Trump admin tells prosecutors to ease up on crypto enforcement – ABC News

Published on: 2025-04-08

Intelligence Report: Trump admin tells prosecutors to ease up on crypto enforcement – ABC News

1. BLUF (Bottom Line Up Front)

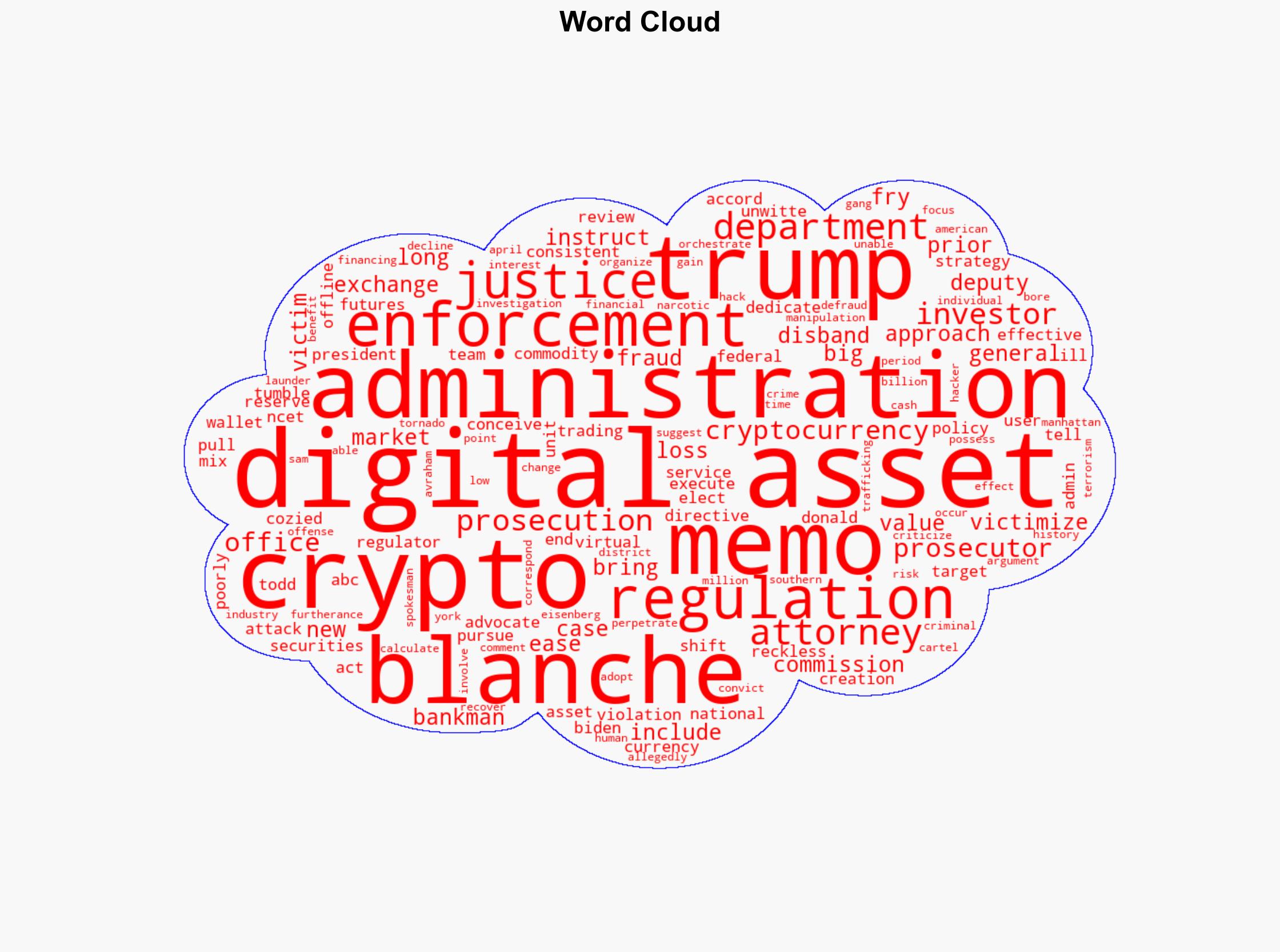

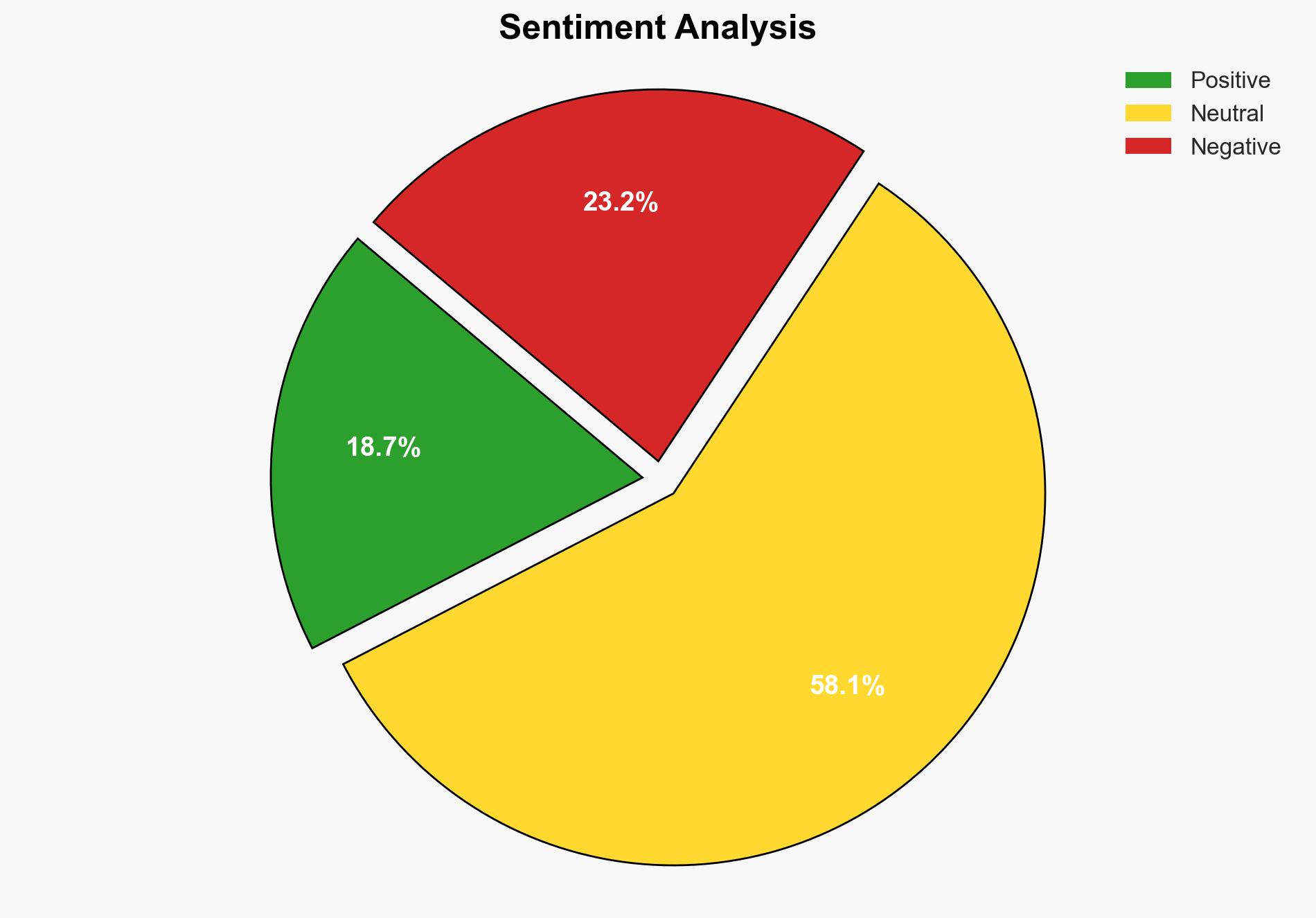

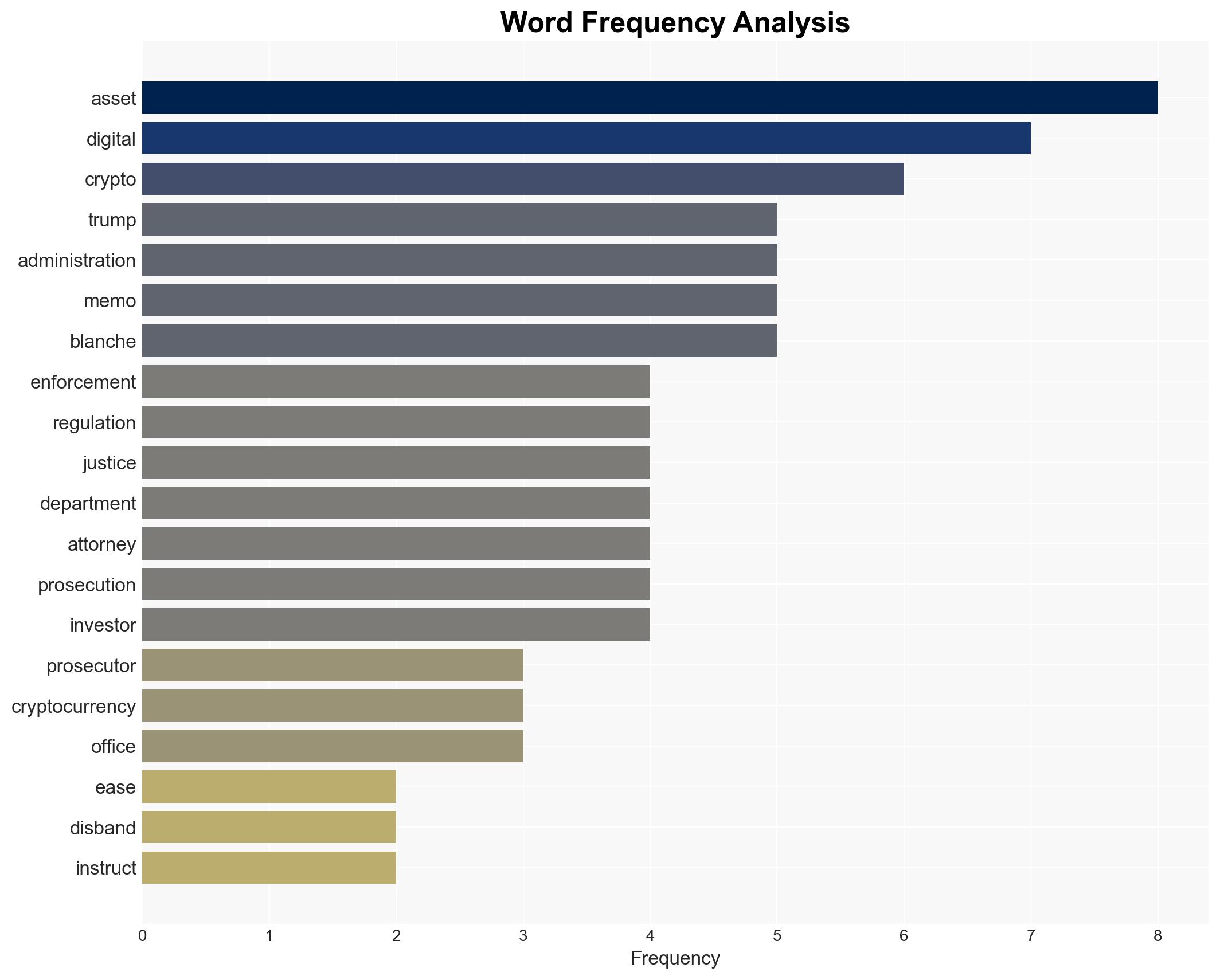

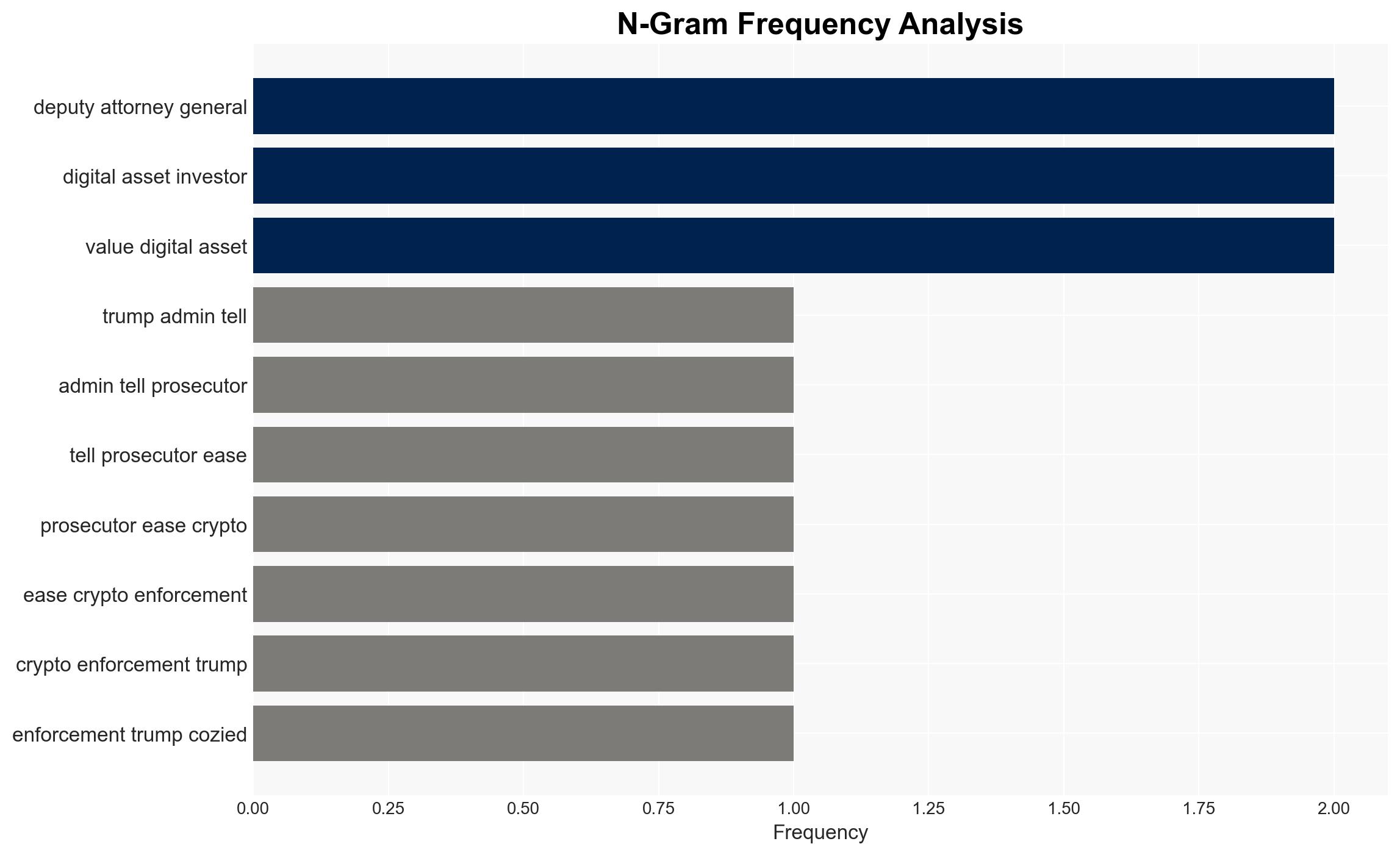

The Trump administration has directed a shift in the enforcement of cryptocurrency regulations, advising prosecutors to ease their approach. This strategic change involves disbanding the National Cryptocurrency Enforcement Team and aligning with a broader policy to reduce regulatory pressures on digital assets. The implications of this directive could significantly impact the regulatory landscape, potentially increasing risks related to financial crimes and investor protection.

2. Detailed Analysis

The following structured analytic techniques have been applied for this analysis:

General Analysis

The Trump administration’s decision to ease cryptocurrency enforcement reflects a policy shift towards fostering a more favorable environment for digital asset innovation. However, this move raises concerns about the potential for increased financial crime activities, including money laundering and fraud. The disbandment of the National Cryptocurrency Enforcement Team could lead to a reduction in oversight and enforcement capabilities, potentially emboldening illicit actors. The memo from Todd Blanche criticizes the previous administration’s approach, suggesting a focus on victimizing individuals rather than addressing systemic risks.

3. Implications and Strategic Risks

The easing of crypto enforcement poses several strategic risks:

- Increased vulnerability to financial crimes, including money laundering and fraud.

- Potential negative impacts on investor confidence and market stability.

- Challenges in balancing innovation with regulatory oversight, potentially affecting national security and economic interests.

The directive could also influence international regulatory trends, as other countries may adjust their policies in response to the U.S. stance.

4. Recommendations and Outlook

Recommendations:

- Enhance inter-agency collaboration to monitor and address emerging risks in the cryptocurrency sector.

- Develop a balanced regulatory framework that supports innovation while safeguarding against financial crimes.

- Invest in technological solutions to improve the detection and prevention of illicit activities in digital asset markets.

Outlook:

Best-case scenario: The regulatory easing fosters innovation and growth in the cryptocurrency sector, attracting investment and enhancing market stability.

Worst-case scenario: Reduced enforcement leads to a surge in financial crimes, undermining investor confidence and triggering regulatory backlash.

Most likely outcome: A mixed impact where innovation progresses, but challenges in enforcement and oversight persist, necessitating ongoing adjustments in policy and strategy.

5. Key Individuals and Entities

The report mentions significant individuals and organizations, including Donald Trump, Todd Blanche, Sam Bankman-Fried, and Avraham Eisenberg. The directive also involves entities such as the Department of Justice, Securities and Exchange Commission, and Commodity Futures Trading Commission.