Too Much Space Too Little Demand China-US Freight Rates Keep Crashing – Sourcing Journal

Published on: 2025-07-10

Intelligence Report: Too Much Space Too Little Demand China-US Freight Rates Keep Crashing – Sourcing Journal

1. BLUF (Bottom Line Up Front)

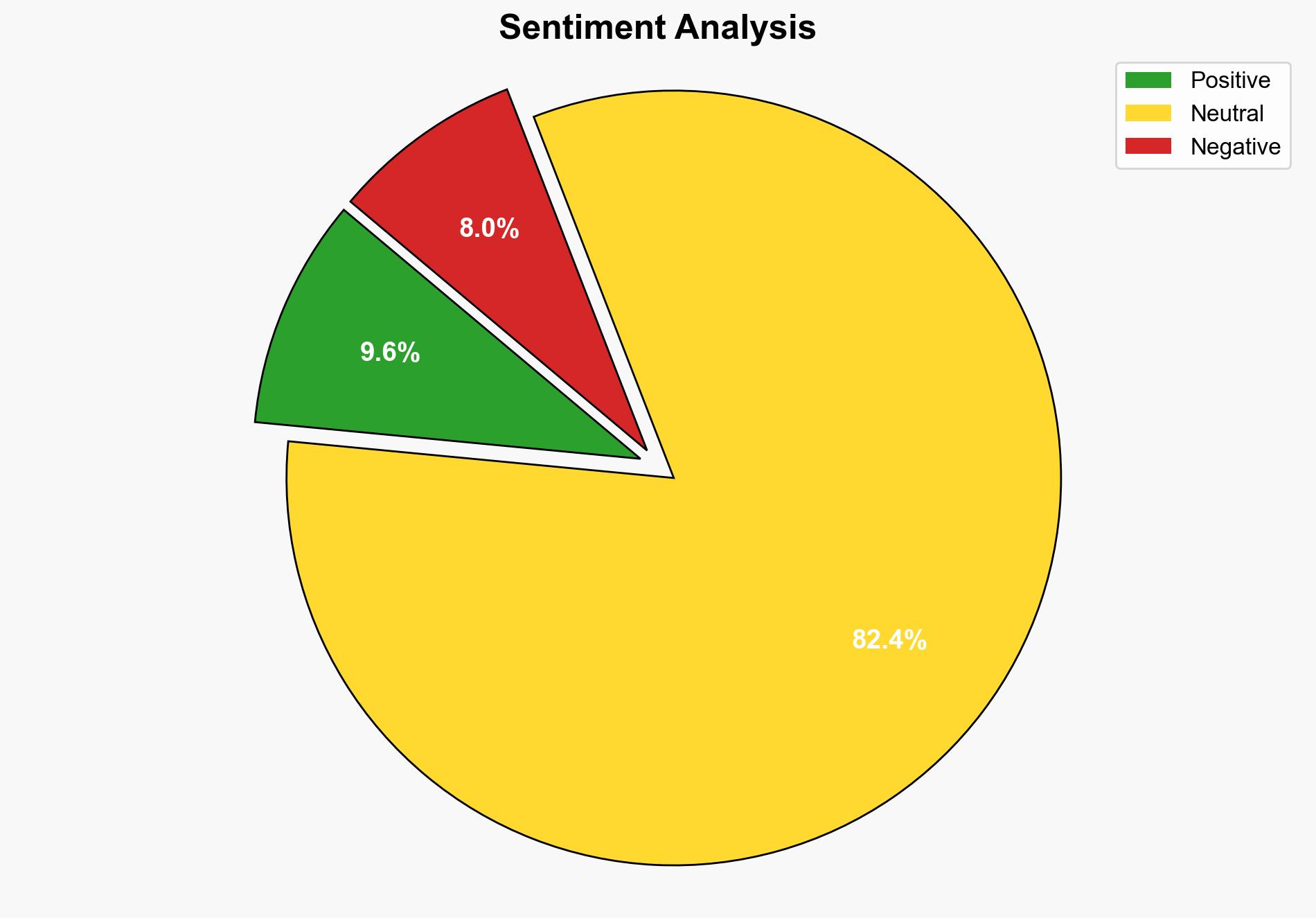

The China-US freight market is experiencing a significant decline in ocean freight rates due to overcapacity and weakened demand. This trend is expected to persist, driven by ongoing tariff uncertainties and fluctuating shipping capacities. Immediate strategic actions are necessary to stabilize the market and mitigate economic impacts.

2. Detailed Analysis

The following structured analytic techniques have been applied to ensure methodological consistency:

Causal Layered Analysis (CLA)

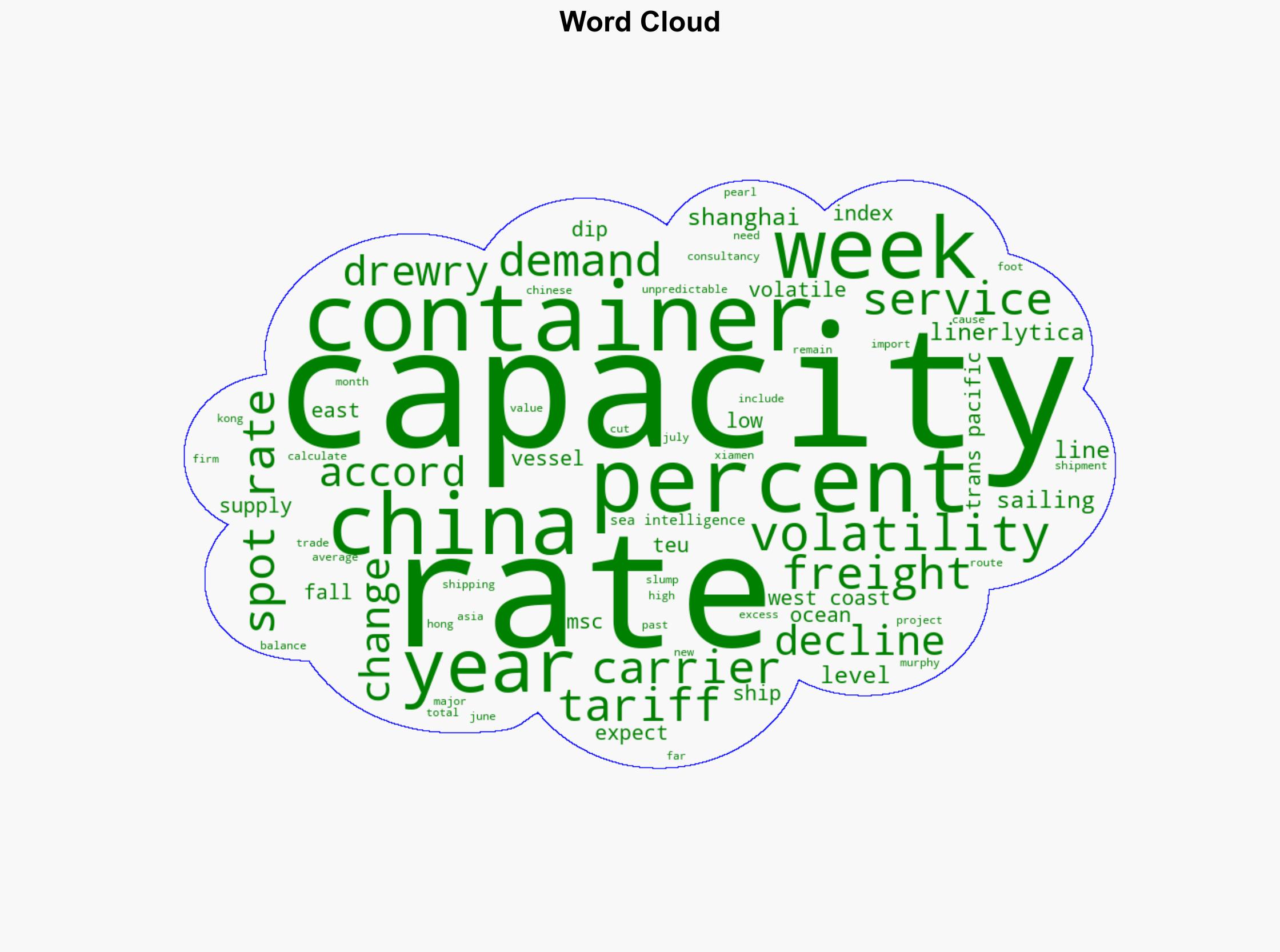

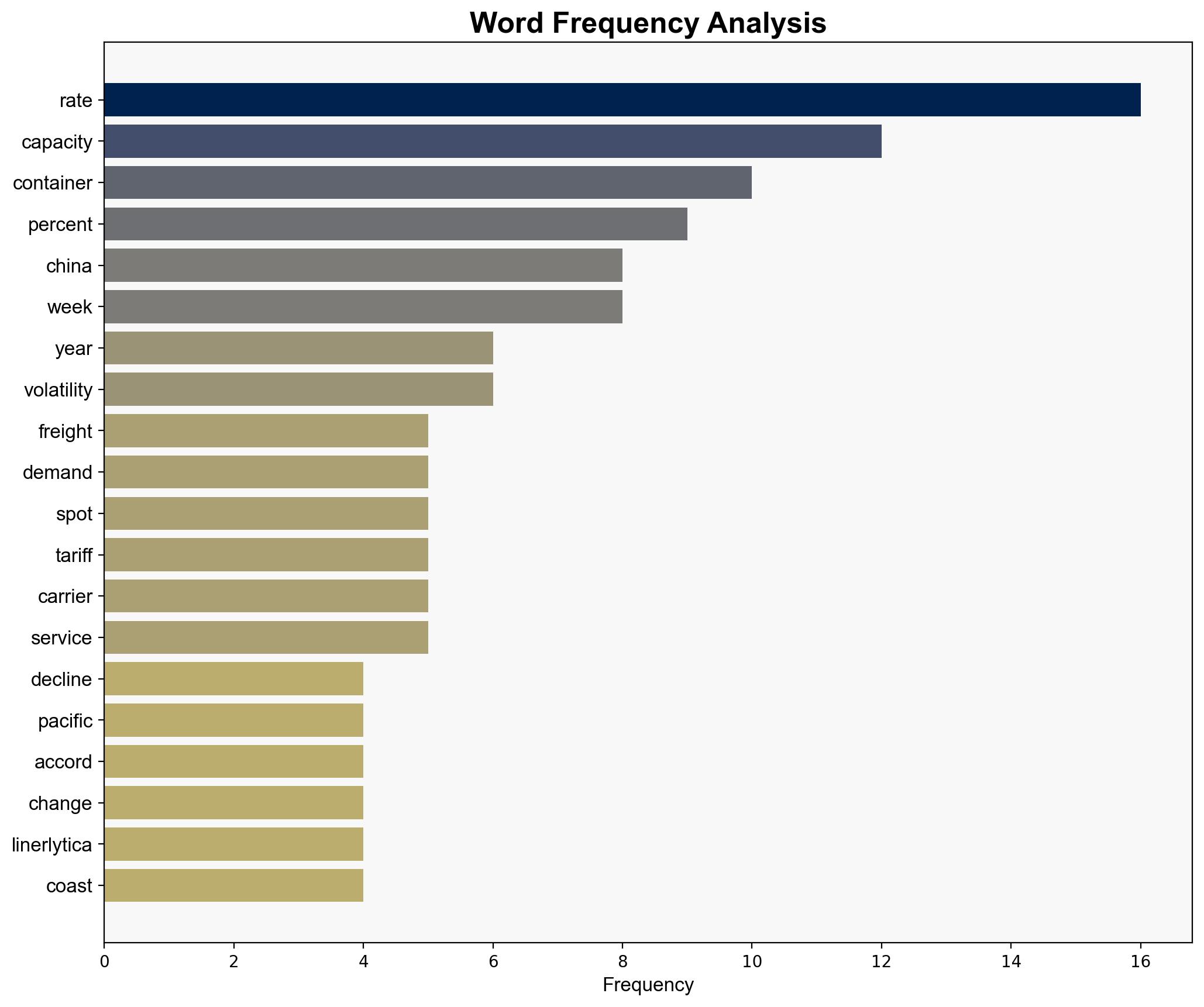

– **Surface Events**: A continuous drop in freight rates between China and the US, with major indices showing a decline.

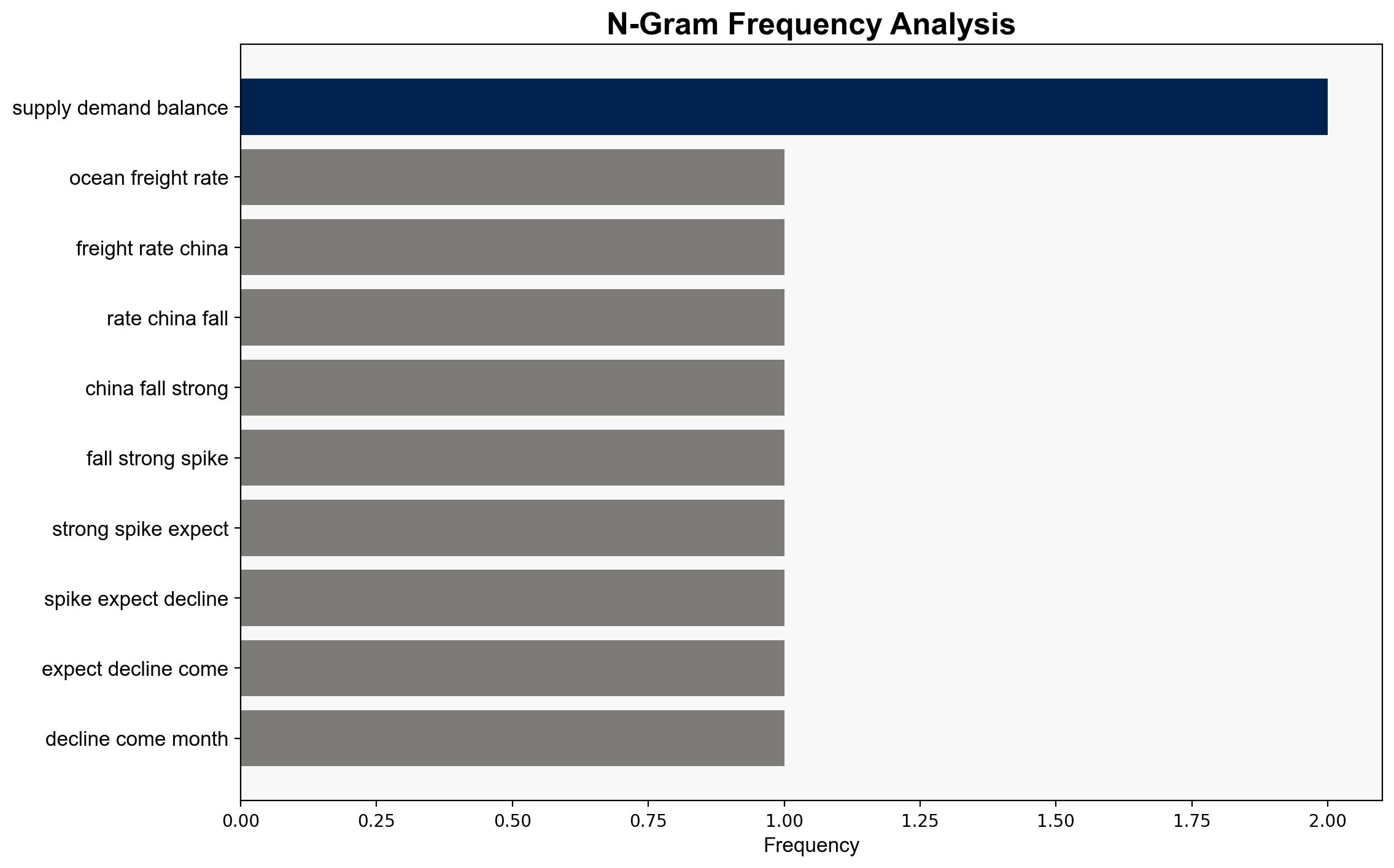

– **Systemic Structures**: Overcapacity in shipping lanes, particularly in the trans-Pacific trade, exacerbated by tariff changes and economic policies.

– **Worldviews**: Global trade tensions and protectionist policies influencing shipping dynamics.

– **Myths**: Belief in the inevitability of market correction without intervention.

Cross-Impact Simulation

– **Economic Dependencies**: The decline in freight rates impacts supply chain costs and could influence global trade patterns.

– **Regional Effects**: Potential shifts in trade routes and logistics strategies as carriers adjust to new market conditions.

Scenario Generation

– **Best Case**: Stabilization of freight rates through coordinated capacity management and tariff resolution.

– **Worst Case**: Prolonged rate decline leading to financial strain on shipping companies and broader economic repercussions.

– **Most Likely**: Continued volatility with gradual adjustments in capacity and strategic alliances among carriers.

3. Implications and Strategic Risks

The persistent decline in freight rates poses economic risks, including potential bankruptcies within the shipping industry and disruptions in global supply chains. The volatility in capacity and rates could lead to unpredictable costs for businesses reliant on trans-Pacific shipping, affecting pricing strategies and market competitiveness.

4. Recommendations and Outlook

- Encourage collaboration among shipping companies to manage capacity effectively and stabilize rates.

- Monitor tariff negotiations closely to anticipate further impacts on trade dynamics.

- Develop contingency plans for businesses to mitigate supply chain disruptions.

- Scenario-based projections suggest a need for adaptive strategies to navigate ongoing market fluctuations.

5. Key Individuals and Entities

– Alan Murphy

– MSC Elodie

– TS Line

– China United Lines

6. Thematic Tags

economic stability, global trade, shipping industry, market volatility