VC funds lock in specialists to vet cybersafety bets – The Times of India

Published on: 2025-08-09

Intelligence Report: VC funds lock in specialists to vet cybersafety bets – The Times of India

1. BLUF (Bottom Line Up Front)

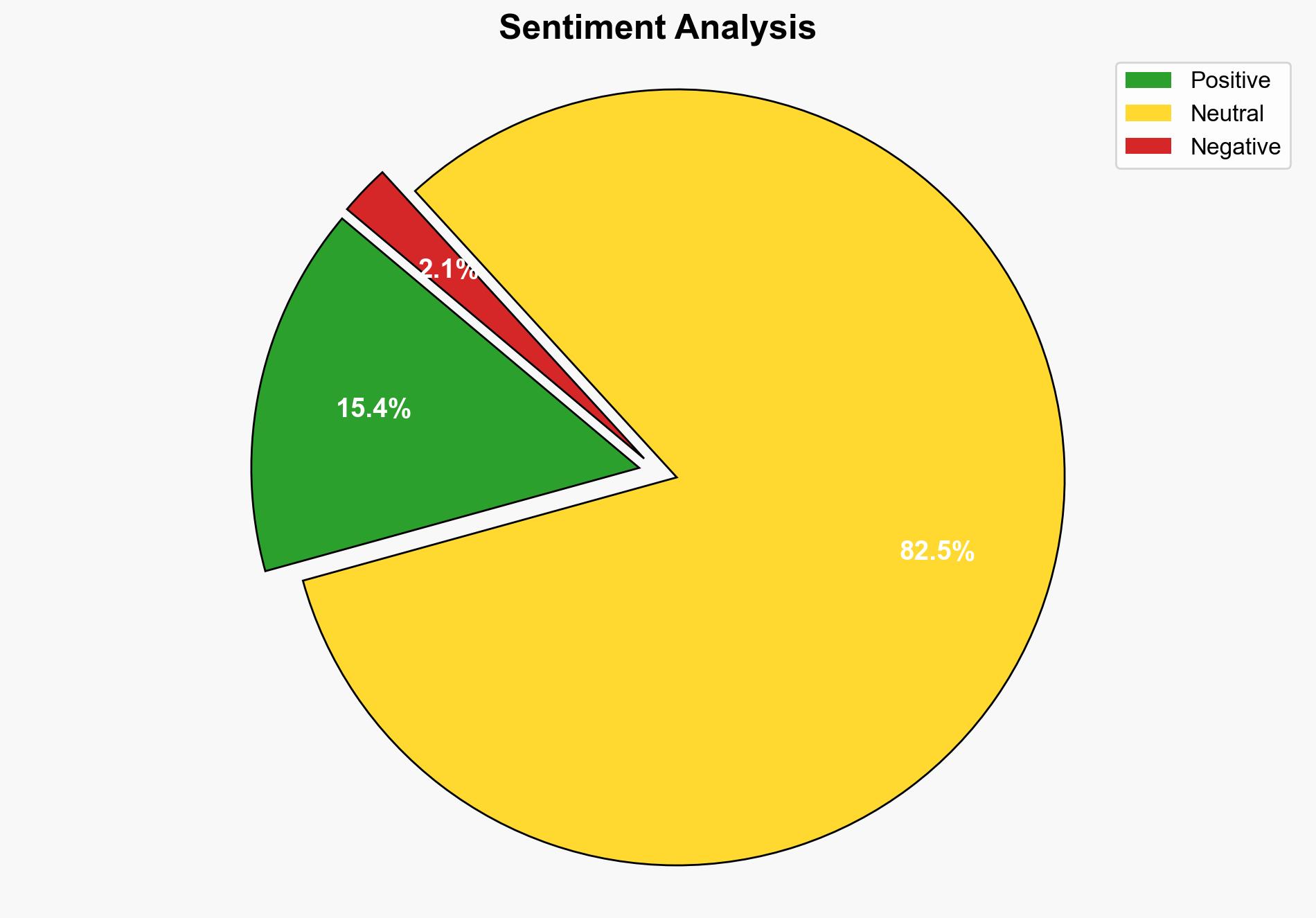

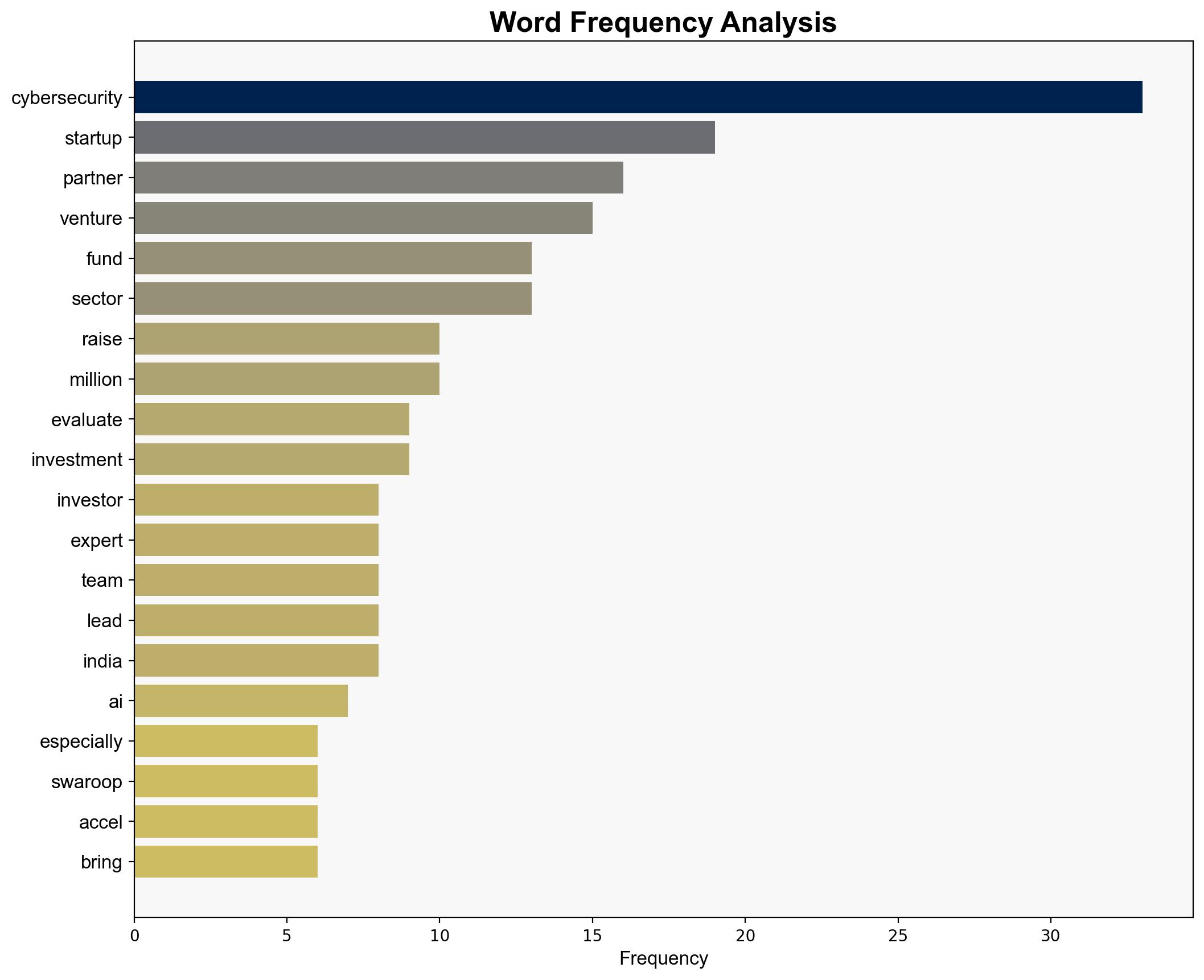

Venture capital funds are increasingly prioritizing investments in cybersecurity startups, driven by the rise of AI and associated data security risks. The most supported hypothesis is that VCs are strategically positioning themselves to capitalize on the growing demand for cybersecurity solutions. Confidence level: High. Recommended action: Encourage collaboration between VCs and cybersecurity experts to enhance investment decisions and foster innovation in the sector.

2. Competing Hypotheses

1. **Hypothesis A**: VCs are investing in cybersecurity startups primarily to mitigate risks associated with AI-driven threats, recognizing the sector’s potential for high returns due to increasing demand for cybersecurity solutions.

2. **Hypothesis B**: VCs are using cybersecurity investments as a strategic hedge against potential losses in other technology sectors, viewing cybersecurity as a relatively stable and necessary field amidst broader technological uncertainties.

Using ACH 2.0, Hypothesis A is better supported due to the explicit mention of AI-driven security concerns and the establishment of dedicated teams to evaluate cybersecurity investments, indicating a proactive approach to capitalize on sector growth.

3. Key Assumptions and Red Flags

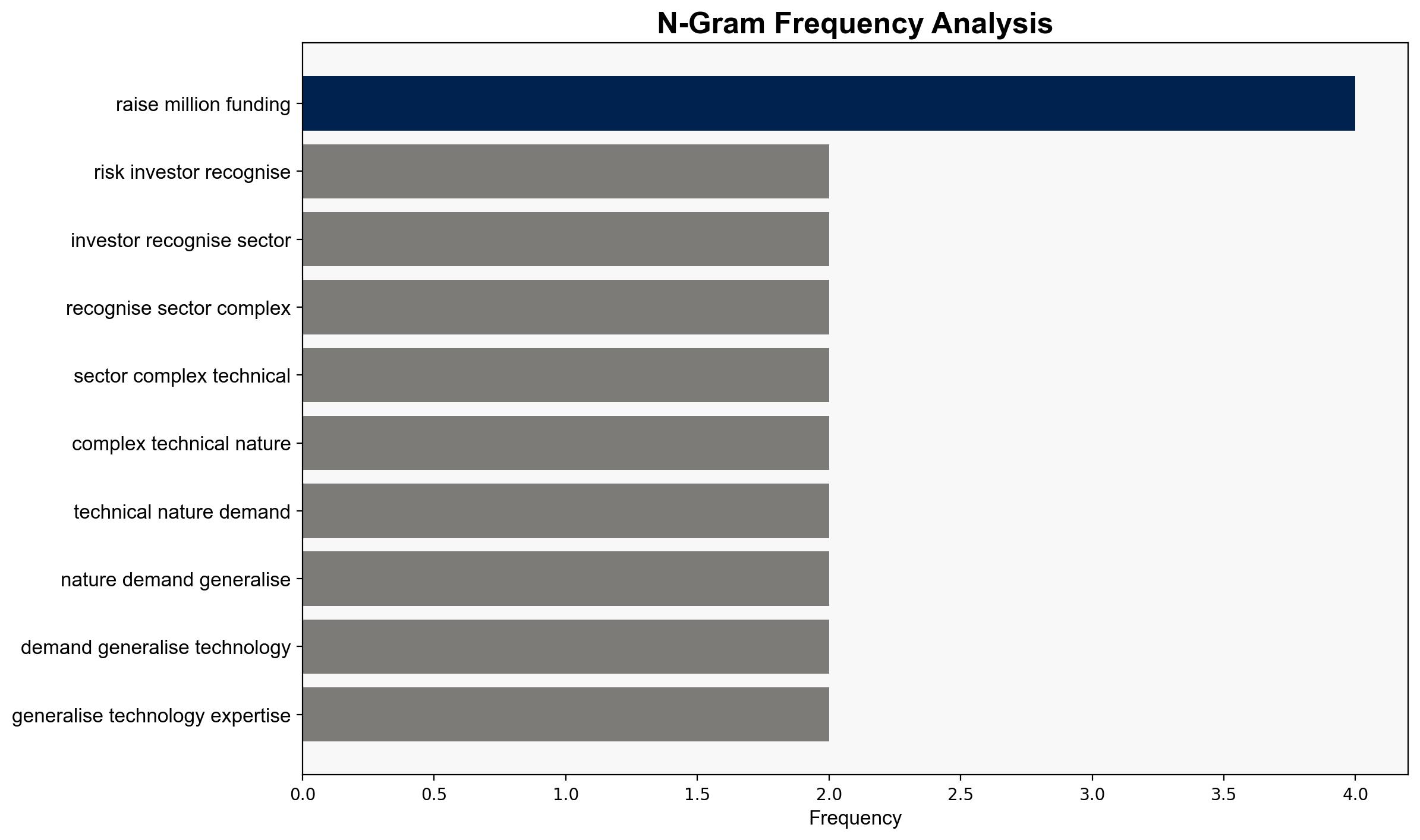

– **Assumptions**: It is assumed that the demand for cybersecurity solutions will continue to rise in tandem with AI advancements. Another assumption is that VCs have the expertise to accurately assess the technical complexities of cybersecurity startups.

– **Red Flags**: Potential over-reliance on AI as a driver for cybersecurity investment could overlook other critical factors. There is also a risk of cognitive bias if VCs predominantly rely on a small pool of experts, potentially limiting diverse perspectives.

4. Implications and Strategic Risks

The increasing focus on cybersecurity investments could lead to accelerated innovation and improved security solutions. However, there is a risk of market saturation if too many startups enter the field without sufficient differentiation. Additionally, geopolitical tensions could influence cybersecurity priorities, affecting investment stability.

5. Recommendations and Outlook

- Encourage VCs to diversify their expert panels to include a broader range of cybersecurity perspectives.

- Monitor geopolitical developments that may impact cybersecurity strategies and adjust investment approaches accordingly.

- Scenario-based projections:

- Best Case: Cybersecurity startups achieve significant technological breakthroughs, leading to robust returns on investment.

- Worst Case: Market saturation leads to diminished returns and increased competition among startups.

- Most Likely: Steady growth in cybersecurity investments with moderate returns as the sector matures.

6. Key Individuals and Entities

– Prayank Swaroop

– Vijendra Katiyar

– Abhishek Prasad

– Accel

– Cornerstone Ventures

– Endiya Partners

7. Thematic Tags

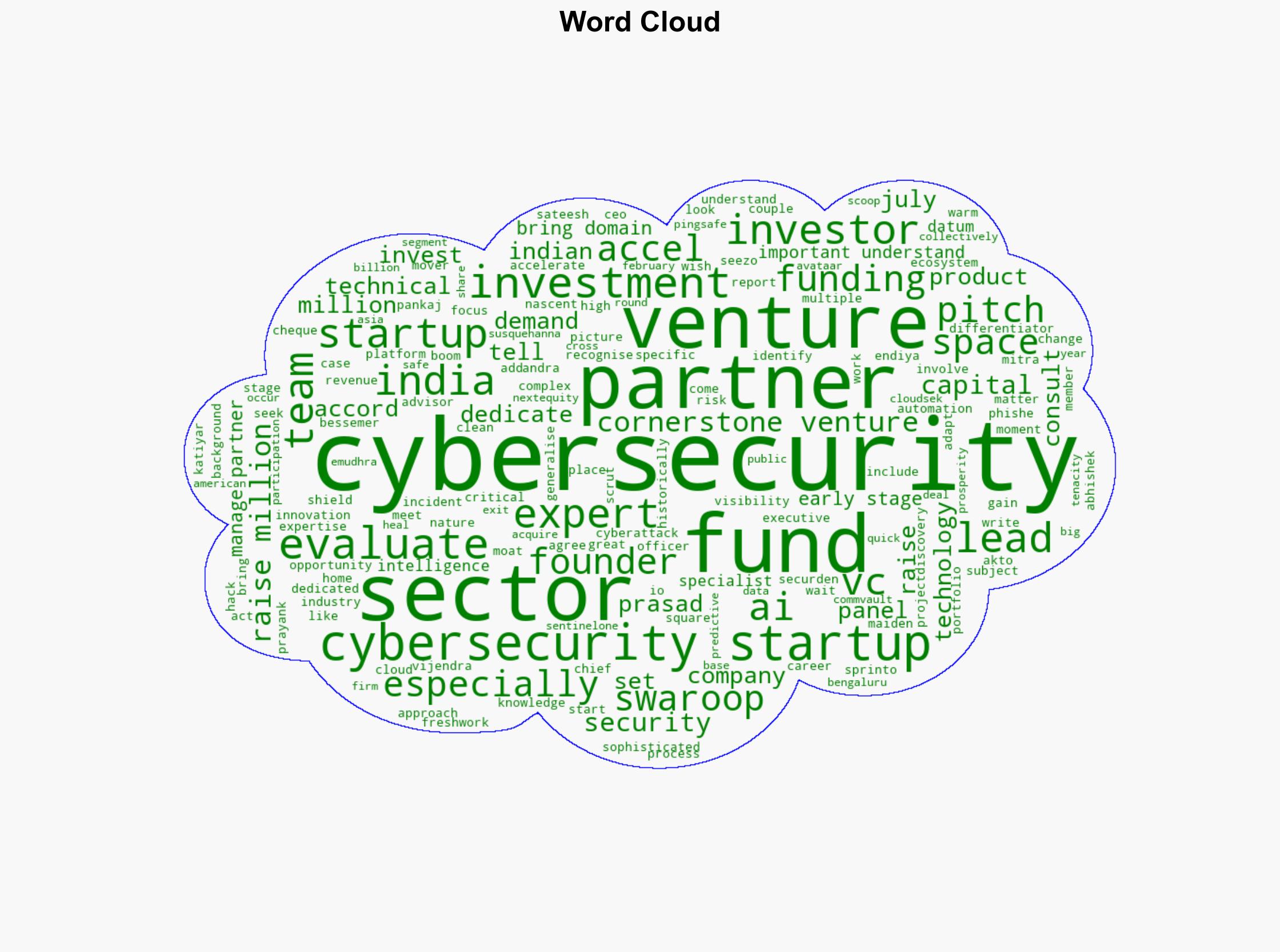

national security threats, cybersecurity, venture capital, AI-driven risks, investment strategies