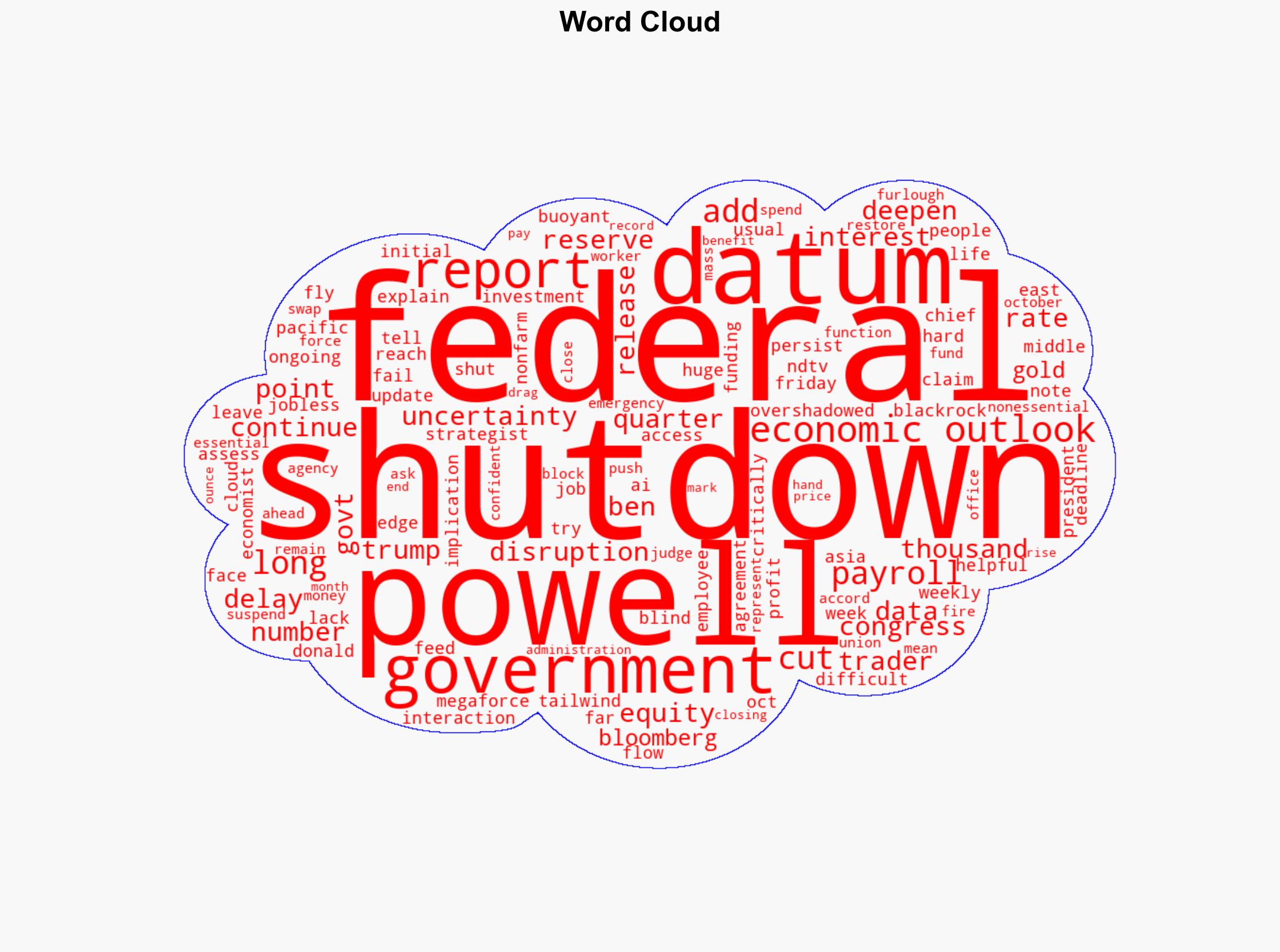

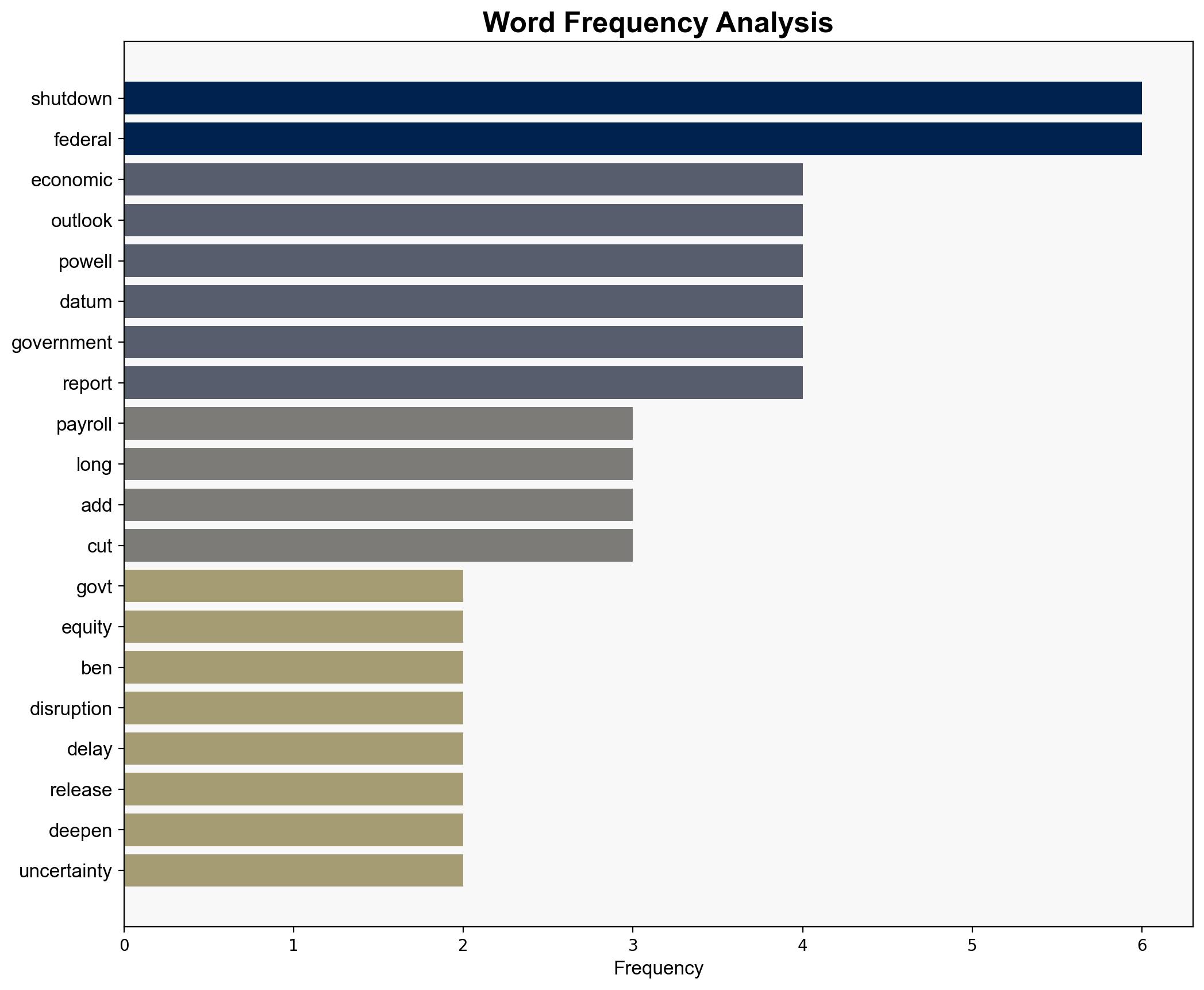

US Govt Shutdown Clouds Economic Outlook What Keeps Equities Buoyant Ben Powell Explains – Ndtvprofit.com

Published on: 2025-10-06

Intelligence Report: US Govt Shutdown Clouds Economic Outlook What Keeps Equities Buoyant Ben Powell Explains – Ndtvprofit.com

1. BLUF (Bottom Line Up Front)

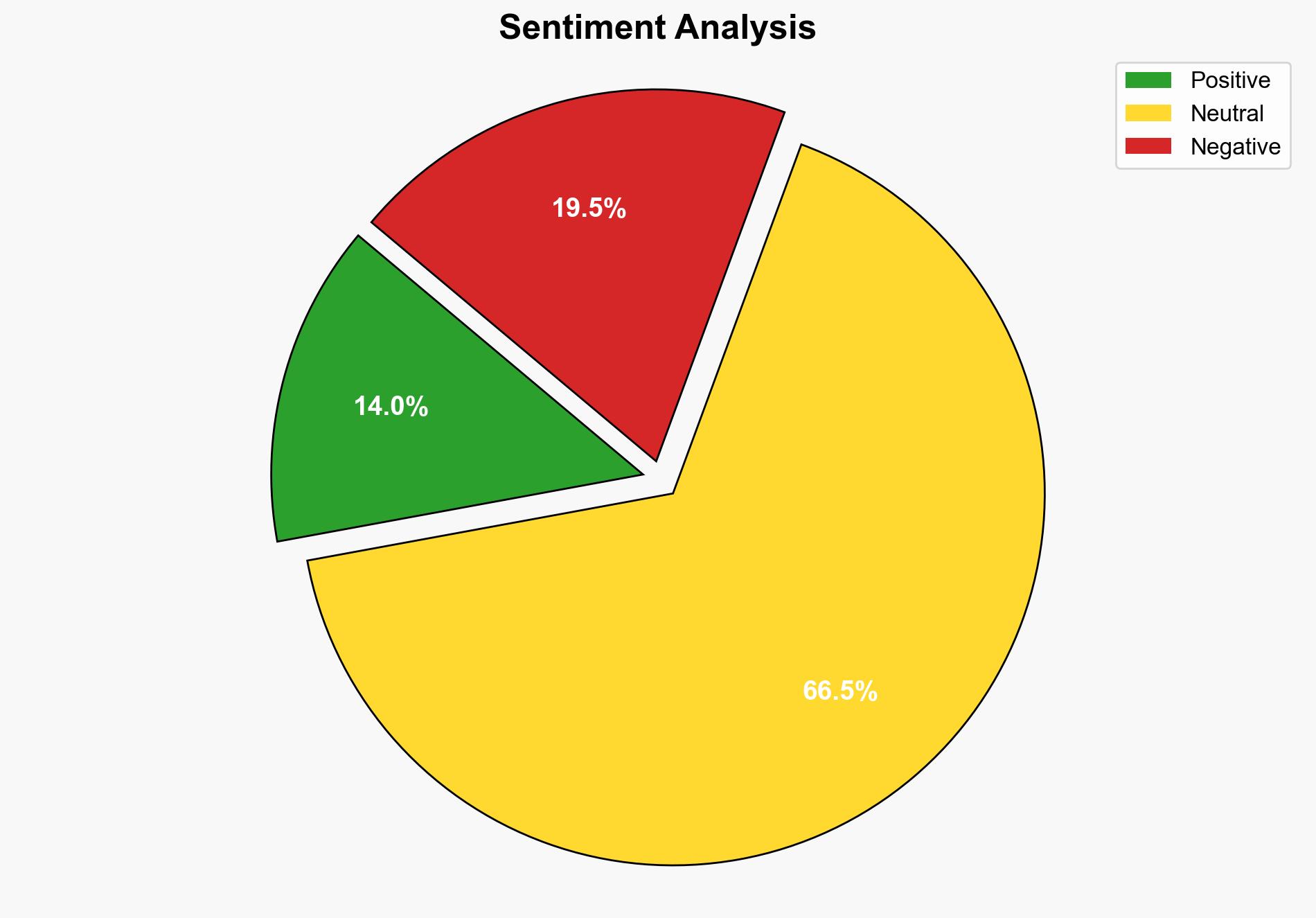

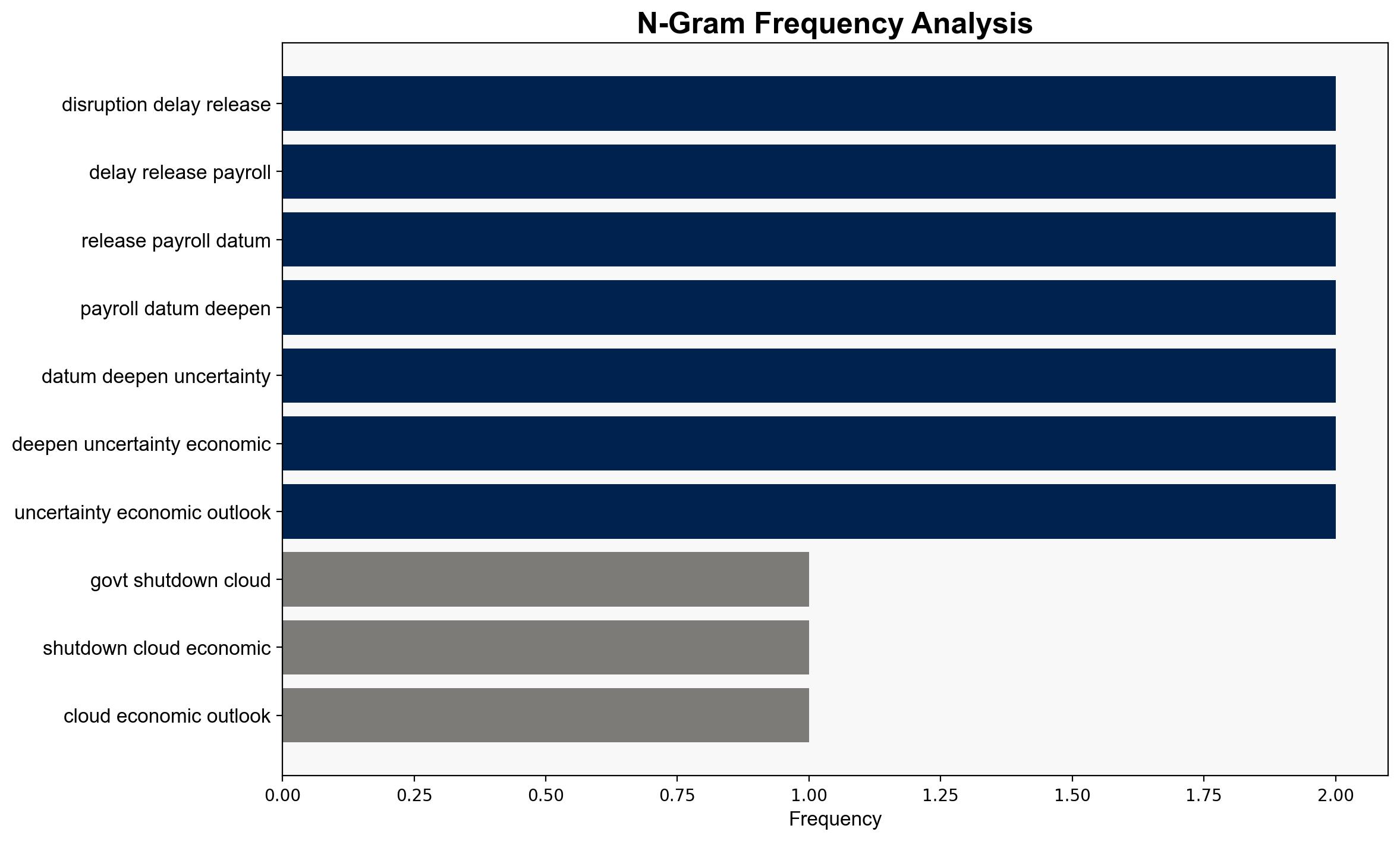

The analysis suggests that despite the economic uncertainty caused by the US government shutdown, equities remain buoyant due to the influence of AI-driven market forces. The hypothesis that AI and other technological advancements are providing a strong tailwind for equities is better supported. Confidence level: Moderate. Recommended action: Monitor AI sector developments and potential shifts in Federal Reserve policy.

2. Competing Hypotheses

1. **Hypothesis A**: The government shutdown is creating significant economic uncertainty, which should negatively impact equity markets. However, equities remain buoyant due to AI and technological advancements providing a strong counterbalance.

2. **Hypothesis B**: The buoyancy of equities is primarily due to market confidence in an impending Federal Reserve interest rate cut, rather than technological advancements.

Using ACH 2.0, Hypothesis A is more supported due to the emphasis on AI as a significant factor in the source text, while Hypothesis B lacks direct evidence linking rate cut expectations to current equity performance.

3. Key Assumptions and Red Flags

– **Assumptions**: Hypothesis A assumes that AI and technological advancements have a substantial and immediate impact on equity markets. Hypothesis B assumes that market participants are primarily motivated by Federal Reserve actions.

– **Red Flags**: The lack of detailed data on AI’s specific impact on equities and the assumption that the Federal Reserve’s actions are the sole driver of market confidence.

– **Blind Spots**: Potential overestimation of AI’s immediate impact and underestimation of geopolitical factors affecting market sentiment.

4. Implications and Strategic Risks

The ongoing government shutdown could lead to prolonged economic uncertainty, affecting consumer confidence and spending. If AI-driven market forces are overestimated, a correction could occur if technological advancements fail to meet expectations. Additionally, if the Federal Reserve does not cut interest rates as anticipated, market volatility could increase.

5. Recommendations and Outlook

- Monitor developments in AI and technological sectors for potential impacts on equity markets.

- Prepare for possible market volatility if Federal Reserve actions deviate from expectations.

- Scenario Projections:

- Best Case: AI advancements continue to drive market growth, and the Federal Reserve cuts interest rates, stabilizing markets.

- Worst Case: AI impact is overestimated, and the Federal Reserve does not cut rates, leading to market correction.

- Most Likely: AI continues to support equities, but market volatility persists due to economic uncertainty.

6. Key Individuals and Entities

Ben Powell, BlackRock, Federal Reserve, President Donald Trump, Congress

7. Thematic Tags

economic uncertainty, AI impact, Federal Reserve policy, market volatility