The price of genocide How US Funding sustains an unraveling Israeli Economy – Juancole.com

Published on: 2025-08-30

Intelligence Report: The Price of Genocide – How US Funding Sustains an Unraveling Israeli Economy

1. BLUF (Bottom Line Up Front)

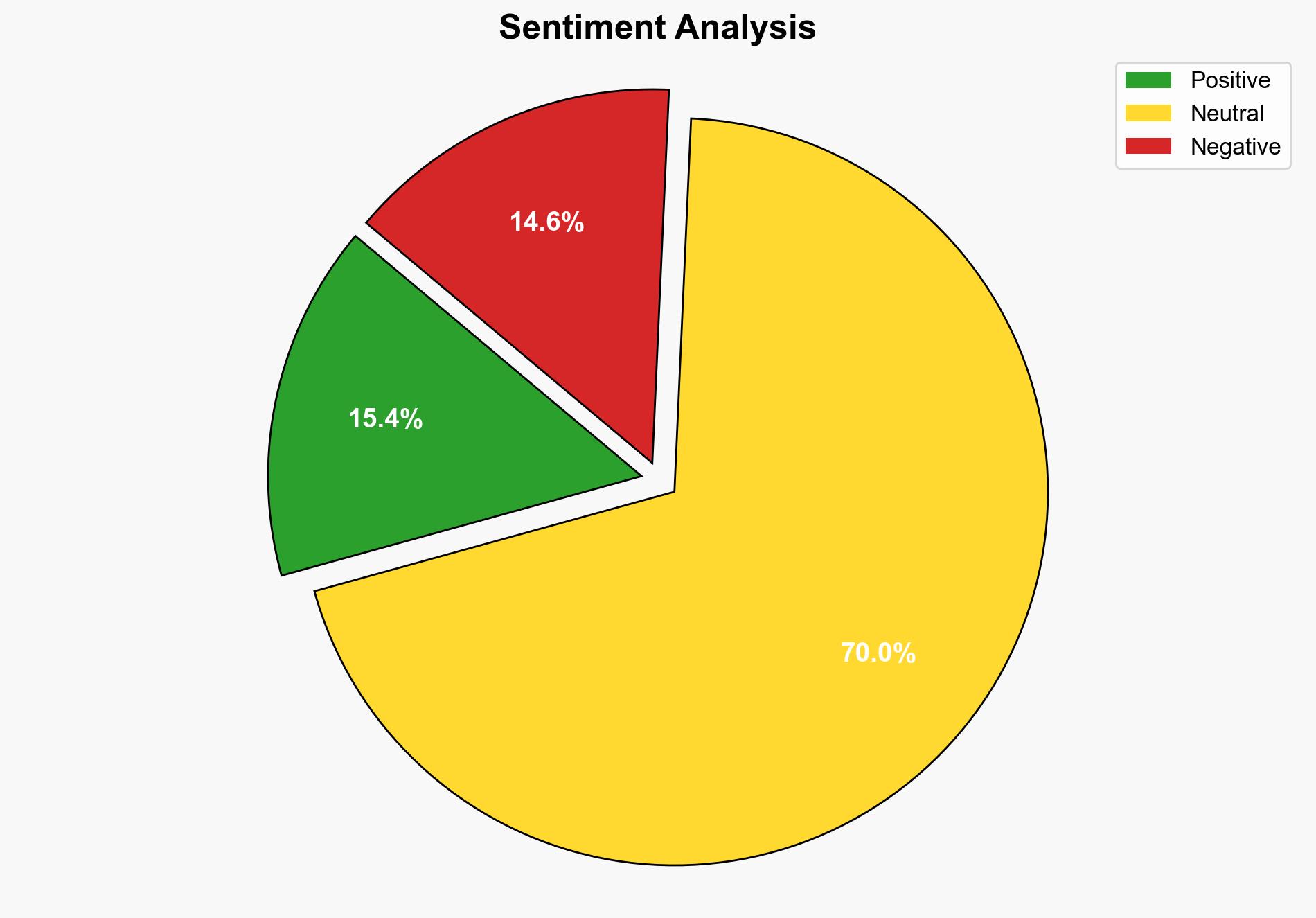

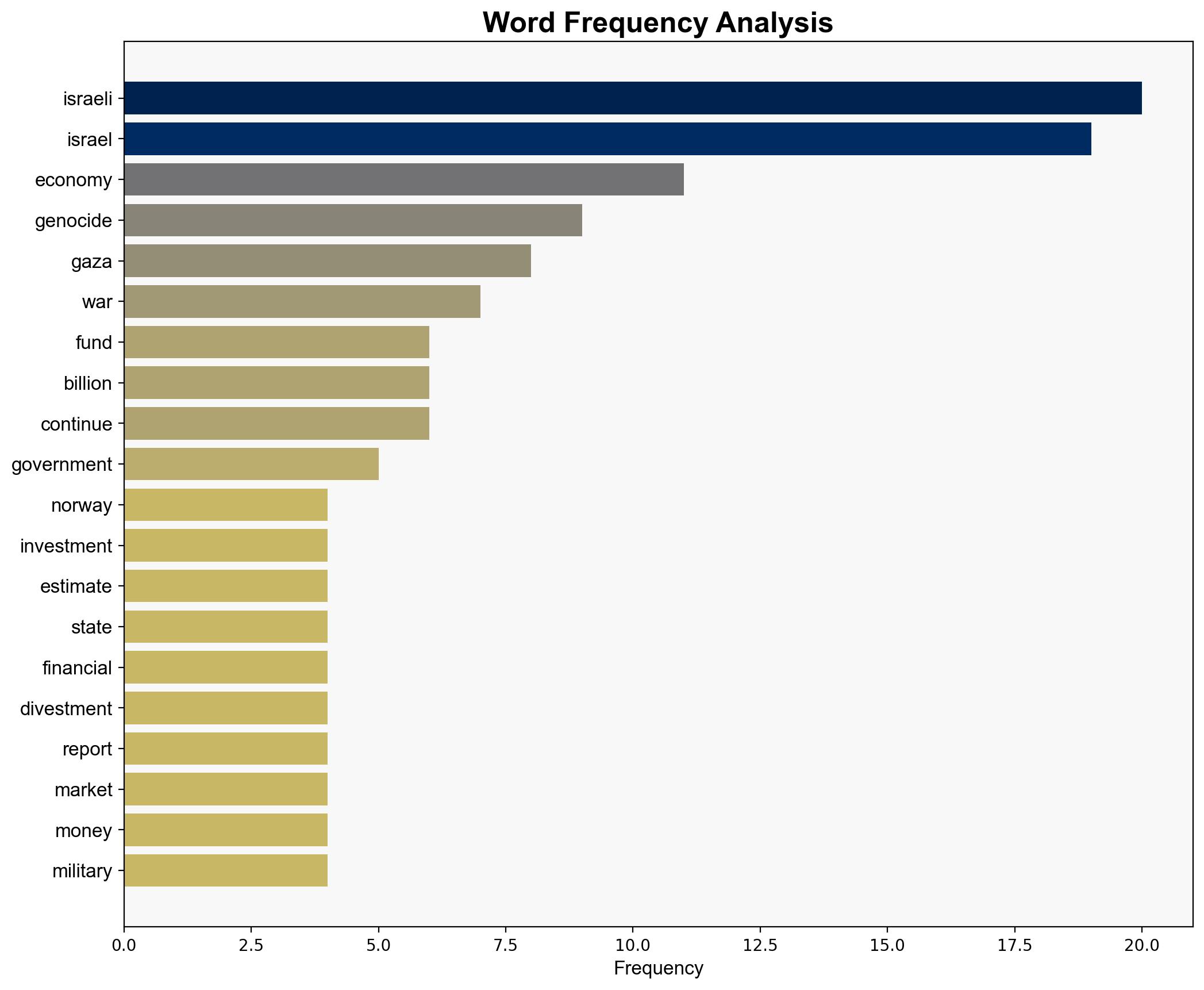

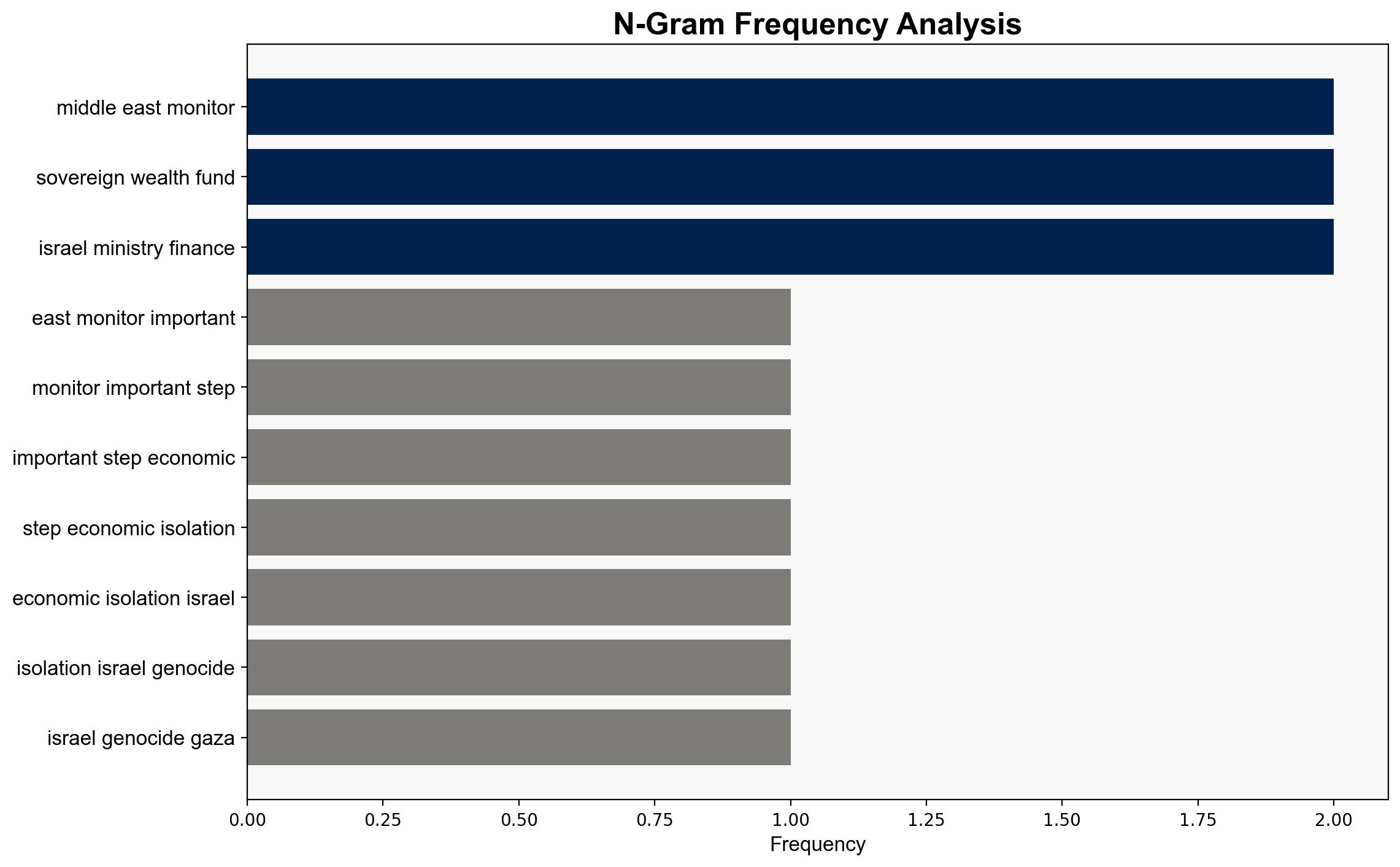

The Israeli economy is under significant strain due to geopolitical tensions and internal political instability. Two competing hypotheses are considered: (1) US financial aid is temporarily stabilizing the Israeli economy, preventing immediate collapse, and (2) the aid is insufficient to counteract long-term economic decline due to sustained geopolitical and internal pressures. The first hypothesis is better supported by current data. Confidence level: Moderate. Recommended action: Monitor US-Israel financial interactions and international divestment trends to anticipate shifts in economic stability.

2. Competing Hypotheses

1. **Hypothesis 1**: US financial aid is effectively stabilizing the Israeli economy in the short term, preventing immediate economic collapse despite geopolitical tensions and divestment actions by other countries.

– **Supporting Evidence**: Significant US financial aid, including military assistance and loan guarantees, provides a buffer against economic contraction. The influx of funds helps maintain investor confidence and supports essential economic sectors.

2. **Hypothesis 2**: US financial aid is insufficient to counteract the long-term economic decline caused by geopolitical tensions, international divestment, and internal political instability.

– **Supporting Evidence**: Reports of falling foreign direct investment, economic contraction, and ongoing divestment by countries like Norway indicate structural weaknesses that US aid cannot fully address.

3. Key Assumptions and Red Flags

– **Assumptions**:

– Hypothesis 1 assumes that US aid will continue at current or increased levels.

– Hypothesis 2 assumes that geopolitical tensions and divestment will persist or escalate.

– **Red Flags**:

– Potential over-reliance on US aid as a stabilizing factor.

– Lack of detailed data on the impact of divestment on specific economic sectors.

– Possible underestimation of internal political instability’s impact on economic performance.

4. Implications and Strategic Risks

– **Economic Risks**: Continued divestment and reduced foreign investment could lead to a deeper economic crisis, affecting regional stability.

– **Geopolitical Risks**: Increased international criticism and legal actions could isolate Israel diplomatically, impacting trade and alliances.

– **Internal Risks**: Political instability may exacerbate economic challenges, leading to potential civil unrest.

5. Recommendations and Outlook

- Monitor US-Israel financial agreements and international divestment trends to assess economic stability.

- Engage in diplomatic efforts to address international concerns and reduce geopolitical tensions.

- Scenario Projections:

– **Best Case**: Stabilization through increased foreign investment and diplomatic resolutions.

– **Worst Case**: Economic collapse due to sustained divestment and geopolitical isolation.

– **Most Likely**: Continued reliance on US aid with moderate economic decline.

6. Key Individuals and Entities

– Benjamin Netanyahu

– Norwegian Government Pension Fund

– Israeli Ministry of Finance

– Bank of Israel

7. Thematic Tags

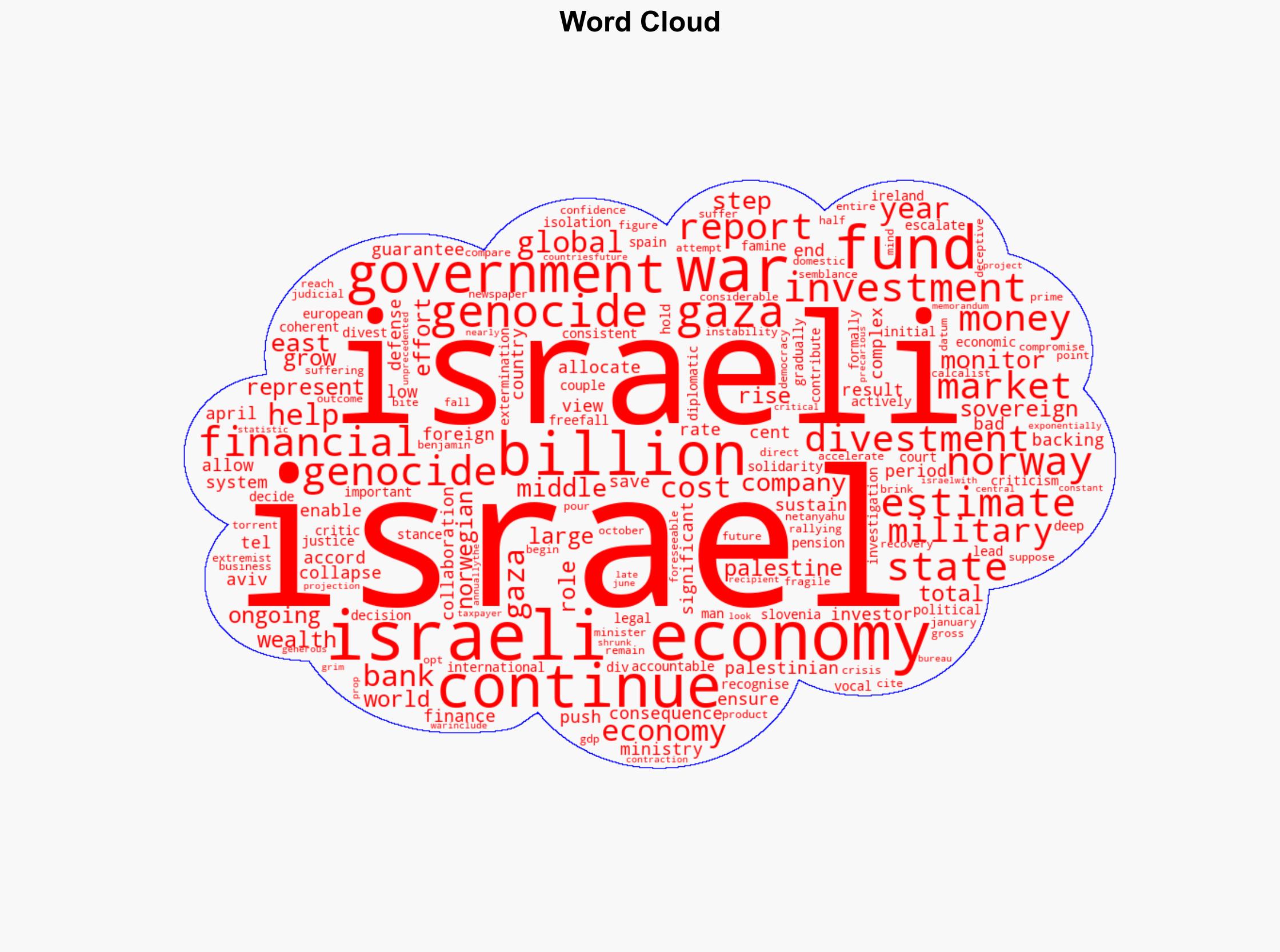

national security threats, economic instability, geopolitical tensions, international divestment