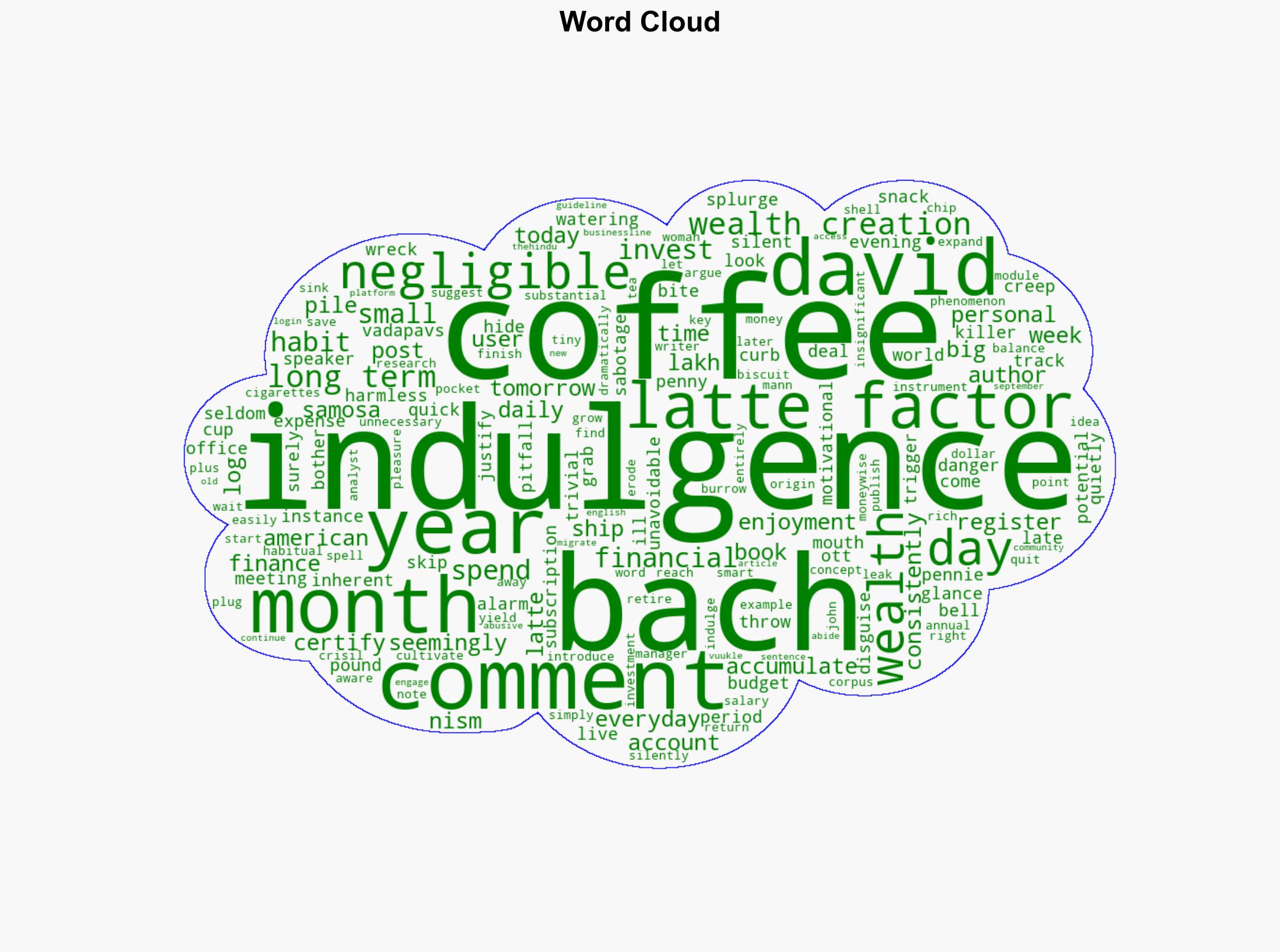

The latte factor wealth killer in disguise – BusinessLine

Published on: 2025-09-29

Intelligence Report: The latte factor wealth killer in disguise – BusinessLine

1. BLUF (Bottom Line Up Front)

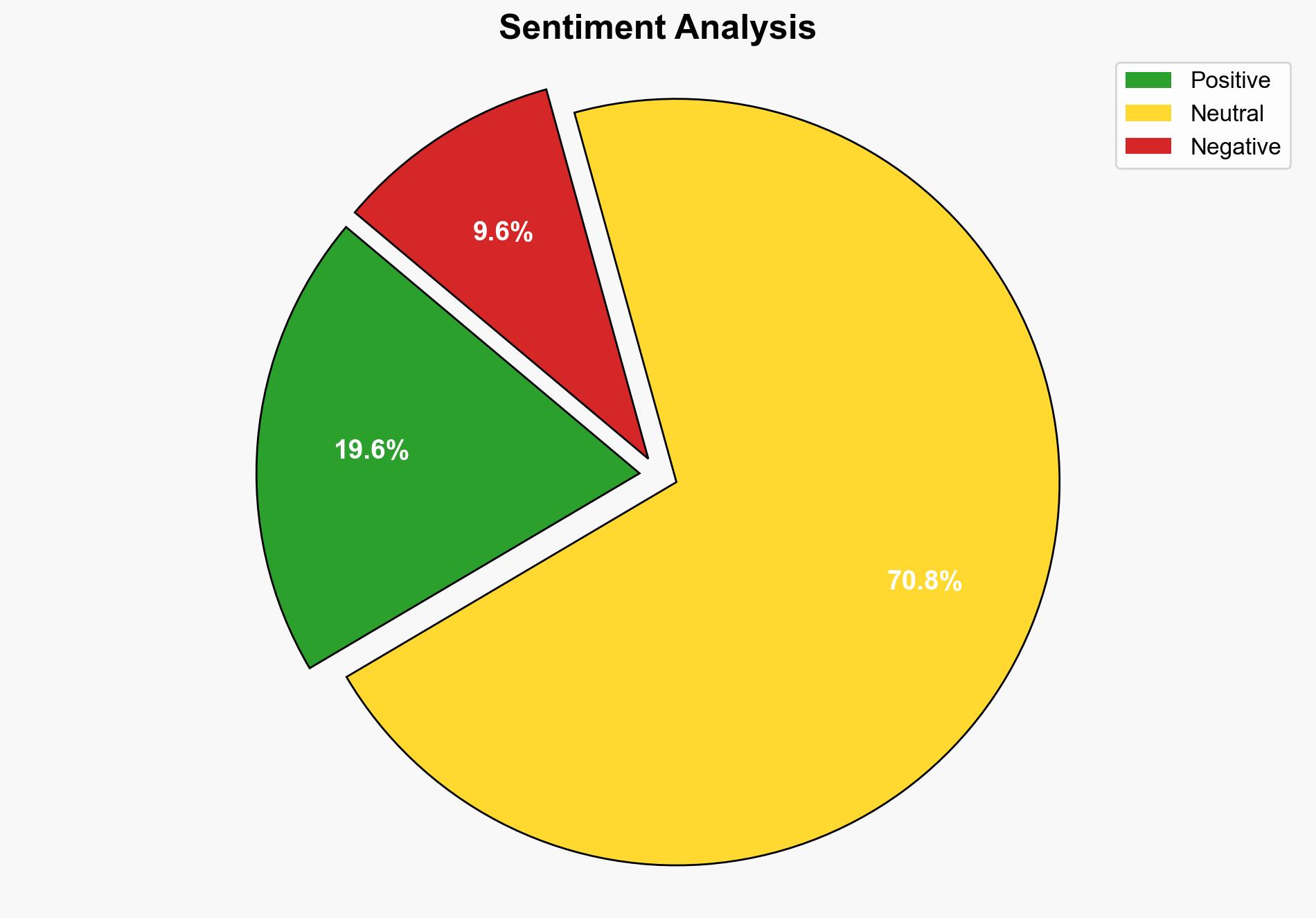

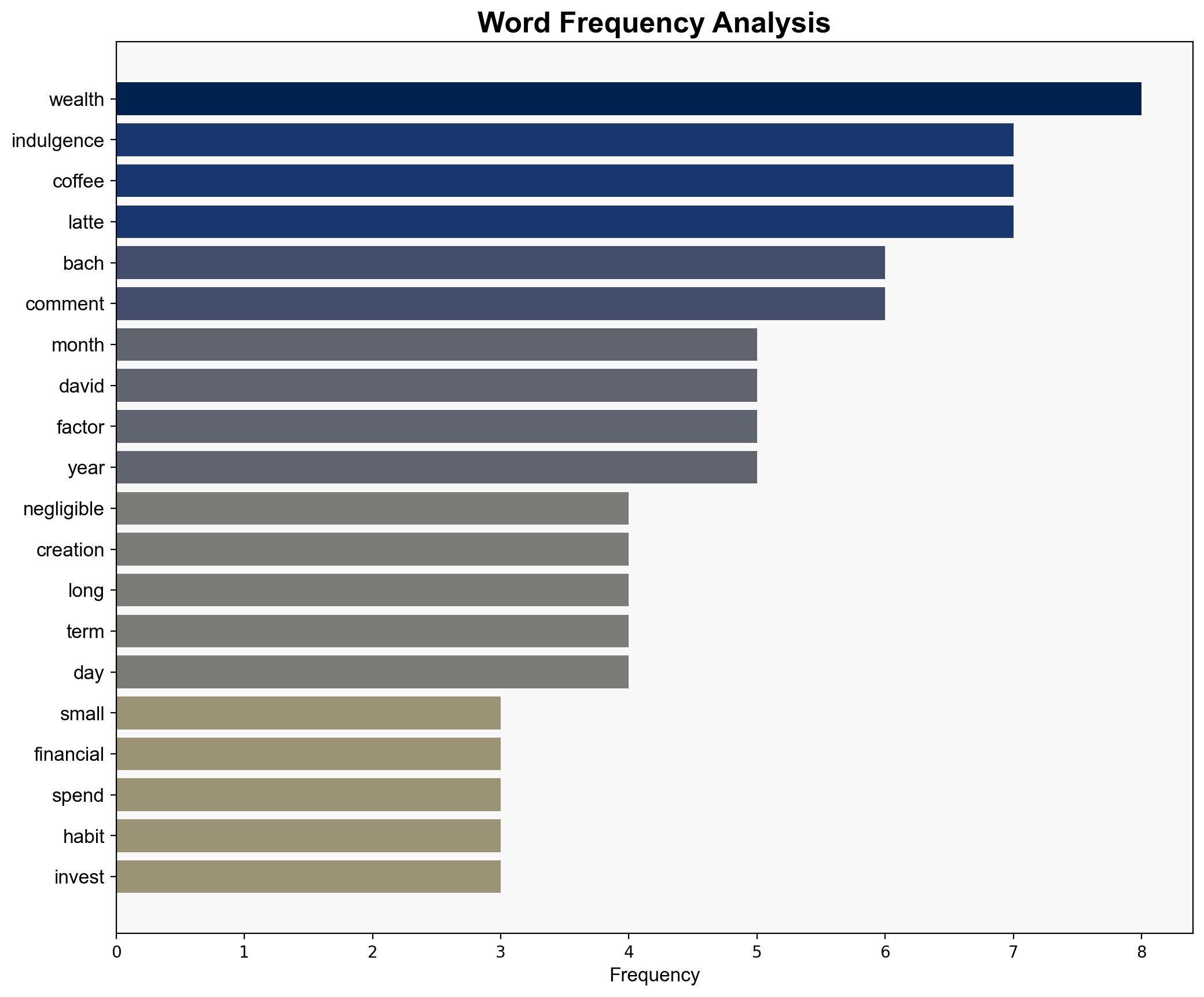

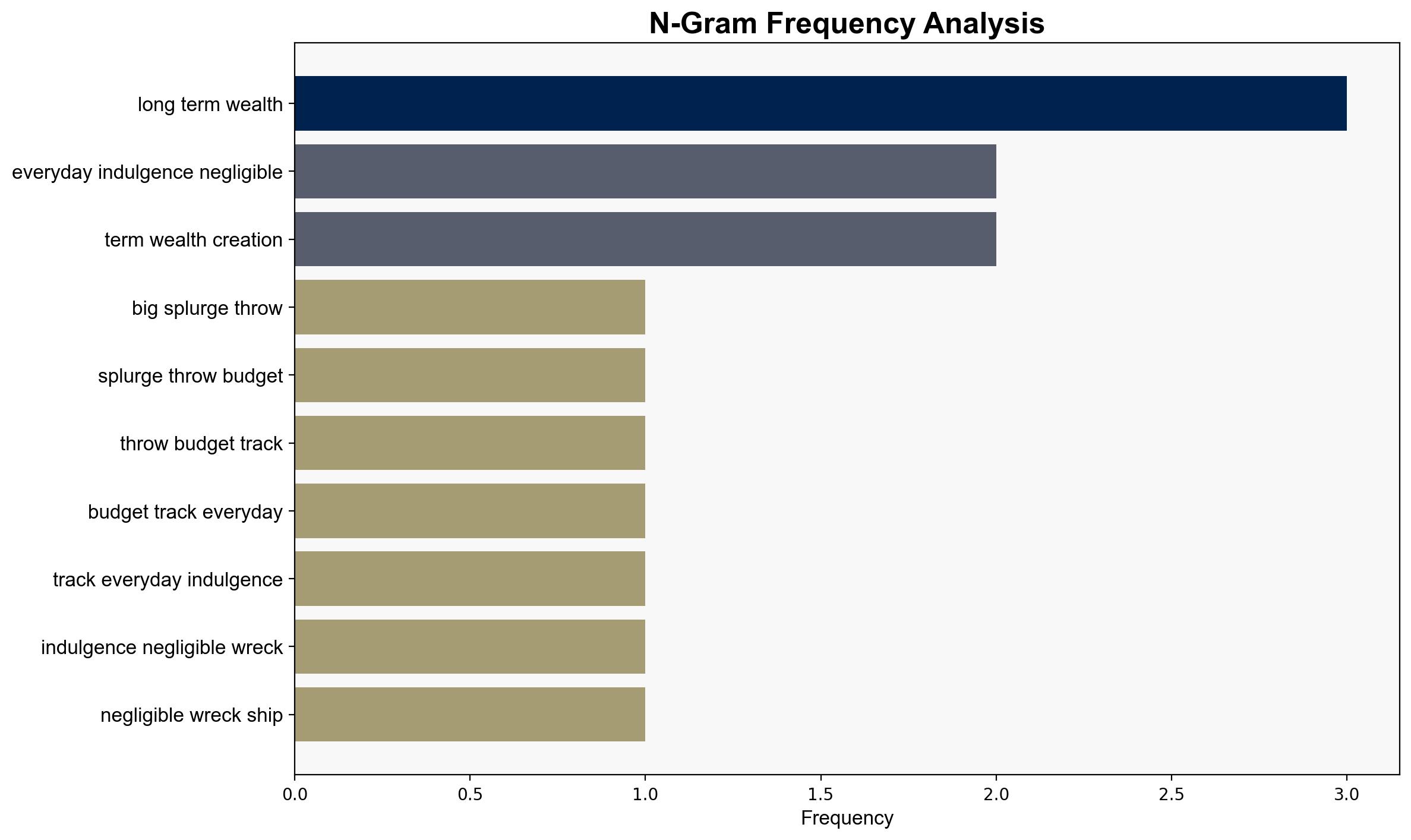

The analysis suggests that the “latte factor,” a concept popularized by David Bach, highlights the potential for small, habitual expenditures to significantly impact long-term wealth accumulation. The most supported hypothesis is that these expenditures, if not managed, can indeed erode financial stability over time. Confidence level: Moderate. Recommended action: Encourage financial literacy programs focusing on the impact of small expenditures and promote balanced financial planning.

2. Competing Hypotheses

1. **Hypothesis A**: The “latte factor” is a significant threat to long-term wealth creation, as small, habitual expenditures accumulate over time, leading to substantial financial erosion.

2. **Hypothesis B**: The impact of the “latte factor” is overstated, as individuals can balance small indulgences with effective financial planning and investment strategies.

Using the Analysis of Competing Hypotheses (ACH) 2.0, Hypothesis A is better supported due to the consistent emphasis on the cumulative effect of small expenses in the source material. Hypothesis B lacks detailed evidence on effective balancing strategies.

3. Key Assumptions and Red Flags

– **Assumptions**: Hypothesis A assumes individuals lack awareness or discipline to manage small expenses. Hypothesis B assumes individuals are financially literate and disciplined.

– **Red Flags**: The source does not provide empirical data on the actual impact of small expenses on wealth accumulation, which could indicate a potential bias or lack of comprehensive analysis.

– **Blind Spots**: The analysis does not consider cultural or socioeconomic factors that might influence spending habits and financial literacy.

4. Implications and Strategic Risks

The “latte factor” concept could lead to increased financial awareness and literacy, potentially reducing personal financial instability. However, if misinterpreted, it might cause unnecessary financial anxiety or guilt over minor expenditures. Economically, widespread adoption of this mindset could influence consumer spending patterns, potentially impacting sectors reliant on small, frequent purchases.

5. Recommendations and Outlook

- Develop and promote financial literacy programs that emphasize the importance of understanding and managing small expenditures.

- Encourage financial institutions to offer tools and resources for tracking and managing daily expenses.

- Scenario Projections:

- Best Case: Increased financial literacy leads to improved personal savings rates and economic stability.

- Worst Case: Misinterpretation of the concept leads to reduced consumer spending, negatively impacting certain economic sectors.

- Most Likely: Gradual increase in financial awareness with moderate impact on spending habits.

6. Key Individuals and Entities

– David Bach: Introduced the “latte factor” concept.

– John David Mann: Co-author with David Bach on related financial literature.

7. Thematic Tags

financial literacy, personal finance, consumer behavior, economic impact