US jury finds BNP Paribas enabled Sudanese atrocities – The Star Online

Published on: 2025-10-18

Intelligence Report: US jury finds BNP Paribas enabled Sudanese atrocities – The Star Online

1. BLUF (Bottom Line Up Front)

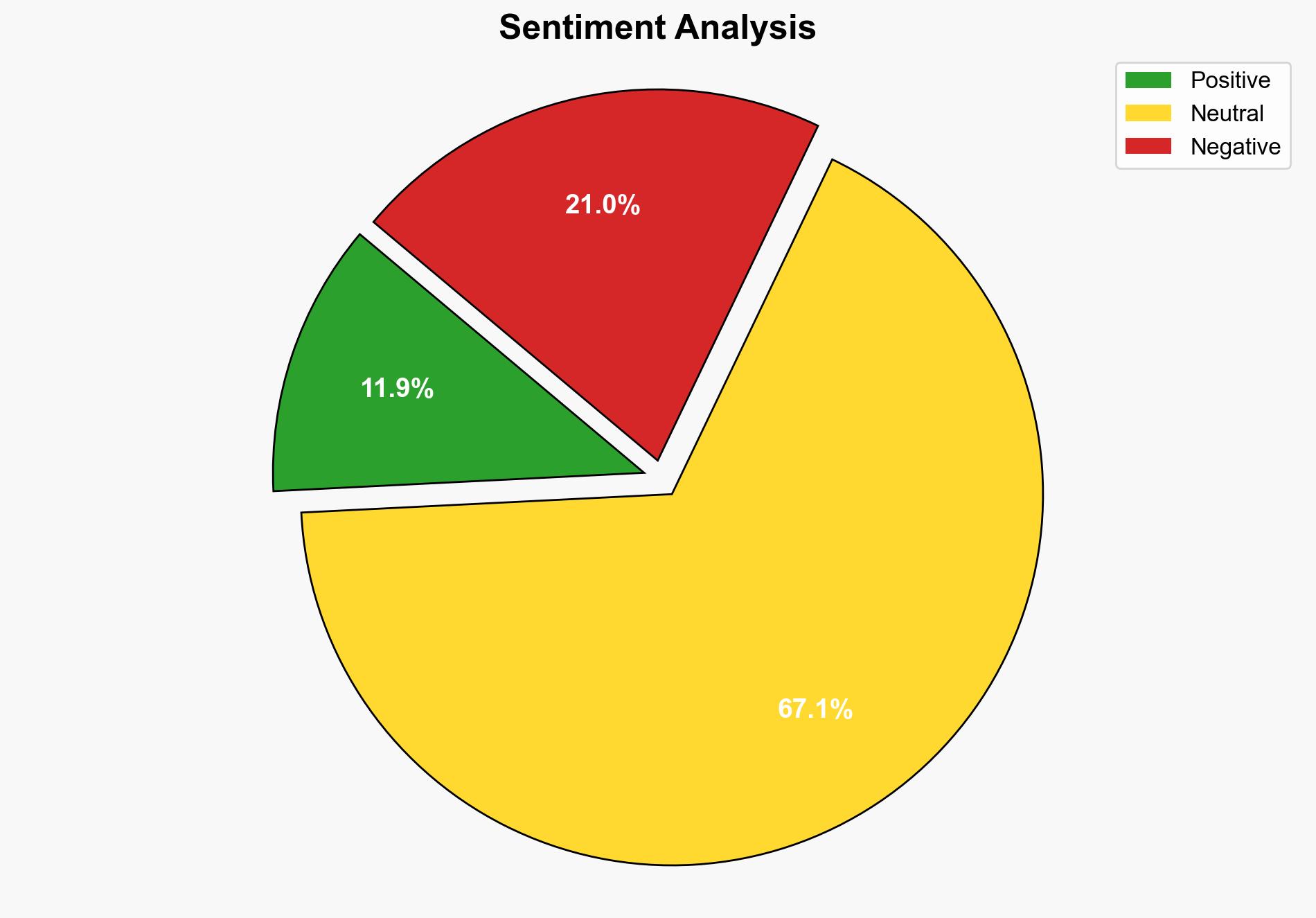

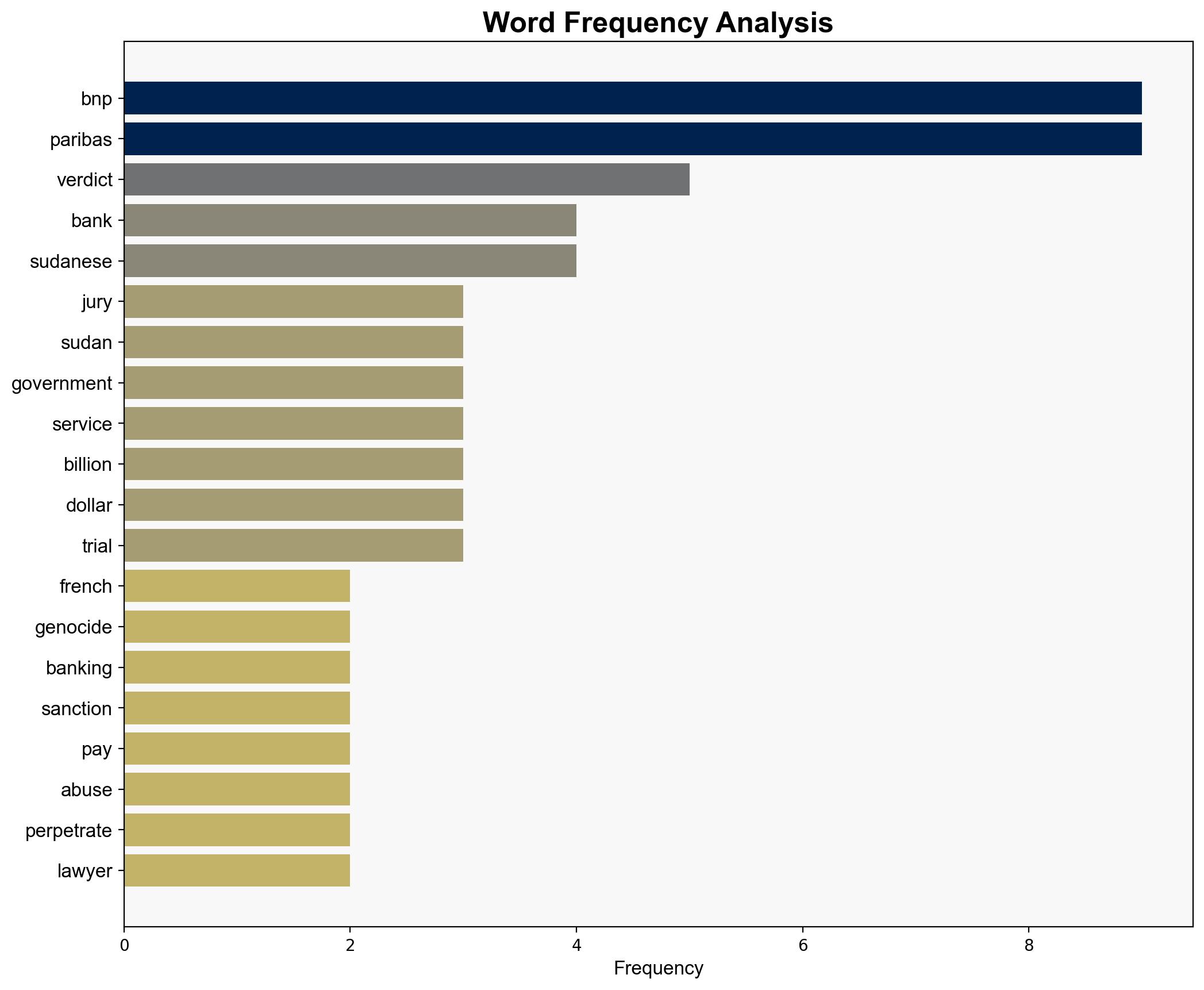

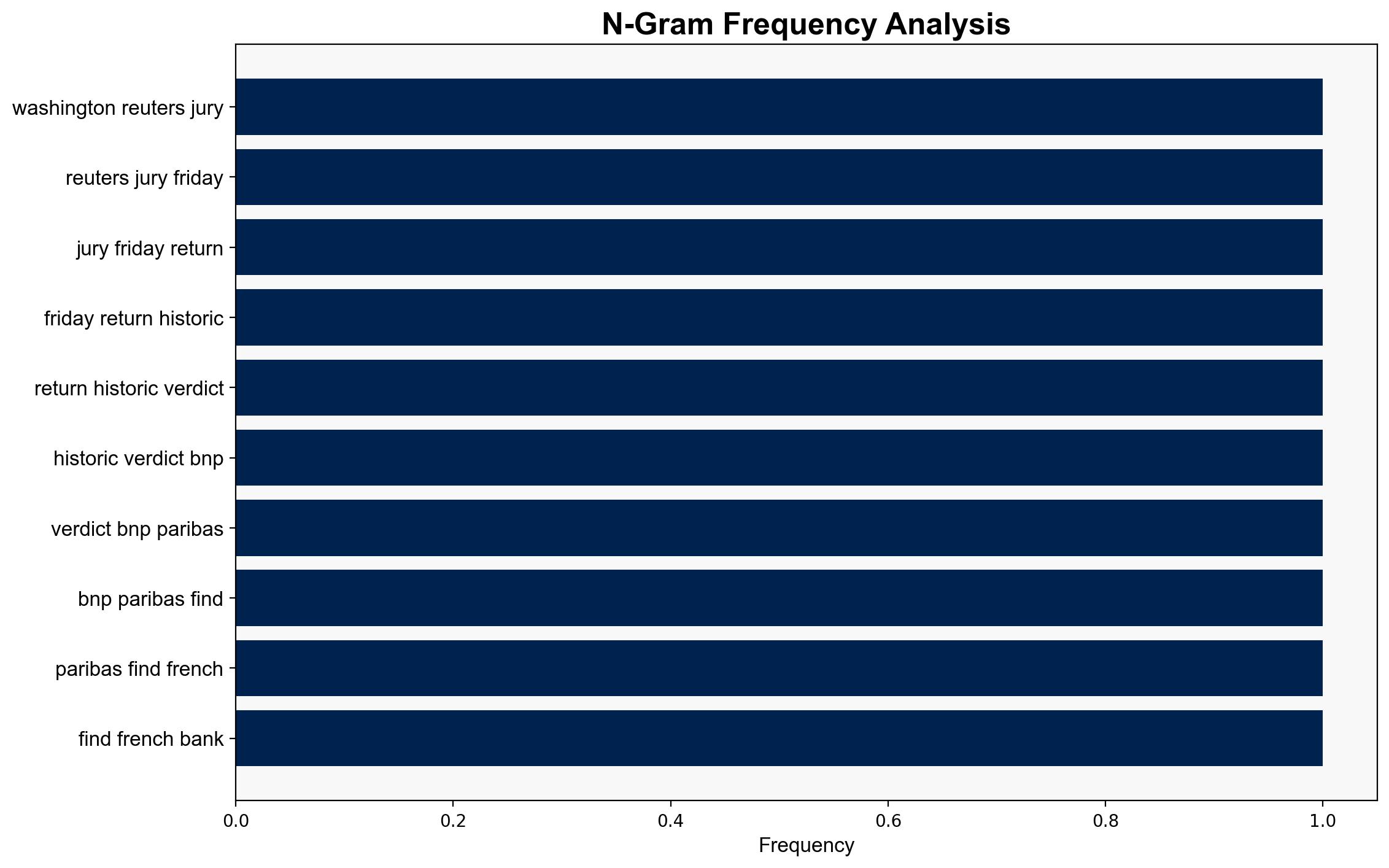

The most supported hypothesis is that BNP Paribas knowingly provided financial services that facilitated Sudanese government actions, violating sanctions and contributing to human rights abuses. Confidence in this assessment is moderate due to potential biases and gaps in evidence. Recommended action includes monitoring BNP Paribas’ appeal process and assessing broader implications for international banking compliance with sanctions.

2. Competing Hypotheses

1. **BNP Paribas knowingly facilitated Sudanese government atrocities**: The bank provided financial services that directly supported the Sudanese government, aware of the potential for these funds to be used in human rights abuses.

2. **BNP Paribas unintentionally violated sanctions due to inadequate oversight**: The bank’s involvement was a result of insufficient internal controls and compliance mechanisms, rather than deliberate support for Sudanese government actions.

Using ACH 2.0, the first hypothesis is better supported by the jury’s verdict and the bank’s previous guilty plea and penalty payment. However, the bank’s appeal and claims of misinterpretation suggest some uncertainty.

3. Key Assumptions and Red Flags

– **Assumptions**: The verdict assumes BNP Paribas had full knowledge of the consequences of their financial services. It also presumes the jury had access to all relevant evidence.

– **Red Flags**: The bank’s assertion of a strong appeal basis and claims of evidence distortion indicate potential gaps in the trial process or interpretation.

– **Blind Spots**: The complexity of international banking regulations and potential geopolitical influences on the trial outcome are not fully explored.

4. Implications and Strategic Risks

The verdict could set a precedent for holding financial institutions accountable for indirect involvement in human rights abuses, impacting global banking operations. There is a risk of increased scrutiny on banks’ compliance with international sanctions, potentially leading to stricter regulations. Geopolitically, this case may strain France-Sudan relations and affect BNP Paribas’ operations in sanctioned countries.

5. Recommendations and Outlook

- Monitor the appeal process for changes in legal interpretations that could affect international banking standards.

- Encourage financial institutions to enhance compliance frameworks to prevent similar incidents.

- Scenario-based projections:

- **Best Case**: BNP Paribas successfully appeals, leading to refined compliance practices without significant financial penalties.

- **Worst Case**: The verdict is upheld, resulting in substantial financial losses and reputational damage, prompting stricter global banking regulations.

- **Most Likely**: Partial success in appeal, leading to a reduced penalty and increased compliance measures.

6. Key Individuals and Entities

– BNP Paribas

– Omar al-Bashir

– Alvin Hellerstein

– Bobby DiCello

7. Thematic Tags

national security threats, international banking compliance, human rights, geopolitical risk