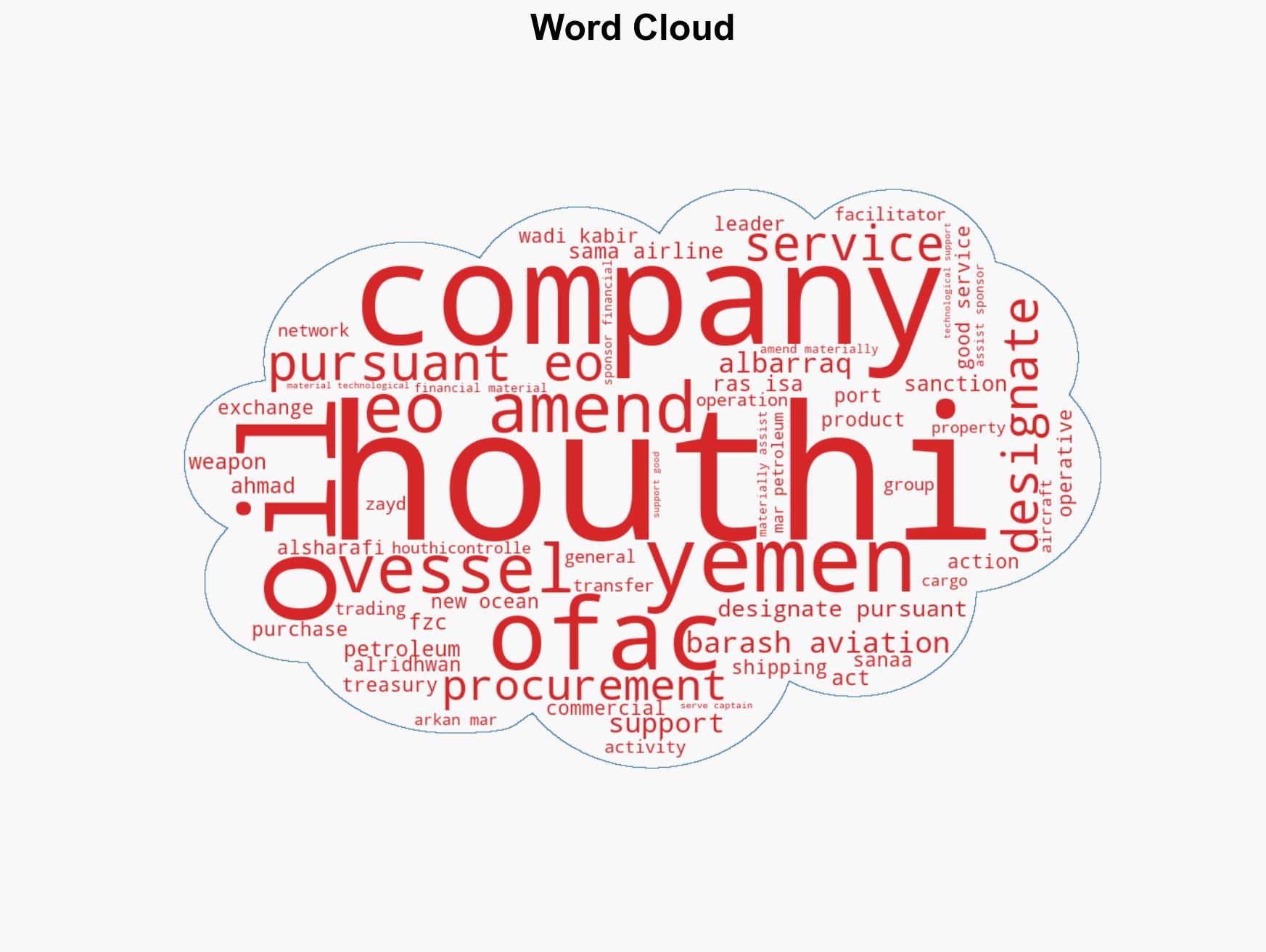

Treasury Targets Houthi Networks Involved in Smuggling and Financing Terrorist Activities

Published on: 2026-01-17

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: Treasury Increases Pressure on Houthi Smuggling and Illicit Revenue Generation Networks

1. BLUF (Bottom Line Up Front)

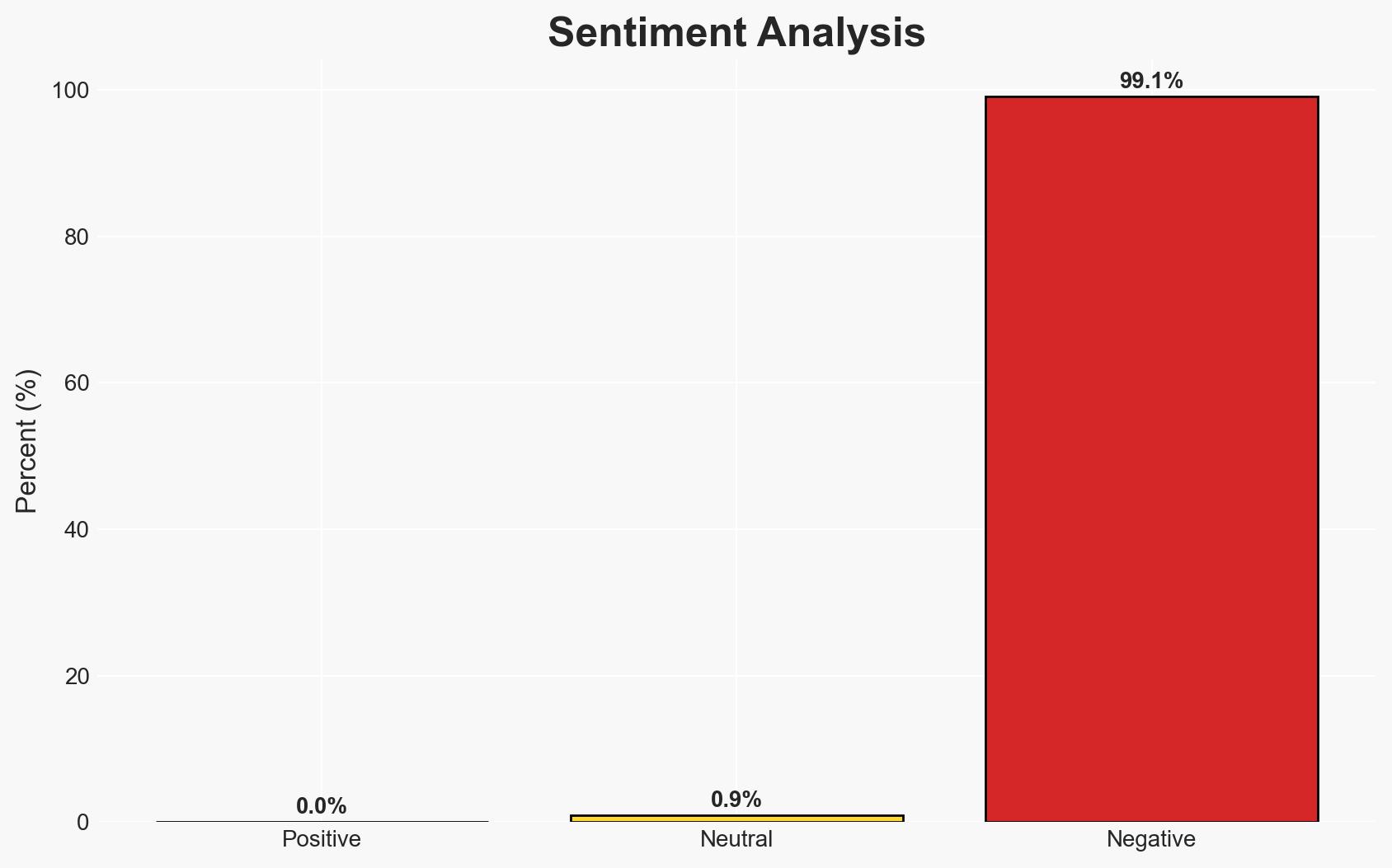

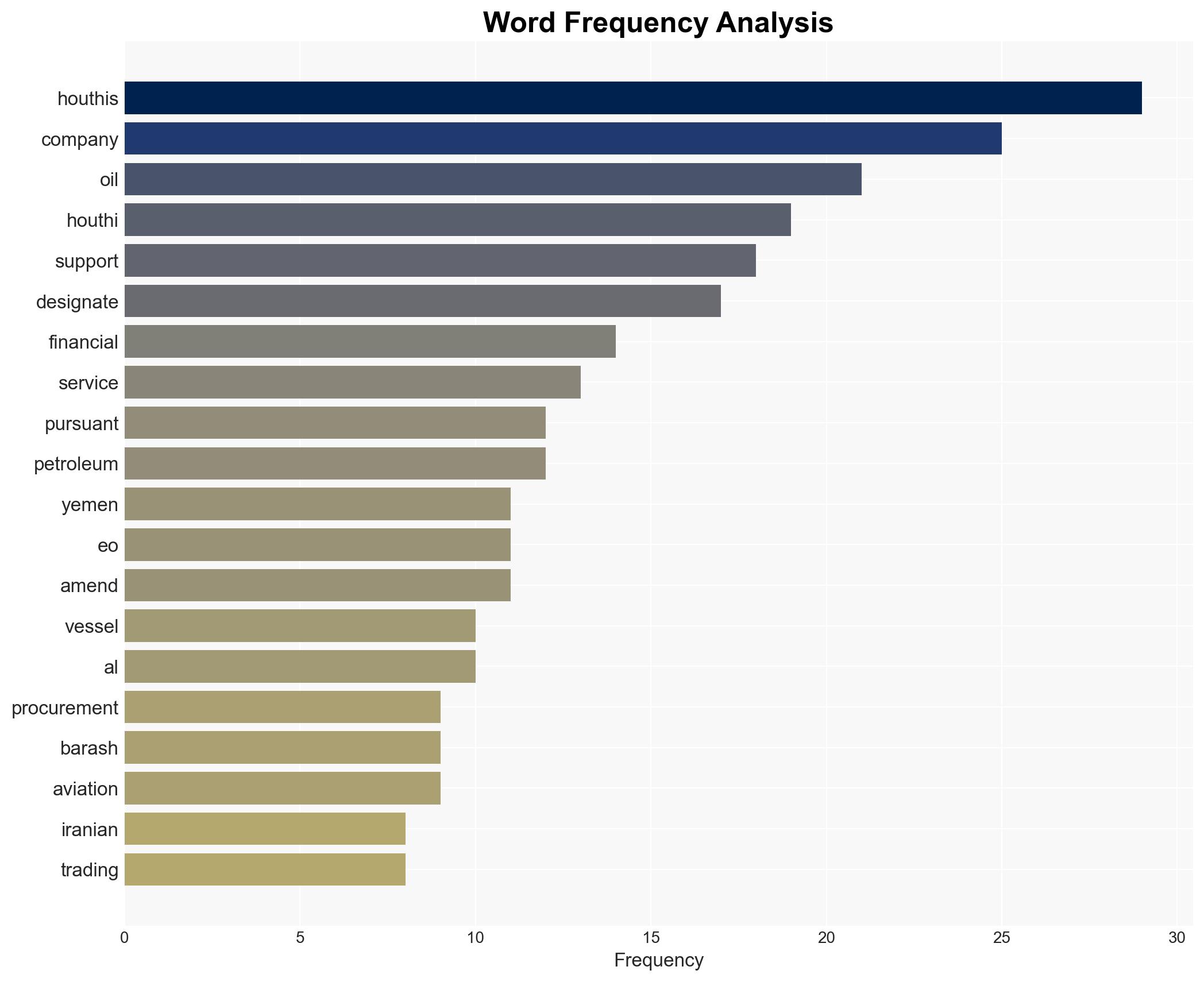

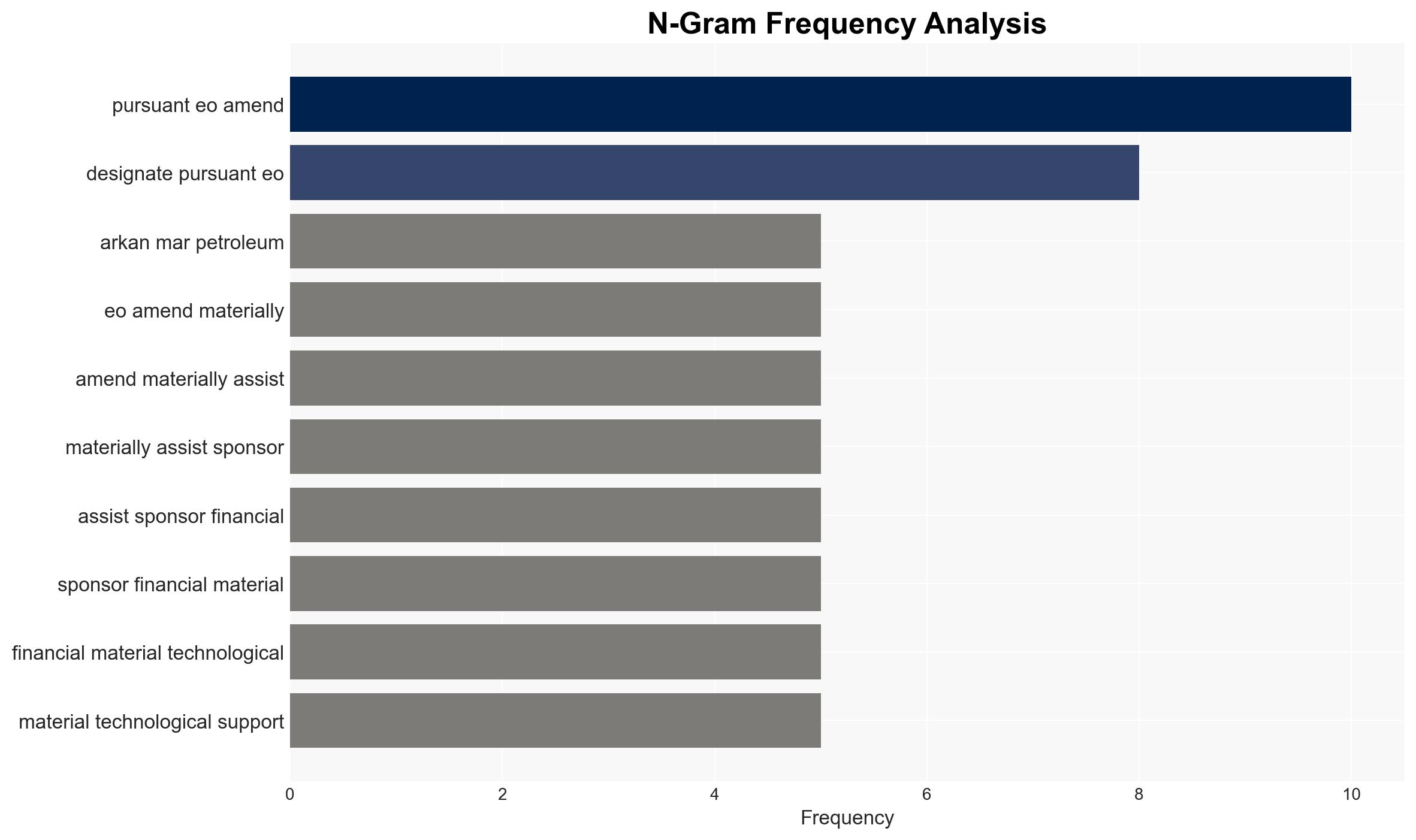

The U.S. Department of the Treasury has intensified efforts to disrupt financial networks supporting the Iran-backed Houthi organization through sanctions on 21 individuals and entities. This action aims to curtail the group’s revenue from illicit oil sales and smuggling operations, which sustain its regional destabilizing activities. The most likely hypothesis is that these measures will temporarily disrupt Houthi operations but may not significantly impair their long-term capabilities due to adaptive strategies. Overall confidence in this assessment is moderate.

2. Competing Hypotheses

- Hypothesis A: The sanctions will significantly disrupt Houthi financial networks, leading to a reduction in their operational capabilities. Supporting evidence includes the targeted nature of the sanctions on key financial conduits and facilitators. However, uncertainties remain about the Houthis’ ability to adapt and find alternative revenue streams.

- Hypothesis B: The sanctions will have limited long-term impact on the Houthis’ capabilities due to their established smuggling networks and adaptability. This is supported by the group’s historical resilience and continued revenue generation despite previous sanctions. Contradicting evidence includes the immediate disruption of specific financial channels.

- Assessment: Hypothesis B is currently better supported due to the Houthis’ demonstrated ability to adapt to sanctions and maintain revenue streams. Indicators that could shift this judgment include evidence of significant operational disruptions or the emergence of new, effective countermeasures by the Treasury.

3. Key Assumptions and Red Flags

- Assumptions: The Houthis rely heavily on Iranian support; sanctions will disrupt key financial channels; the Houthis will seek alternative revenue sources.

- Information Gaps: Detailed understanding of the full extent of the Houthis’ financial networks and their adaptability strategies.

- Bias & Deception Risks: Potential bias in overestimating the effectiveness of sanctions; risk of underestimating the Houthis’ resilience and adaptability.

4. Implications and Strategic Risks

This development could lead to temporary disruptions in Houthi operations but may also drive them to innovate or deepen reliance on other illicit activities. The broader geopolitical dynamics involving Iran and regional allies could be affected.

- Political / Geopolitical: Potential escalation in U.S.-Iran tensions; increased regional instability if Houthis seek alternative support.

- Security / Counter-Terrorism: Possible short-term reduction in Houthi attacks; long-term threat persists if adaptation occurs.

- Cyber / Information Space: Potential increase in cyber operations as a means to circumvent sanctions.

- Economic / Social: Economic strain on entities in UAE and Oman involved in illicit networks; potential social unrest if economic conditions worsen.

5. Recommendations and Outlook

- Immediate Actions (0–30 days): Enhance monitoring of financial transactions in the region; engage with regional partners to identify and disrupt alternative revenue channels.

- Medium-Term Posture (1–12 months): Strengthen intelligence-sharing with allies; develop resilience measures against potential retaliatory actions by the Houthis.

- Scenario Outlook: Best: Significant disruption of Houthi operations; Worst: Houthis adapt and escalate attacks; Most-Likely: Temporary disruption with eventual adaptation by the Houthis.

6. Key Individuals and Entities

- Waleed Fathi Salam Baidhani

- Imran Asghar

- Al Sharafi Oil Companies Services

- Adeema Oil FZC

- Arkan Mars Petroleum DMCC

- Alsaa Petroleum and Shipping FZC

7. Thematic Tags

Counter-Terrorism, sanctions, illicit finance, regional security, Iran-Houthi relations, oil smuggling, economic disruption

Structured Analytic Techniques Applied

- ACH 2.0: Reconstruct likely threat actor intentions via hypothesis testing and structured refutation.

- Indicators Development: Track radicalization signals and propaganda patterns to anticipate operational planning.

- Narrative Pattern Analysis: Analyze spread/adaptation of ideological narratives for recruitment/incitement signals.

- Network Influence Mapping: Map influence relationships to assess actor impact.

Explore more:

Counter-Terrorism Briefs ·

Daily Summary ·

Support us