US jury finds French bank BNP Paribas complicit in Sudan atrocities – Al Jazeera English

Published on: 2025-10-18

Intelligence Report: US jury finds French bank BNP Paribas complicit in Sudan atrocities – Al Jazeera English

1. BLUF (Bottom Line Up Front)

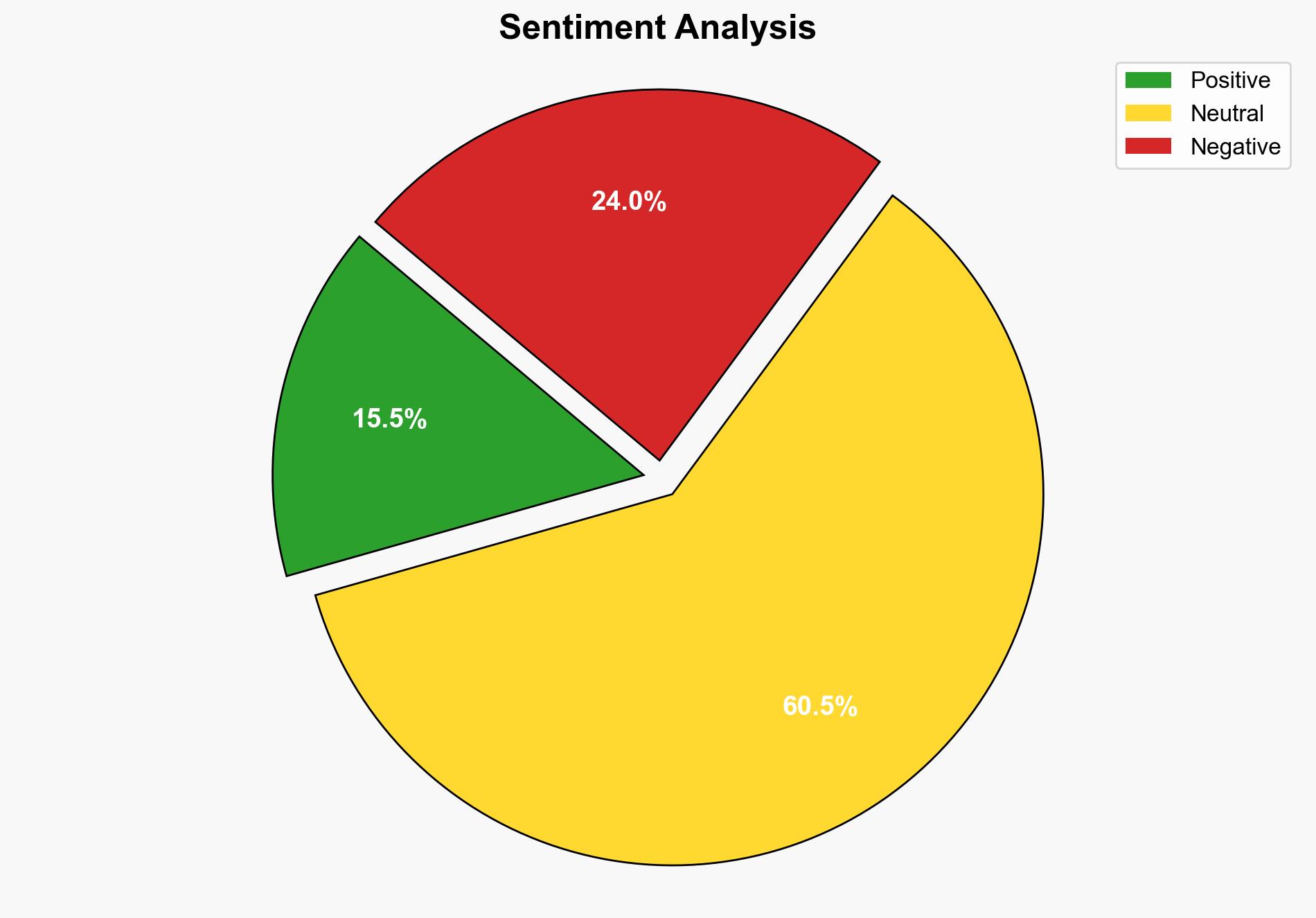

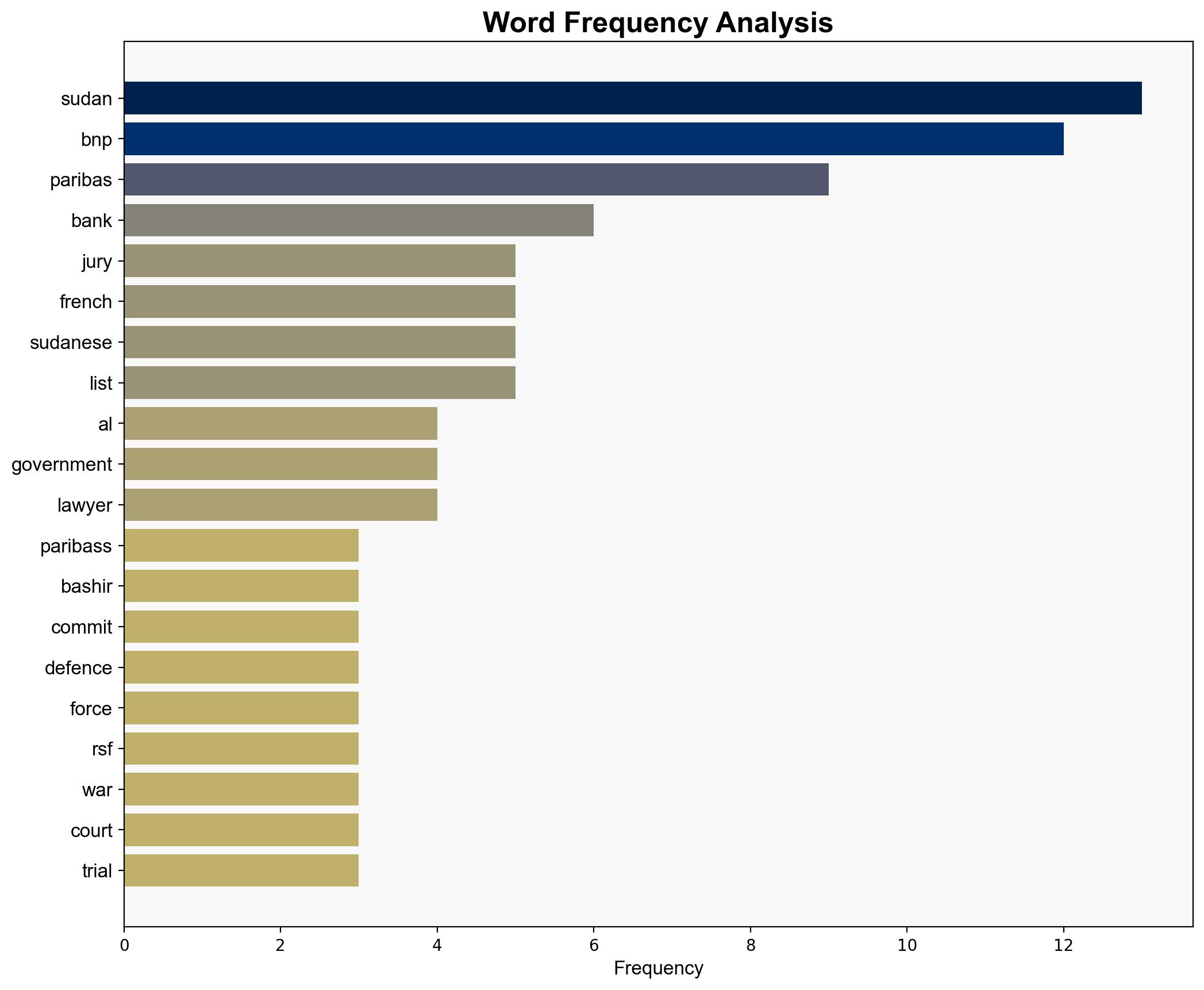

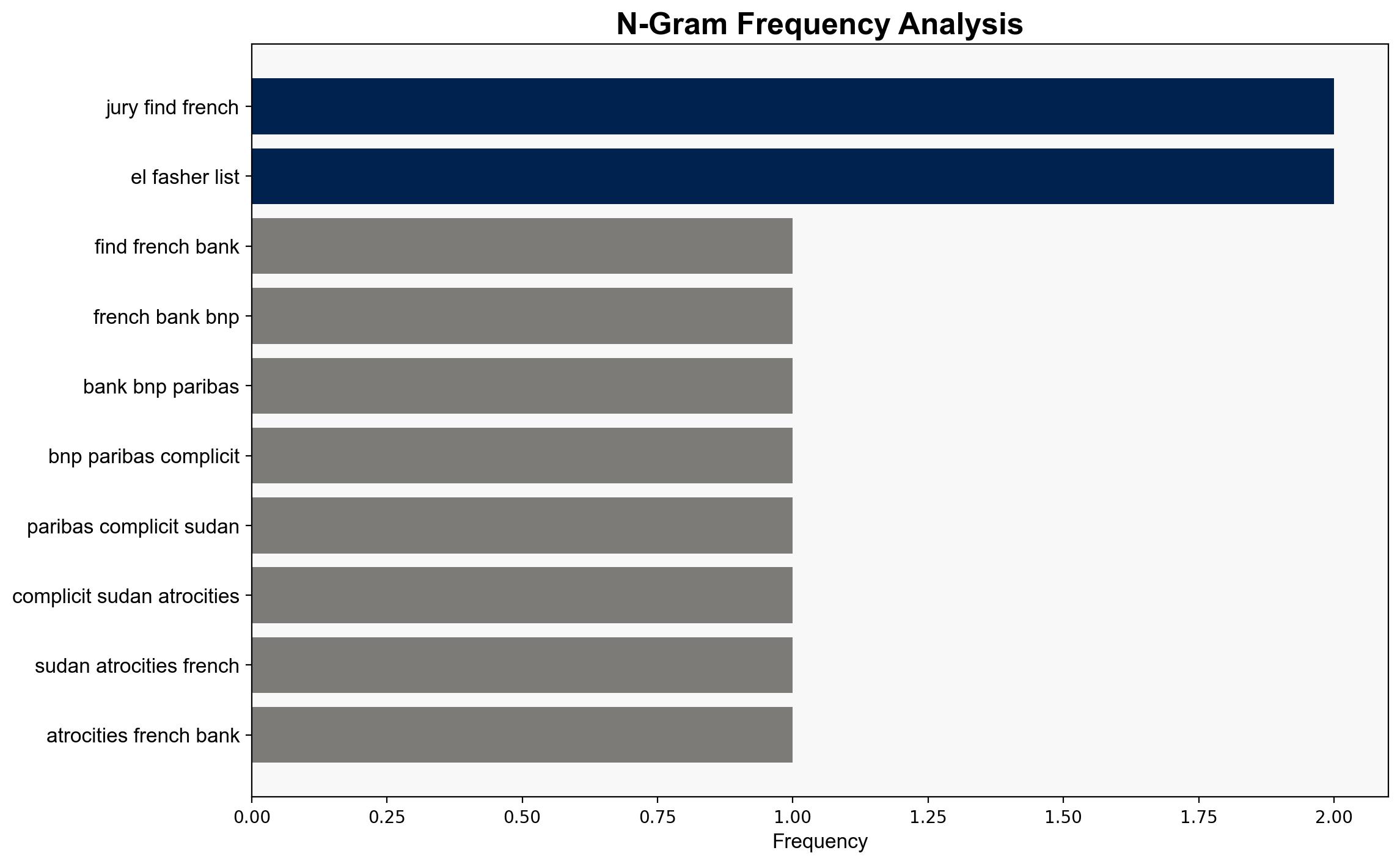

The jury’s verdict against BNP Paribas for complicity in Sudanese atrocities raises significant legal and reputational risks for the bank, with potential geopolitical ramifications. The hypothesis that BNP Paribas knowingly facilitated Sudan’s regime is more supported than the defense’s claim of unawareness. Confidence in this assessment is moderate due to potential biases and incomplete data. Recommended actions include monitoring BNP Paribas’ appeal process and assessing impacts on international banking regulations.

2. Competing Hypotheses

1. **BNP Paribas knowingly facilitated Sudan’s regime**: The bank provided financial services that enabled the Sudanese government to sustain operations despite international sanctions, indicating complicity in human rights violations.

2. **BNP Paribas was unaware of the regime’s actions**: The bank’s operations were legal under European law, and it lacked knowledge of the human rights abuses occurring in Sudan at the time.

Using the Analysis of Competing Hypotheses (ACH) 2.0, the first hypothesis is better supported by the jury’s verdict, the bank’s previous guilty plea, and the financial transactions that aligned with Sudan’s operational needs during the conflict.

3. Key Assumptions and Red Flags

– **Assumptions**: The first hypothesis assumes BNP Paribas had sufficient oversight and knowledge of its transactions’ impacts. The second assumes a lack of due diligence or effective compliance mechanisms.

– **Red Flags**: The bank’s statement of intent to appeal suggests potential new evidence or legal arguments. The complexity of international banking regulations may obscure full transparency.

– **Blind Spots**: Limited insight into internal BNP Paribas communications and decision-making processes during the relevant period.

4. Implications and Strategic Risks

– **Economic**: Potential sanctions or fines could impact BNP Paribas’ financial stability and market position.

– **Geopolitical**: The case may strain France-Sudan relations and influence international banking regulations.

– **Psychological**: Erosion of trust in global financial institutions could lead to increased scrutiny and regulatory pressure.

5. Recommendations and Outlook

- Monitor the appeal process to assess potential shifts in legal interpretations and implications for international banking practices.

- Engage with international regulatory bodies to anticipate changes in compliance requirements.

- Scenario Projections:

- **Best Case**: BNP Paribas successfully appeals, mitigating reputational damage.

- **Worst Case**: Appeal fails, leading to increased sanctions and regulatory scrutiny.

- **Most Likely**: Ongoing legal battles with moderate impact on BNP Paribas’ operations and reputation.

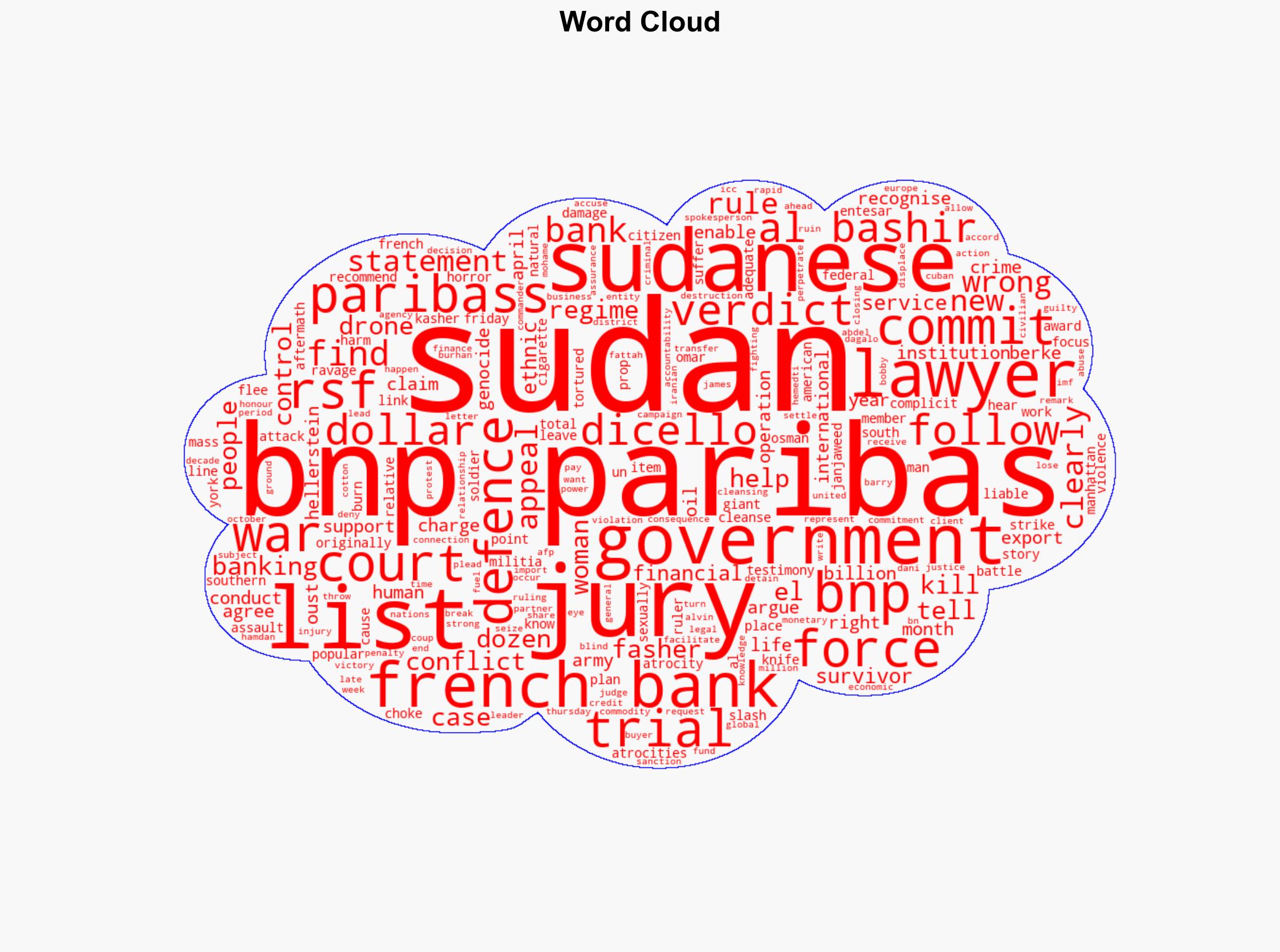

6. Key Individuals and Entities

– BNP Paribas

– Omar al-Bashir

– Bobby DiCello (Plaintiff’s representative)

– Alvin Hellerstein (District Judge)

7. Thematic Tags

national security threats, financial compliance, international law, human rights, geopolitical risk