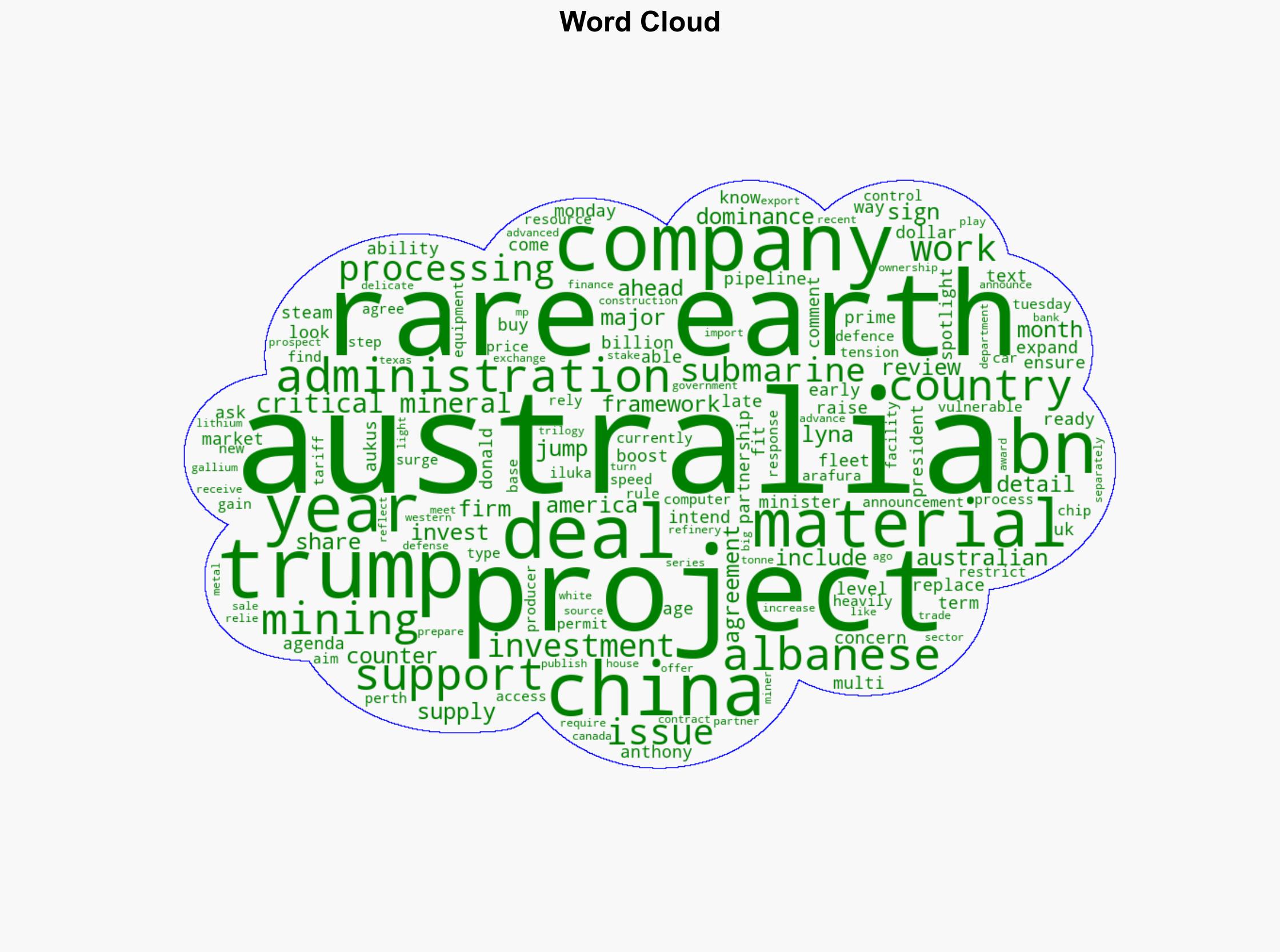

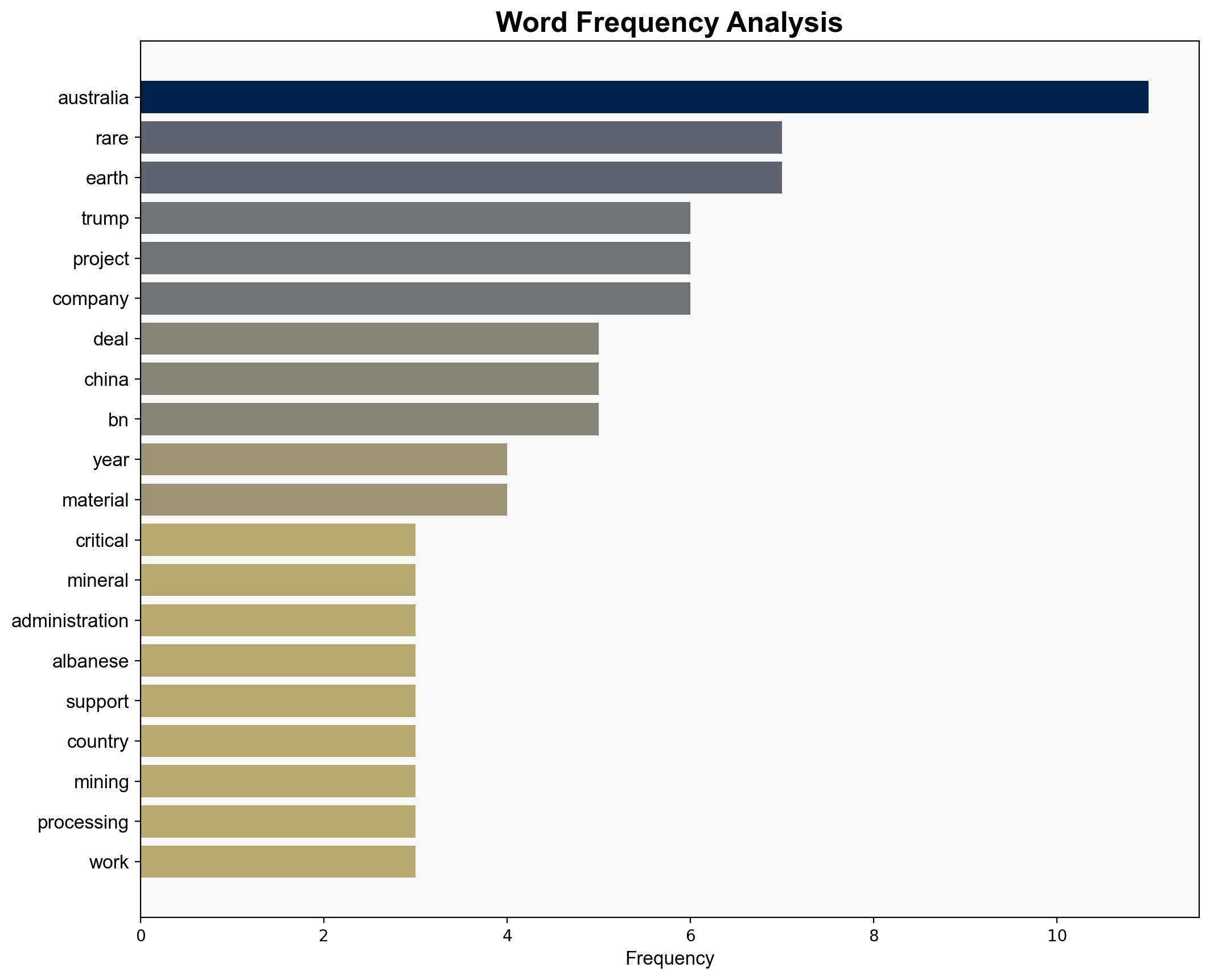

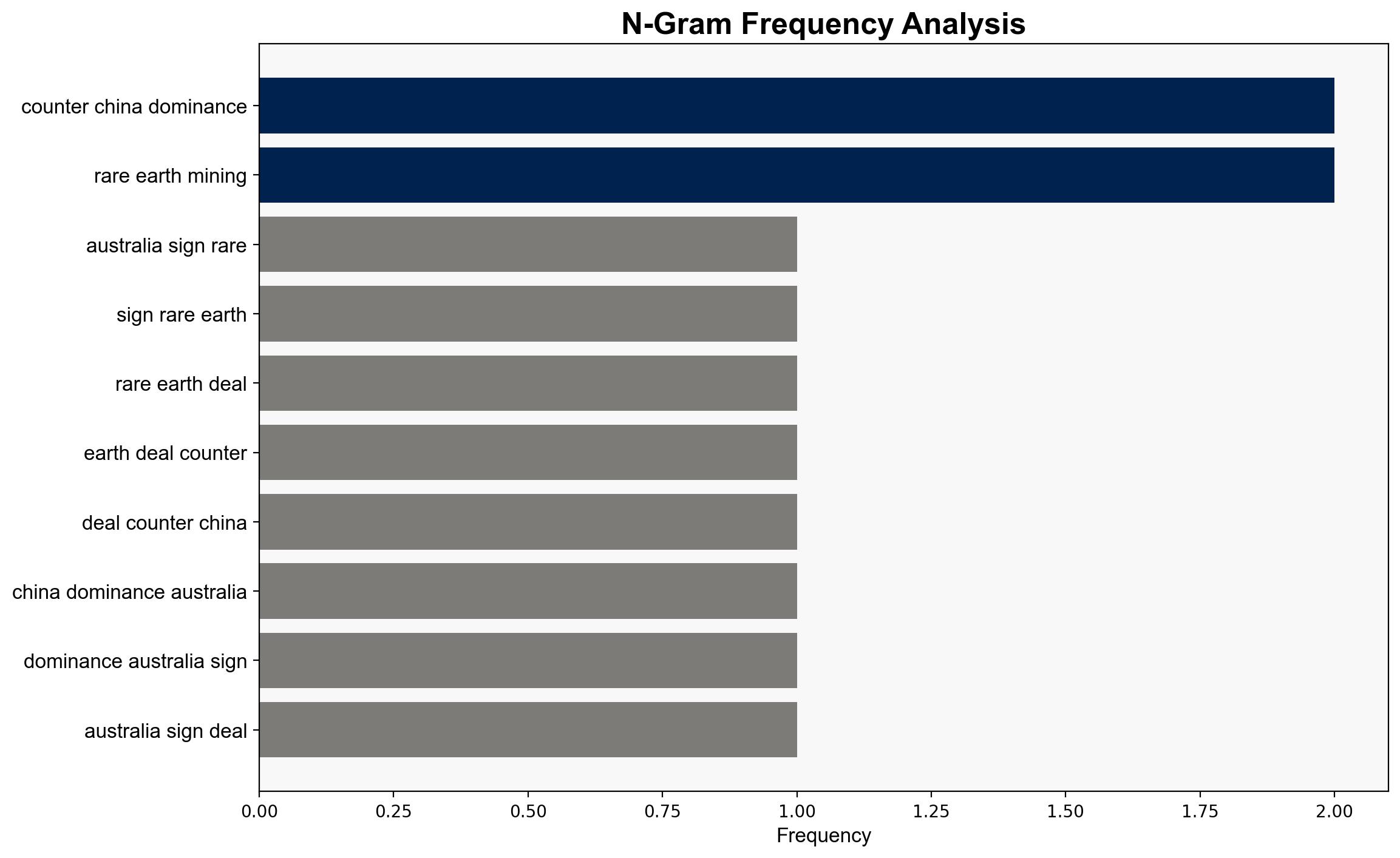

US and Australia sign rare earths deal to counter China’s dominance – BBC News

Published on: 2025-10-20

Intelligence Report: US and Australia sign rare earths deal to counter China’s dominance – BBC News

1. BLUF (Bottom Line Up Front)

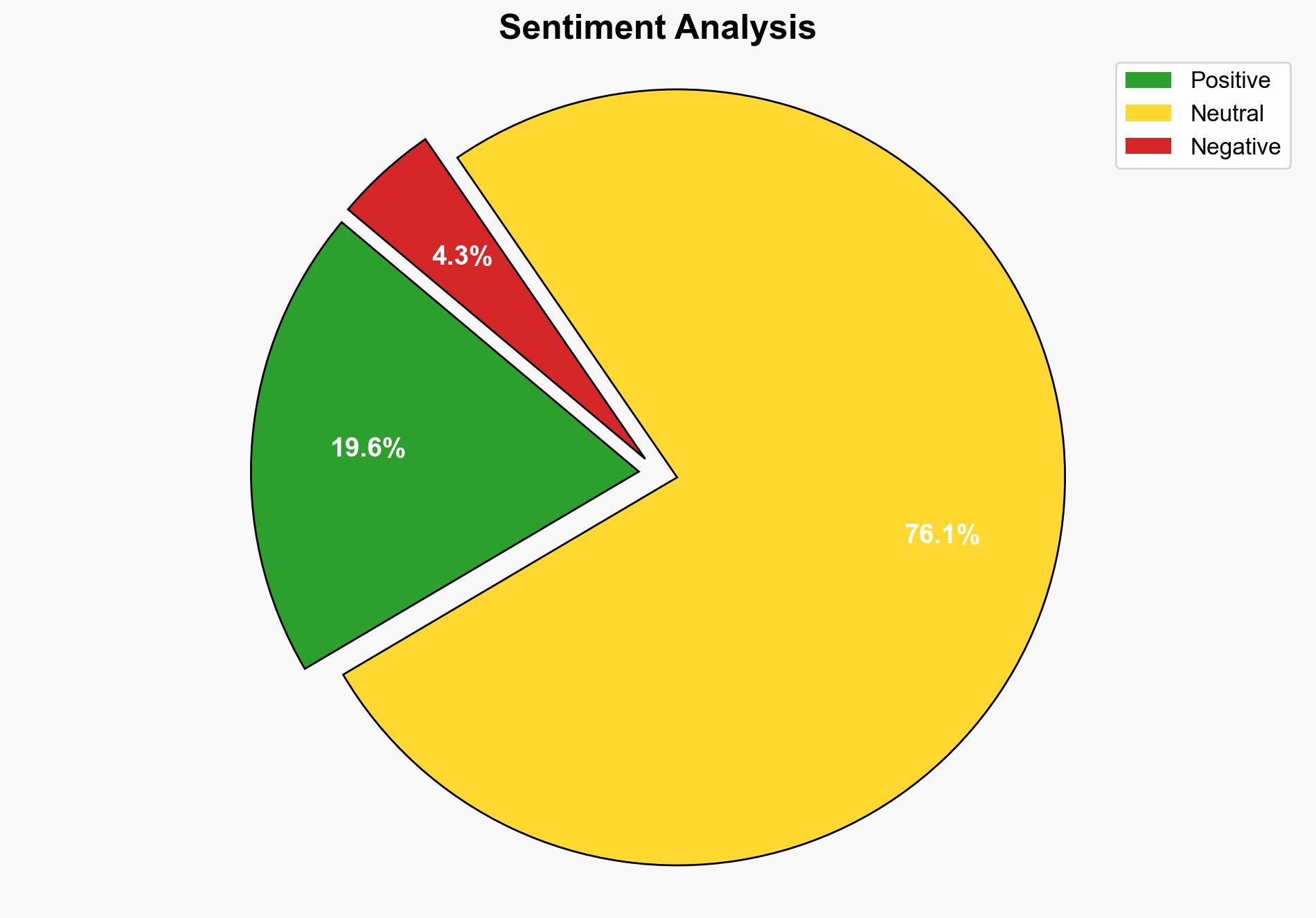

The strategic judgment is that the US-Australia rare earths deal is primarily aimed at reducing dependency on China for critical minerals, with a moderate confidence level. The most supported hypothesis is that this agreement is a proactive measure to secure supply chains and enhance geopolitical leverage. Recommended action includes further diversification of supply sources and investment in domestic processing capabilities.

2. Competing Hypotheses

1. **Hypothesis A**: The US-Australia deal is a strategic move to reduce dependency on China for rare earths, ensuring supply chain security and geopolitical leverage.

– **Supporting Evidence**: The deal aims to boost supply and processing capabilities, aligning with US efforts to counter China’s market dominance.

– **SAT Applied**: ACH 2.0 indicates strong alignment with US strategic goals to diversify critical mineral sources.

2. **Hypothesis B**: The deal is primarily an economic initiative to stimulate investment and development in Australia’s mining sector, with geopolitical considerations being secondary.

– **Supporting Evidence**: Significant investment in Australian projects and infrastructure suggests economic motivations.

– **SAT Applied**: Bayesian Scenario Modeling shows moderate probability, with economic benefits being a primary driver.

3. Key Assumptions and Red Flags

– **Assumptions**: The US and Australia have the capacity to rapidly develop alternative supply chains. China will not retaliate economically or diplomatically in a manner that significantly disrupts global markets.

– **Red Flags**: Lack of detailed implementation plans could indicate overestimation of project timelines. Potential underestimation of China’s response capabilities.

– **Blind Spots**: The impact of environmental regulations on mining expansion and processing is not addressed.

4. Implications and Strategic Risks

– **Economic**: Potential for increased investment in the rare earths sector, but also risk of market volatility if China responds with trade restrictions.

– **Geopolitical**: Strengthened US-Australia alliance may provoke a strategic recalibration by China, possibly affecting regional stability.

– **Cyber**: Increased cyber espionage risks targeting rare earths supply chains.

– **Psychological**: Perception of a US-led coalition against China could escalate tensions.

5. Recommendations and Outlook

- **Mitigation**: Encourage further diversification of rare earths sources, including partnerships with other nations.

- **Exploitation**: Invest in technology to improve processing efficiency and reduce environmental impact.

- **Scenario Projections**:

– **Best Case**: Successful diversification leads to stable supply chains and reduced geopolitical tensions.

– **Worst Case**: Economic retaliation by China disrupts global markets and heightens regional tensions.

– **Most Likely**: Gradual improvement in supply chain security with moderate geopolitical friction.

6. Key Individuals and Entities

– Anthony Albanese

– Donald Trump

– Arafura Rare Earth

– Iluka Resources

– Lynas Rare Earth

7. Thematic Tags

national security threats, economic strategy, geopolitical dynamics, resource security