US Blacklists Crypto Network Behind Ruble-Backed Stablecoin and Shuttered Exchange Garantex – CoinDesk

Published on: 2025-08-14

Intelligence Report: US Blacklists Crypto Network Behind Ruble-Backed Stablecoin and Shuttered Exchange Garantex – CoinDesk

1. BLUF (Bottom Line Up Front)

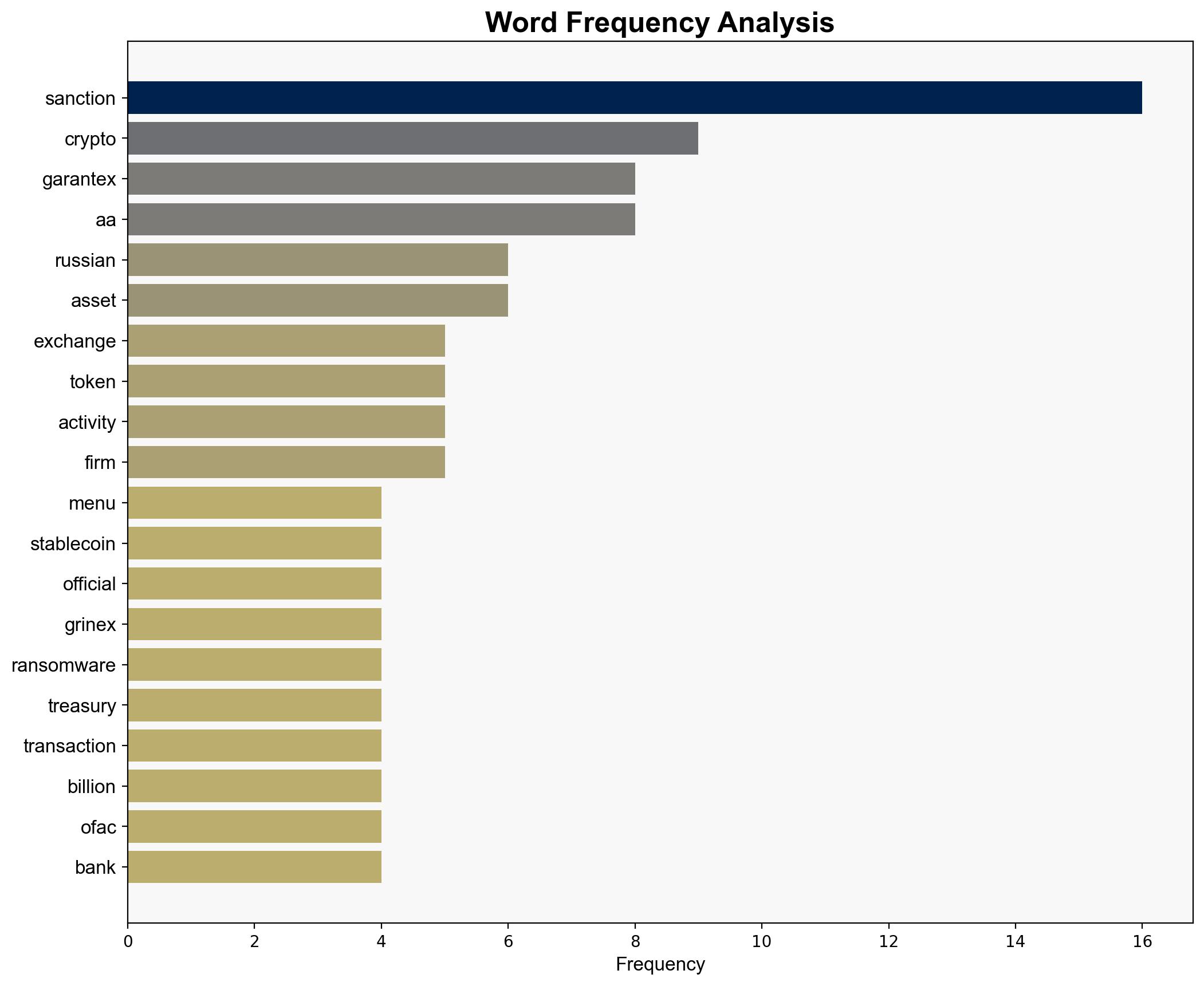

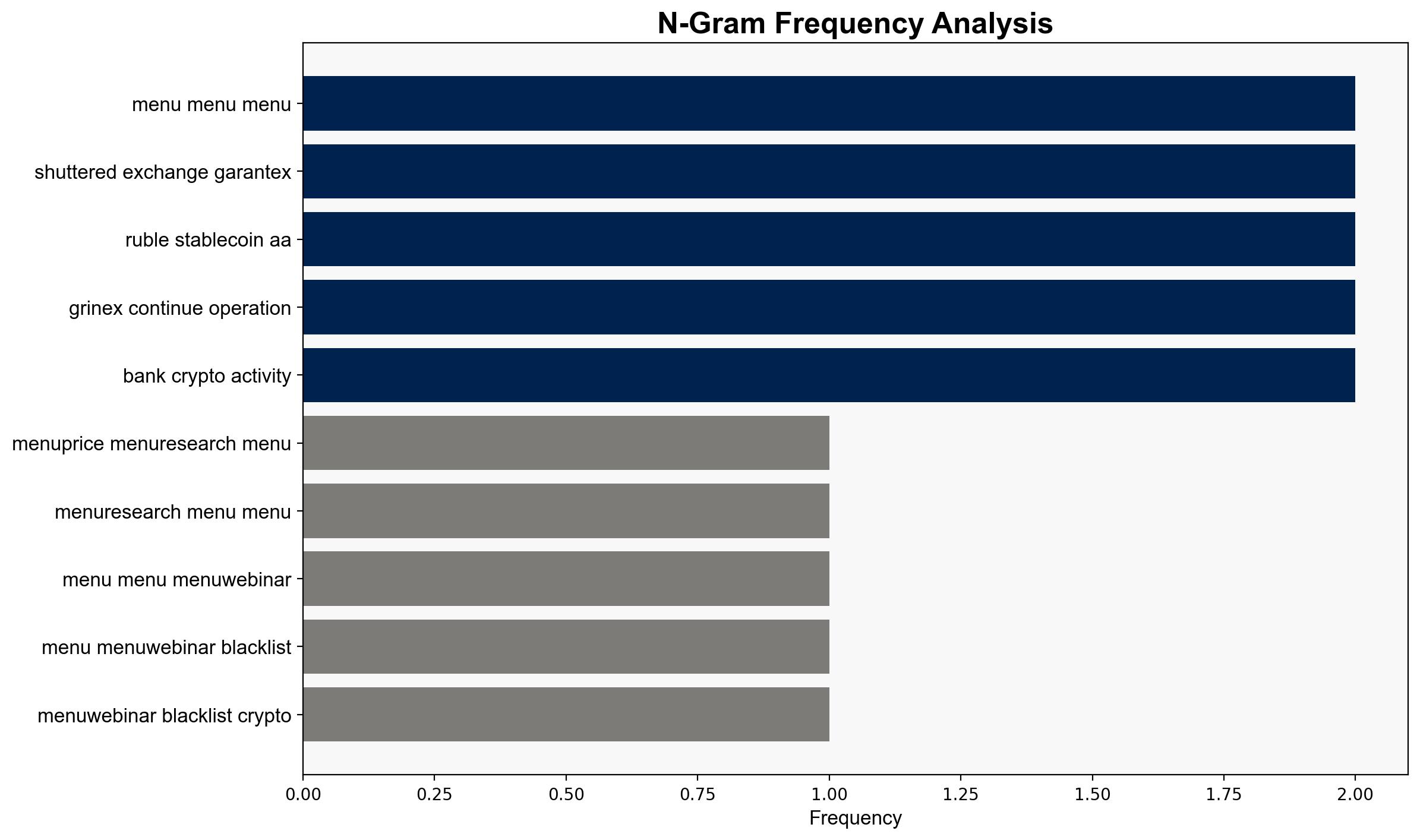

The US Treasury’s action against the crypto network associated with the ruble-backed stablecoin and the shuttered exchange Garantex is a strategic move to curb sanction evasion by Russian entities. The most supported hypothesis is that these networks are primarily used to bypass international sanctions, posing a significant national security threat. Recommended action includes enhancing international cooperation to monitor and disrupt these networks. Confidence Level: High.

2. Competing Hypotheses

1. **Hypothesis A**: The primary purpose of the ruble-backed stablecoin and associated networks is to facilitate sanction evasion by Russian entities, enabling them to conduct cross-border transactions outside the traditional banking system.

2. **Hypothesis B**: The networks are primarily used for legitimate financial activities, with only a minority of transactions linked to sanction evasion or illicit activities.

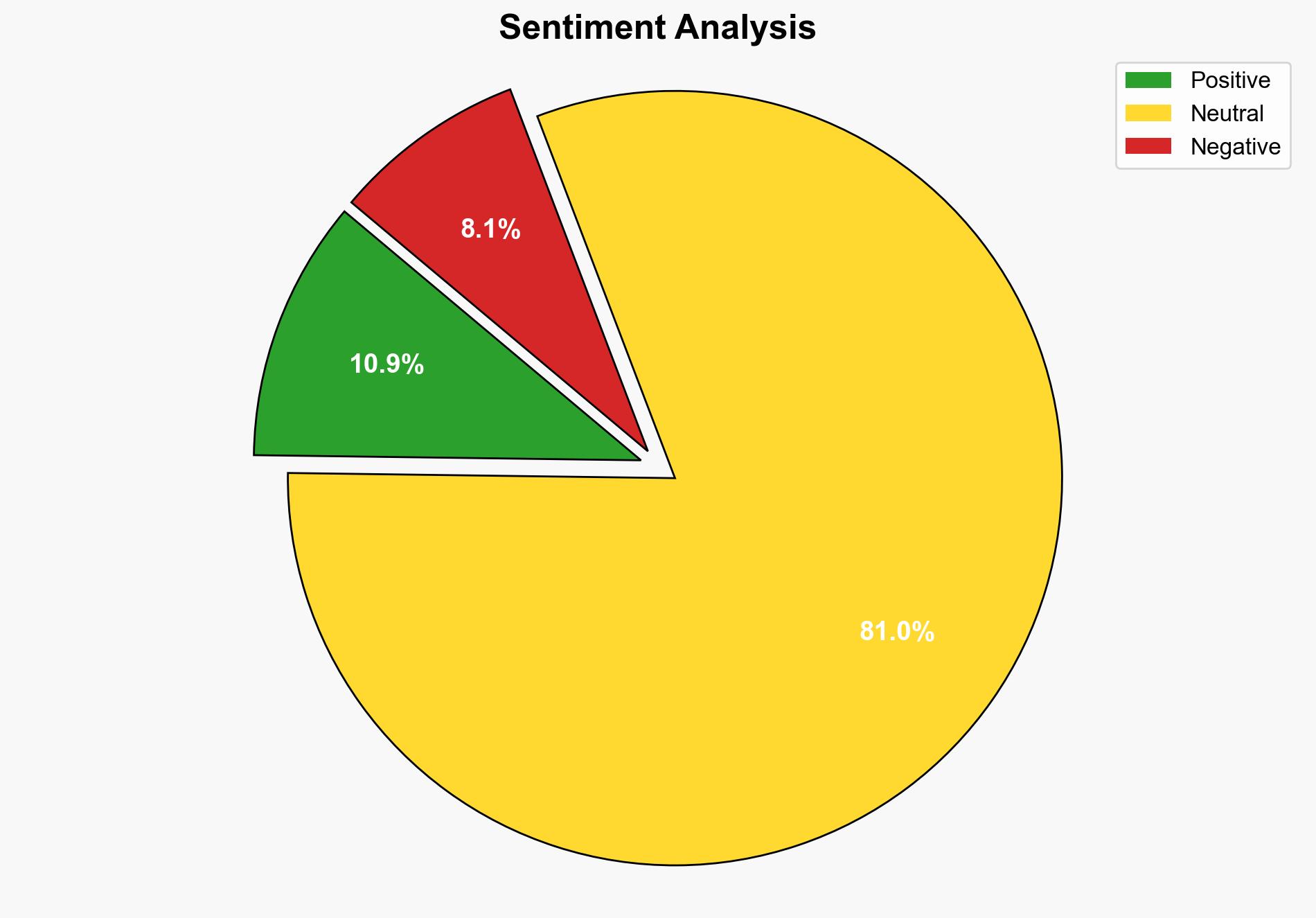

Using the Analysis of Competing Hypotheses (ACH) 2.0, Hypothesis A is better supported due to the volume of transactions linked to ransomware and darknet activities, as well as the involvement of sanctioned individuals and entities.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that the majority of transactions through these networks are illicit. This may overlook legitimate uses of the technology.

– **Red Flags**: The rapid creation of successor networks like Grinex suggests a deliberate strategy to evade sanctions, indicating potential deception.

– **Blind Spots**: Limited visibility into the full scope of transactions and the potential involvement of non-Russian entities.

4. Implications and Strategic Risks

The continued operation of these networks poses a risk of undermining international sanctions, potentially emboldening other sanctioned states to adopt similar strategies. This could lead to a proliferation of alternative financial systems that bypass traditional regulatory oversight, increasing cyber and financial crime risks.

5. Recommendations and Outlook

- Enhance international collaboration with law enforcement and financial institutions to monitor and disrupt these networks.

- Develop advanced analytic tools to detect and trace illicit transactions in real-time.

- Scenario Projections:

- Best Case: Successful disruption of networks leads to a significant reduction in sanction evasion activities.

- Worst Case: Networks proliferate, leading to widespread adoption of alternative financial systems by other sanctioned entities.

- Most Likely: Continued cat-and-mouse game with periodic disruptions but persistent evasion efforts.

6. Key Individuals and Entities

– Sergey Mendeleev

– Aleksandr Mira

– Pavel Karavatsky

– Ilan Shor

– Old Vector LLC

– Promsvyazbank (PSB)

7. Thematic Tags

national security threats, cybersecurity, counter-terrorism, regional focus