Think Youre Earning Enough Heres the Average Income for Ages 4554 – Investopedia

Published on: 2025-11-13

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: Think You’re Earning Enough? Here’s the Average Income for Ages 45-54 – Investopedia

1. BLUF (Bottom Line Up Front)

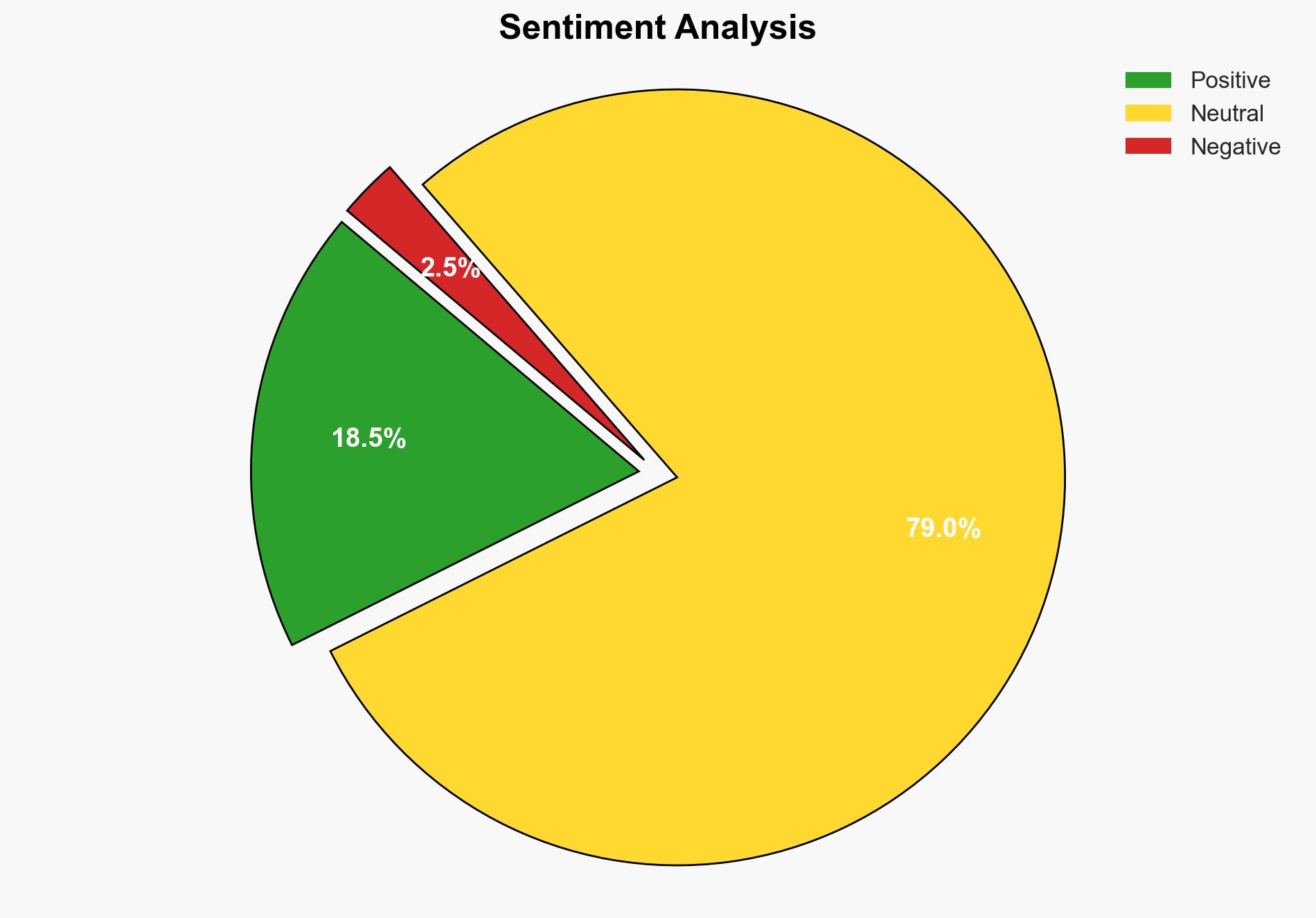

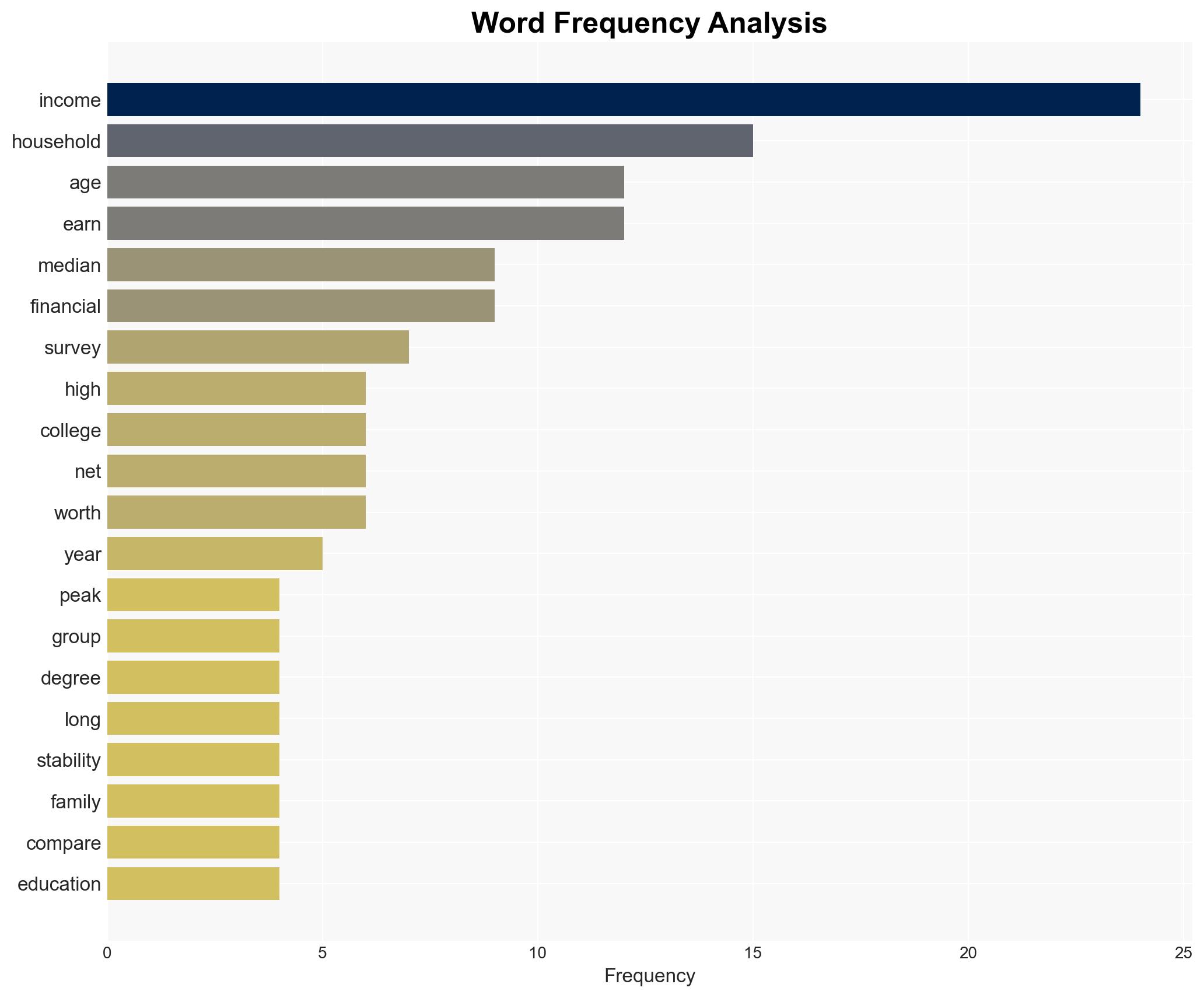

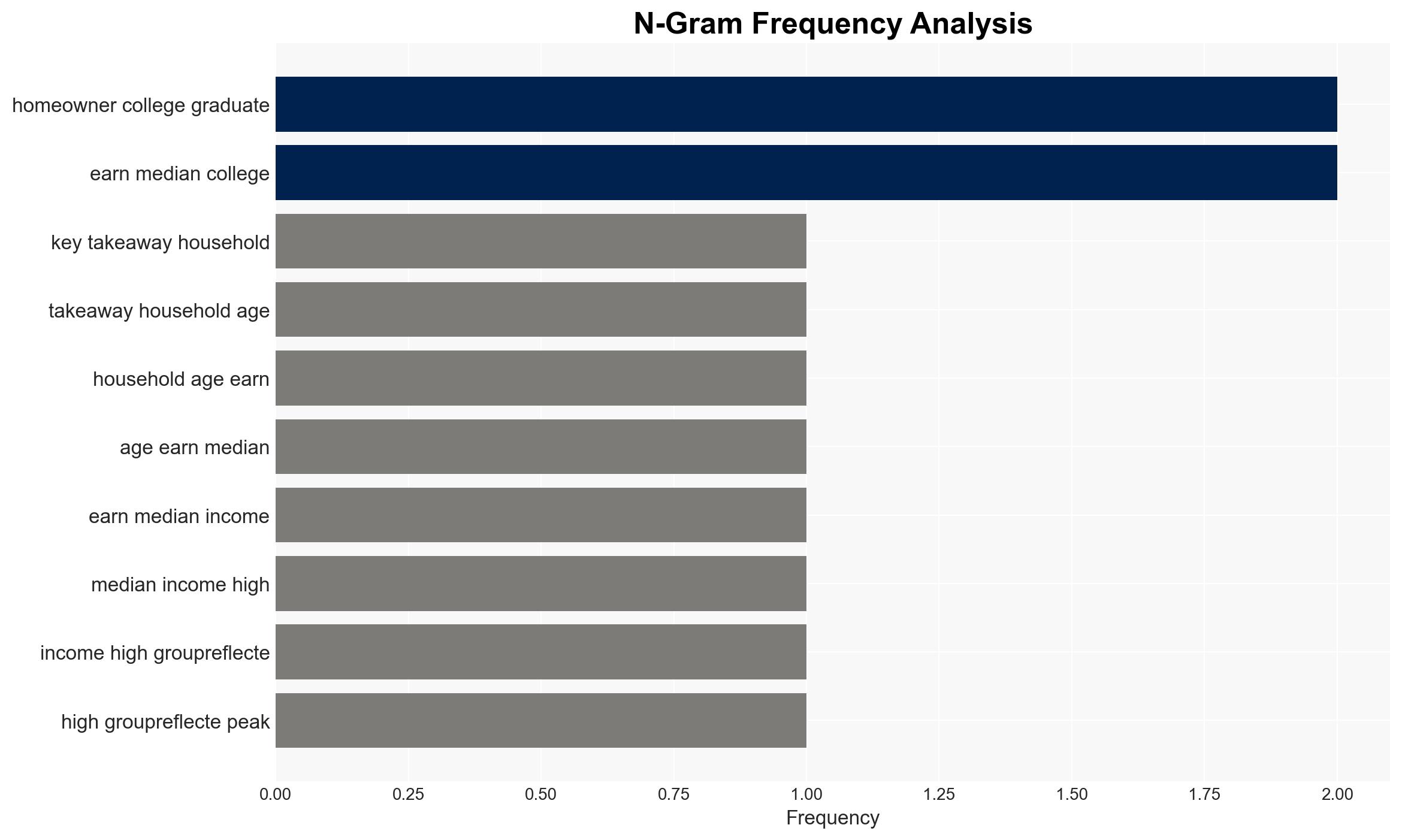

With a medium confidence level, the most supported hypothesis is that household income and net worth for individuals aged 45-54 are significantly influenced by education level and homeownership status. Strategic recommendations include enhancing financial literacy programs and supporting policies that promote homeownership and higher education to mitigate income disparity.

2. Competing Hypotheses

Hypothesis 1: The primary determinant of income and financial stability for the 45-54 age group is educational attainment and homeownership status.

Hypothesis 2: External economic factors, such as inflation and market volatility, are the primary determinants of income and financial stability for the 45-54 age group.

Evidence suggests that educational attainment and homeownership are more consistent predictors of financial outcomes than external economic factors, which are more variable and less controllable by individuals. Thus, Hypothesis 1 is more likely.

3. Key Assumptions and Red Flags

Assumptions include the reliability of Federal Reserve data and the stability of current economic conditions. A red flag is the potential bias in self-reported income and asset data. Deception indicators are minimal, but there is a risk of over-reliance on historical data without accounting for future economic disruptions.

4. Implications and Strategic Risks

The income gap tied to education and homeownership may exacerbate socio-economic disparities, leading to increased political and social tensions. Economic risks include potential housing market instability and inflation impacting renters disproportionately. The lack of financial literacy could further widen the wealth gap.

5. Recommendations and Outlook

- Enhance financial literacy programs focusing on the importance of education and homeownership.

- Support policies that make higher education and homeownership more accessible.

- Best-case scenario: Increased education and homeownership rates lead to reduced income disparity.

- Worst-case scenario: Economic downturn exacerbates income and wealth gaps.

- Most-likely scenario: Gradual improvement in financial stability for educated homeowners, with persistent gaps for others.

6. Key Individuals and Entities

Tyler Gilley, CFP, Wealth Advisor at Halbert Hargrove, Long Beach, Calif.

7. Thematic Tags

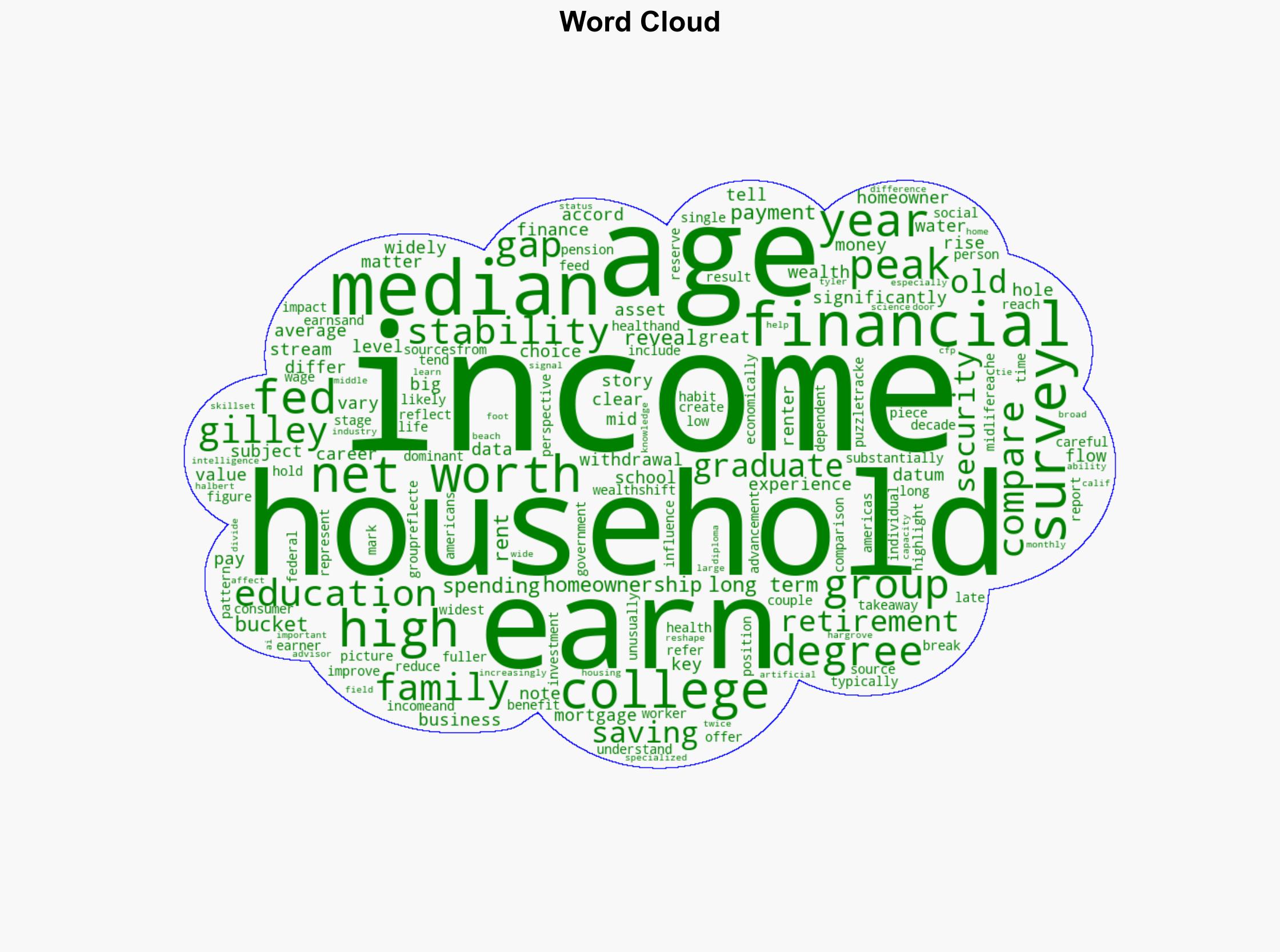

Economic Disparity, Financial Literacy, Homeownership, Education, Income Gap

Structured Analytic Techniques Applied

- Adversarial Threat Simulation: Model and simulate actions of cyber adversaries to anticipate vulnerabilities and improve resilience.

- Indicators Development: Detect and monitor behavioral or technical anomalies across systems for early threat detection.

- Bayesian Scenario Modeling: Quantify uncertainty and predict cyberattack pathways using probabilistic inference.

- Narrative Pattern Analysis: Deconstruct and track propaganda or influence narratives.

Explore more:

Cybersecurity Briefs ·

Daily Summary ·

Methodology