Toyo Tire CEO Expects Profit to Beat Guidance Plans Stock Buybacks – Financial Post

Published on: 2025-10-20

Intelligence Report: Toyo Tire CEO Expects Profit to Beat Guidance Plans Stock Buybacks – Financial Post

1. BLUF (Bottom Line Up Front)

Toyo Tire’s CEO anticipates exceeding profit guidance and plans stock buybacks, indicating confidence in market demand and strategic growth initiatives. The most supported hypothesis suggests that Toyo Tire’s strategic investments and market positioning will lead to sustained profitability and shareholder value. Confidence level: Moderate. Recommended action: Monitor market conditions and competitor responses to validate strategic assumptions.

2. Competing Hypotheses

1. **Hypothesis A**: Toyo Tire’s strategic investments in production facilities and digital transformation will lead to exceeding profit guidance and successful stock buybacks, driven by resilient demand and operational efficiencies.

2. **Hypothesis B**: Despite strategic plans, external market factors such as economic downturns, geopolitical tensions, or unexpected operational challenges could hinder Toyo Tire’s ability to exceed profit guidance and execute stock buybacks effectively.

Using ACH 2.0, Hypothesis A is better supported by the current data, including the CEO’s confidence, planned investments, and market demand indicators. However, Hypothesis B remains plausible given potential external risks.

3. Key Assumptions and Red Flags

– **Assumptions**:

– Resilient demand for tires will continue.

– Investments in automation and digital transformation will yield expected efficiencies.

– Geopolitical and economic conditions will remain stable.

– **Red Flags**:

– Over-reliance on optimistic market demand projections.

– Potential underestimation of geopolitical risks affecting supply chains.

– Lack of detailed contingency plans for economic downturns.

4. Implications and Strategic Risks

– **Economic Risks**: A global economic slowdown could reduce demand for new vehicles, impacting tire sales.

– **Geopolitical Risks**: Tariffs and trade tensions, particularly in Europe and Asia, could disrupt supply chains.

– **Operational Risks**: Delays or cost overruns in new facility constructions could impact profitability.

– **Technological Risks**: Failure to effectively implement digital transformation could result in competitive disadvantage.

5. Recommendations and Outlook

- Conduct a thorough risk assessment of geopolitical and economic factors affecting key markets.

- Develop contingency plans for potential disruptions in supply chains and market demand.

- Scenario-based projections:

- Best Case: Successful implementation of strategic plans leads to increased market share and profitability.

- Worst Case: Economic downturn and geopolitical tensions severely impact operations and profitability.

- Most Likely: Moderate success in strategic initiatives with manageable external challenges.

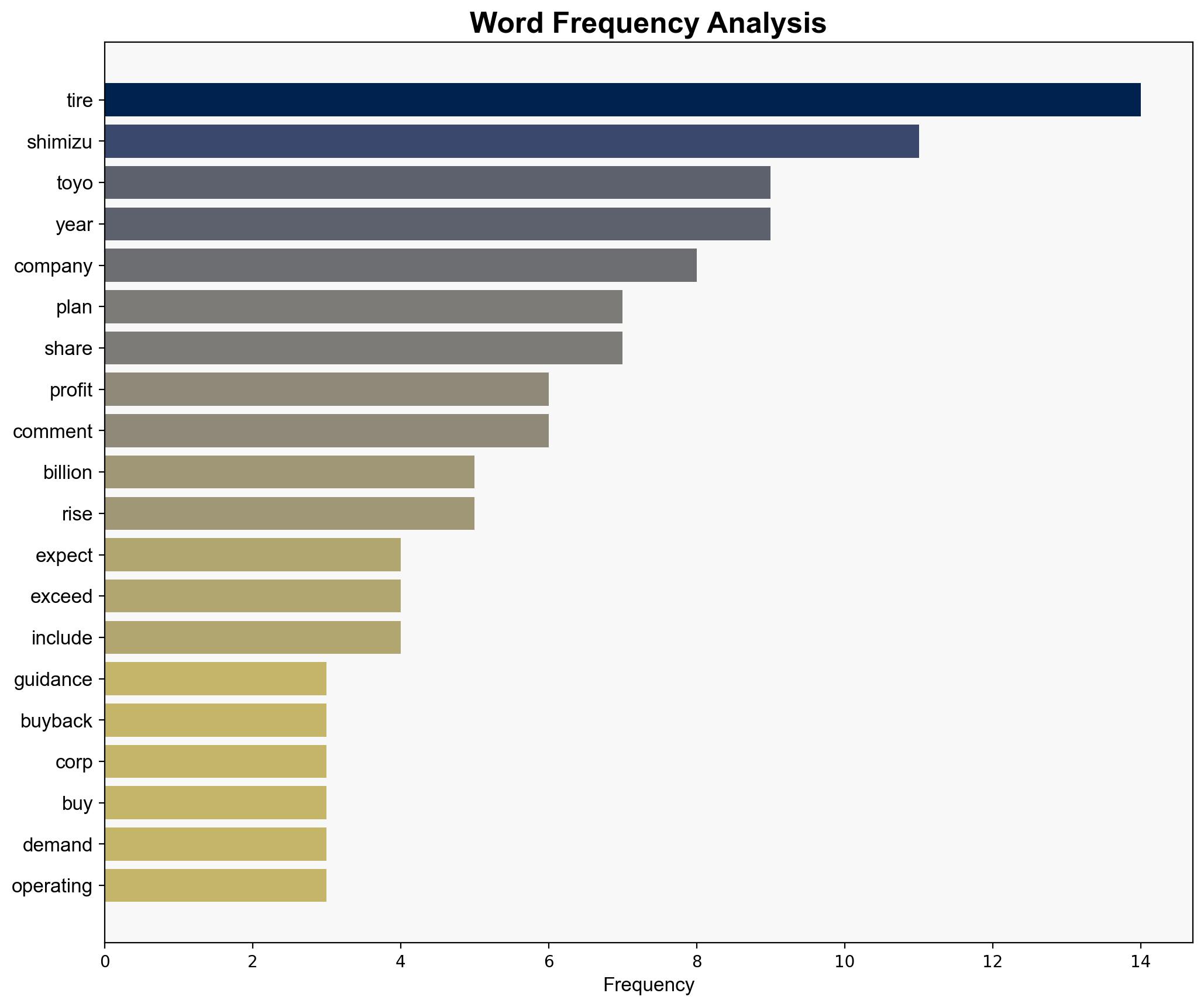

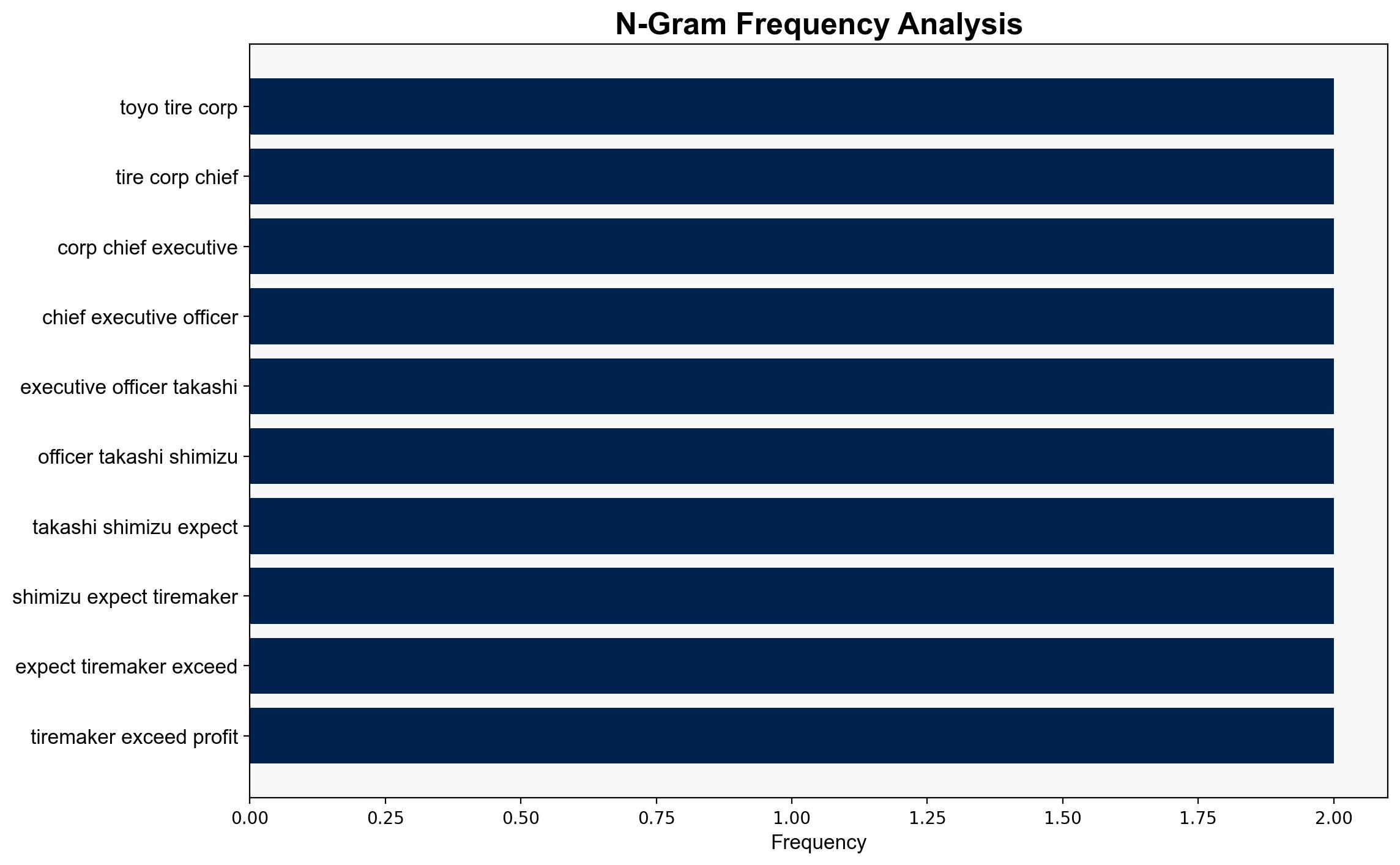

6. Key Individuals and Entities

– Takashi Shimizu

– Palliser Capital

– Orbis Investment Management Ltd

– Mitsubishi Corp

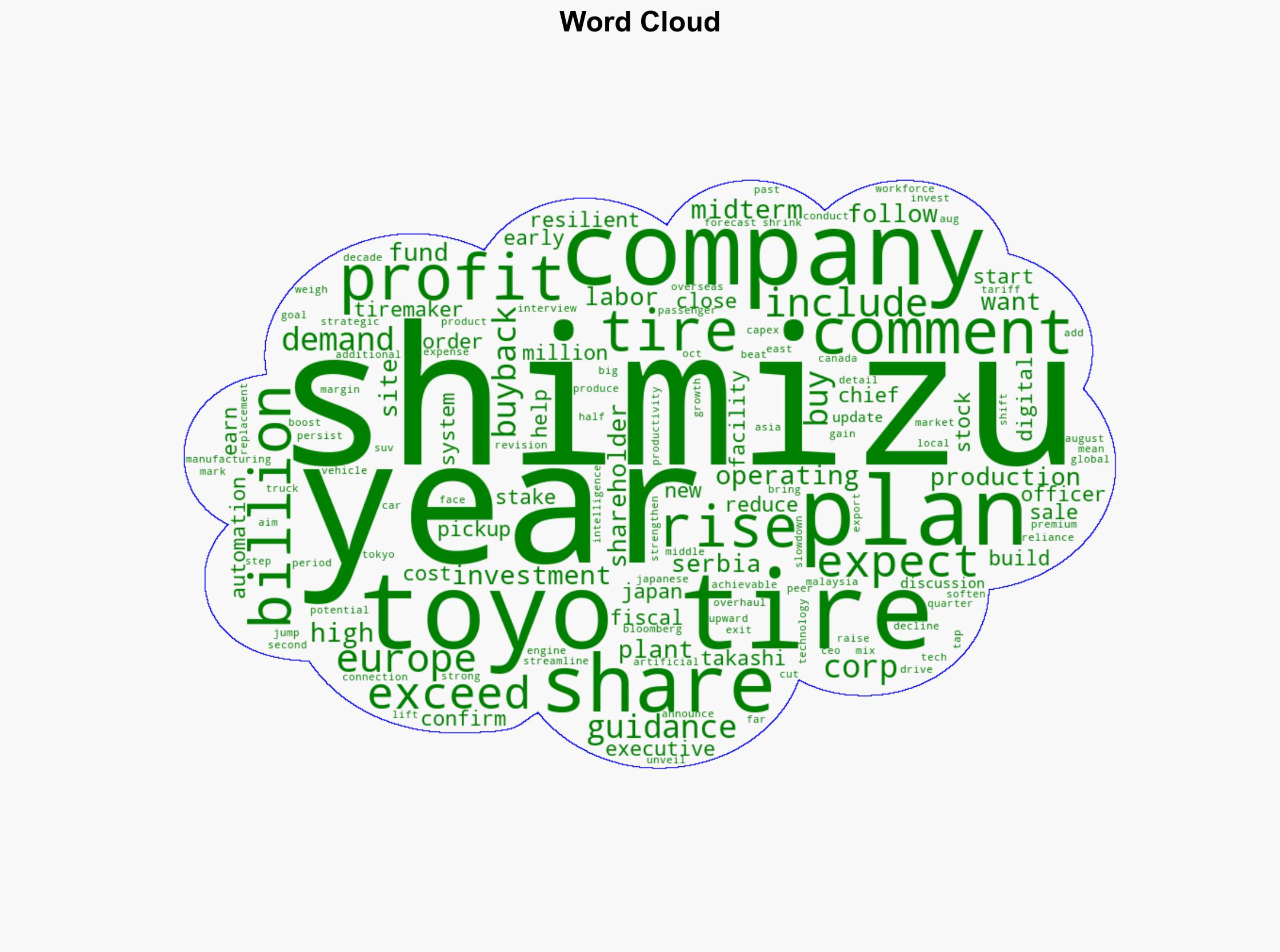

7. Thematic Tags

economic strategy, market dynamics, corporate governance, geopolitical risk