US wont start Bitcoin reserve until other countries do Mike Alfred – Cointelegraph

Published on: 2025-11-19

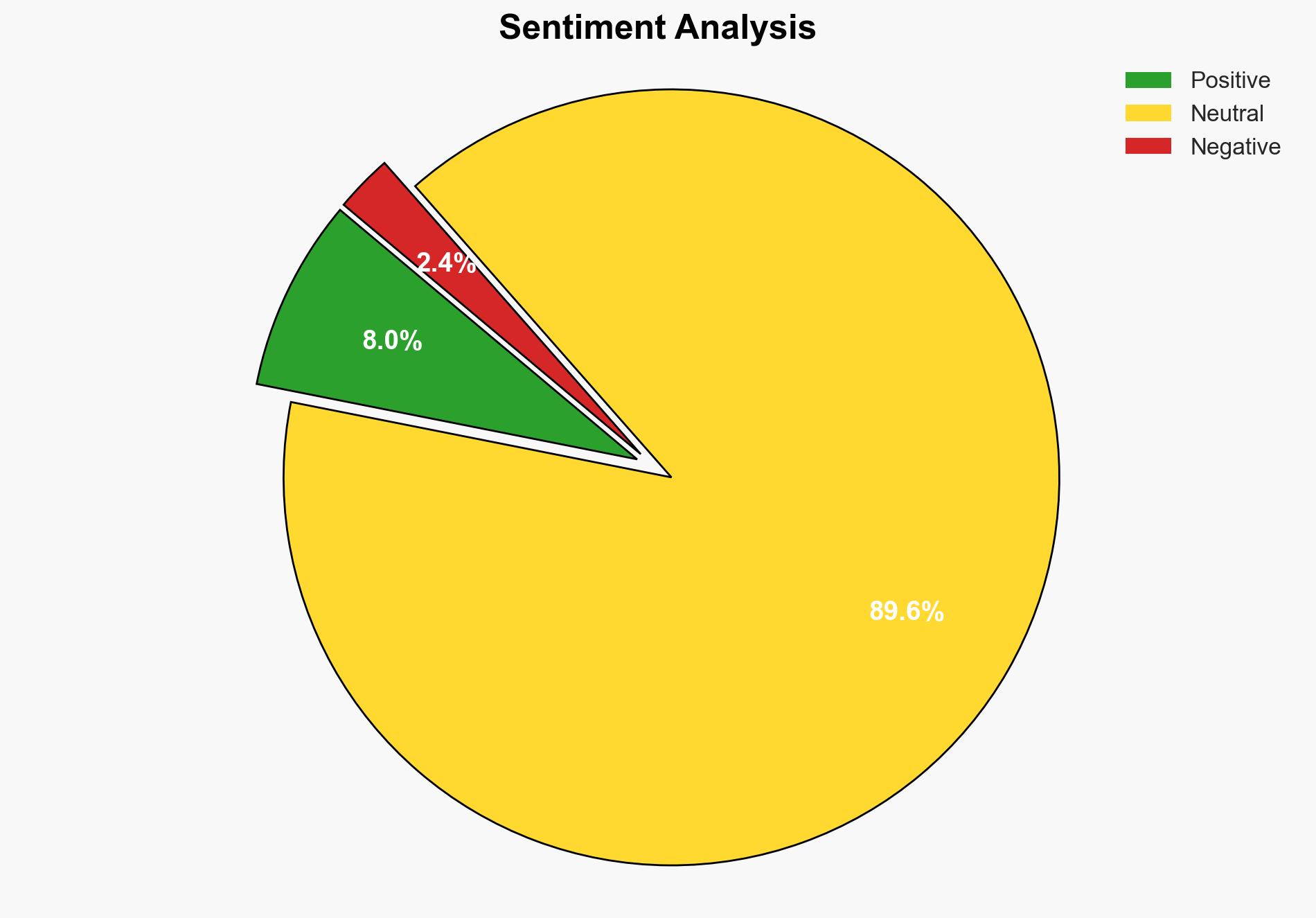

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: Strategic Considerations for US Bitcoin Reserve Accumulation

1. BLUF (Bottom Line Up Front)

The US government is unlikely to initiate a Bitcoin reserve until other nations do so first. The most supported hypothesis is that the US will adopt a wait-and-see approach, influenced by external pressures and strategic considerations. Confidence Level: Moderate. Recommended action: Monitor international developments in cryptocurrency reserves and prepare contingency plans for rapid adaptation.

2. Competing Hypotheses

Hypothesis 1: The US government will not start accumulating Bitcoin as a strategic reserve until other major countries do so, due to a preference for maintaining traditional financial stability and avoiding premature exposure to cryptocurrency volatility.

Hypothesis 2: The US government will proactively establish a Bitcoin reserve to lead in digital currency innovation and hedge against potential global economic shifts, despite current hesitancy.

Hypothesis 1 is more likely due to the US’s historical cautious approach to adopting new financial technologies and the absence of immediate strategic necessity.

3. Key Assumptions and Red Flags

Assumptions: The US government prioritizes financial stability over rapid adoption of emerging technologies. Other countries’ actions significantly influence US policy decisions.

Red Flags: Overreliance on speculative future valuations of Bitcoin. Potential bias from cryptocurrency advocates like Mike Alfred, who may overstate the urgency and benefits of a Bitcoin reserve.

4. Implications and Strategic Risks

Failure to establish a Bitcoin reserve could result in strategic disadvantages if other nations gain significant economic leverage through cryptocurrency. Conversely, premature accumulation could expose the US to financial risks associated with Bitcoin’s volatility. Political risks include domestic and international criticism of either action or inaction.

5. Recommendations and Outlook

- Actionable Steps: Establish a task force to monitor global cryptocurrency reserve trends and assess potential impacts on US strategic interests. Develop a flexible policy framework to enable rapid response to international developments.

- Best Scenario: The US leads in digital currency innovation, establishing a Bitcoin reserve that enhances economic resilience.

- Worst Scenario: The US falls behind as other nations leverage cryptocurrency reserves for economic advantage.

- Most-likely Scenario: The US maintains a cautious approach, adapting policies as international trends evolve.

6. Key Individuals and Entities

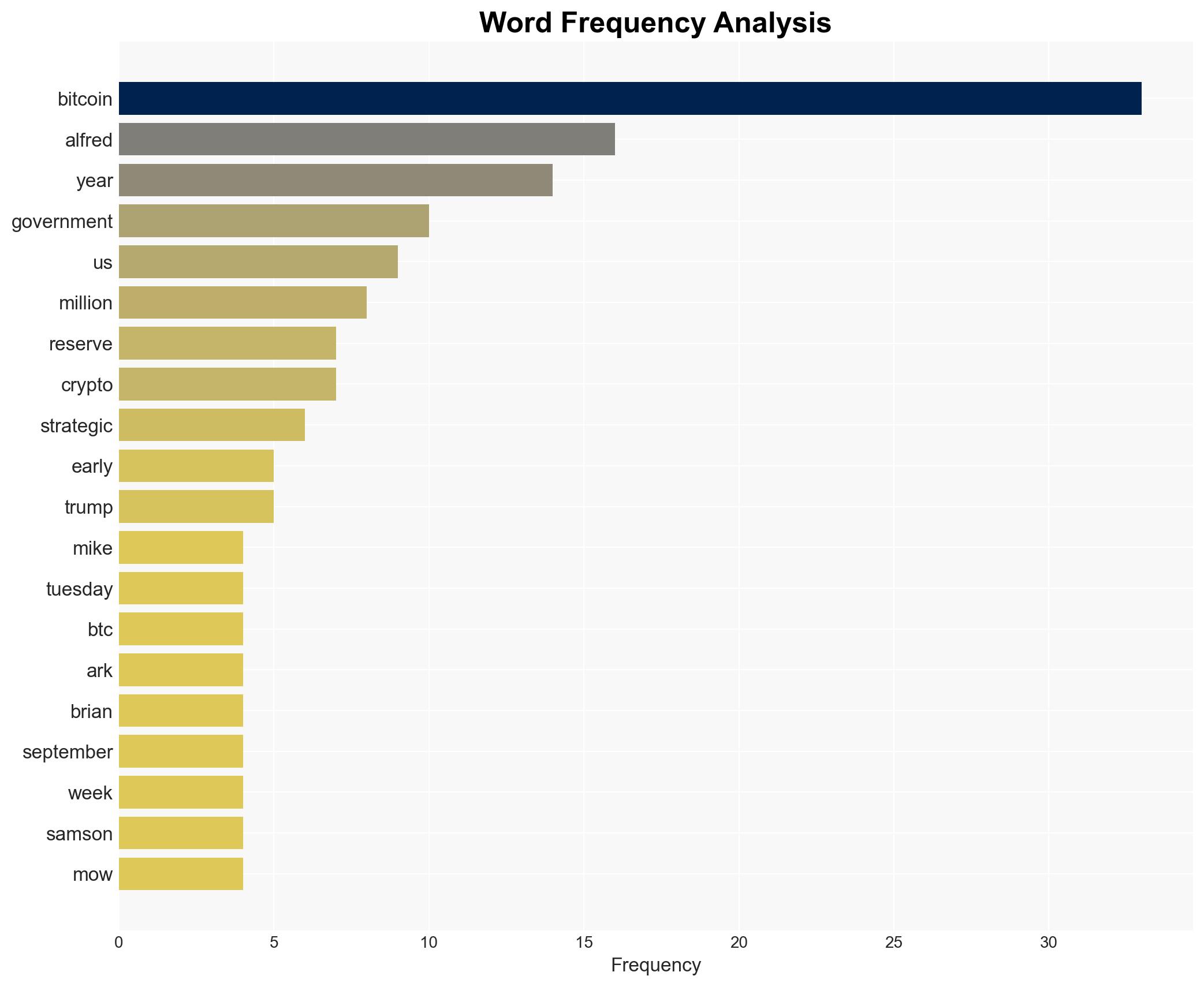

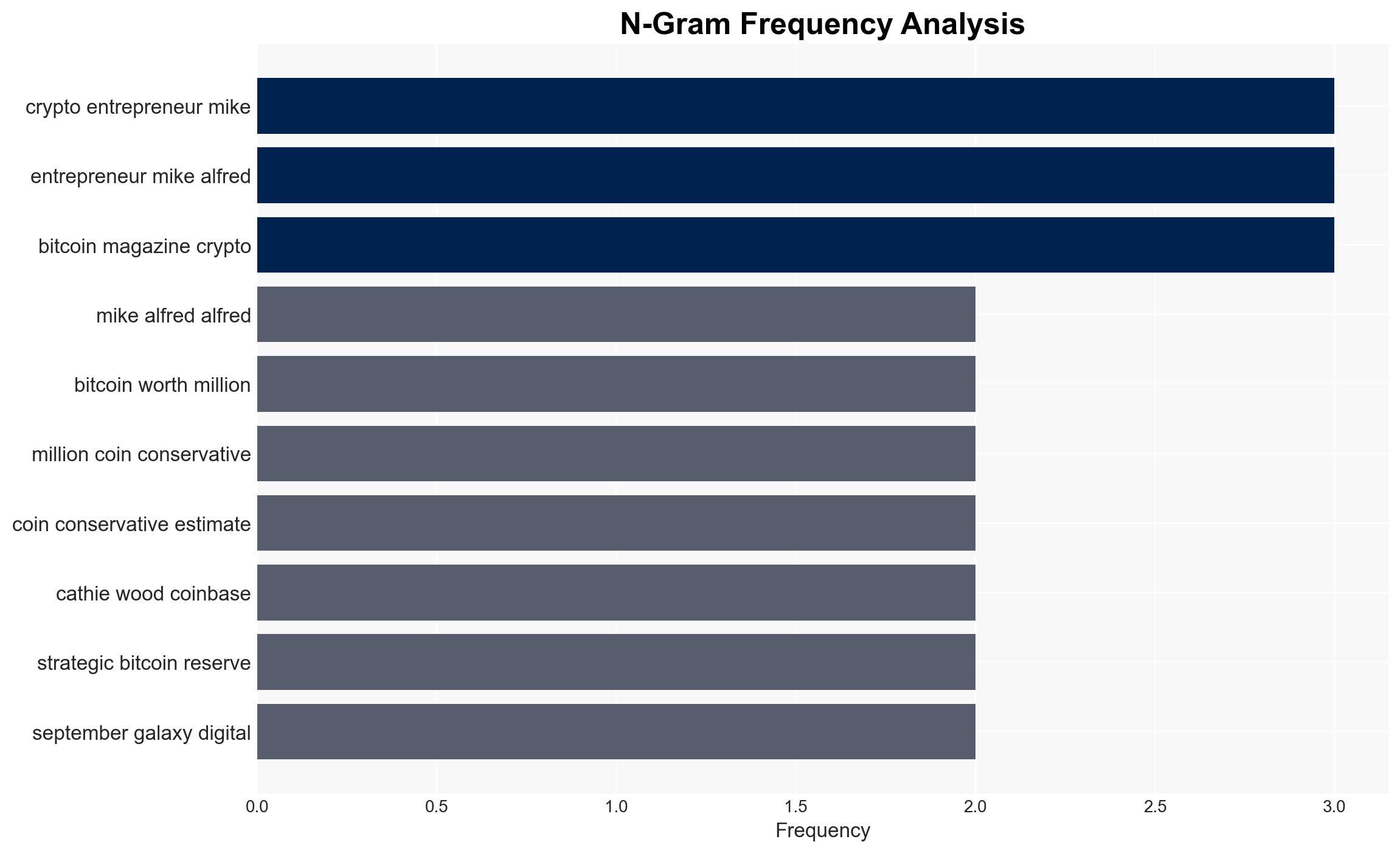

Mike Alfred, Cathie Wood, Brian Armstrong, Donald Trump, Alex Thorn, Samson Mow.

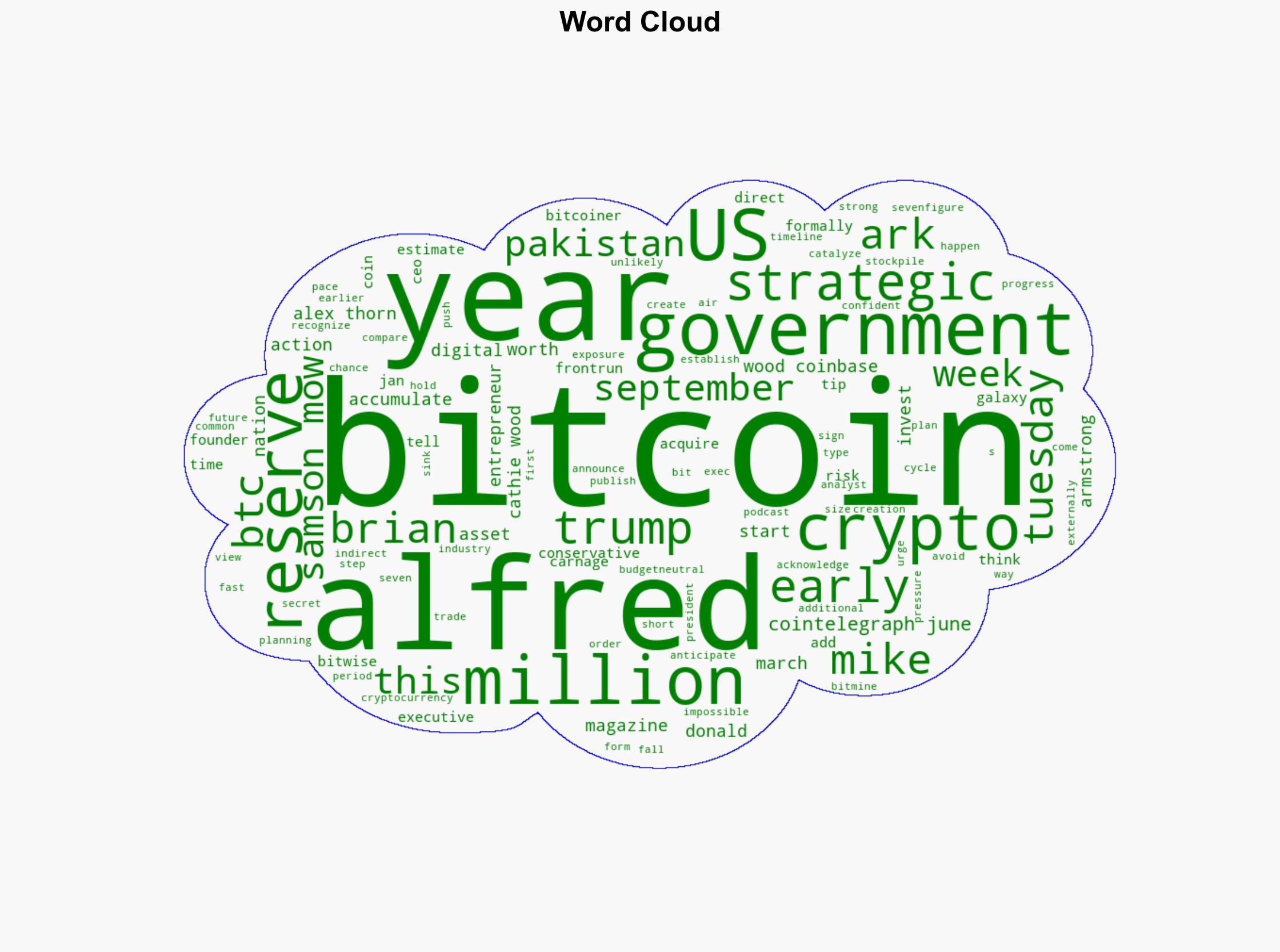

7. Thematic Tags

Regional Focus, Regional Focus: United States, Global Cryptocurrency Trends

Structured Analytic Techniques Applied

- Causal Layered Analysis (CLA): Analyze events across surface happenings, systems, worldviews, and myths.

- Cross-Impact Simulation: Model ripple effects across neighboring states, conflicts, or economic dependencies.

- Scenario Generation: Explore divergent futures under varying assumptions to identify plausible paths.

Explore more:

Regional Focus Briefs ·

Daily Summary ·

Support us