US Government Shutdown UK ETNs Hedera Upgrade Crypto Week Ahead – CoinDesk

Published on: 2025-10-06

Intelligence Report: US Government Shutdown UK ETNs Hedera Upgrade Crypto Week Ahead – CoinDesk

1. BLUF (Bottom Line Up Front)

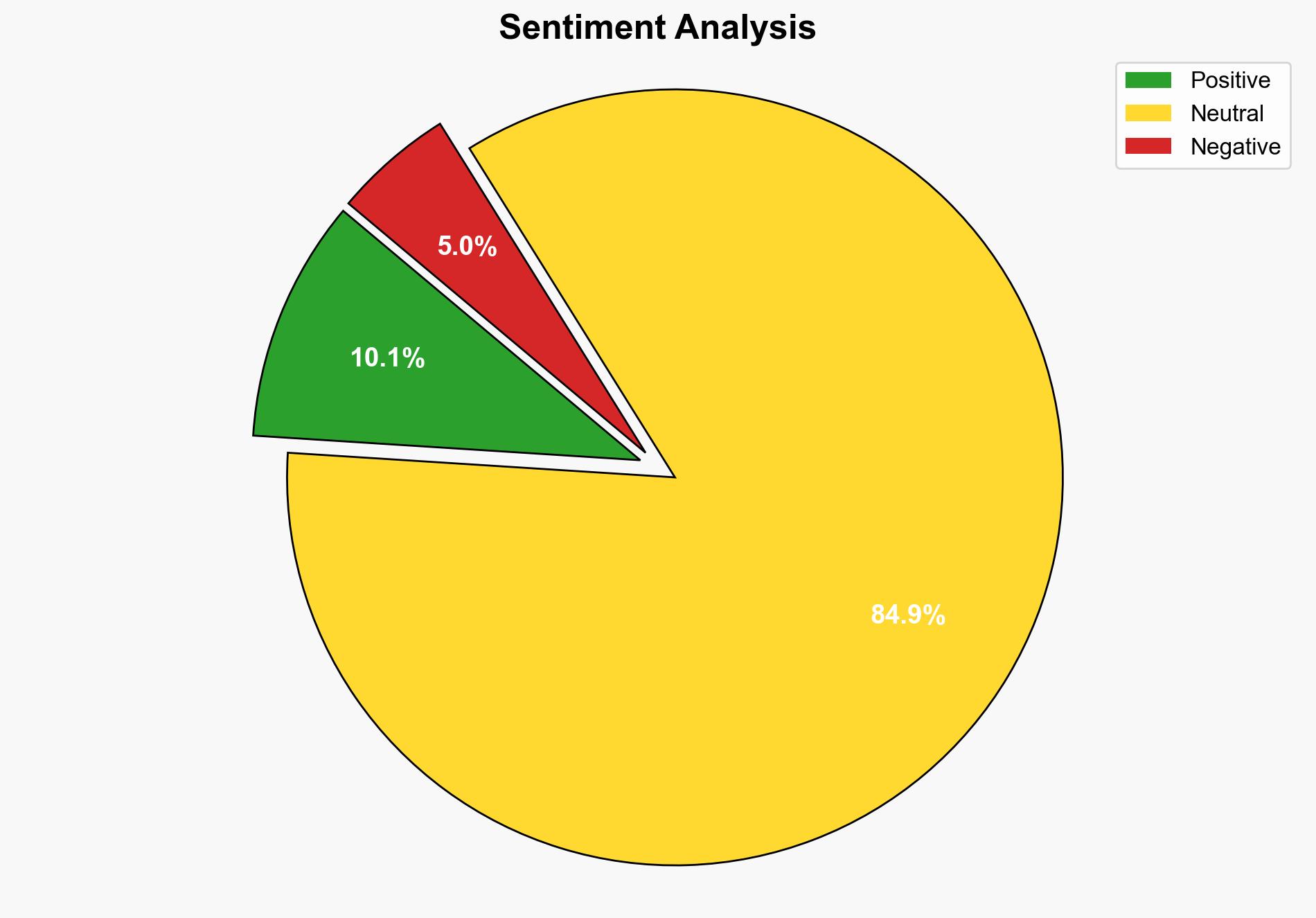

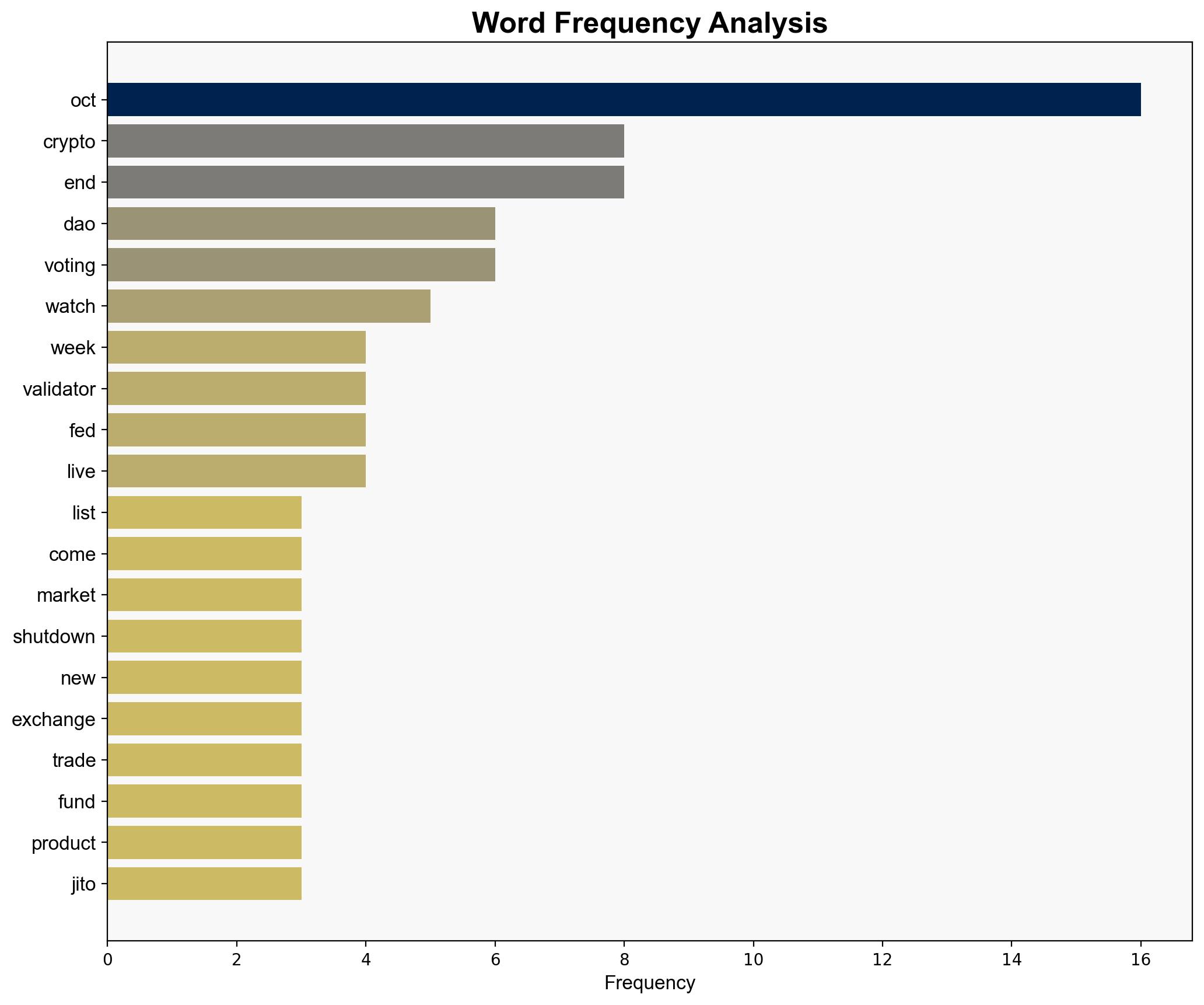

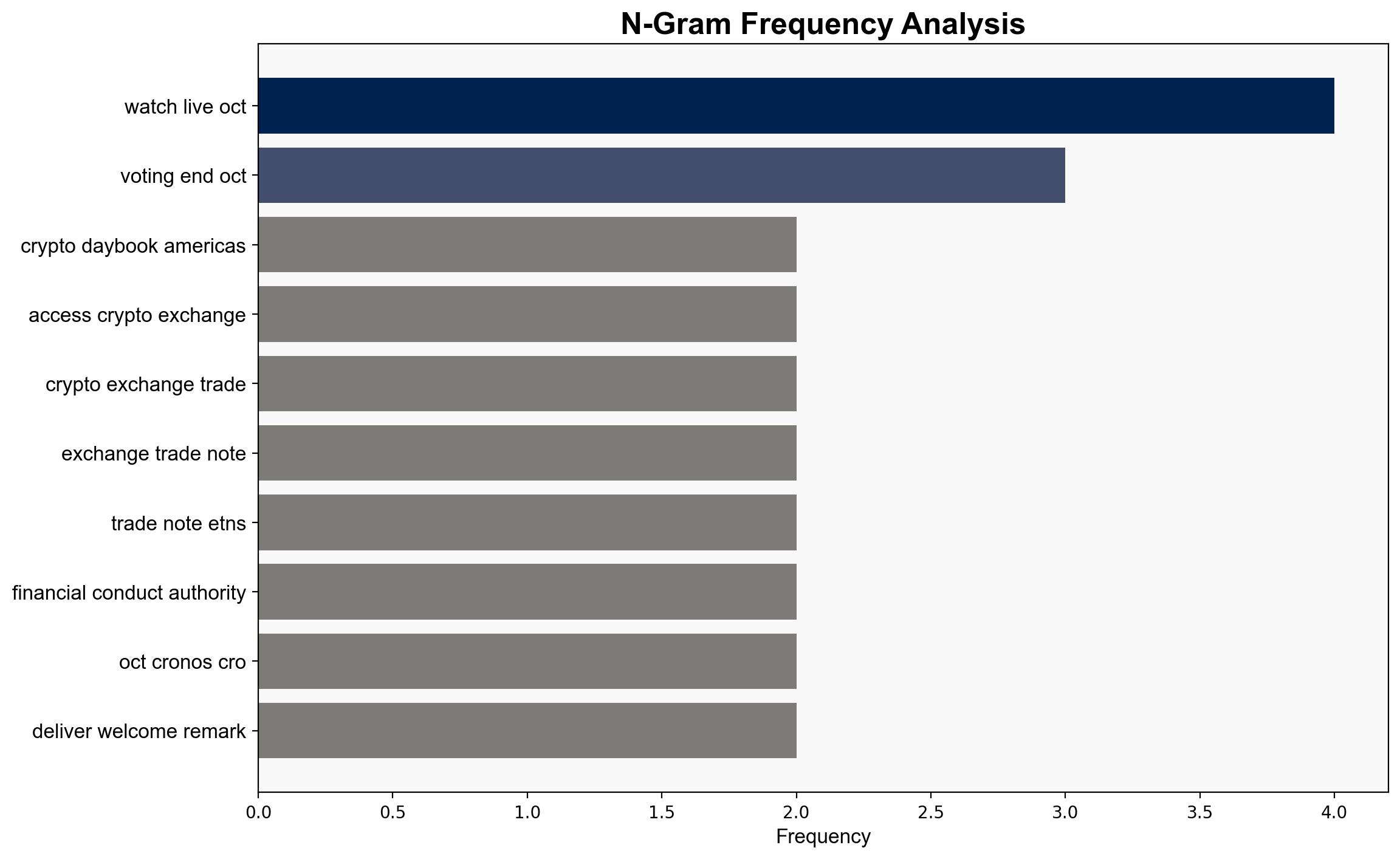

The analysis suggests that the potential US government shutdown and regulatory changes in the UK regarding Exchange-Traded Notes (ETNs) could significantly impact the cryptocurrency market. The hypothesis that the shutdown will delay key economic data releases, affecting market volatility, is better supported. Confidence level: Moderate. Recommended action: Monitor regulatory developments and prepare for increased market volatility.

2. Competing Hypotheses

Hypothesis 1: The US government shutdown will delay key economic data releases, leading to increased market volatility and uncertainty in the cryptocurrency market.

Hypothesis 2: The UK Financial Conduct Authority’s (FCA) decision to rescind the ban on ETNs will provide retail investors with new opportunities, stabilizing the cryptocurrency market despite the US government shutdown.

Using Analysis of Competing Hypotheses (ACH), Hypothesis 1 is better supported due to the immediate impact of delayed economic data on market sentiment and trading activities. Hypothesis 2, while plausible, relies on longer-term regulatory changes that may not immediately counteract the effects of a government shutdown.

3. Key Assumptions and Red Flags

Assumptions:

– The US government shutdown will occur and last long enough to delay significant economic data releases.

– The cryptocurrency market is sensitive to macroeconomic data and regulatory changes.

– UK retail investors will quickly adapt to the availability of ETNs.

Red Flags:

– Inconsistent data on the duration and impact of the government shutdown.

– Potential overestimation of the immediate impact of UK regulatory changes on the global crypto market.

4. Implications and Strategic Risks

The US government shutdown could lead to a cascade of economic uncertainties, affecting investor confidence and market stability. This may result in increased volatility in the cryptocurrency market. Conversely, the UK regulatory changes could attract new investors, potentially offsetting some negative impacts. However, the timing and scale of these effects remain uncertain.

5. Recommendations and Outlook

- Monitor US government activities closely to anticipate the duration and impact of the shutdown.

- Engage with UK regulatory updates to understand the implications of ETN availability for retail investors.

- Scenario Projections:

- Best Case: Quick resolution of the US shutdown and positive market response to UK ETNs stabilize the crypto market.

- Worst Case: Prolonged shutdown exacerbates market volatility, overshadowing UK regulatory benefits.

- Most Likely: Initial volatility due to the shutdown, with gradual stabilization as UK regulatory changes take effect.

6. Key Individuals and Entities

– Michelle Bowman

– Stephen Miran

– Michael Barr

– Jerome Powell

7. Thematic Tags

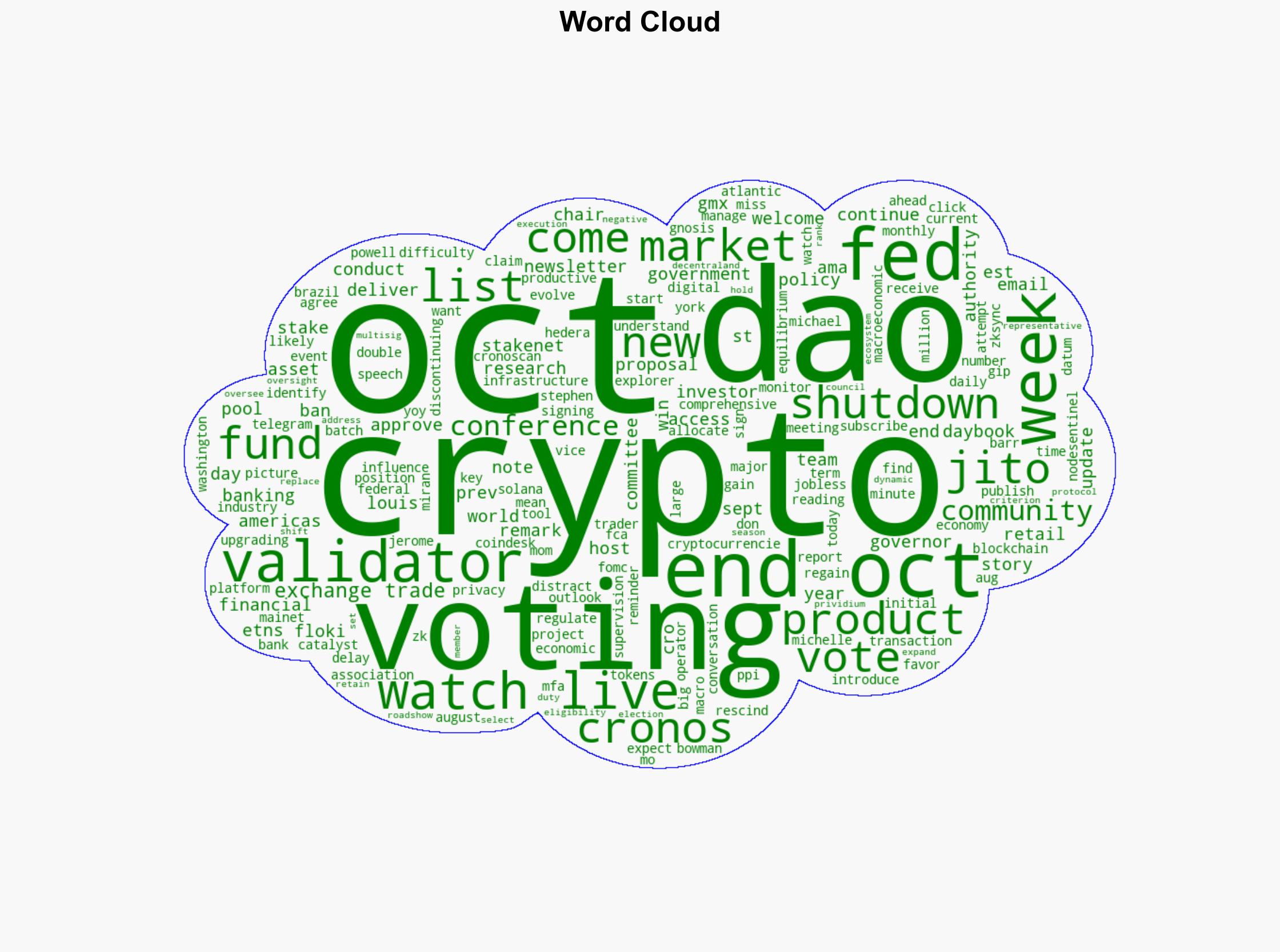

national security threats, cybersecurity, financial regulation, market volatility, cryptocurrency