US jury issues 20M verdict against French bank BNP Paribas over Sudanese atrocities – Financial Post

Published on: 2025-10-18

Intelligence Report: US jury issues 20M verdict against French bank BNP Paribas over Sudanese atrocities – Financial Post

1. BLUF (Bottom Line Up Front)

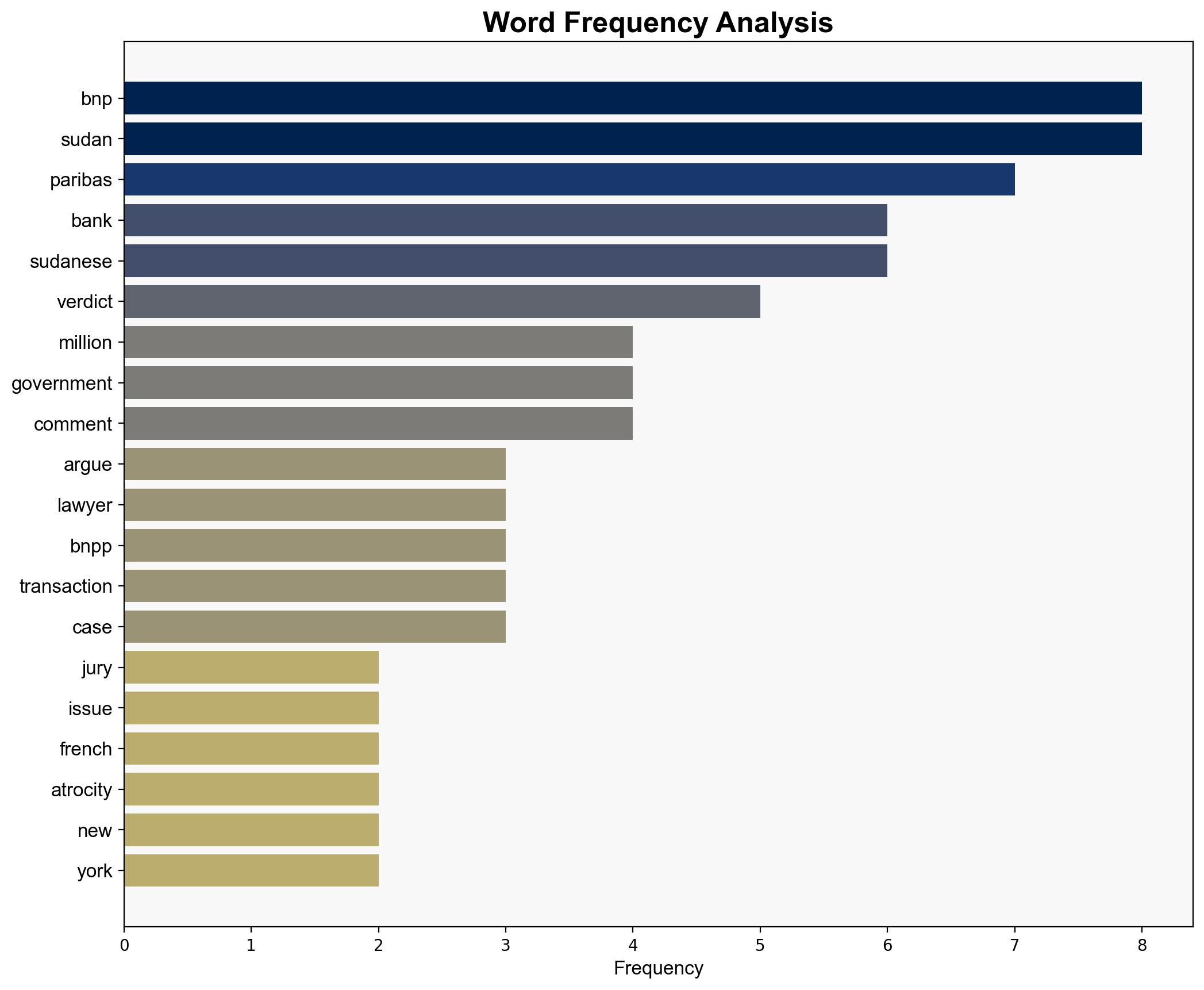

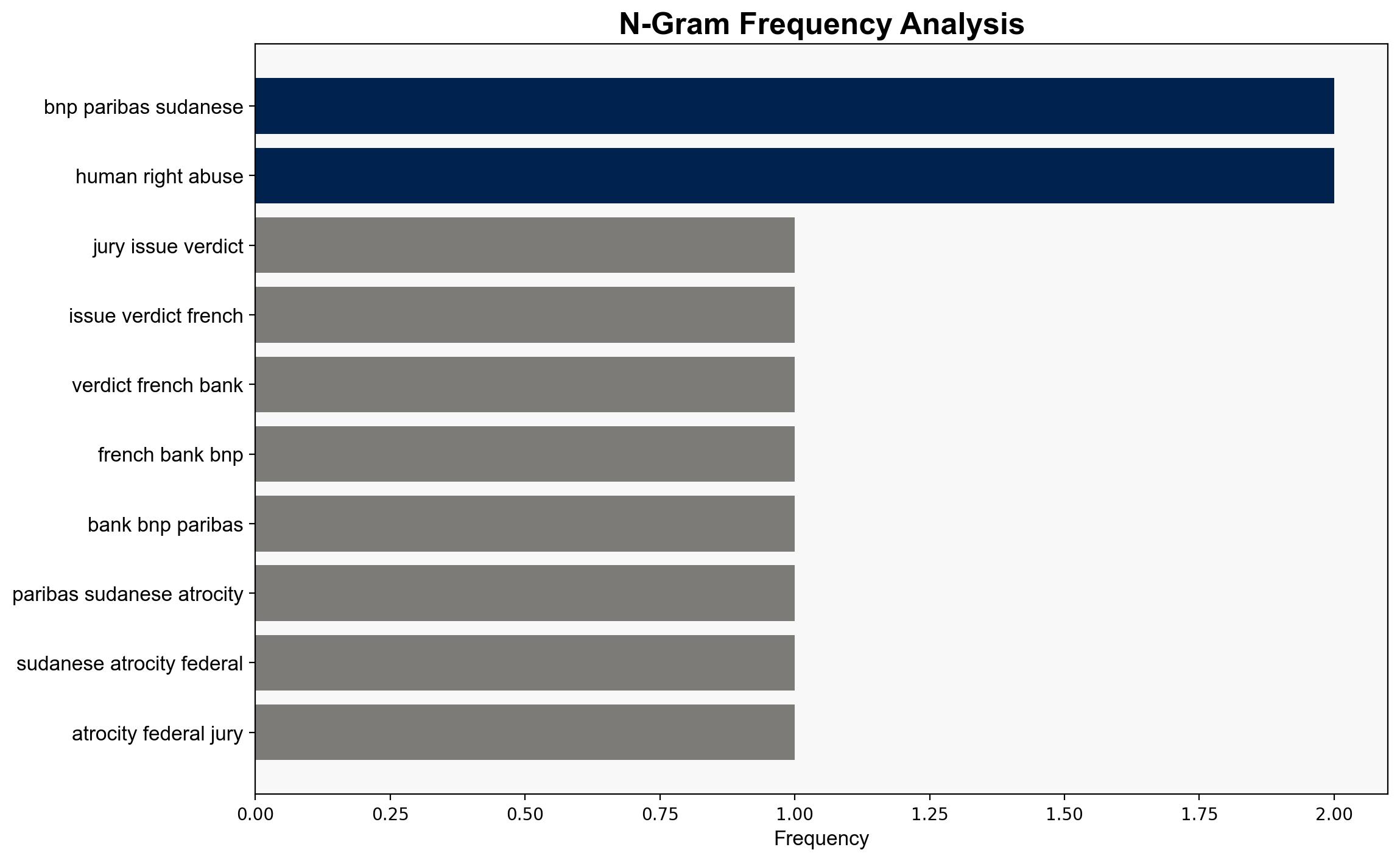

The most supported hypothesis is that BNP Paribas knowingly facilitated financial transactions that indirectly supported Sudanese government atrocities, resulting in a $20 million verdict against the bank. Confidence in this hypothesis is moderate due to the complexity of financial transactions and the potential for appeal. Recommended action includes monitoring the appeal process and assessing the broader implications for international banking regulations and corporate accountability.

2. Competing Hypotheses

Hypothesis 1: BNP Paribas knowingly facilitated financial transactions that supported the Sudanese government’s atrocities, leading to the jury’s verdict.

Hypothesis 2: BNP Paribas was unaware of the Sudanese government’s use of the financial system for atrocities, and the verdict is based on circumstantial evidence and legal interpretation.

Using Analysis of Competing Hypotheses (ACH), Hypothesis 1 is better supported by the jury’s decision and the bank’s prior guilty plea acknowledging similar transactions. However, Hypothesis 2 is plausible given the bank’s argument of insufficient evidence linking specific transactions to human rights abuses.

3. Key Assumptions and Red Flags

Assumptions:

– The jury’s verdict reflects a comprehensive understanding of the bank’s involvement.

– BNP Paribas had adequate compliance mechanisms to detect misuse of financial services.

Red Flags:

– BNP Paribas’s claim of “strong ground for appeal” suggests potential gaps in the jury’s understanding or presentation of evidence.

– The absence of specific transaction details linking BNP Paribas directly to atrocities raises questions about the verdict’s foundation.

4. Implications and Strategic Risks

The verdict could set a precedent for holding financial institutions accountable for indirect involvement in human rights abuses, impacting international banking operations and compliance standards. There is a risk of increased scrutiny on banks with operations in conflict zones, potentially leading to stricter regulations and higher operational costs. Geopolitically, this case may strain France-Sudan relations and affect BNP Paribas’s global reputation.

5. Recommendations and Outlook

- Monitor the appeal process and any changes in international banking regulations.

- Encourage financial institutions to enhance compliance and due diligence mechanisms to prevent misuse of services.

- Scenario Projections:

- Best Case: The appeal clarifies legal standards, leading to improved compliance without significant financial penalties.

- Worst Case: The verdict is upheld, resulting in substantial financial penalties and reputational damage to BNP Paribas.

- Most Likely: The appeal leads to a reduced verdict, but prompts regulatory changes affecting international banking practices.

6. Key Individuals and Entities

– BNP Paribas

– Adam Levitt (Plaintiff’s lawyer)

– Omar al-Bashir (Former Sudanese President)

7. Thematic Tags

national security threats, international banking, corporate accountability, human rights, geopolitical impact