US imposes sanctions on Hezbollah’s gold exchange and financial network to disrupt funding operations

Published on: 2026-02-11

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: US hits Hezbollah’s gold exchange and financial network with sanctions

1. BLUF (Bottom Line Up Front)

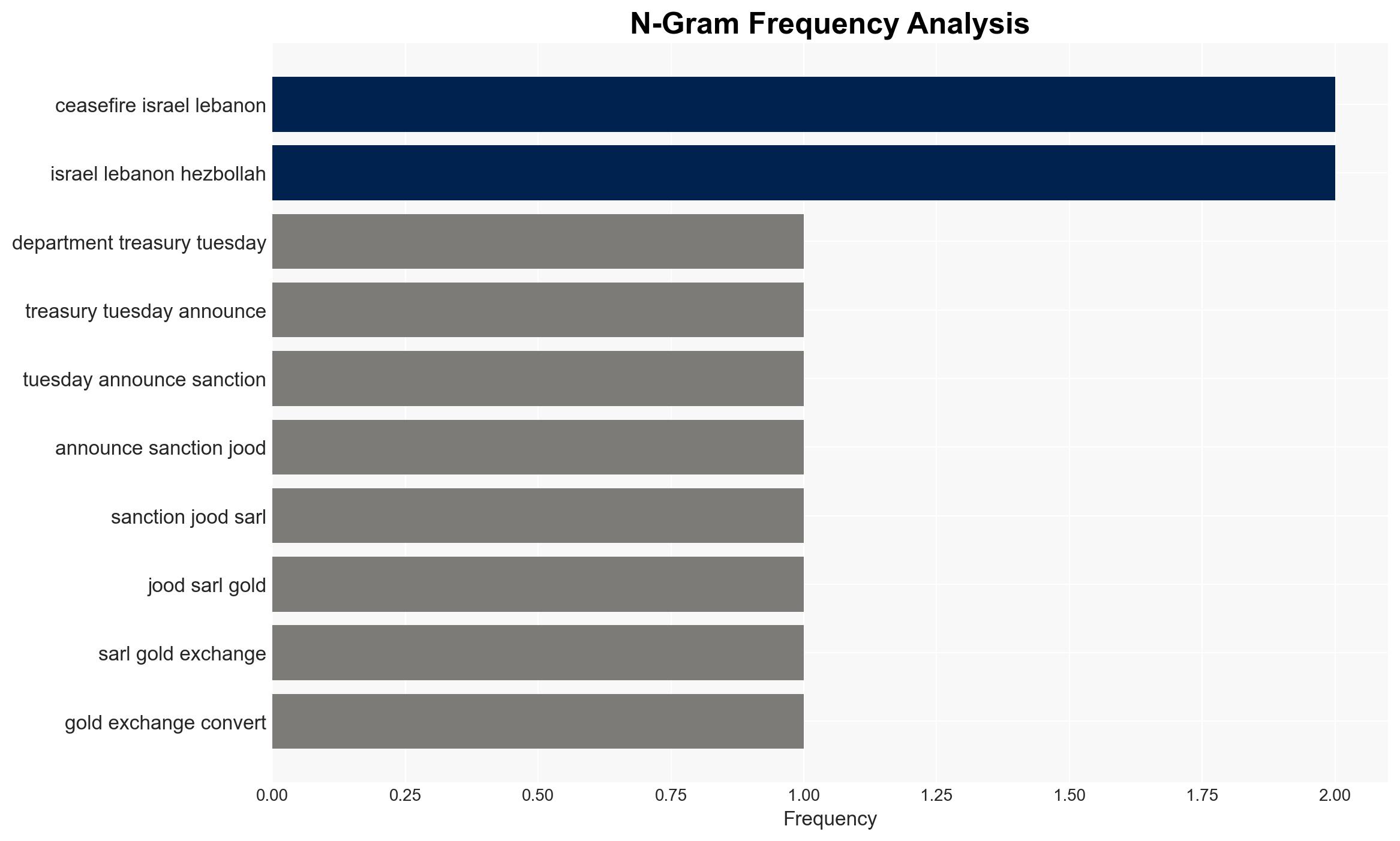

The US Treasury’s sanctions against Hezbollah’s financial network, including Jood SARL, aim to disrupt funding for Hezbollah’s terrorist activities. The most likely hypothesis is that these sanctions will temporarily hinder Hezbollah’s financial operations but may not lead to long-term disarmament or destabilization of Hezbollah. This action affects Hezbollah, its financial facilitators, and potentially the broader Middle East security landscape. Overall confidence in this assessment is moderate.

2. Competing Hypotheses

- Hypothesis A: The sanctions will significantly disrupt Hezbollah’s financial operations, leading to a reduction in its capability to conduct terrorist activities. Supporting evidence includes the targeting of key financial nodes and individuals. However, uncertainties remain about Hezbollah’s ability to adapt and find alternative funding sources.

- Hypothesis B: Hezbollah will circumvent the sanctions through alternative networks and continue its operations with minimal disruption. This is supported by Hezbollah’s historical resilience and adaptability in the face of sanctions. Contradicting evidence includes the comprehensive nature of the current sanctions.

- Assessment: Hypothesis B is currently better supported due to Hezbollah’s demonstrated ability to adapt to past sanctions and the complexity of dismantling entrenched financial networks. Key indicators that could shift this judgment include evidence of Hezbollah’s financial distress or successful enforcement of sanctions by international partners.

3. Key Assumptions and Red Flags

- Assumptions: Hezbollah relies significantly on Jood SARL for funding; sanctions will be enforced effectively; Hezbollah lacks immediate alternative funding sources.

- Information Gaps: Details on Hezbollah’s full financial network and alternative funding mechanisms; the extent of international cooperation in enforcing sanctions.

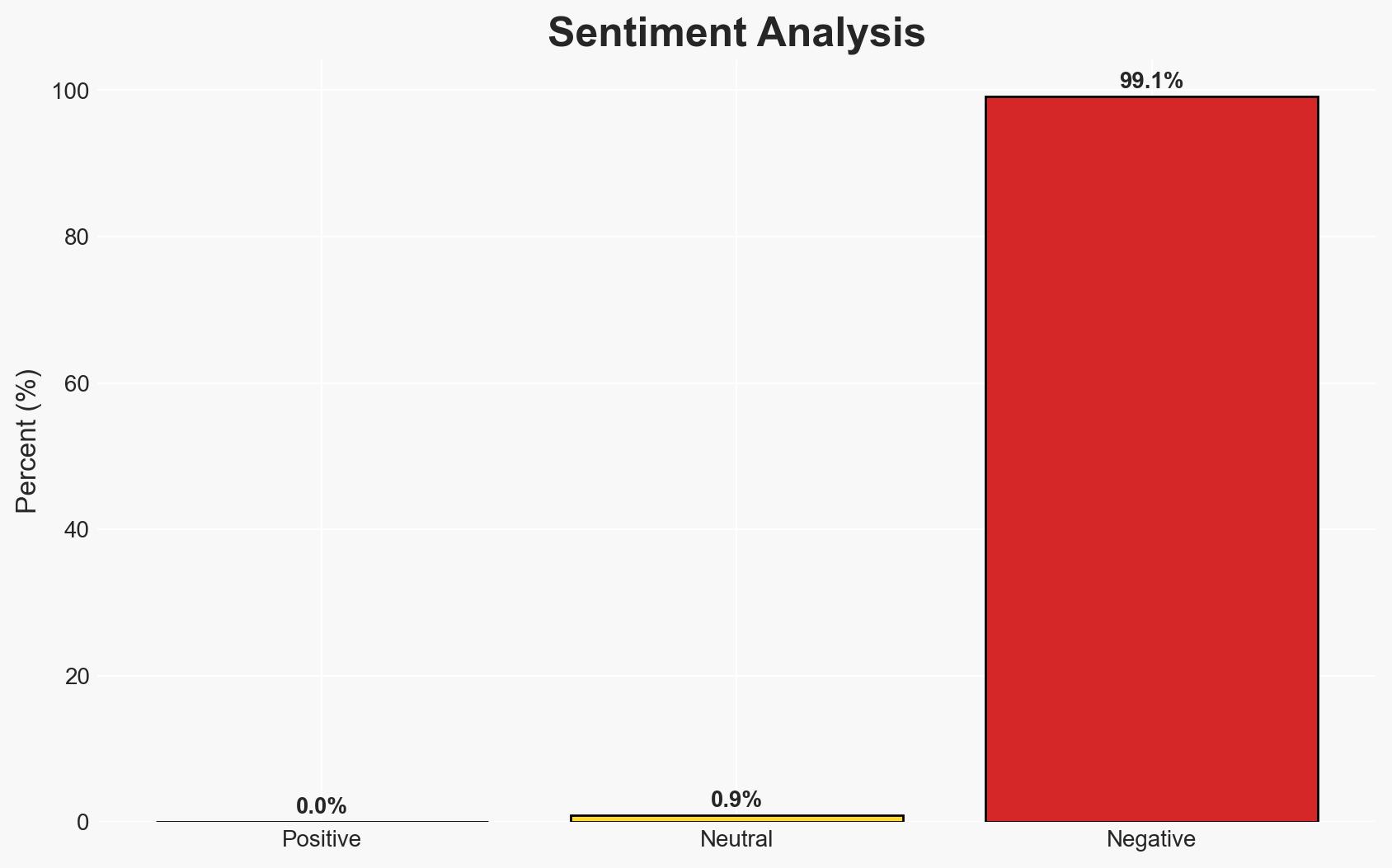

- Bias & Deception Risks: Potential bias in US sources emphasizing the effectiveness of sanctions; Hezbollah’s possible misinformation campaigns to downplay the impact.

4. Implications and Strategic Risks

This development could lead to temporary financial strain on Hezbollah, potentially reducing its operational tempo. However, it may also drive Hezbollah to strengthen its clandestine financial networks, complicating future counter-terrorism efforts.

- Political / Geopolitical: Increased tensions between the US and Hezbollah-supporting states; potential backlash affecting US interests in the region.

- Security / Counter-Terrorism: Short-term reduction in Hezbollah’s operational capacity; long-term risk of more sophisticated financial evasion tactics.

- Cyber / Information Space: Possible increase in cyber operations by Hezbollah to secure funding or retaliate against sanctions.

- Economic / Social: Potential economic impact on regions in Lebanon reliant on Hezbollah-linked financial activities; social unrest if Hezbollah’s support base is financially affected.

5. Recommendations and Outlook

- Immediate Actions (0–30 days): Monitor Hezbollah’s financial activities for signs of adaptation; enhance intelligence-sharing with regional partners.

- Medium-Term Posture (1–12 months): Develop resilience measures to counter Hezbollah’s financial networks; strengthen partnerships with international financial institutions for enforcement.

- Scenario Outlook:

- Best: Sanctions lead to significant disruption of Hezbollah’s operations, reducing regional tensions.

- Worst: Hezbollah adapts quickly, increasing regional instability and retaliatory actions.

- Most-Likely: Hezbollah experiences temporary disruption but continues operations with alternative funding.

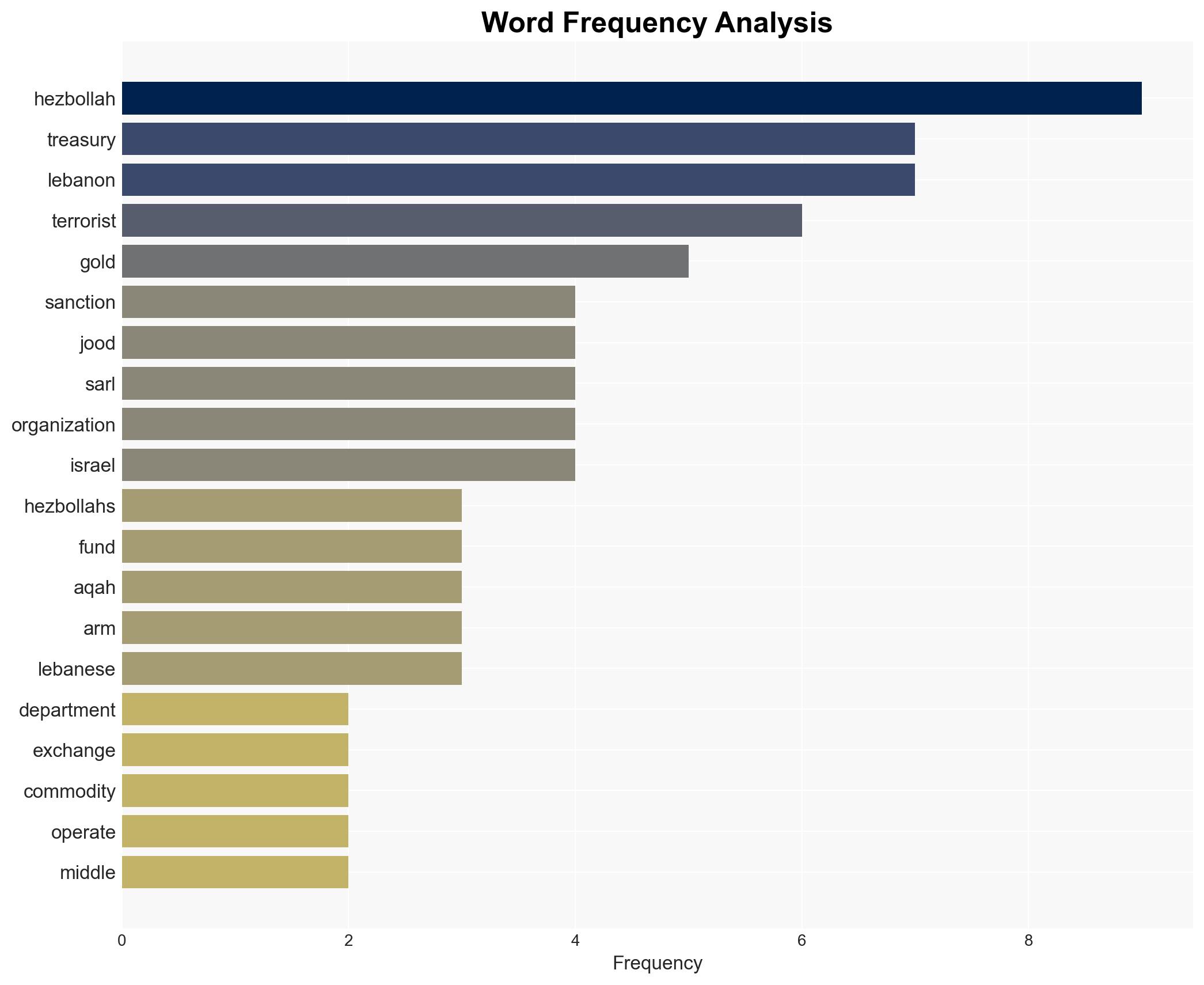

6. Key Individuals and Entities

- Jood SARL

- Al-Qard al-Hassan (AQAH)

- Mohamed Nayef Maged

- Ali Karnib

7. Thematic Tags

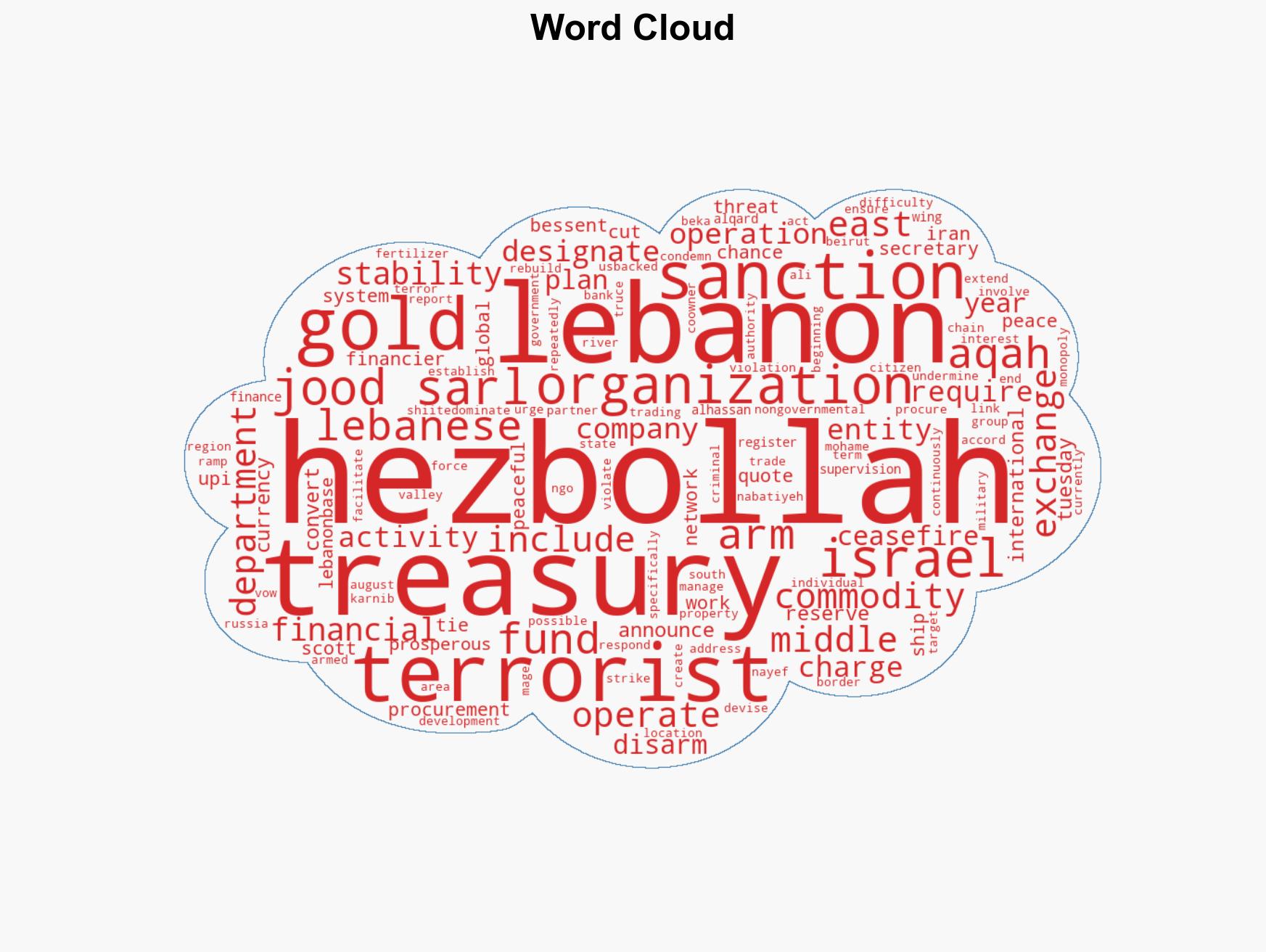

regional conflicts, counter-terrorism, sanctions, Hezbollah, financial networks, Middle East security, US Treasury, international cooperation

Structured Analytic Techniques Applied

- Causal Layered Analysis (CLA): Analyze events across surface happenings, systems, worldviews, and myths.

- Cross-Impact Simulation: Model ripple effects across neighboring states, conflicts, or economic dependencies.

- Scenario Generation: Explore divergent futures under varying assumptions to identify plausible paths.

- Network Influence Mapping: Map influence relationships to assess actor impact.

Explore more:

Regional Conflicts Briefs ·

Daily Summary ·

Support us