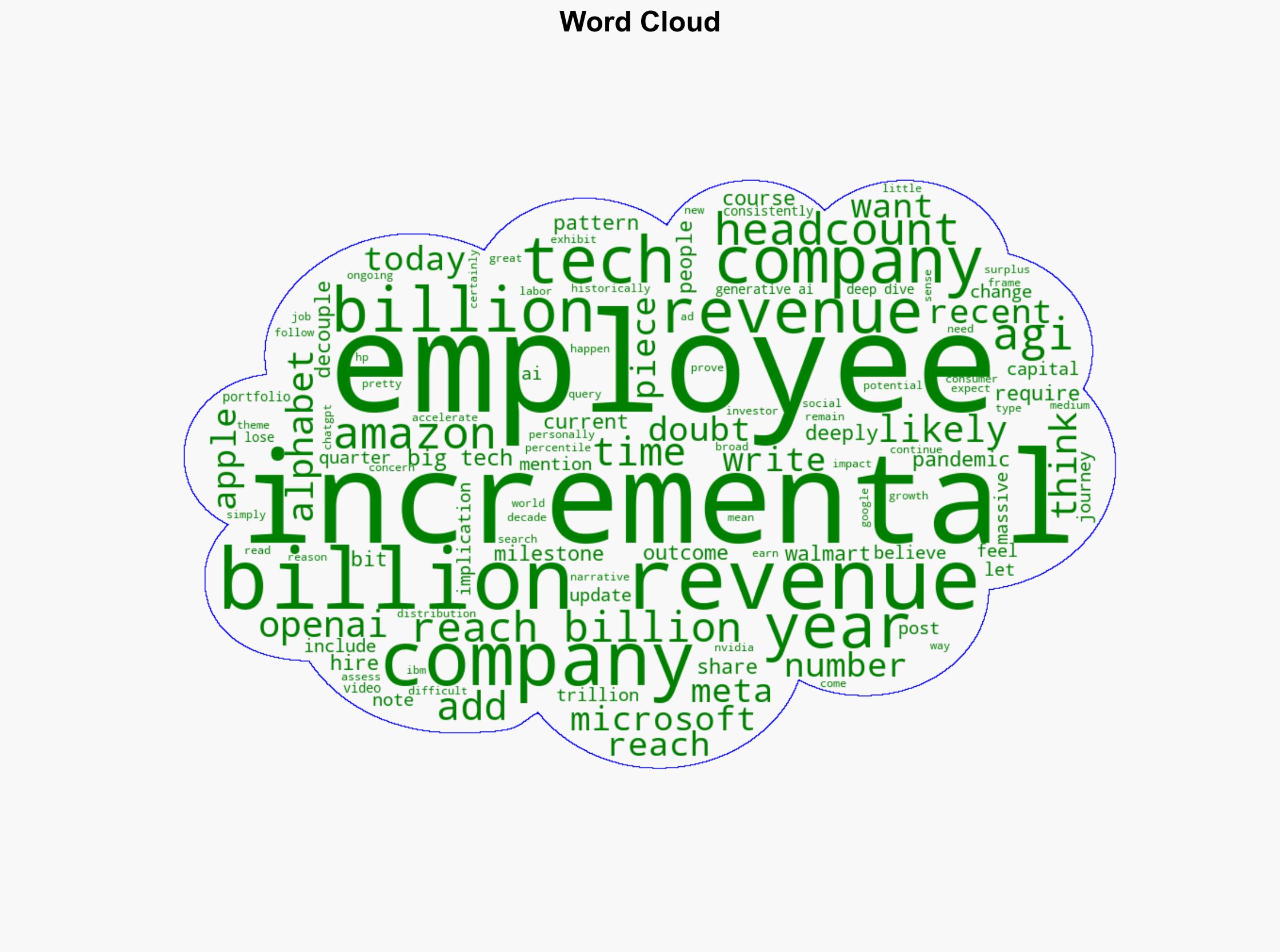

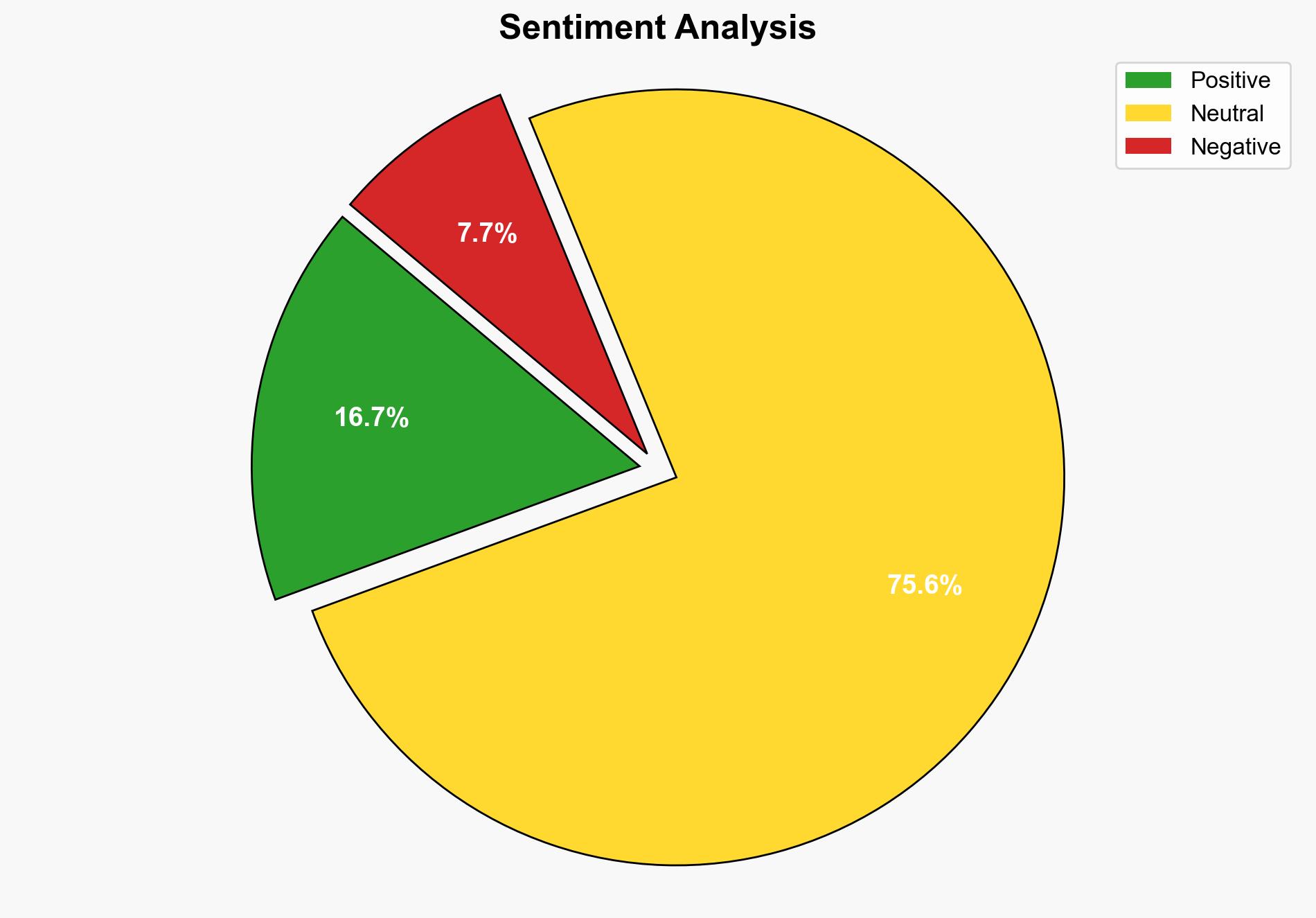

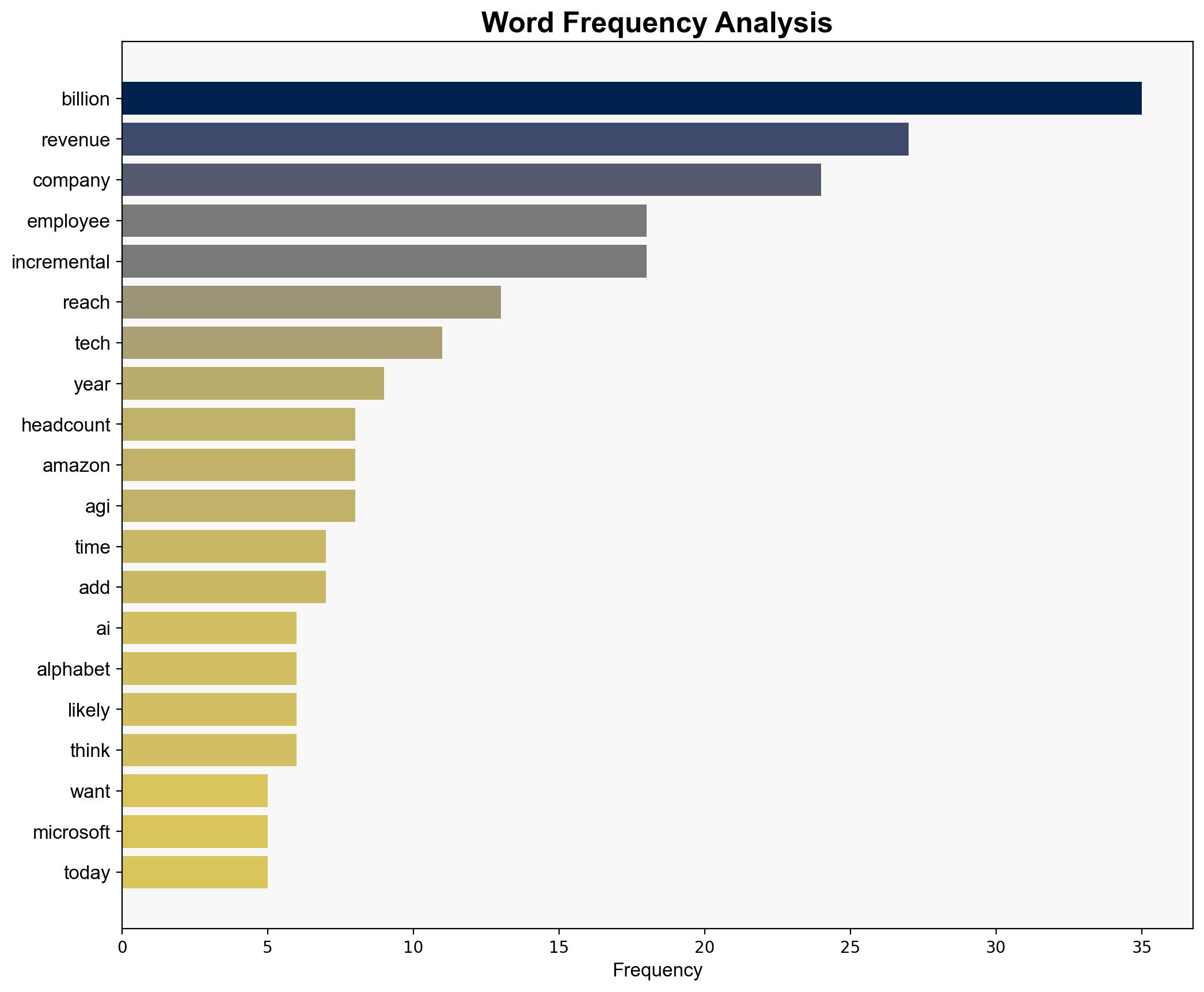

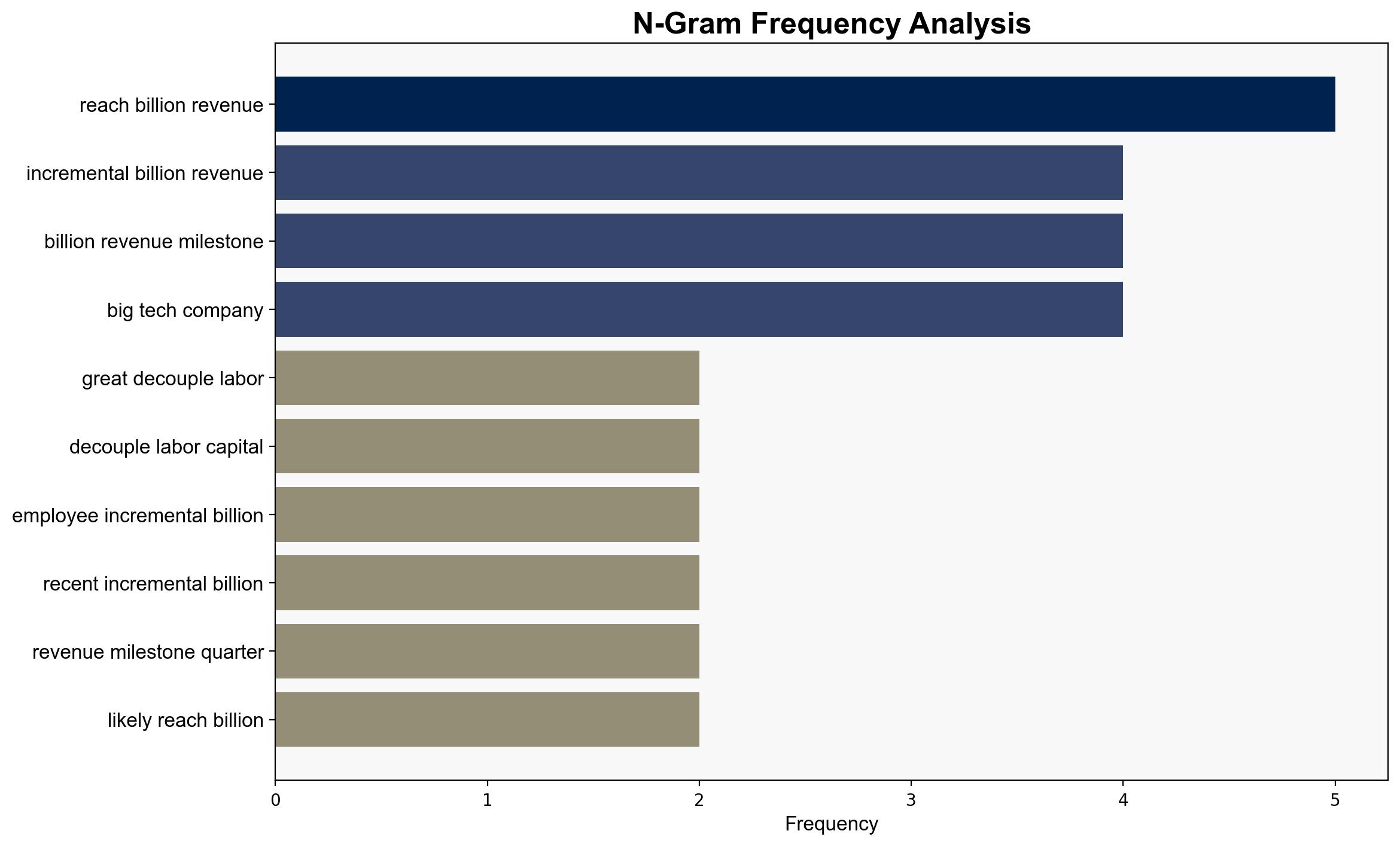

The analysis suggests a significant decoupling of revenue growth from labor growth in major tech companies, driven by technological advancements such as generative AI. The most supported hypothesis is that this trend will continue, leading to increased efficiency and potential workforce reductions. Confidence level: Moderate. Recommended action: Monitor technological advancements and labor market impacts closely to anticipate economic and social shifts.

2. Competing Hypotheses

1. **Hypothesis A**: The decoupling of labor and capital is primarily driven by technological advancements, such as AI, which enhance productivity and reduce the need for additional human capital.

2. **Hypothesis B**: The observed decoupling is a temporary phenomenon influenced by post-pandemic economic adjustments and will stabilize as companies recalibrate their workforce needs.

Using Bayesian Scenario Modeling, Hypothesis A is better supported due to consistent patterns across multiple tech companies and the ongoing integration of AI technologies. Hypothesis B lacks strong evidence as the trend persists beyond immediate post-pandemic adjustments.

3. Key Assumptions and Red Flags

– **Assumptions**: Hypothesis A assumes continuous technological innovation and adoption across industries. Hypothesis B assumes a return to pre-pandemic economic norms.

– **Red Flags**: Potential over-reliance on current data trends without considering long-term economic cycles. Lack of data on smaller companies and non-tech sectors.

– **Blind Spots**: The impact of regulatory changes or societal pushback against automation is not considered.

4. Implications and Strategic Risks

The decoupling trend could lead to significant economic shifts, including increased unemployment in certain sectors and greater income inequality. It may also influence geopolitical dynamics as countries with advanced AI capabilities gain economic advantages. Cybersecurity risks could escalate as reliance on AI systems grows.

5. Recommendations and Outlook

- Monitor AI and automation developments to anticipate labor market changes.

- Encourage policies that support workforce retraining and education in high-demand tech skills.

- Scenario Projections:

- Best: Seamless integration of AI leads to economic growth and new job creation.

- Worst: Rapid job displacement without adequate retraining leads to economic instability.

- Most Likely: Gradual adaptation with mixed economic outcomes.

6. Key Individuals and Entities

– Apple, Alphabet, Microsoft, Meta, Nvidia, Amazon, Walmart

7. Thematic Tags

economic transformation, technological innovation, labor market dynamics, AI integration