The Three Factors This Wall Street Expert Says Will Keep the Bull Market Running Into 2026 – Investopedia

Published on: 2025-11-16

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report:

1. BLUF (Bottom Line Up Front)

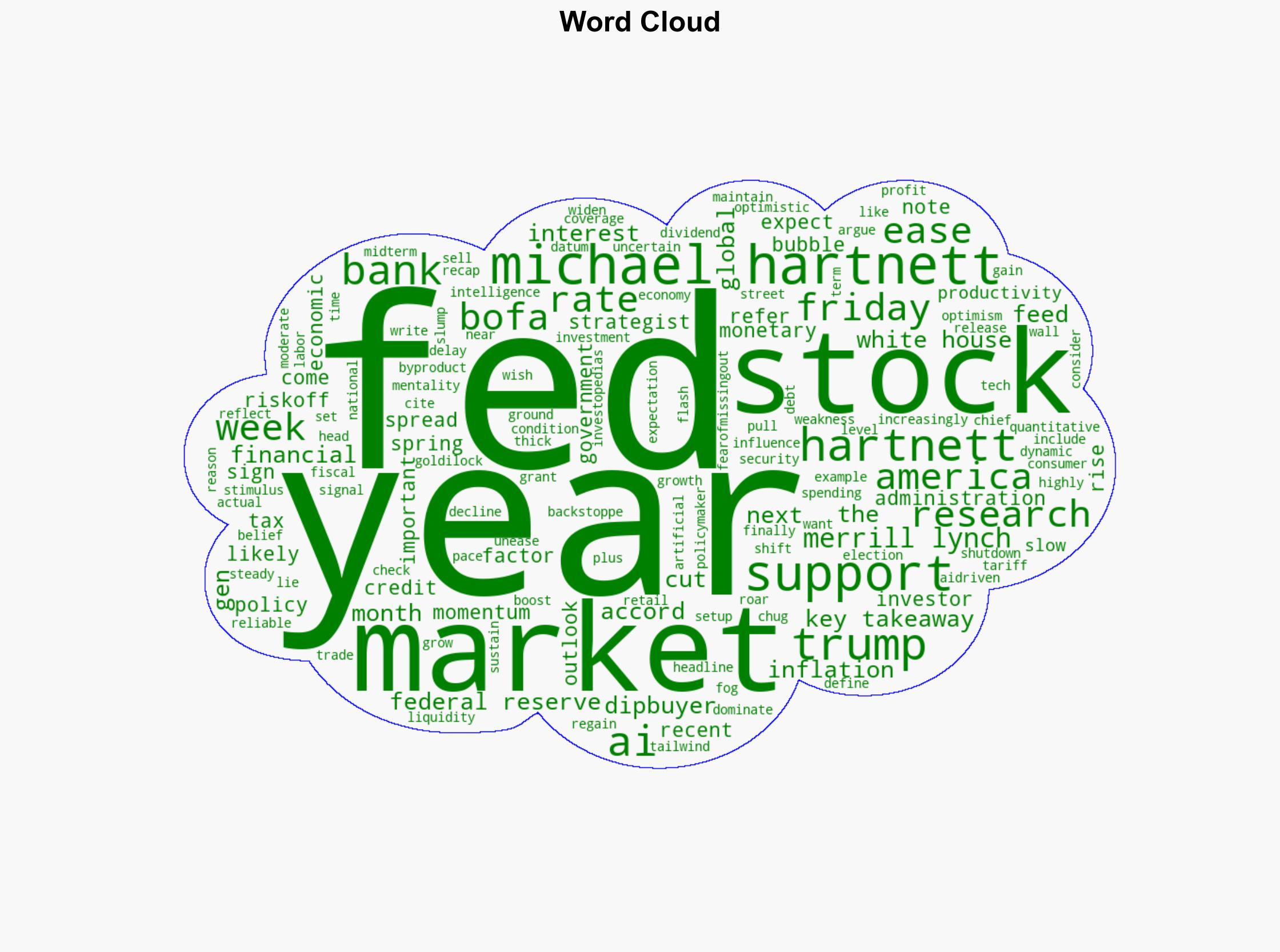

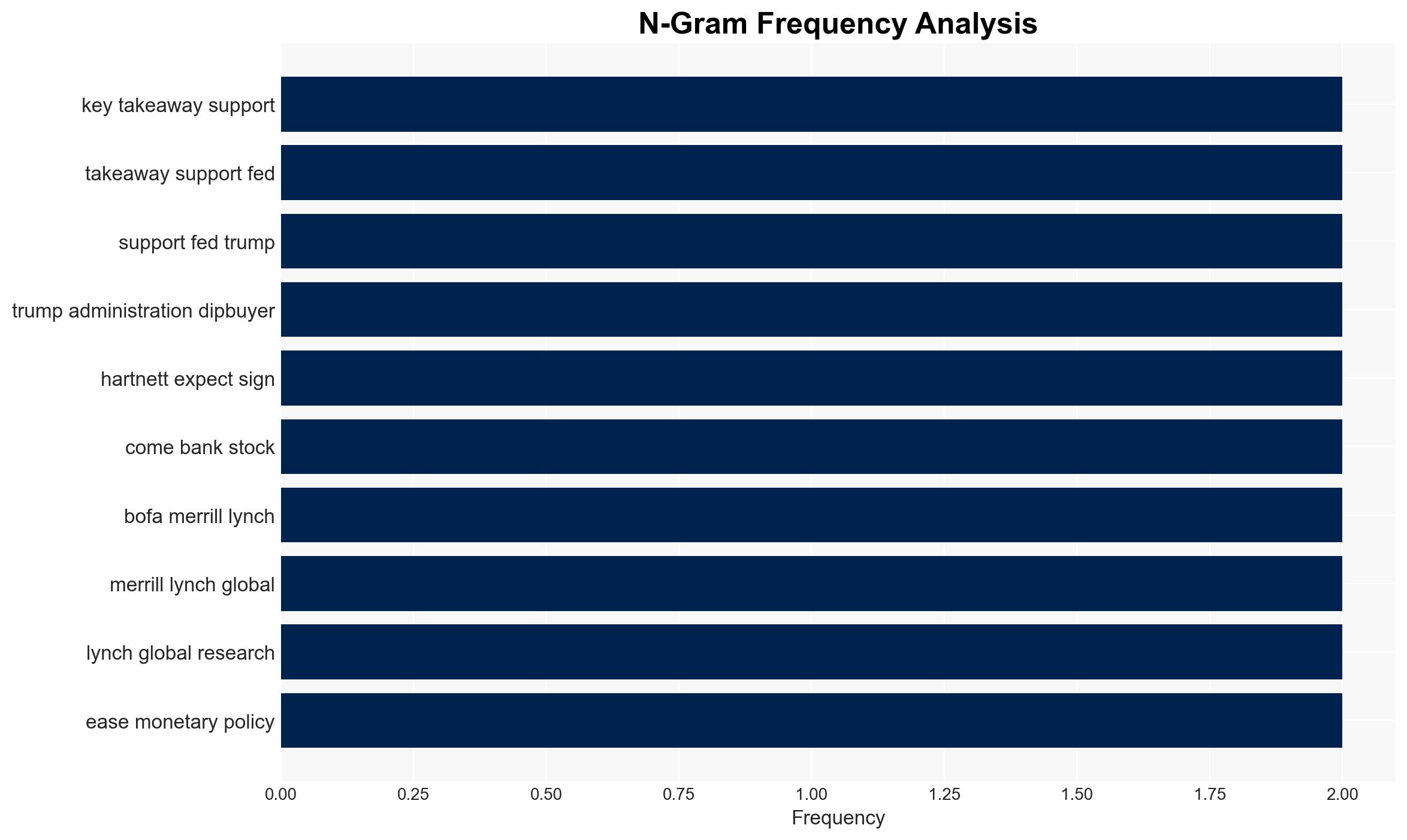

The most supported hypothesis is that the bull market will continue into 2026, driven by supportive fiscal and monetary policies, AI-driven productivity gains, and consumer spending. However, this is contingent upon the absence of significant economic disruptions or policy shifts. Confidence Level: Moderate.

2. Competing Hypotheses

Hypothesis 1: The bull market will continue into 2026, supported by fiscal stimulus, Federal Reserve policies, and AI-driven productivity gains. This hypothesis is supported by the current economic policies and market dynamics.

Hypothesis 2: The bull market will face significant disruptions before 2026 due to potential economic shocks, policy changes, or geopolitical tensions. This hypothesis considers the inherent volatility and unpredictability of global markets.

Hypothesis 1 is more likely given the current trajectory of fiscal and monetary policies, but Hypothesis 2 cannot be discounted due to the unpredictable nature of external shocks and policy shifts.

3. Key Assumptions and Red Flags

Assumptions: The analysis assumes continued fiscal and monetary support, stable geopolitical conditions, and no significant economic shocks.

Red Flags: Potential red flags include rising debt levels, geopolitical tensions, and unexpected shifts in Federal Reserve policy. These could indicate vulnerabilities in the current market outlook.

4. Implications and Strategic Risks

Potential risks include a sharp increase in interest rates, geopolitical conflicts, or a significant economic downturn, which could lead to a rapid market correction. Additionally, over-reliance on AI-driven productivity gains may lead to overvaluation and subsequent market instability.

5. Recommendations and Outlook

- Mitigation: Diversify investments to hedge against potential market corrections. Monitor geopolitical developments and Federal Reserve policy announcements closely.

- Exploitation: Capitalize on sectors benefiting from fiscal stimulus and AI advancements.

- Best Scenario: Continued market growth with stable economic conditions and policy support.

- Worst Scenario: A significant market downturn triggered by economic shocks or policy missteps.

- Most-likely Scenario: Moderate market growth with periodic volatility, contingent on policy stability and economic conditions.

6. Key Individuals and Entities

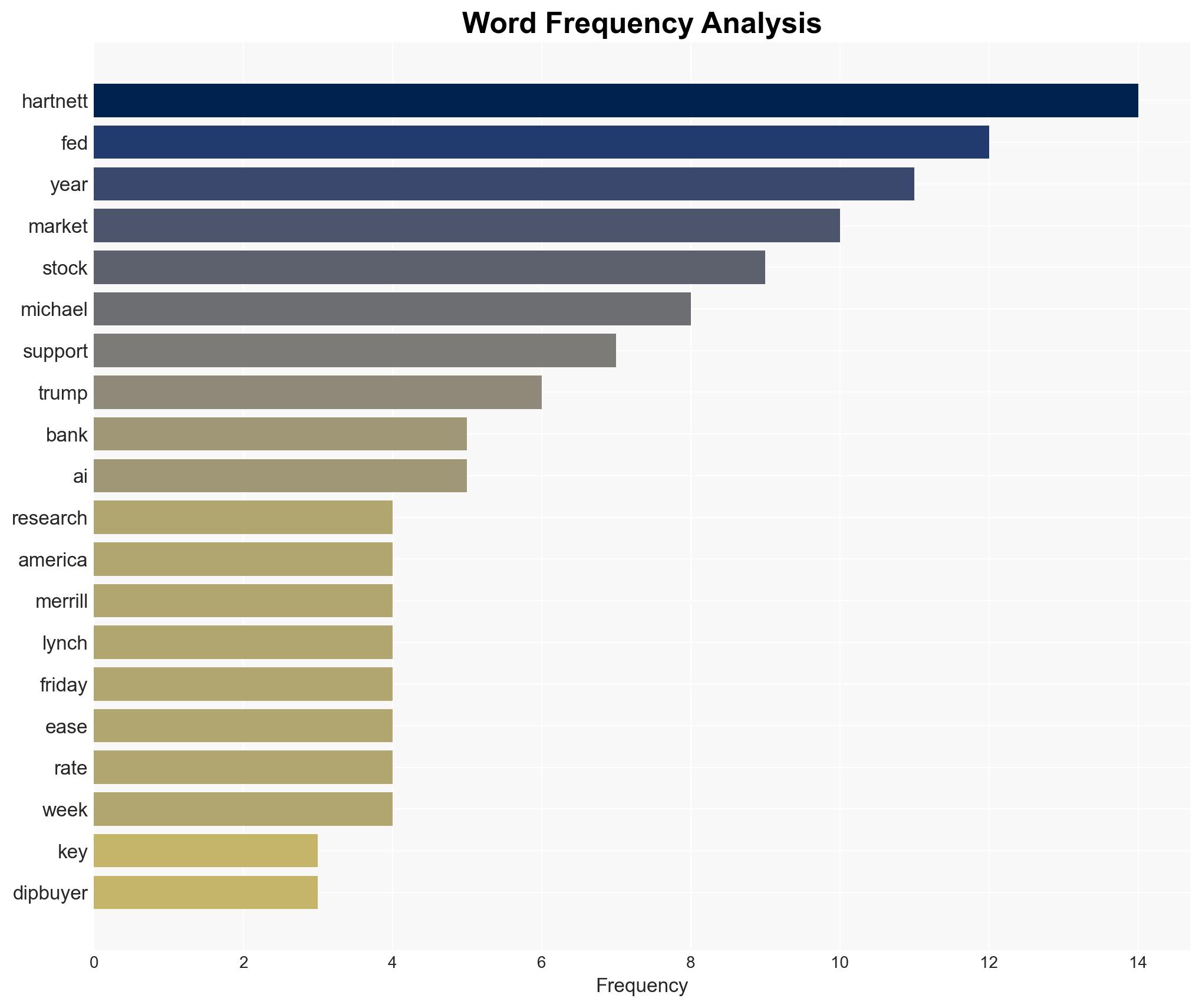

Michael Hartnett – Chief Investment Strategist, BofA Merrill Lynch Global Research

7. Thematic Tags

National Security Threats, Economic Stability, Market Volatility, Fiscal Policy, AI-driven Productivity

Structured Analytic Techniques Applied

- Cognitive Bias Stress Test: Expose and correct potential biases in assessments through red-teaming and structured challenge.

- Bayesian Scenario Modeling: Use probabilistic forecasting for conflict trajectories or escalation likelihood.

- Network Influence Mapping: Map relationships between state and non-state actors for impact estimation.

- Narrative Pattern Analysis: Deconstruct and track propaganda or influence narratives.

Explore more:

National Security Threats Briefs ·

Daily Summary ·

Support us

·