Wall St futures oil plunge markets bay for US rate cuts – Yahoo Entertainment

Published on: 2025-04-06

Intelligence Report: Wall St futures oil plunge markets bay for US rate cuts – Yahoo Entertainment

1. BLUF (Bottom Line Up Front)

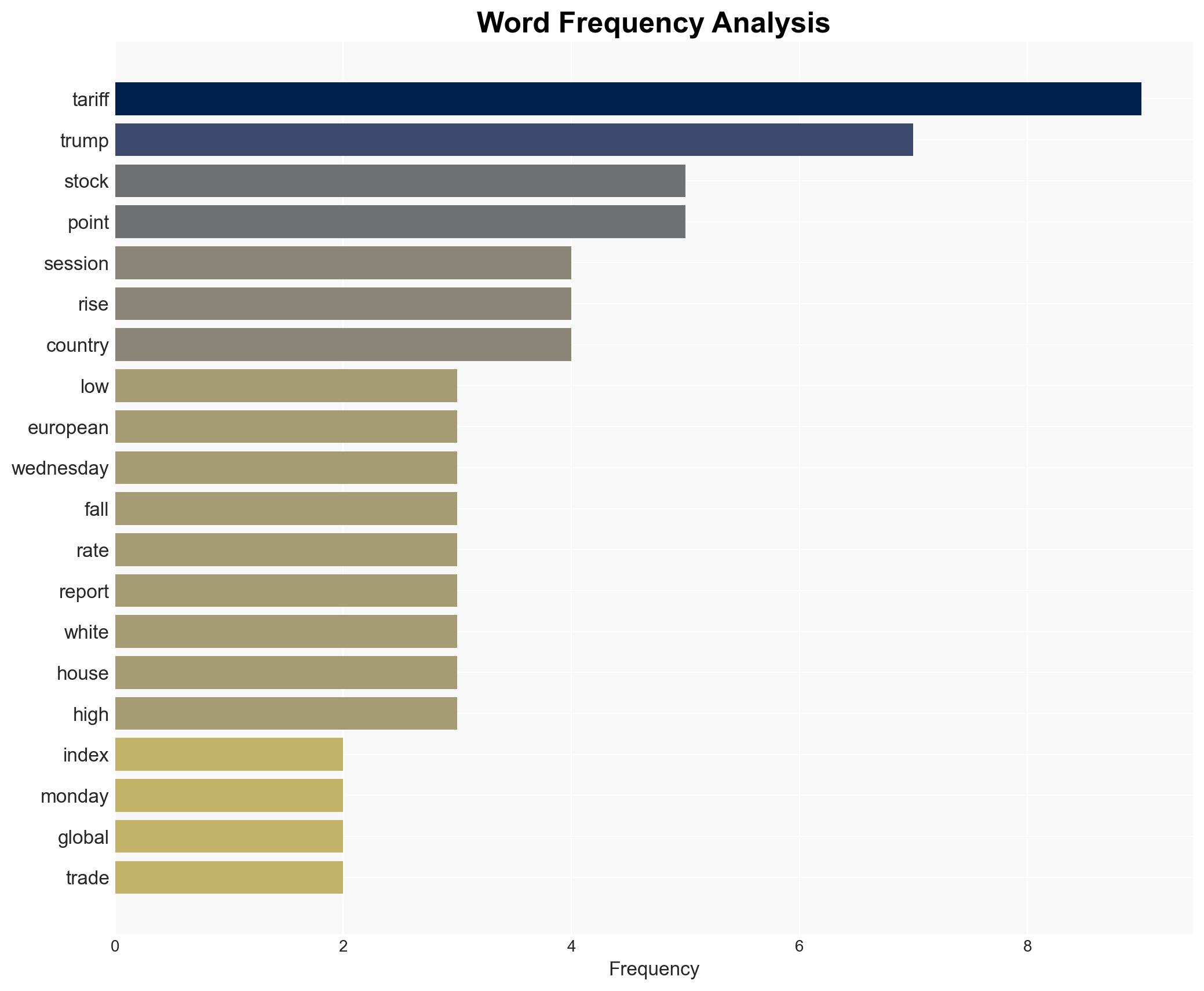

The recent volatility in major stock indices, driven by ongoing trade tensions and fluctuating treasury yields, has heightened investor anxiety. The potential for increased tariffs on Chinese imports and the subsequent economic repercussions are prompting calls for U.S. Federal Reserve intervention. Immediate strategic focus should be on monitoring trade negotiations and preparing for potential interest rate adjustments to stabilize markets.

2. Detailed Analysis

The following structured analytic techniques have been applied for this analysis:

General Analysis

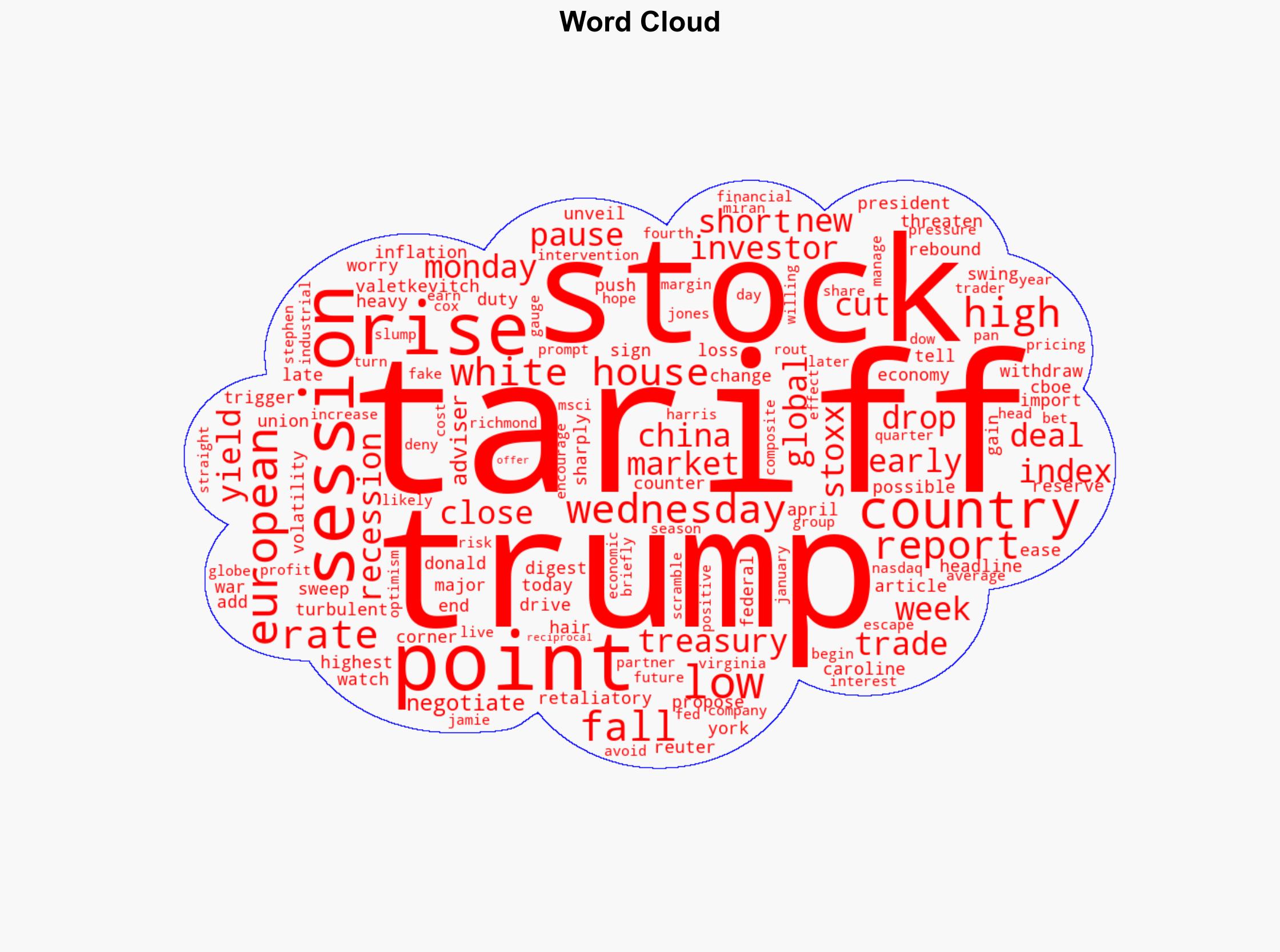

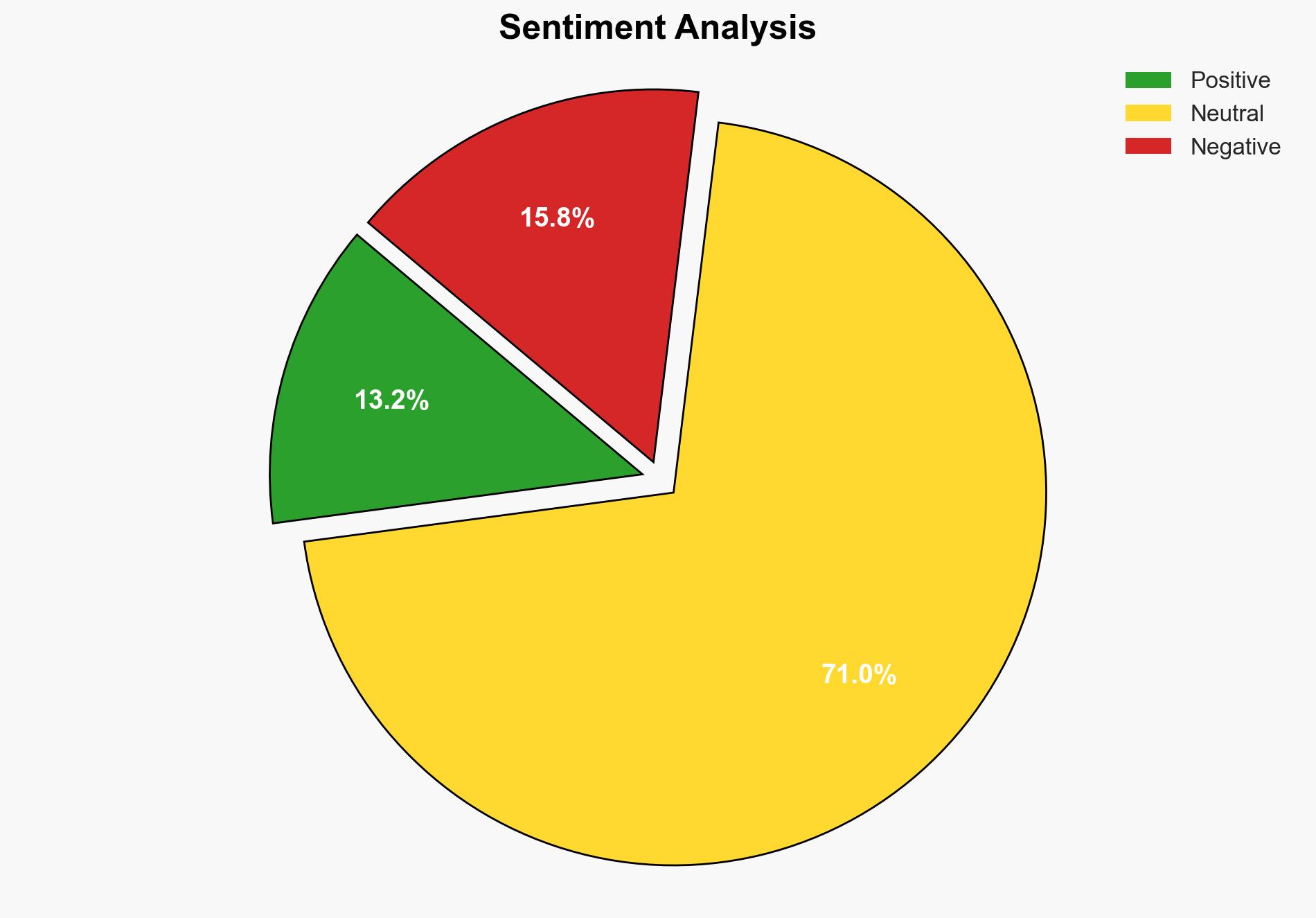

Recent market turbulence is primarily attributed to escalating trade tensions between the U.S. and China. The threat of additional tariffs has led to significant stock market fluctuations, with the CBOE Volatility Index reaching its highest level since April. Investor sentiment is heavily influenced by the potential for inflation and recession, prompting speculation about Federal Reserve rate cuts. Despite brief market recoveries, the overall trend remains bearish, with European markets also experiencing declines.

3. Implications and Strategic Risks

The ongoing trade dispute poses substantial risks to global economic stability. Key concerns include:

- Increased likelihood of a global recession if trade tensions persist.

- Potential for inflationary pressures due to higher import costs.

- Negative impacts on corporate profit margins, affecting earnings reports.

- Heightened market volatility, leading to investor uncertainty.

These factors could adversely affect national security and economic interests, necessitating close monitoring and strategic planning.

4. Recommendations and Outlook

Recommendations:

- Engage in diplomatic efforts to de-escalate trade tensions and negotiate mutually beneficial agreements.

- Prepare for potential Federal Reserve interventions, including interest rate adjustments, to stabilize markets.

- Encourage diversification of supply chains to mitigate tariff impacts.

Outlook:

Best-case scenario: Successful trade negotiations lead to a reduction in tariffs, stabilizing markets and fostering economic growth.

Worst-case scenario: Escalation of trade tensions results in a global recession, with significant market downturns and economic instability.

Most likely scenario: Continued volatility with intermittent market recoveries, as negotiations progress and Federal Reserve actions are anticipated.

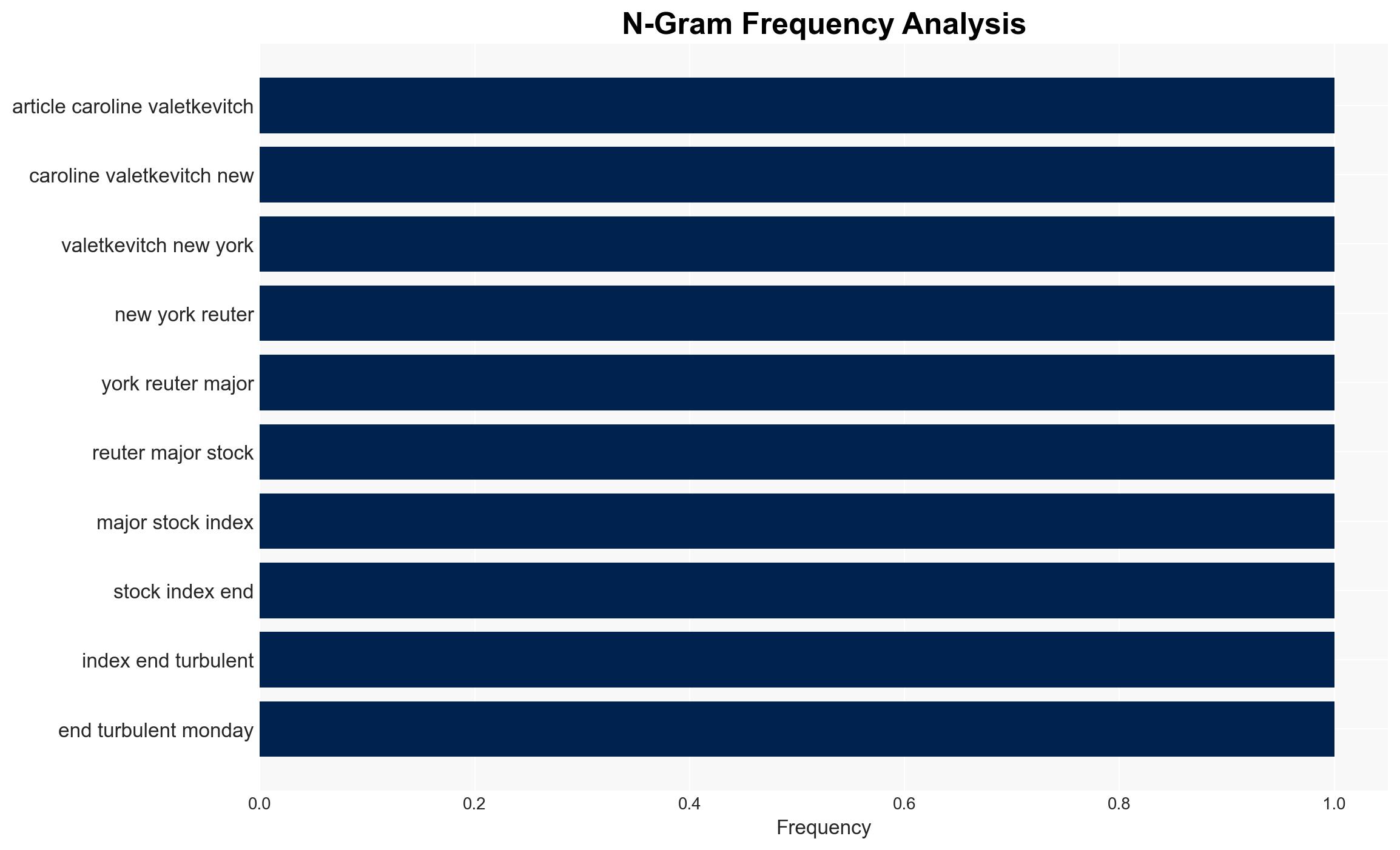

5. Key Individuals and Entities

The report mentions significant individuals such as Donald Trump, Caroline Valetkevitch, Jamie Cox, and Stephen Miran. Key entities involved include the U.S. Federal Reserve, the European Union, and the White House. These individuals and entities play critical roles in shaping the current economic landscape and influencing market dynamics.