UAE Royal’s $500 Million Stake in Trump-Linked Crypto Firm Sparks Concerns Over Foreign Influence

Published on: 2026-02-03

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

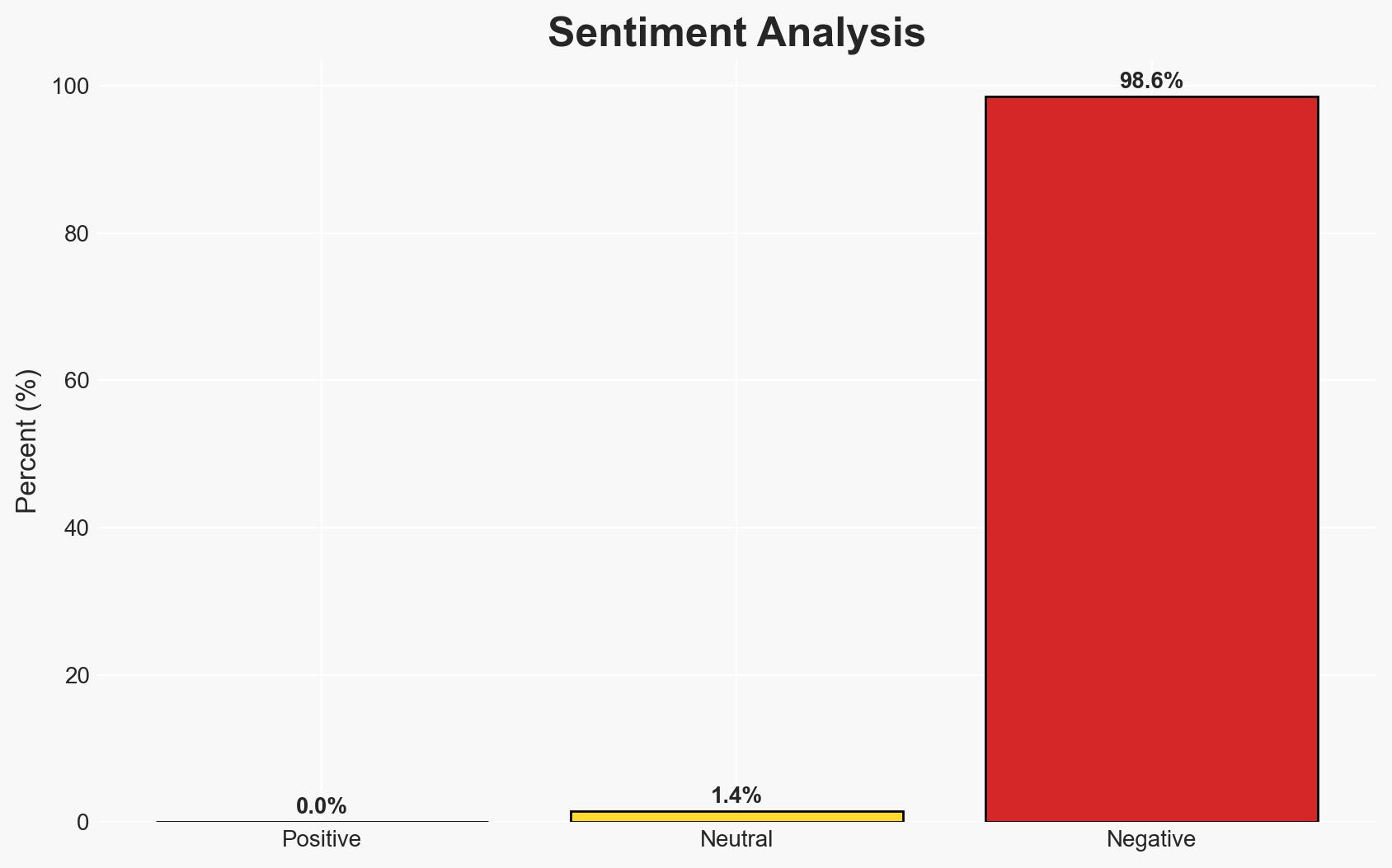

Intelligence Report: A 500 Million question UAEs strategic purchase of Trump-linked crypto firm raises eyebrows of foreign influence

1. BLUF (Bottom Line Up Front)

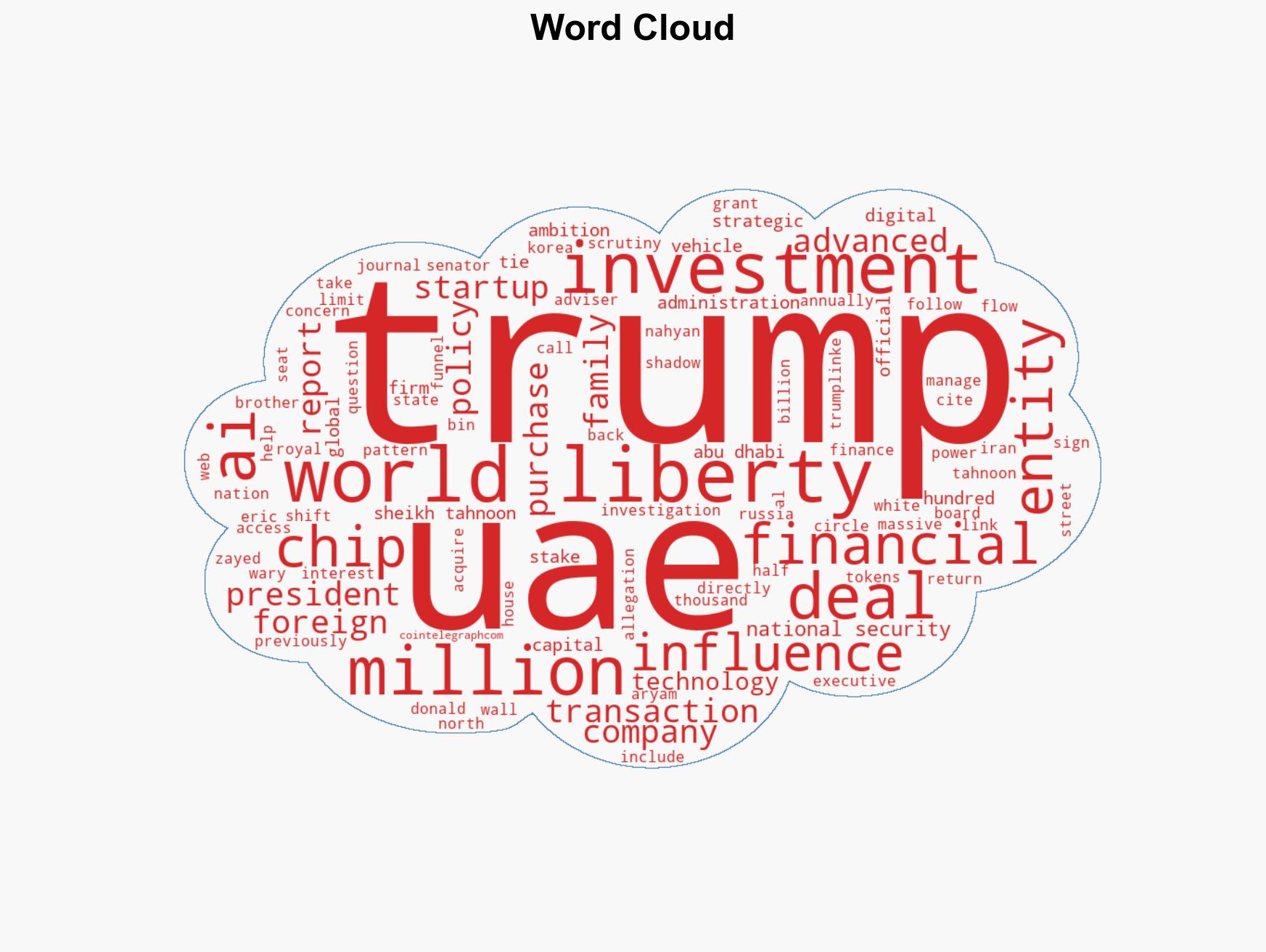

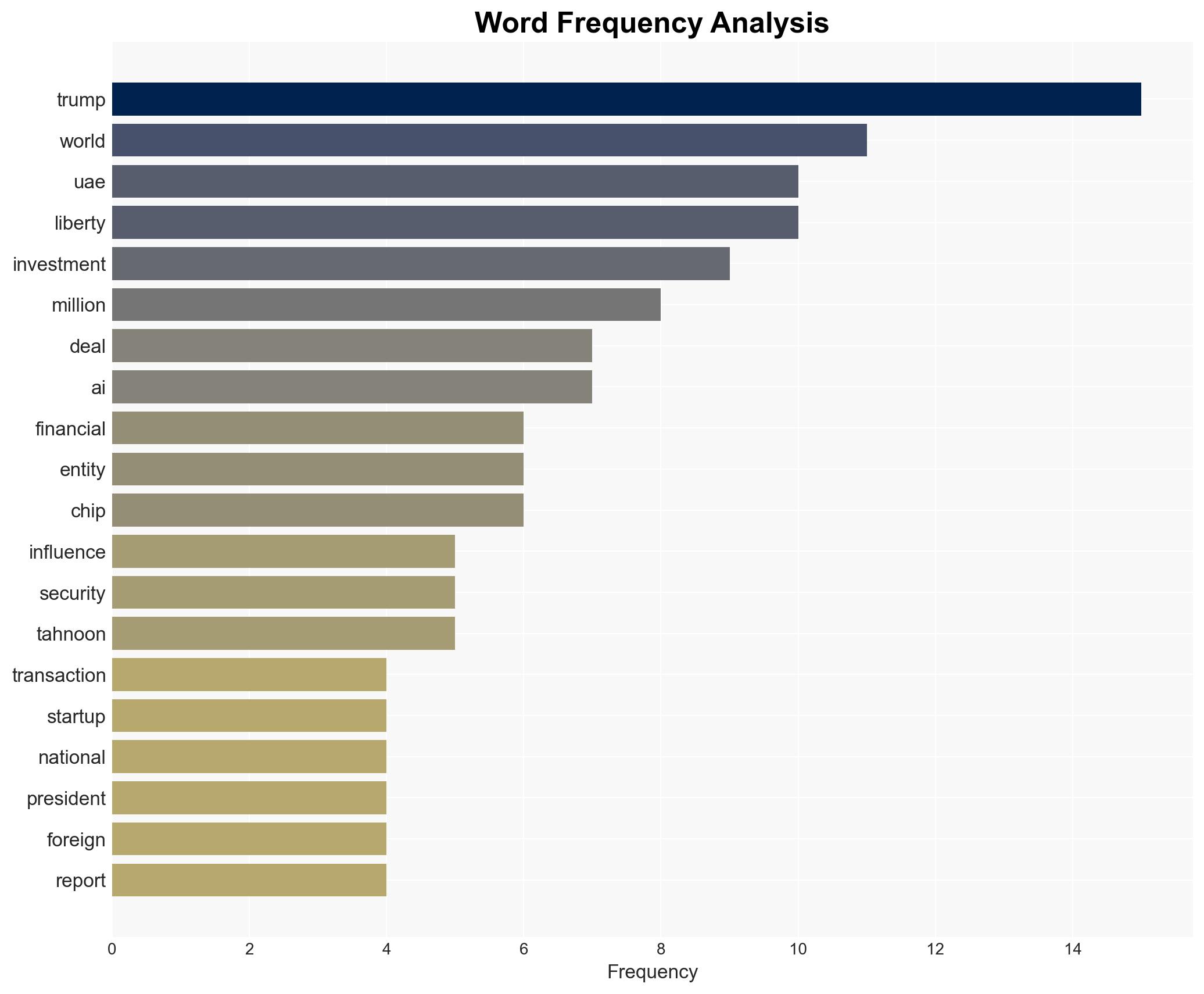

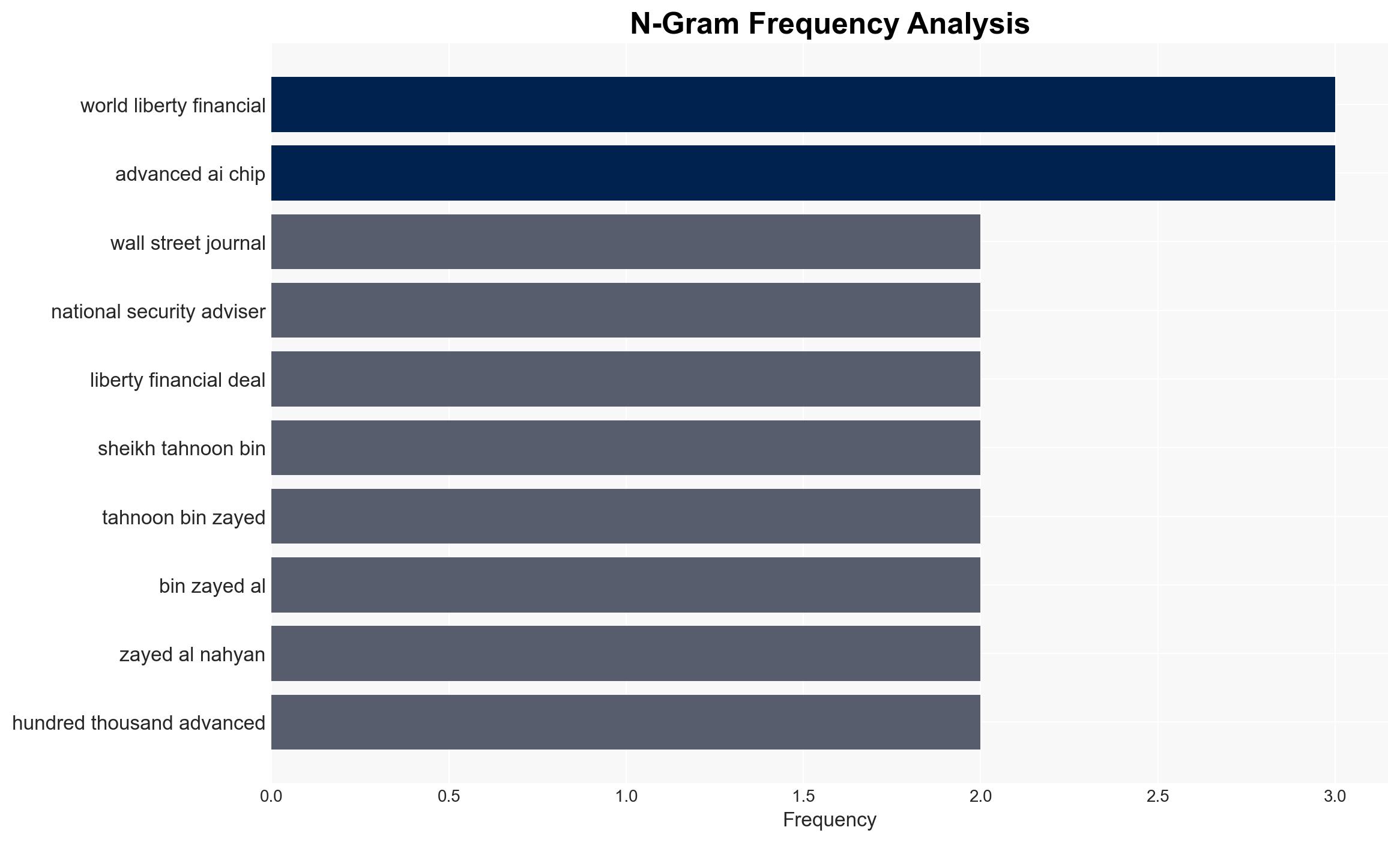

The acquisition of a 49% stake in World Liberty Financial by a UAE entity linked to Sheikh Tahnoon bin Zayed Al Nahyan raises significant concerns about foreign influence on U.S. national security policy, particularly regarding advanced AI technology transfers. The transaction, involving substantial financial flows to Trump-affiliated entities, suggests potential realignment of U.S. priorities in favor of UAE interests. Overall confidence in this judgment is moderate, given the complexity and opacity of the involved parties.

2. Competing Hypotheses

- Hypothesis A: The UAE’s investment in World Liberty Financial is primarily a strategic move to gain influence over U.S. policy decisions, particularly concerning AI technology access. This is supported by the timing of the investment and subsequent policy shifts, although the lack of transparency in the deal raises uncertainties.

- Hypothesis B: The transaction is a legitimate business investment with no ulterior motives beyond financial gain. While the lack of public disclosure and the involvement of politically connected individuals contradict this, it remains a plausible explanation absent direct evidence of influence peddling.

- Assessment: Hypothesis A is currently better supported due to the correlation between the investment and policy changes favoring UAE interests. Key indicators that could shift this judgment include further disclosures about the deal’s terms or additional evidence of policy influence.

3. Key Assumptions and Red Flags

- Assumptions: The UAE has strategic interests in accessing U.S. AI technology; Trump-affiliated entities are open to foreign influence; U.S. policy shifts are influenced by financial transactions.

- Information Gaps: Details of the contractual terms between the UAE and World Liberty Financial; the extent of U.S. policy changes directly attributable to this investment.

- Bias & Deception Risks: Potential bias in sources reporting on Trump-related activities; risk of UAE or Trump entities manipulating information to obscure true intentions.

4. Implications and Strategic Risks

This development could lead to increased scrutiny of foreign investments in U.S. companies, particularly those with political connections. It may also prompt legislative or regulatory actions to safeguard national security interests.

- Political / Geopolitical: Potential strain on U.S.-UAE relations if perceived as undue influence; increased Congressional oversight on foreign investments.

- Security / Counter-Terrorism: Risk of sensitive technology transfer to entities with questionable affiliations, impacting U.S. security posture.

- Cyber / Information Space: Possible exploitation of digital platforms for influence operations; increased cyber espionage risks.

- Economic / Social: Potential destabilization of markets due to perceived political risks; public backlash against perceived foreign interference.

5. Recommendations and Outlook

- Immediate Actions (0–30 days): Initiate a comprehensive review of foreign investments in politically sensitive sectors; enhance monitoring of UAE-linked entities in the U.S.

- Medium-Term Posture (1–12 months): Strengthen legislative frameworks governing foreign investments; develop partnerships to safeguard critical technologies.

- Scenario Outlook:

- Best: Transparent disclosures lead to policy adjustments without major geopolitical fallout.

- Worst: Escalation of tensions with UAE and allies, leading to economic and diplomatic repercussions.

- Most-Likely: Incremental policy adjustments with ongoing scrutiny of foreign investments.

6. Key Individuals and Entities

- Sheikh Tahnoon bin Zayed Al Nahyan – UAE National Security Adviser

- Eric Trump – Signatory of the deal

- World Liberty Financial – Cryptocurrency firm linked to Trump

- Aryam Investment 1 – UAE investment firm

- G42 – Abu Dhabi AI company

7. Thematic Tags

regional conflicts, foreign influence, national security, AI technology, geopolitical risk, investment scrutiny, U.S.-UAE relations, political finance

Structured Analytic Techniques Applied

- Causal Layered Analysis (CLA): Analyze events across surface happenings, systems, worldviews, and myths.

- Cross-Impact Simulation: Model ripple effects across neighboring states, conflicts, or economic dependencies.

- Scenario Generation: Explore divergent futures under varying assumptions to identify plausible paths.

- Narrative Pattern Analysis: Deconstruct and track propaganda or influence narratives.

Explore more:

Regional Conflicts Briefs ·

Daily Summary ·

Support us