Their money was stolen and gambled away Betting companies won’t give it back – ABC News (AU)

Published on: 2025-10-04

Intelligence Report: Their money was stolen and gambled away Betting companies won’t give it back – ABC News (AU)

1. BLUF (Bottom Line Up Front)

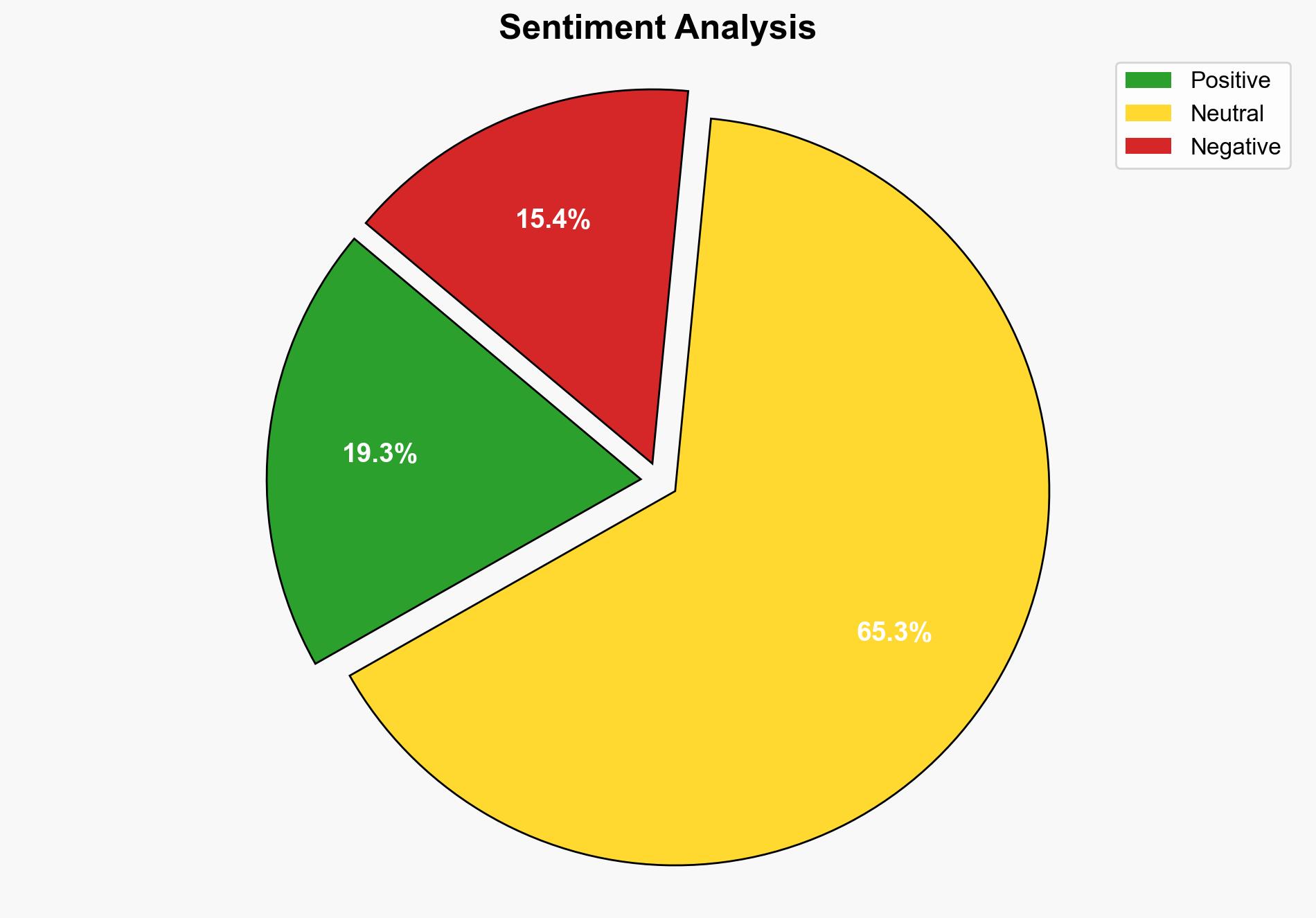

The most supported hypothesis is that betting companies, while operating within legal frameworks, exploit regulatory gaps that allow them to profit from criminal activities without accountability. Confidence level: Moderate. Recommended action: Advocate for regulatory reforms to close legal loopholes and enhance oversight of betting companies.

2. Competing Hypotheses

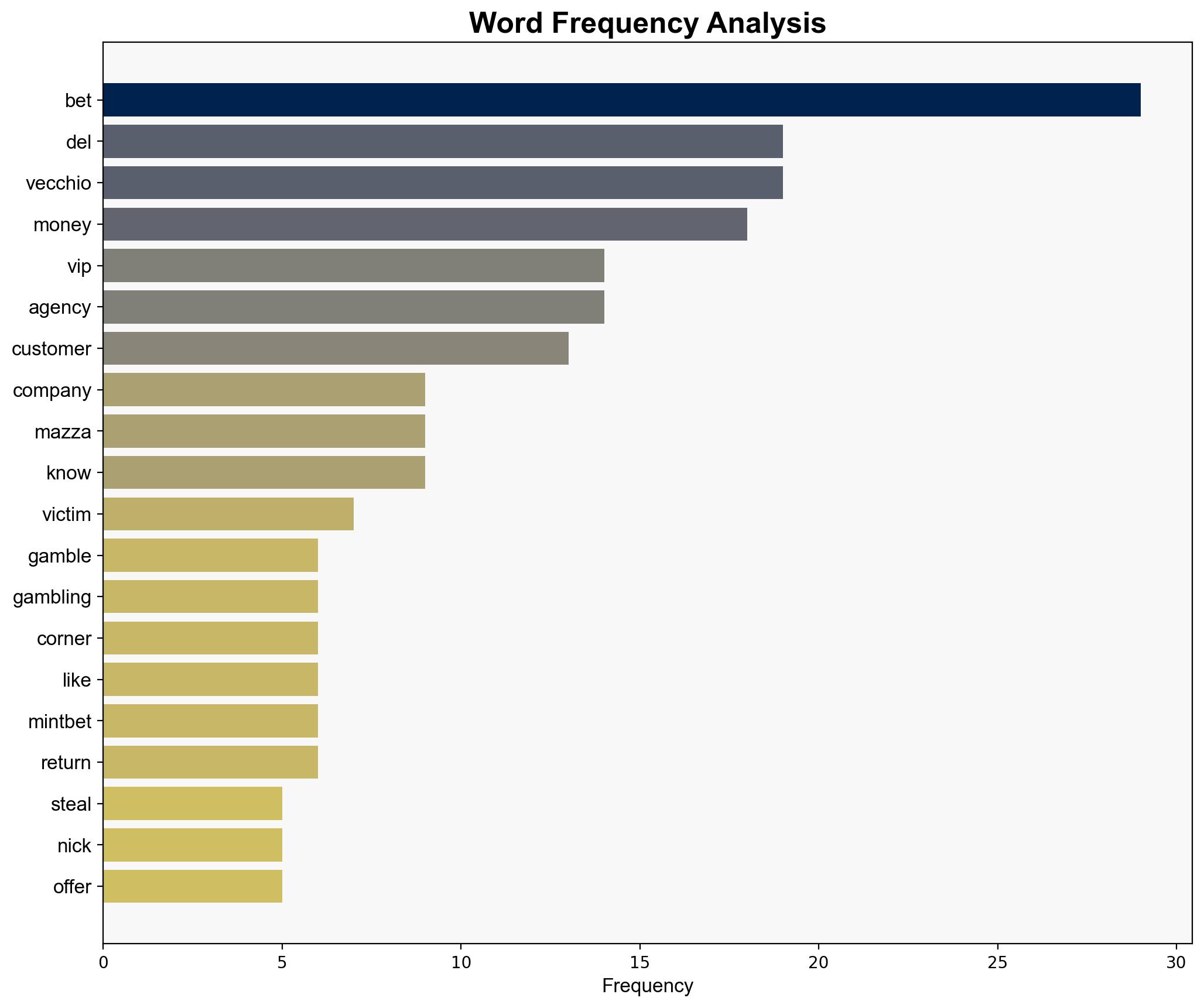

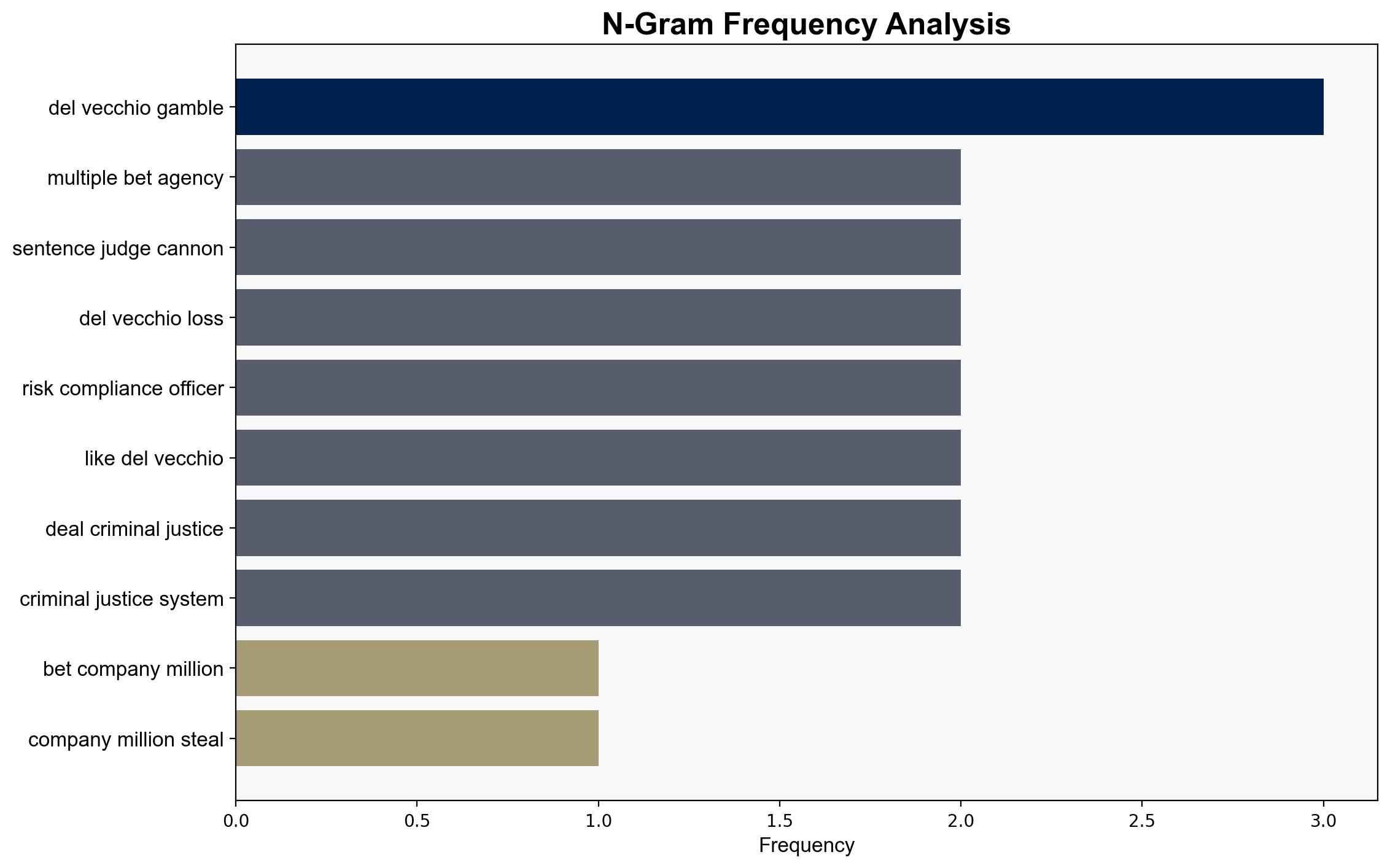

1. **Hypothesis A**: Betting companies are complicit in facilitating and profiting from criminal activities due to inadequate regulatory oversight and internal compliance failures.

2. **Hypothesis B**: Betting companies operate within the legal boundaries, and the responsibility for the misappropriation of funds lies solely with the individual (Anthony Del Vecchio) who exploited these systems for personal gain.

Using the Analysis of Competing Hypotheses (ACH), Hypothesis A is better supported due to evidence of systemic issues in compliance and risk management within betting companies, as indicated by the lack of due diligence on high-risk customers like Del Vecchio.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that betting companies have the capacity and obligation to identify and report suspicious activities. Another assumption is that current regulations are insufficient to prevent such exploitation.

– **Red Flags**: The reluctance of Mintbet’s director to address inquiries and the absence of a clear regulatory response indicate potential systemic issues.

– **Blind Spots**: The extent of regulatory oversight and the effectiveness of current compliance measures are not fully detailed.

4. Implications and Strategic Risks

– **Economic**: Continued exploitation of regulatory gaps could undermine public trust in financial systems and lead to economic losses for individuals.

– **Cyber**: Increased digital transactions in betting could be vulnerable to cyber exploitation.

– **Geopolitical**: International scrutiny may arise if similar cases are identified globally, affecting Australia’s regulatory reputation.

– **Psychological**: Public perception of the betting industry could deteriorate, leading to increased calls for reform.

5. Recommendations and Outlook

- **Regulatory Reform**: Push for comprehensive regulatory reforms to enhance oversight and accountability of betting companies.

- **Compliance Enhancement**: Encourage betting companies to improve internal compliance measures and risk assessment protocols.

- **Public Awareness**: Increase public awareness about the risks associated with betting and the importance of regulatory oversight.

- **Scenario Projections**:

– **Best Case**: Regulatory reforms are implemented, reducing exploitation and increasing public trust.

– **Worst Case**: Continued exploitation leads to significant financial losses and reputational damage.

– **Most Likely**: Incremental reforms are adopted, with gradual improvement in oversight and compliance.

6. Key Individuals and Entities

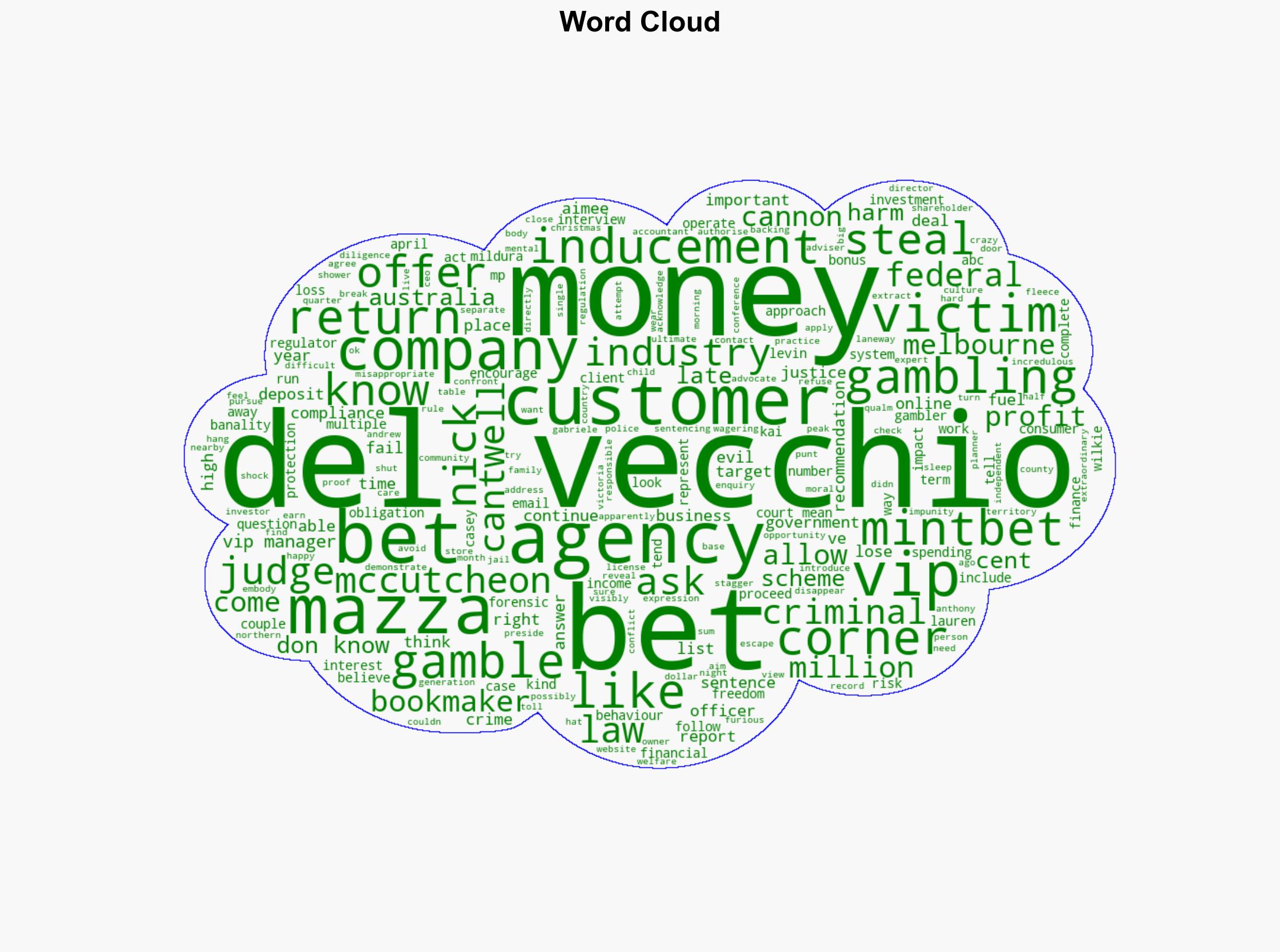

– Anthony Del Vecchio

– Nick and Aimee Mazza

– Casey McCutcheon

– Kai Cantwell

7. Thematic Tags

economic regulation, financial crime, regulatory oversight, public trust