Trump clears US Steel sale to Nippon Steel but details of merger still unclear – CBS News

Published on: 2025-06-13

Intelligence Report: Trump clears US Steel sale to Nippon Steel but details of merger still unclear – CBS News

1. BLUF (Bottom Line Up Front)

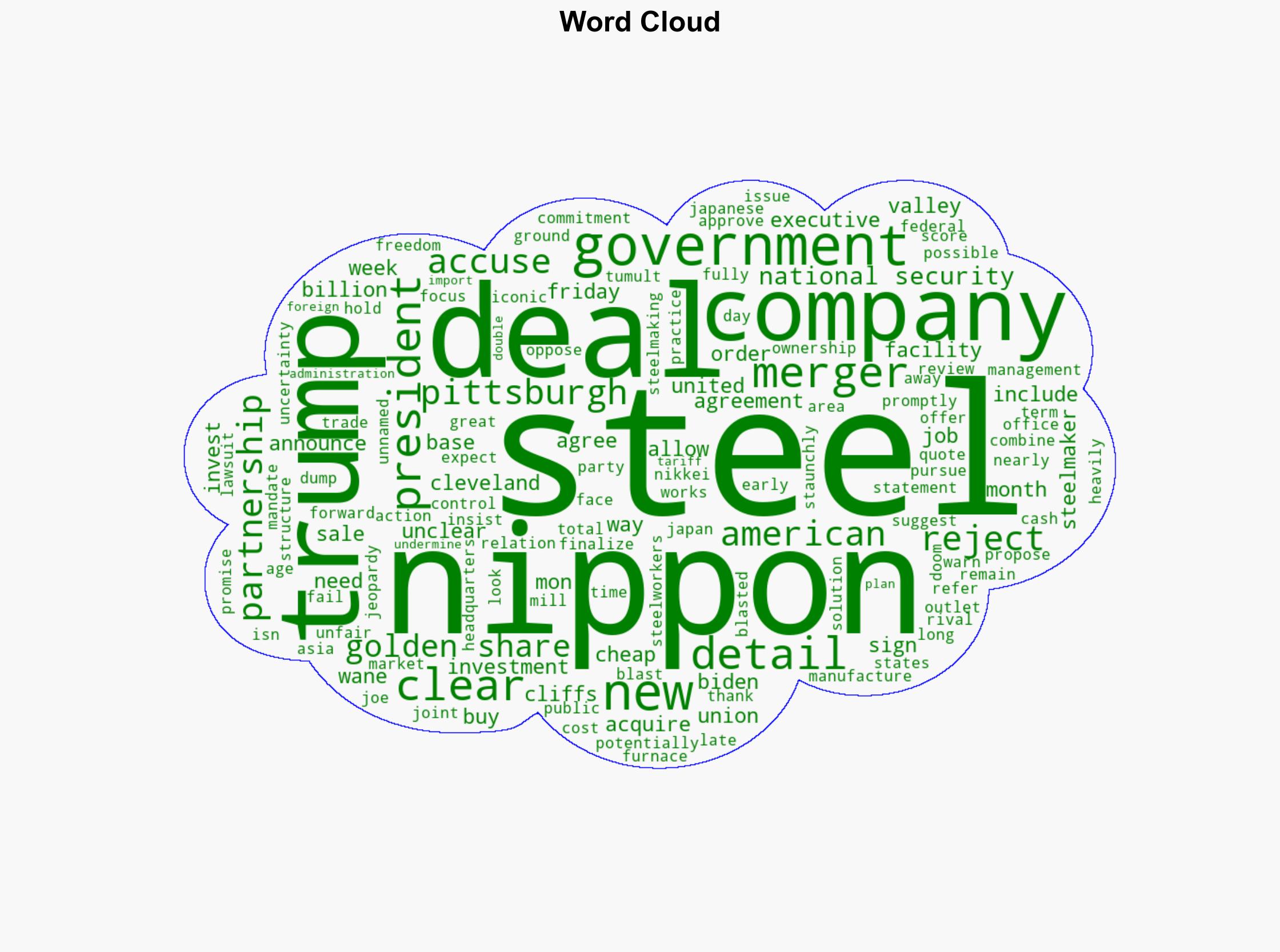

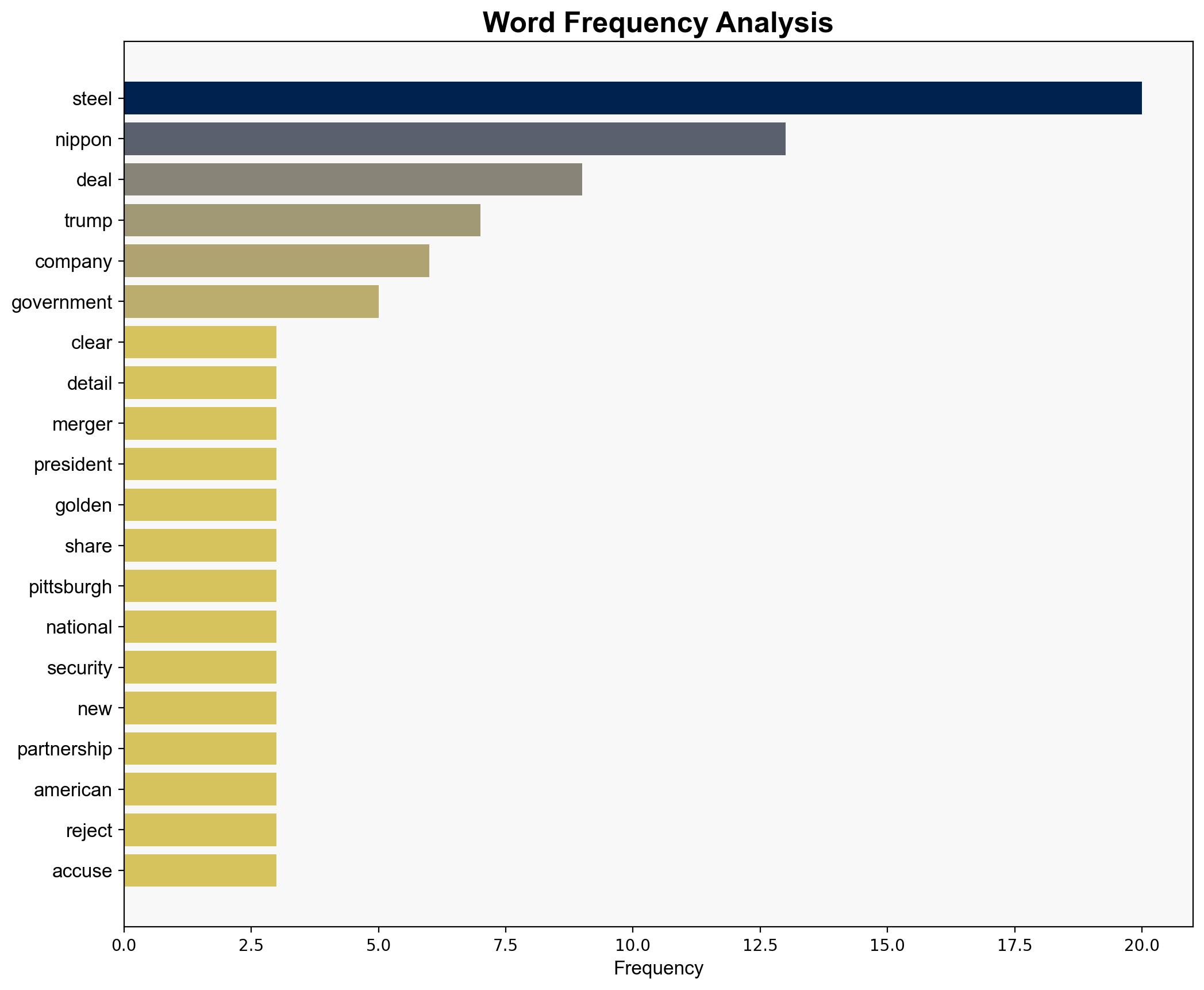

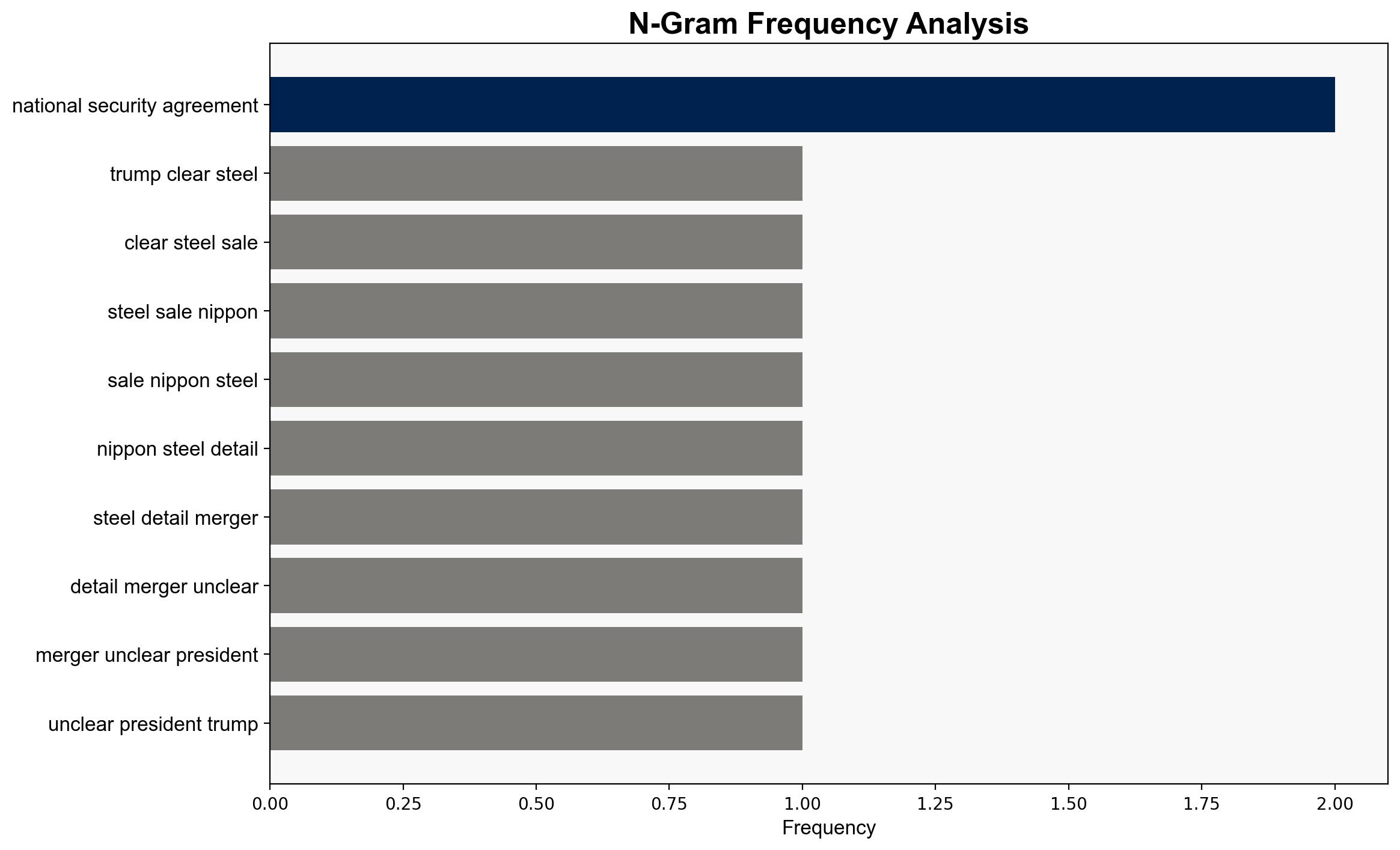

The U.S. government has approved the sale of U.S. Steel to Japan-based Nippon Steel, though the specifics of the merger remain vague. This decision, facilitated by an executive order, includes a national security agreement mandating significant investment and a potential “golden share” for the U.S. government. The deal’s implications for the U.S. steel industry, particularly in terms of job security and market competition, are significant and warrant close monitoring.

2. Detailed Analysis

The following structured analytic techniques have been applied to ensure methodological consistency:

Cognitive Bias Stress Test

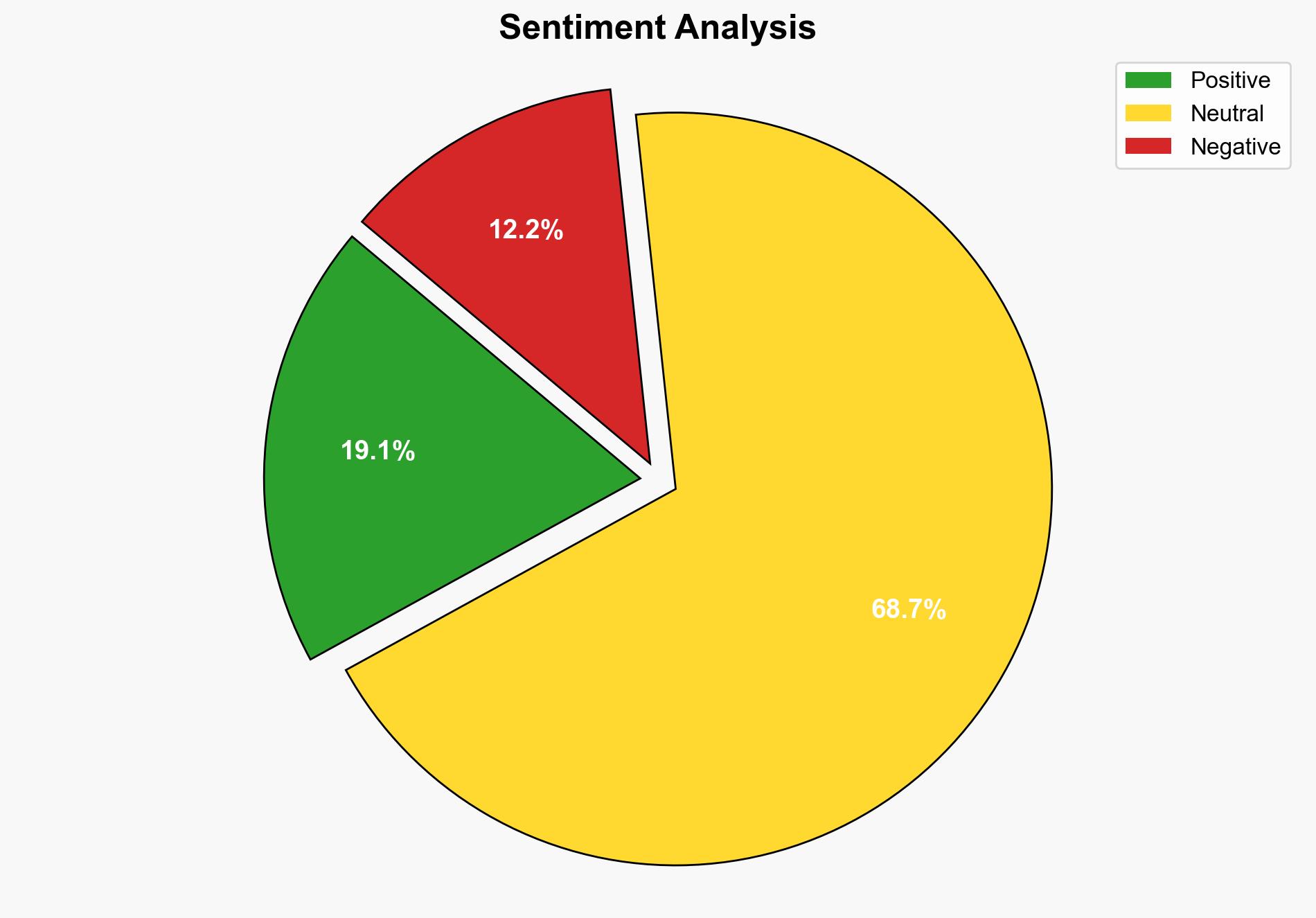

Potential biases in the assessment of the merger’s impact have been identified and addressed through rigorous challenge processes. The focus remains on ensuring a balanced view of the strategic benefits and risks.

Bayesian Scenario Modeling

Probabilistic forecasting suggests a moderate likelihood of increased foreign influence in the U.S. steel market, with potential for economic and security repercussions.

Network Influence Mapping

Influence relationships between Nippon Steel, U.S. government entities, and domestic competitors have been mapped to assess potential shifts in market dynamics and regulatory responses.

3. Implications and Strategic Risks

The merger could lead to increased foreign control over a key U.S. industry, raising national security concerns. Economic risks include potential job losses and market destabilization due to increased competition and possible unfair trade practices. The issuance of a “golden share” may mitigate some security risks but could complicate corporate governance.

4. Recommendations and Outlook

- Monitor compliance with the national security agreement and ensure robust oversight of Nippon Steel’s operations in the U.S.

- Engage with stakeholders to address labor concerns and ensure workforce stability.

- Scenario-based projections:

- Best Case: Successful integration with minimal disruption, leading to enhanced industry competitiveness.

- Worst Case: Significant job losses and market instability due to aggressive foreign competition.

- Most Likely: Gradual market adjustments with moderate economic impact.

5. Key Individuals and Entities

Donald Trump, Nippon Steel, Cleveland-Cliffs, United Steelworkers Union

6. Thematic Tags

national security threats, economic impact, foreign investment, industrial policy