US Leading Indicators Signal Further Economic Slowdown – Barron’s

Published on: 2025-06-20

Intelligence Report: US Leading Indicators Signal Further Economic Slowdown – Barron’s

1. BLUF (Bottom Line Up Front)

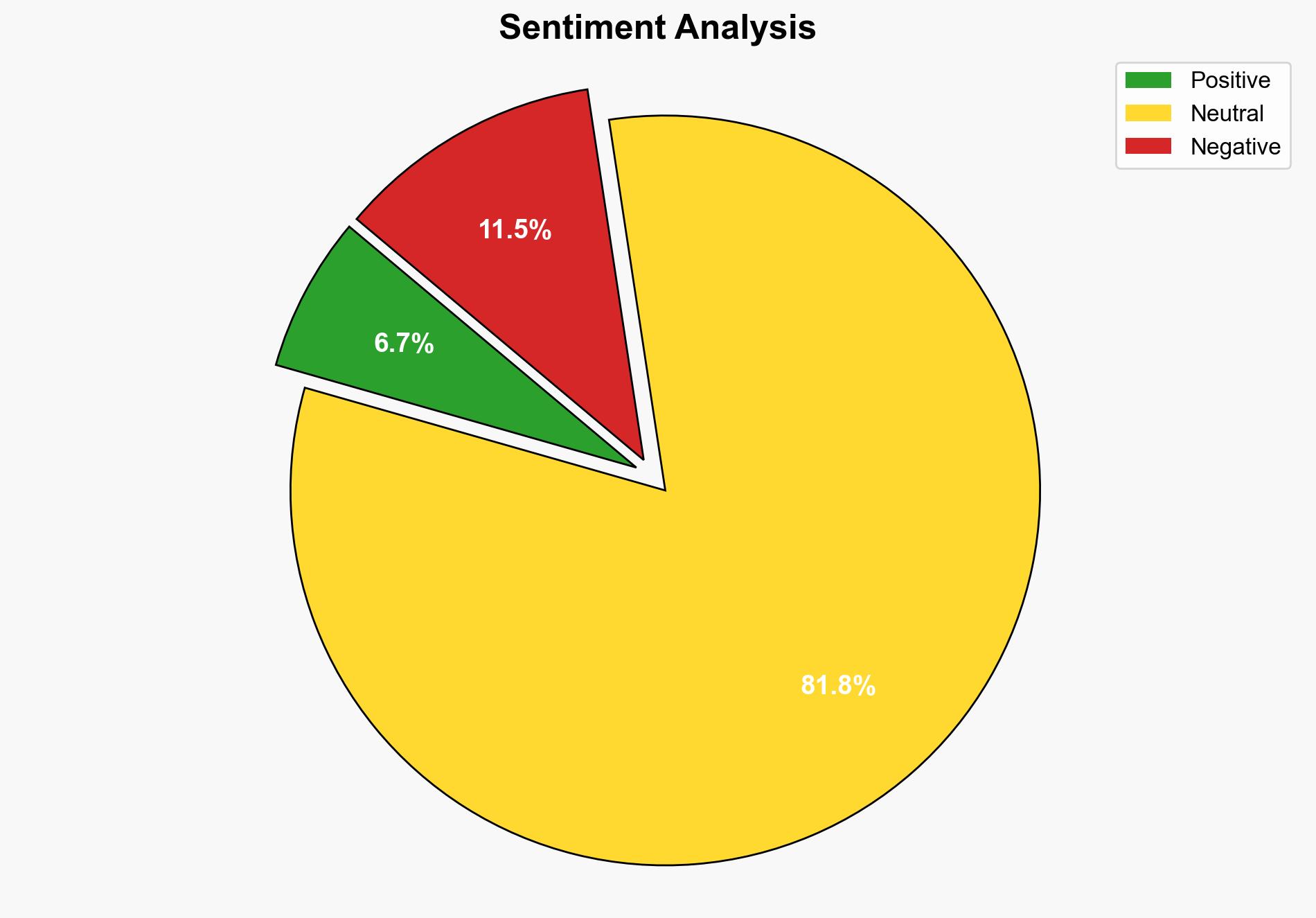

The US economy shows signs of a potential slowdown, influenced by geopolitical tensions in the Middle East and domestic monetary policy uncertainties. Key indicators suggest a cautious approach to economic and market strategies is warranted. Recommendations include monitoring Federal Reserve actions and geopolitical developments closely to anticipate market shifts.

2. Detailed Analysis

The following structured analytic techniques have been applied to ensure methodological consistency:

Causal Layered Analysis (CLA)

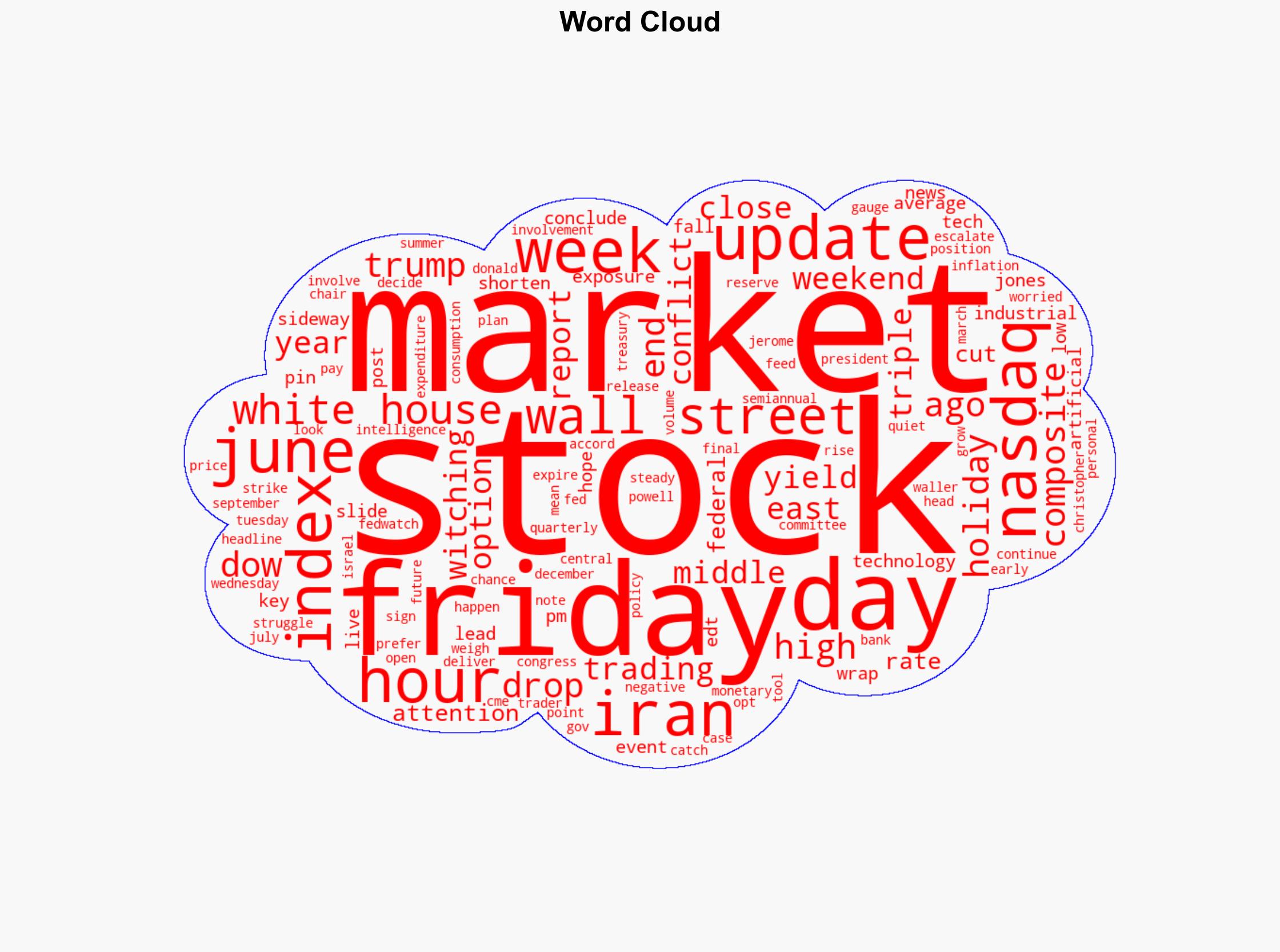

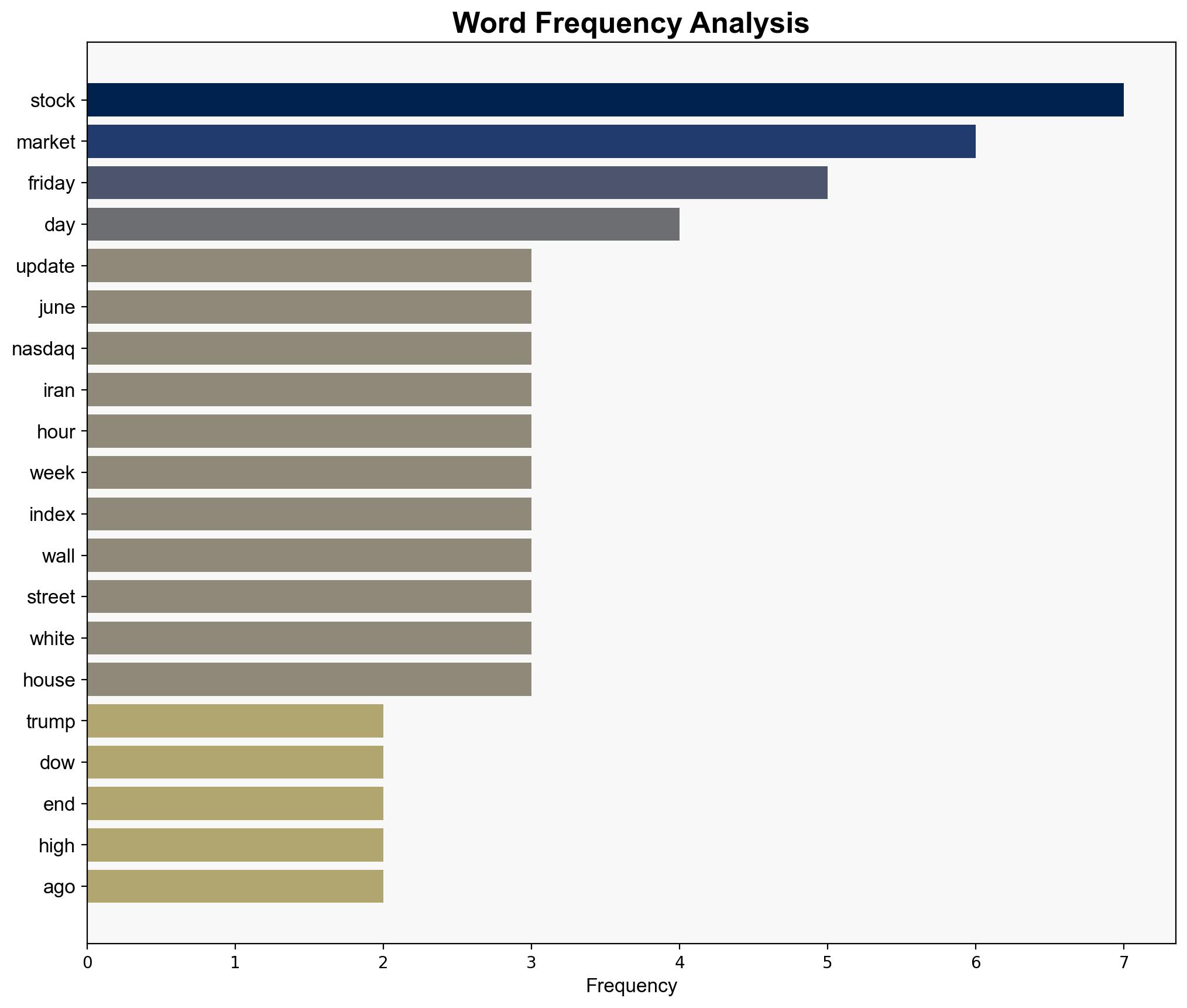

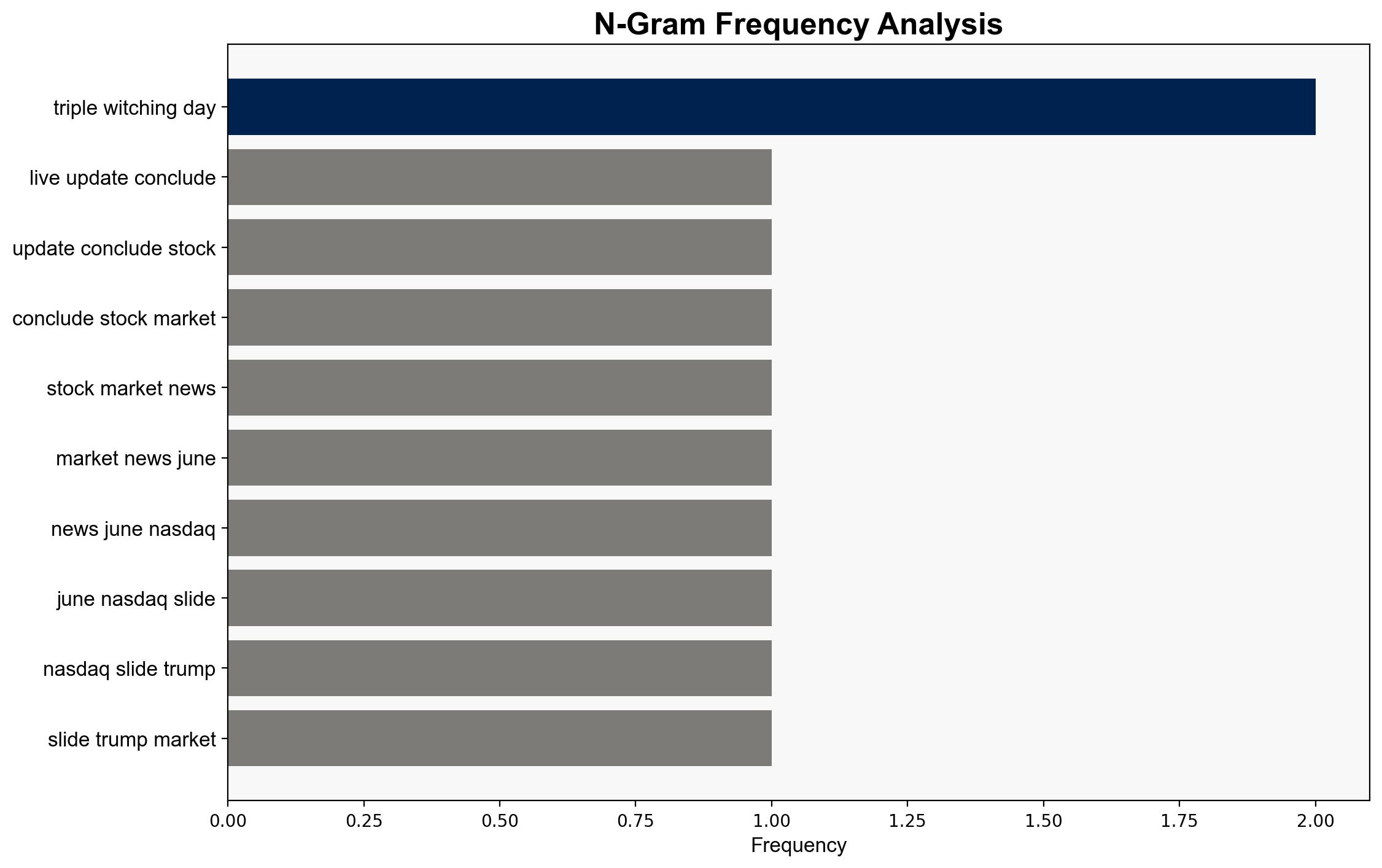

Surface events include fluctuations in stock indices and treasury yields, driven by geopolitical tensions and Federal Reserve policies. Systemic structures involve the interconnectedness of global markets and US monetary policy. Worldviews reflect investor sentiment wary of potential conflicts and economic policy shifts. Myths include the belief in market resilience despite geopolitical instability.

Cross-Impact Simulation

Geopolitical tensions, particularly involving Iran, could lead to market volatility. Economic dependencies on Middle Eastern oil and global trade routes may exacerbate these impacts. The Federal Reserve’s monetary policy decisions will also have significant ripple effects on both domestic and international markets.

Scenario Generation

Possible scenarios include:

– A de-escalation in Middle Eastern tensions leading to market stabilization.

– An escalation resulting in increased market volatility and economic downturn.

– The Federal Reserve maintaining current rates, providing temporary market relief, or cutting rates, potentially boosting market confidence.

3. Implications and Strategic Risks

The primary risks include economic instability due to geopolitical conflicts and uncertain monetary policies. Potential cascading effects include increased market volatility, disruptions in global supply chains, and heightened investor anxiety. Cross-domain risks involve potential cyber threats linked to geopolitical tensions.

4. Recommendations and Outlook

- Monitor Federal Reserve communications and policy decisions closely to anticipate market reactions.

- Prepare for potential market volatility by diversifying investments and securing supply chains.

- Develop contingency plans for scenarios involving geopolitical escalations.

- Scenario-based projections:

- Best Case: Geopolitical tensions ease, and the Federal Reserve provides clear guidance, stabilizing markets.

- Worst Case: Escalation in the Middle East leads to significant market disruptions and economic downturn.

- Most Likely: Continued market fluctuations with moderate geopolitical tensions and cautious Federal Reserve actions.

5. Key Individuals and Entities

Jerome Powell, Donald Trump, Christopher Waller

6. Thematic Tags

national security threats, economic instability, geopolitical tensions, Federal Reserve policy