US Shipping Faces Minimal Exposure to Chinas Retaliatory Port Restrictions – Sourcing Journal

Published on: 2025-10-08

Intelligence Report: US Shipping Faces Minimal Exposure to China’s Retaliatory Port Restrictions – Sourcing Journal

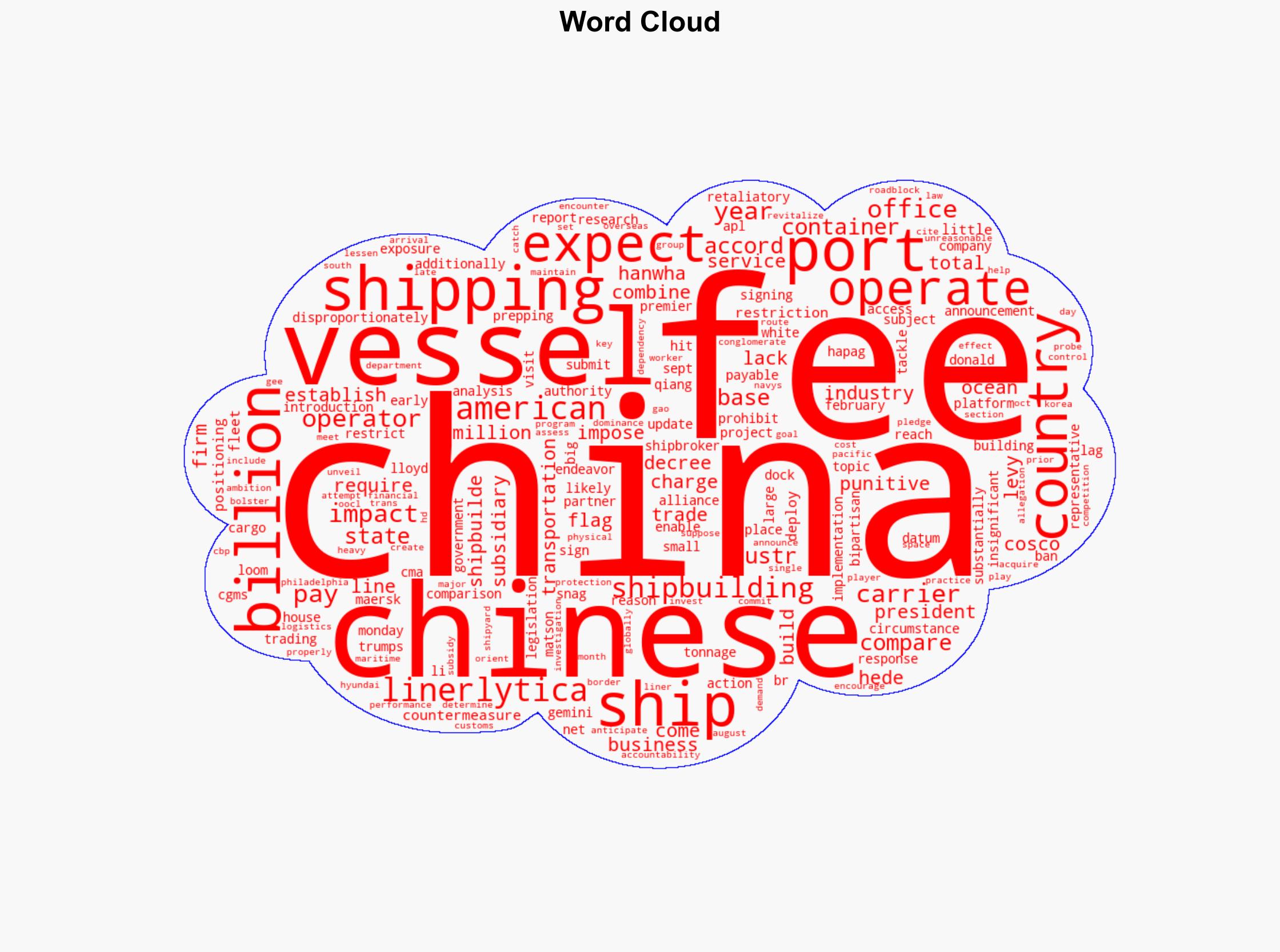

1. BLUF (Bottom Line Up Front)

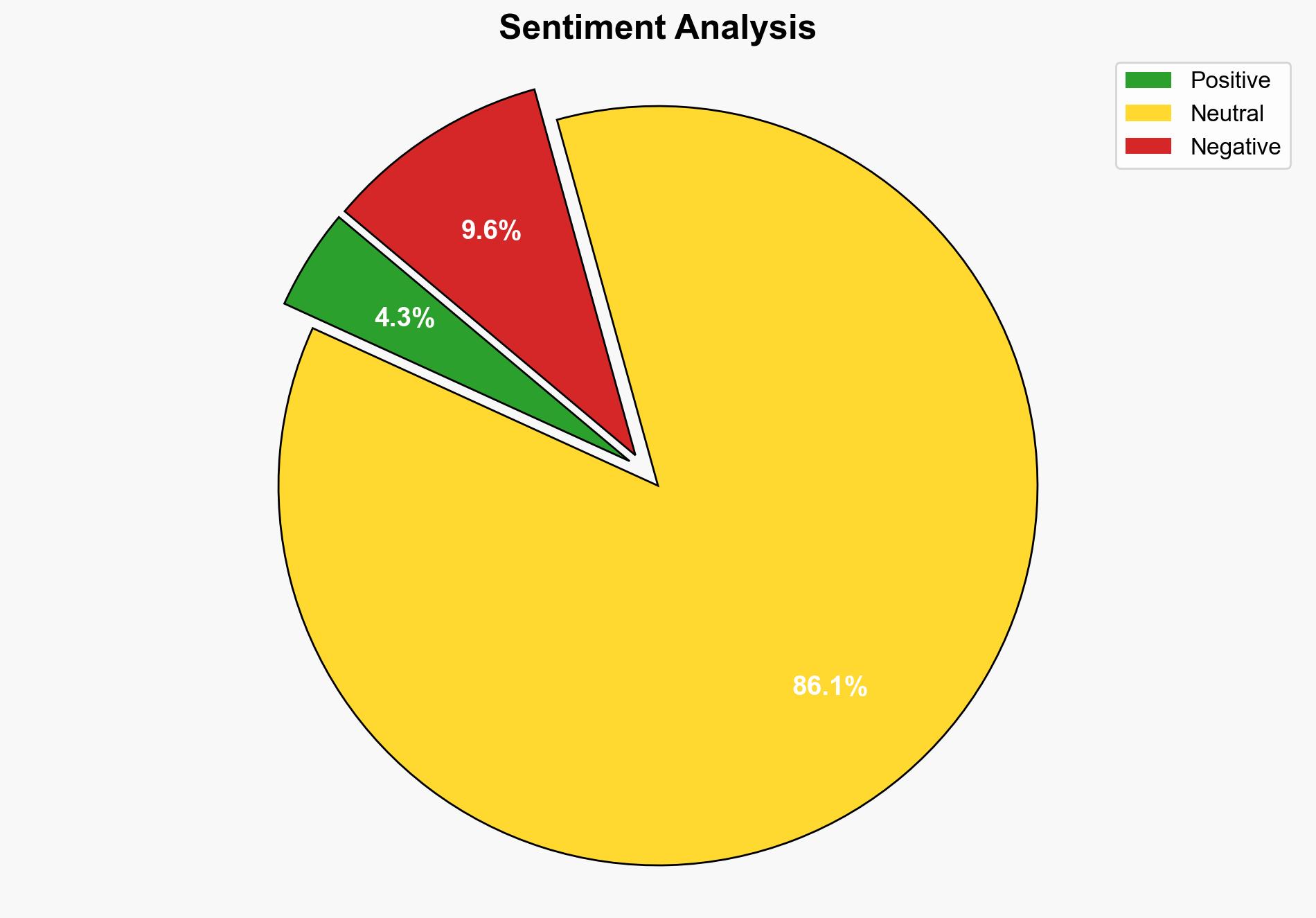

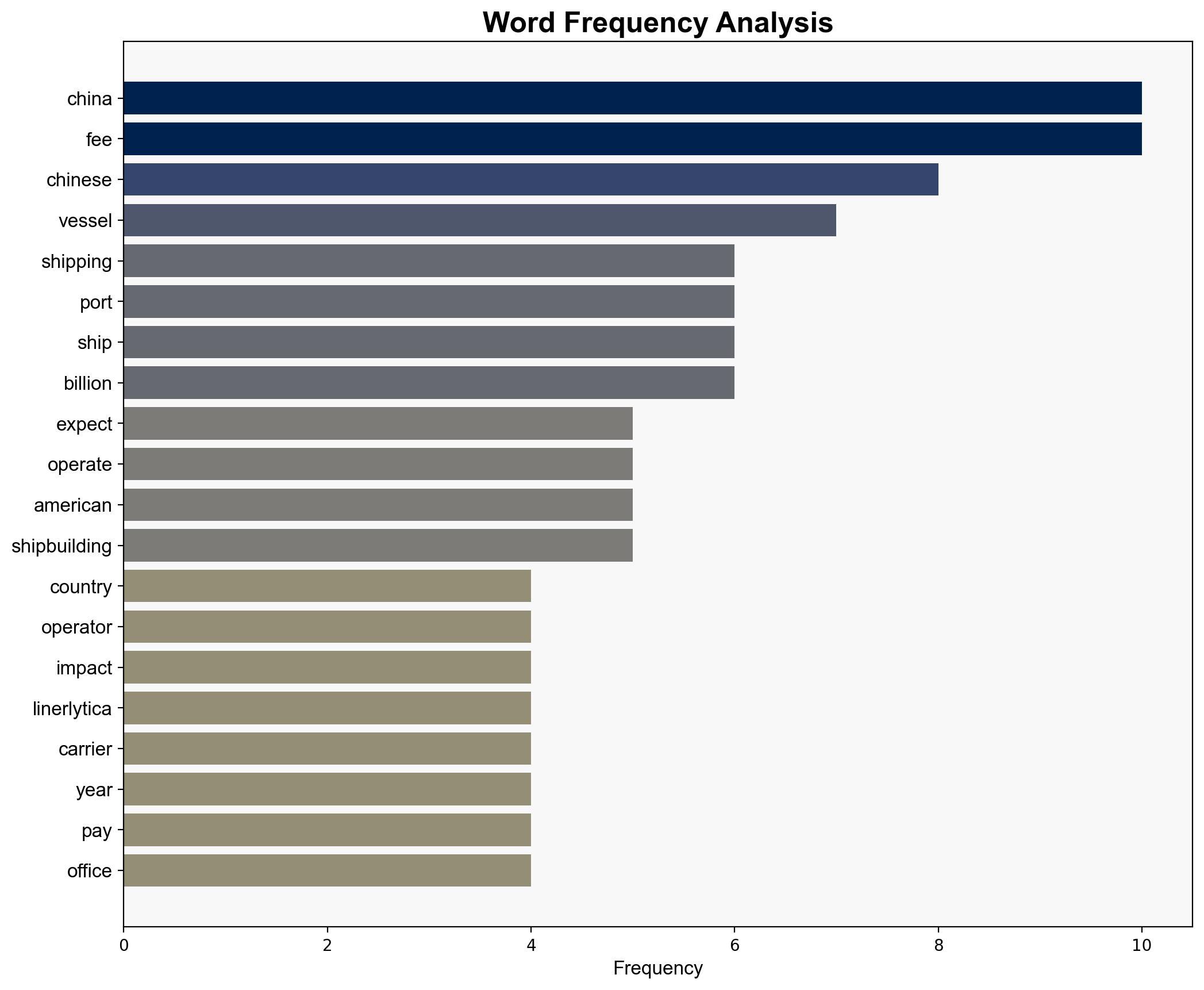

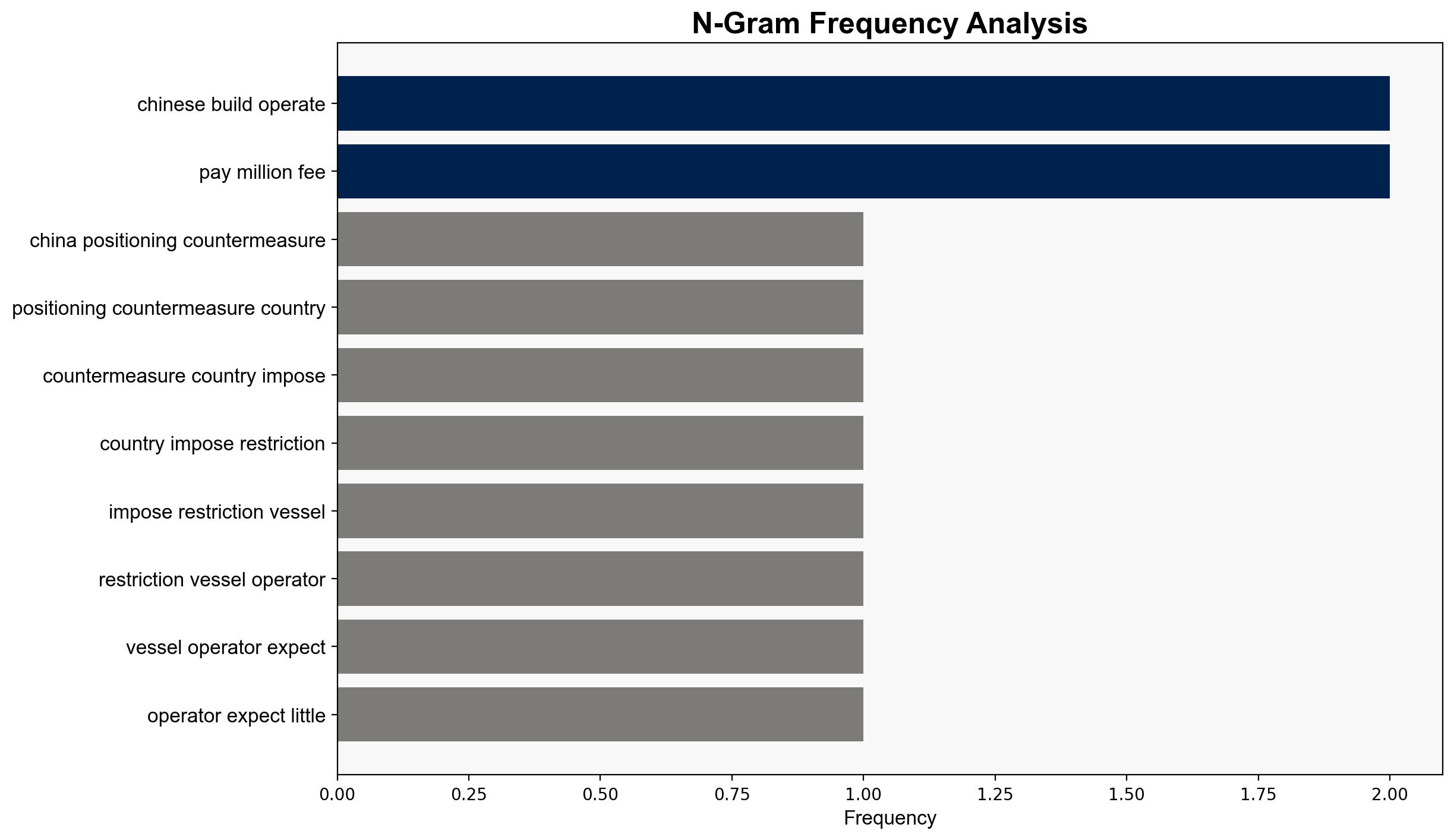

The analysis suggests that US shipping will face minimal direct impact from China’s retaliatory port restrictions due to the relatively small exposure of US operators compared to Chinese counterparts. The most supported hypothesis is that the economic impact on US shipping will be negligible, with a medium to high confidence level. It is recommended to monitor the situation for any indirect effects on global shipping dynamics and potential escalation in trade tensions.

2. Competing Hypotheses

1. **Hypothesis A**: The US shipping industry will experience minimal impact from China’s retaliatory port restrictions due to limited exposure and the small number of US-flagged vessels operating in Chinese ports.

2. **Hypothesis B**: The US shipping industry may face indirect consequences through increased costs and logistical challenges as global shipping dynamics adjust to China’s retaliatory measures, potentially affecting supply chains and trade routes.

Using ACH 2.0, Hypothesis A is better supported by the data, which indicates that the direct financial impact on US operators is significantly lower than on Chinese operators. Hypothesis B lacks direct evidence but remains plausible due to potential indirect effects.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that the current level of US exposure to Chinese ports will remain constant and that retaliatory measures will not escalate further.

– **Red Flags**: Potential escalation in trade tensions or additional retaliatory actions by China could alter the impact assessment. The absence of detailed data on indirect effects and supply chain disruptions is a blind spot.

4. Implications and Strategic Risks

The primary implication is the potential for increased trade tensions between the US and China, which could lead to broader economic repercussions. Strategic risks include the possibility of China expanding restrictions to other sectors or countries, impacting global supply chains. The psychological impact on market confidence and investor sentiment should also be considered.

5. Recommendations and Outlook

- Monitor developments in US-China trade relations and any new measures that could affect shipping and trade.

- Engage with industry stakeholders to assess potential indirect impacts on supply chains and prepare contingency plans.

- Scenario Projections:

- Best Case: Retaliatory measures remain limited, with no significant impact on global shipping.

- Worst Case: Escalation leads to broader trade restrictions, affecting global supply chains and economic stability.

- Most Likely: Minimal direct impact on US shipping, with some indirect effects on global trade dynamics.

6. Key Individuals and Entities

– Premier Li Qiang

– COSCO Shipping

– Matson

– CMA CGM’s American President Lines (APL)

– Hapag-Lloyd

– Maersk

– Hanwha Group

7. Thematic Tags

national security threats, economic impact, trade relations, global supply chain, US-China relations